(Photo source: dpa)

WeChat released Wang Chao on the weekend.

GuShiio.comAGI reported on February 17 that Tencent confirmed on the 16th that WeChat has launched the AI search function and officially grey-tested the in-depth thinking service provided by the DeepSeek-R1 model.

Tencent said that some users who have been qualified for the test can see the AI search words in the search entry at the top of the WeChat dialog box. After clicking to enter, they can use the DeepSeek-R1 full-blood model for free and enjoy a more diversified search experience. If the entry is not displayed, it means that this grayscale test has not covered the user account yet. The WeChat team is gradually expanding the scope of the test, and you can wait patiently for the subsequent opening.

Earlier, Tencent Yuanbao also connected to the DeepSeek-R1 model. At the same time, many large AI model companies such as Baidu, Huawei, and Step Star have connected to the DeepSeek-R1 model, making the DeepSeek circle of friends more than 100 companies.

Although the DeepSeek R1 model has the advantages of low training costs and comparable performance to OpenAI o1, the current problems it faces cannot be underestimated.

On the one hand, when manufacturers provide services based on the DeepSeek R1 model, computing power costs remain high, and MaaS (Model as a Service) costs have not been reduced; On the other hand, whether Tencent, Baidu, and ByteDance continue to develop model products and services such as Hunyuan and Bean Baobao makes the industry pay special attention to how to achieve positive commercialization after accessing the DeepSeek model. Everyone is exploring the subsequent development path, trying to find a way to maximize the commercial value of the DeepSeek model in a complex market environment.

You Yang, founder of Luchen Technology, said on Weibo and his circle of friends that in the short term, China’s MaaS model may be the worst business model. Big manufacturers will charge each other with low prices and free prices. The full-blooded version of DeepSeek R1 only charges 16 yuan per million tokens (output).If 100 billion tokens are exported per day, DeepSeek’s services will lose at least 400 million yuan a month, and AMD chips will lose more than 200 million yuan.

The public account Consensus Crusher pointed out that10-20 Wan Zhang Nvidia H20 can support 50 million to 100 million simultaneous online users, which basically meets the usage of the first batch of Deepseek users on WeChat and also exceeds the simultaneous online users of ChatGPT.

It is estimated that it will cost hundreds of millions of dollars, including NVIDIA’s GPU and operating costs, but WeChat ultimately provides free AI search services.Min Kerui, CEO of Minta Search, recently said that many cloud vendors ‘service prices are the same as or lower than DeepSeek, but they are all losing money.

So, will the open source basic model + ultra-low-cost API model replace the MaaS model under the DeepSeek craze?

After communicating with many industry people, GuShiio.comAGI found that they generally believe that DeepSeek will not fundamentally change the MaaS model, but it will inevitably usher in further upgrades, especially as the demand for computing power continues to grow and more companies increase investment in AI, profit margins still exist.

Cheng Yin, research manager at IDC China, told GuShiio.comAGI,On the one hand, DeepSeek lowers the threshold of AI technology through algorithm optimization and efficient training, supports small and medium-sized enterprises in fine-tuning on cloud platforms, lowers the threshold of computing power, promotes the transformation of MaaS models, and transforms cloud vendor services, which not only reduces costs but also enhances model flexibility; On the other hand, in the future, open source and business models will compete differently, and there are many factors to consider when choosing, so it is too early to judge who will be replaced, but the impact on the development of enterprise-level AI in China is definitely positive. Due to the reduction of its overall cost and threshold, more and more companies will be attracted to invest heavily in AI.

Why is the MaaS model difficult to make profits?

Before answering the profit question, you should first understand what is MaaS?

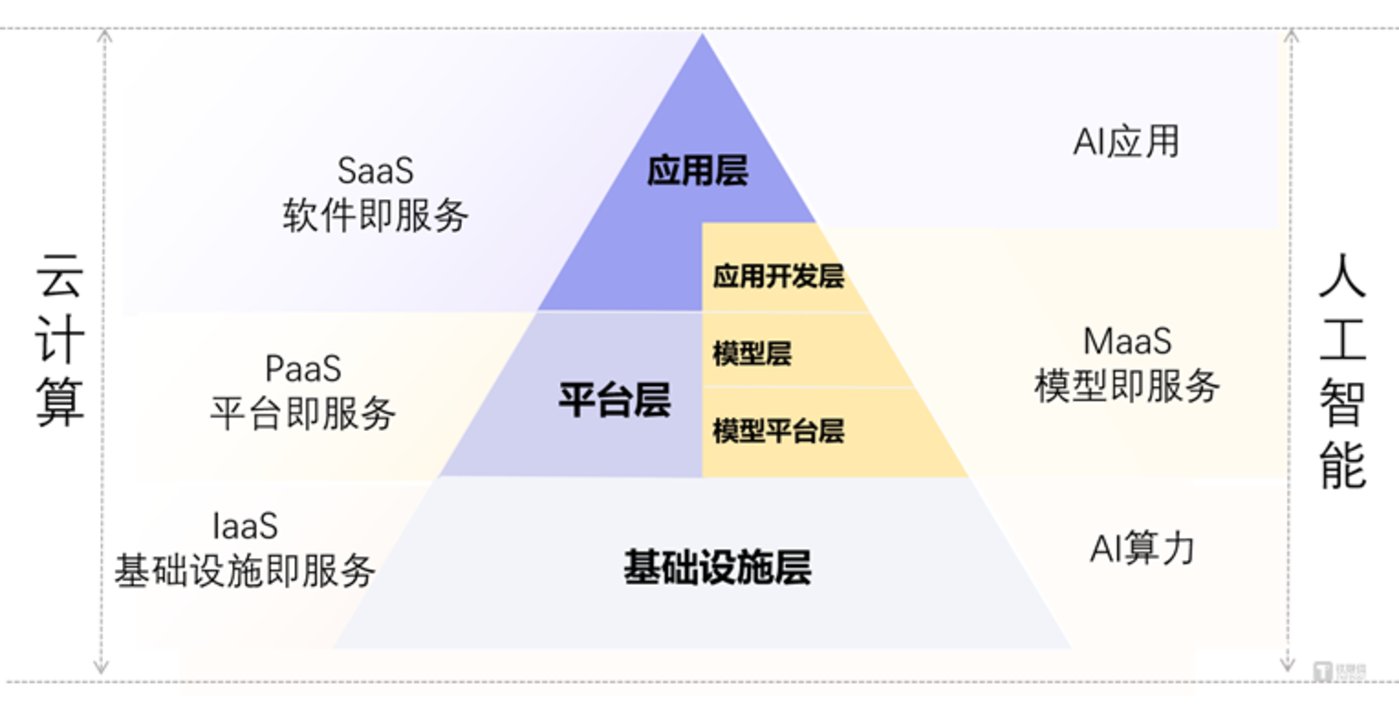

MaaS, called Model as a Service, is an AI service model based on cloud computing. It encapsulates AI algorithm models and related capabilities and provides them to users in the form of services. Its core goals are to reduce the threshold for AI technology use, control application construction costs, simplify the complexity of system operation and maintenance management, and improve the application efficiency of AI technology.

Simply put, model developers deploy trained AI models in the cloud and provide them to enterprise or individual users in various forms such as API interfaces, platform services, model services, dataset services, and AI application development services. Users do not need to carry out complex model training and maintenance, call model functions on demand, and pay based on usage. This does not include revenue from the Cloud Basic Resource Layer (IaaS) and computing power sold separately.

If IaaS, PaaS (Platform as a Service) and SaaS (Software as a Service) were key business models in the cloud computing era, today’s rapid development of large models has promoted the rise of the MaaS business model. Through MaaS, enterprises can provide complex AI models in the form of services, greatly reducing the threshold for technology application. At the same time, for the needs of specific industries and enterprises such as finance, government, and medical care, large model manufacturers also provide privatization and customization solutions to meet the needs of customers. Demand for data implementation and high security.

Schematic diagram of MaaS positioning and comparison (Source: public account of China Academy of Information and Technology)

In essence, AI applications require elastic invocation of large models.

An AI application company once told GuShiio.comAGI that every step and scene in its product calls different models, including bean bags, MiniMax, Wenxin Big Model, etc., which allows a product to obtain a better generative AI experience, but the price level is uneven, and some API calls are very expensive.

It is worth noting that there are differences in the application of AI service models in different regions.In the United States, although major cloud computing companies such as Amazon AWS and Microsoft have not explicitly adopted the name MaaS, they more use APIs to build generative AI solutions and provide use case support. For example, Run:ai proposed the AI-as-a-service model (AIaaS). In contrast, China has become the region with the most widespread use of the MaaS model.

According to the Allied market research report, the global AI software-as-a-service market will be worth US$11.7 billion in 2023 and is expected to reach US$178.9 billion by 2032, with a compound growth rate of 35.9% from 2024 to 2032.

However, looking back at the four little dragons of AI and the previous heyday of cloud computing and SaaS, it is clear thatThe AI and cloud service software industries have problems such as high investment, low profits (even losses), and long payment cycles. However, under the AI competition to burn money, the loss challenges of AI companies and cloud service companies have not been solved.

example,AI software company Shangtang achieved revenue of 1.739 billion yuan in the first half of 2024, a year-on-year increase of 21.4%, and a net loss to its parent company of 2.477 billion yuan; while cloud manufacturers Baidu Cloud and Tencent Cloud are still at a loss; Even if Alibaba Cloud is profitable, profits only account for less than 10% of revenue. In the first three quarters of 2024, revenue was 81.754 billion yuan, and the adjusted EBITA profit was only 6.43 billion yuan. Alibaba Group has invested hundreds of billions of yuan in cloud computing power, talent, AI algorithms, etc.

Many AI industry professionals told GuShiio.comAGI that in the past ten years, the AI To B-end project system has led to a long payment cycle for companies, especially in the current market environment, where payment is difficult. In addition, major technology companies continue to increase prices, computing power costs continue to rise, resulting in the AI model itself not showing a good business model. Therefore, MaaS is not the ultimate model for enterprise AI.

For example, OpenAI is not the first pot of gold for a company.According to reports, OpenAI in the United States expects its annualized revenue to reach US$3.7 billion in 2024, of which approximately 75% of revenue comes from ChatGPT paid subscriptions. However, after paying operating costs, wages and management fees, OpenAI expects an annual loss of approximately US$5 billion. OpenAI predicts that the company’s total loss will reach US$44 billion between 2023 and 2028, and a profit of US$14 billion will not be achieved until 2029.

Therefore, there is still a long way to go for industrial chain companies related to the AI model to have a considerable profit model.

Today, the open source AI model DeepSeek has triggered a new round of government and enterprise deployments AI model craze.On February 16, the Guangzhou City Government Services and Data Management Bureau officially deployed the DeepSeek-R1 and V3671B models on the government external network. At the same time, Shenzhen City officially provided DeepSeek model application services to all districts and departments in the city based on the government cloud environment, which will enrich the application of government service scenarios.

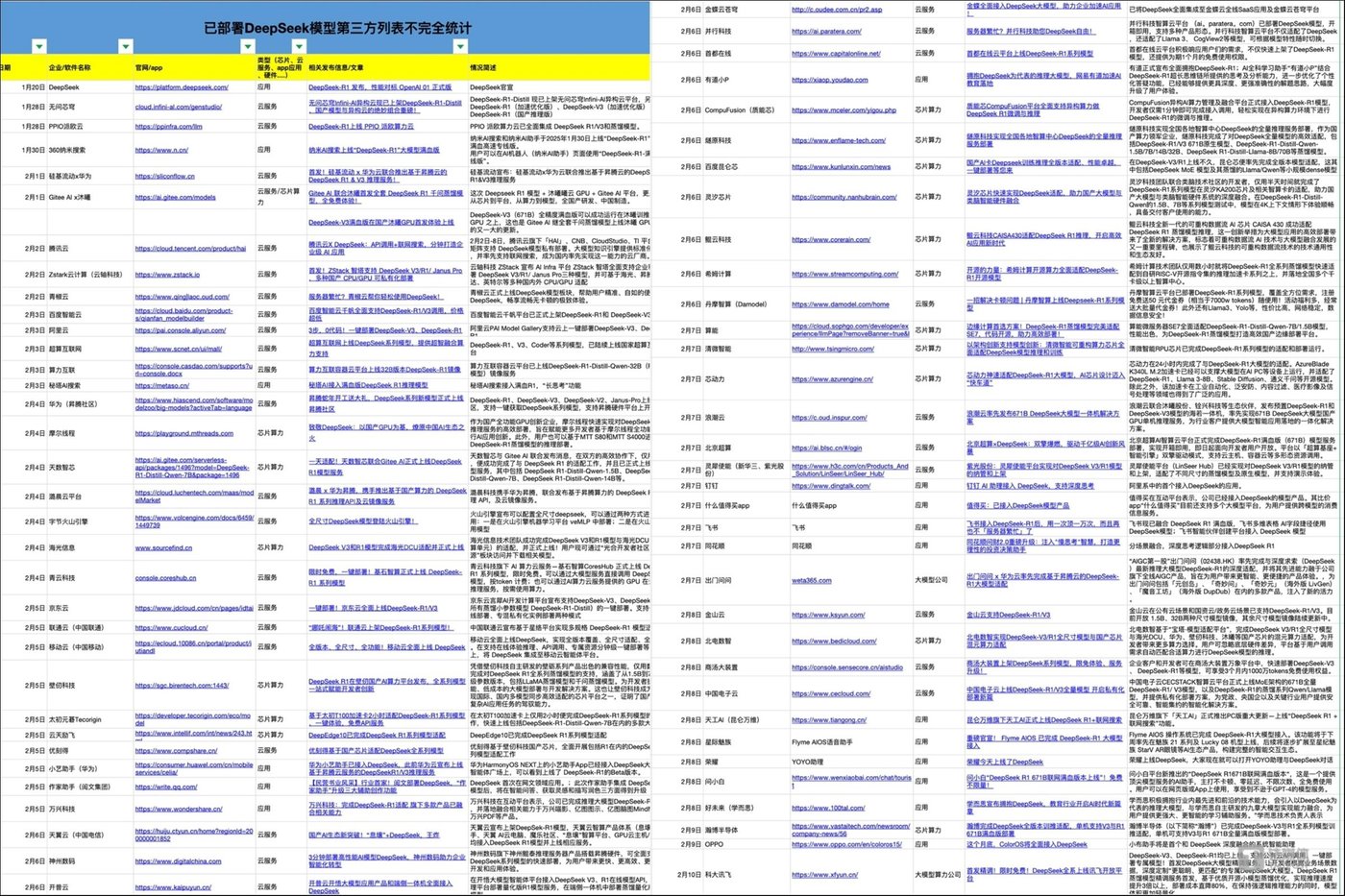

According to I statistics, as of February 16,More than 110 companies in the AI computing power, AI cloud services, and AI application fields, including Alibaba Cloud, Tencent Cloud, Volcano Engine, Huawei, and Moore Thread, have announced access to or adaptation to DeepSeek model products.

Although DeepSeek uses algorithm optimization and efficient training to lower the AI threshold, and its open source model helps small and medium-sized enterprises, promoting MaaS model transformation and service transformation, the current competition between open source and commercial models is fierce, and computing power costs and personnel deployment costs are still high. The factors are complex. After many companies adapt/deploy DeepSeek, whether customers are willing to pay for a long time and be able to form a new profit model still needs to be paid continuously.

Wang Hai (pseudonym), an AI industry person, admitted to GuShiio.comAGI that each company has its own strategic or business intentions, integrates multiple model technologies, and provides free or paid services. MaaS services are mainly obtained through the industrial chain and government-enterprise-end projects. How to gain income from projects, how to help real business or improve value, therefore, this in itself does not mean that there is a problem with the MaaS model. Large-scale model API calls and MaaS services can generate greater value.

“During our conversations with companies, we also learned that in fact, model services themselves are not very profitable. Their profits are very thin, and applications may make more money than model services. It is equivalent to the model itself being bought vegetables, and the application is a plate of cooked vegetables and cooked rice after these vegetables are cooked. This process will actually generate some profits. rdquo; Wang Hai pointed out that large-scale model API calls and MaaS services can generate greater value.

Second half of the big model: Six tigers accelerate their differentiation

“The server is busy. Please try again later.& rdquo;

This is the content that the DeepSeek model frequently replies after experiencing congestion and intermittent paralysis in the past month. It also shows that the relevant servers connected to DeepSeek are still full, and the demand for computing power in the large model is still strong.

Cheng Yin said thatThe deployment process for accessing DeepSeek’s large model needs to meet both the stringent requirements of high concurrency and low latency, and needs to comprehensively consider multiple factors such as data security, privacy protection, elastic resource expansion, and system maintenance. DeepSeek has launched multiple deployment model licenses that have also challenged the main commercialization methods of global large model technology providers. Currently, the methods introduced include cloud deployment, local/intranet deployment, edge deployment, hybrid deployment, containerized/microservice deployment, and federal deployment model.

At the same time, on the side,The super application Tencent WeChat has connected the DeepSeek model to the AI search function, bringing the Normandy moment for domestic AI applications.

Large models are capital-intensive R & D industries. Not only does training require a lot of computing power, but also requires a lot of money to conduct reasoning during operation. At the same time, now that DeepSeek-R1/V3 is fully open source, the value of the closed-source model is questioned.

Wang Xiaochuan, founder and CEO of Baichuan Intelligent, recently said that starting a business is always difficult. In the past, the main purpose was to convince the boss, but this time, it is to convince the team, investors, and external partners.

Entering 2025, a new round of DeepSeek craze is coming,This has also allowed the domestic model Six Tigers Intelligent Spectrum AI, Baichuan Intelligence, Step Star, One and One Everything, Dark Side of the Moon, and Minimax to stand at a new crossroads and make different development choices: some choose to continue to devote themselves to the research and development of new models and explore more possibilities for industrial implementation; some choose to embrace the DeepSeek model and use its advantages to open up new business landscapes.

- Step Star: The latest jump text connects to the DeepSeek-R1 model;

- MiniMax: DeepSeek-R1 deep thinking model has been launched in the overseas version of 01;

- Everything: PopAi, its overseas AI application, is connected to the DeepSeek model. Before the advent of DeepSeek-R1, founder of Zero Everything Kai-Fu Lee has publicly stated that the company will no longer pursue training super large models. Lightweight models with moderate parameters, excellent performance, faster reasoning speed, and lower reasoning cost are more suitable for commercial scenarios., will become a catalyst for the explosion of AI-First applications. In addition, on February 14, the industrial model base jointly established by Zero One and Suzhou High-tech Zone was officially awarded.

- Baichuan Intelligent: On January 25, a new model Baichuan-M1-preview was released, which has language, visual and search reasoning capabilities. On February 13, an AI pediatrician based on Baichuan-M1 took up his post in Beijing after nearly a month of internal testing;

- Dark Side of the Moon: Kimik1.5 Multimodal Thinking Model will be released on January 25, and a large model that continues to obtain SOTA results will also be launched.

- Intelligent AI: We will not connect DeepSeek for the time being, but will choose to add additional Agent agents. Agentic GLM (a system-level large model developed by Intelligent AI for mobile phones) has landed on Samsung’s latest Galaxy S25 series mobile phones to provide real-time AI-based voice and video calls, as well as visual understanding and system function invocation, AI search, copywriting and other functions.

The latest report from international investment bank Morgan Stanley predicts that the AI market is dividing. DeepSeek has changed the narrative of the AI industry and demonstrated the rewards of not taking the unusual path. The concept that only a few companies in the world can meet the conditions and use extremely powerful chips and infrastructure to provide impetus for AI development is no longer true. Companies that can afford entry costs are no longer limited to a few industry leaders.

Morgan Stanley points out that the DeepSeek craze has prompted some companies to pay high prices to stay ahead; but for the other camp, AI is the cost center, and for these companies, what is pursuing is more convenient tokens.

“We believe that market winners will ultimately be companies that can quickly scale up and commercialize new technologies. As the market enters the promotion stage, we are gradually optimistic about participants in the AI model, and believe that starting from the second half of 2025, there will be better opportunities for the recovery of edge devices. rdquo; Morgan Stanley believes that today’s AI craze is a bit like the Internet popularity in 1995. At that time, everyone expected Cisco, or AltaVista, or Hotmail to win the competition, but Amazon provided the cheapest service per second token and became the ultimate winner.

Cheng Yin said that for AI applications, updates and upgrades of large models will help accelerate the innovation and commercialization of application scenarios.In the future, whether it is applications aimed at improving personal productivity such as copywriting and content generation, online meeting summary, AI assistant, and search, or scenarios aimed at horizontal business functions such as customer service and marketing,Or the commercialization of industry-specific scenarios will be the focus of the market this year.

Talking about the impact of computing power,Cheng Yin told GuShiio.comAGI that she believes that it is difficult to say at the moment. It cannot be proved that pre-training and reasoning of large models have significantly reduced computing power requirements. If the assumption is to drive more companies to deploy AI, China’s computing power market may usher in growth.

Cheng Yin emphasized thatDeepSeek leads the basic model to open up another new development paradigm. In 2025, the industry will also pay more attention to the implementation of large models and generative AI. The entire ecosystem should work together to accelerate the innovation and commercialization of application scenarios.