① Powell held a meeting tonight, and Trump issued a document calling for interest rate cuts;

② Alibaba strengthened before the market and was hitting key resistance levels;

③ Buffett, the “trapped” stock god, has added to Western Oil;

④ Well-known whistleblower: Apple entered the new product release cycle starting on Wednesday.

Cailian News, February 12 (Editor Shi Zhengcheng)As the just-released U.S. inflation data exceeded market expectations, the three major futures indexes collectively plunged before the market.

As of press time, Dow Jones index futures (2503 contract) fell 0.92%, S & P 500 index futures fell 0.98%, and Nasdaq 100 index futures fell 1.03%. Spot gold plunged more than US$10 in the short term and is currently around US$2870/ounce.

(Spot gold daily chart, source: TradingView)

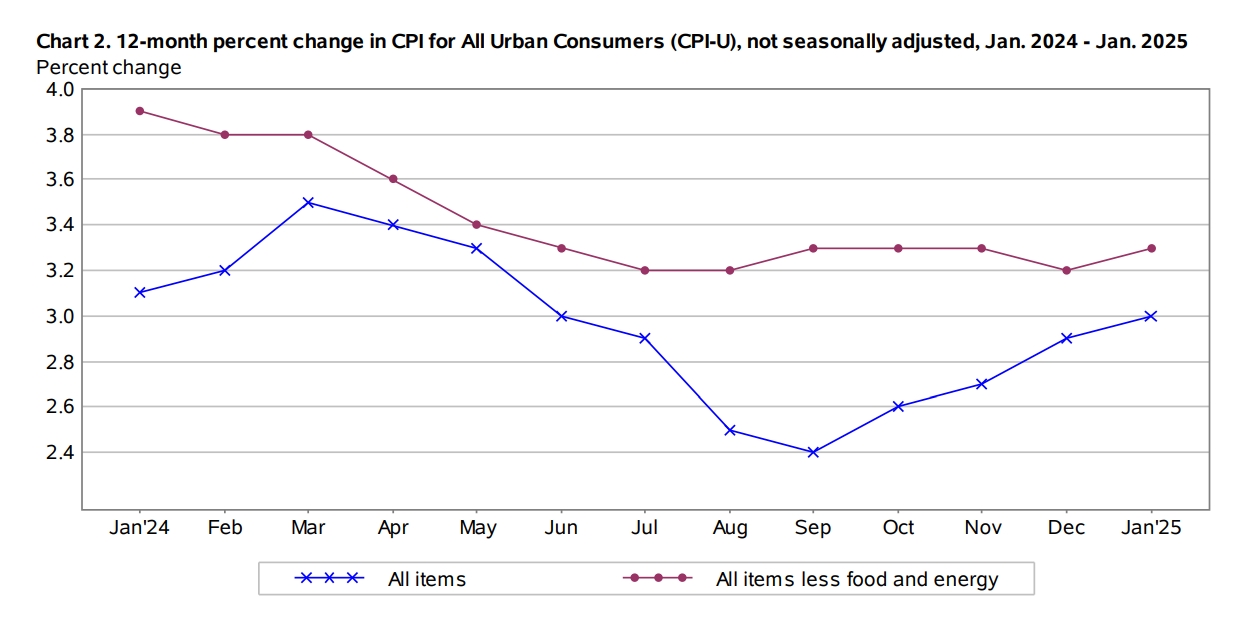

The U.S. CPI grew by 3% year-on-year in January, compared with an expected 2.9%. The core CPI, which excludes volatile food and energy prices, increased by 3.3% year-on-year, which was also higher than expected.

(Source: Bureau of Labor Statistics)

U.S. President Trump has boasted to voters that he will implement price cuts “on his first day in office.” Less than a month after taking office, his tone has quietly changed. Asked this week how American families are coping with inflation, Trump circled and said: “I think we will get richer-look, we are not rich now, we owe a good $36 trillion.”

Even so, Trump is still obsessed with the tariff issue.According to his previous forecast, a “reciprocal tariff” policy would be introduced on Wednesday-setting up separate tariffs for each U.S. trading partner.At the same time, due to the complexity of international trade itself, whether his ideas can be implemented and the specific results are also confusing.

William Reinsch, a senior fellow at the Center for Strategic and International Studies (CSIS), saidTrump’s “reciprocal tariffs” are equivalent to transferring control of U.S. tariffs to other countries, following the tariff rates set by trading opponents, which may have counterproductive effects.Reinsch explained: “Colombia imposes high tariffs on coffee beans to protect the industry. If the United States, which does not grow coffee beans, also imposes high tariffs on Colombia coffee beans, only American consumers will be harmed.”

Federal Reserve Chairman Powell will also continue to appear in Congress on Wednesday. During Tuesday’s hearing, he stressed as scheduled that he was “not in a hurry to adjust interest rates.”

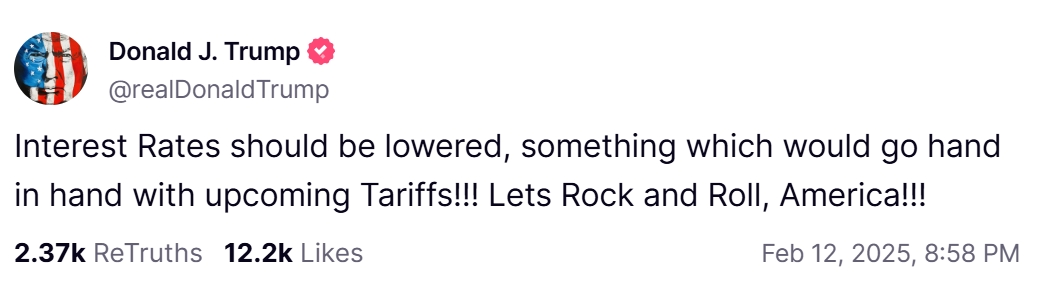

By the way, Trump, who seemed to have not had a deep understanding of the harm of tariffs, began to guide Powell’s work again. Shortly before press time,Trump posted on social media platforms that the Federal Reserve should cut interest rates to match his tariffs.

For investors in China assets, there is another unique attraction tonight-Alibaba is hitting a new high since October 7 last yearIt is also the pressure level since the beginning of 2022. It was reported yesterday that Apple is working with Alibaba to provide “Apple Intelligence” for the iPhone.

(Alibaba’s weekly chart of U.S. stocks, source: TradingView)

Apple CEO Cook mentioned in his earnings briefing last month that the iOS 18.4 update will bring a simplified Chinese version of “Apple Intelligence”, but it is not yet certain whether Bank of China users can use it during the launch.

other messages

[Buffett, the “trapped” stock god, has added another position in Western Oil]

According to regulatory filings filed by Berkshire on Tuesday (February 11), the company bought 763,017 shares of Occidental Oil Company stock last Friday, with a total transaction value of approximately $35.7 million, with a weighted average price of $46.8195 per share. According to statistics, Buffett has added positions in Western oil many times in the past two years, with an average purchase price in the range of 50-60 US dollars.

[Well-known whistleblower: Apple enters the new product release cycle starting on Wednesday]

Well-known Apple whistleblower Mark Gulman said that Apple seems to start a round of update cycles for various product lines starting on Wednesday. In addition to the expected iPhone SE, even the unpopular product Apple Vision Pro seems to have a chance to appear.

[Research finds that diet drugs such as Ozempic may cause blindness]

According to a new study, new weight-loss drugs may lead to blindness in users. Researchers published in the Journal of the American Medical Association-Ophthalmology last month that nine U.S. patients developed symptoms of blindness after taking Novo Nordisk’s Ozempic or Lilly’s Mounjaro.

[Ultramicro computer performance forecast is slightly lower than expected]

After close on Tuesday,”Nvidia concept stock” Ultracomputer released its results forecast for the second fiscal quarter of fiscal 2025, with revenue ranging from US$5.6 billion to US$5.7 billion and adjusted earnings per share of US$0.58 -0.60, both lower than expectations; third-quarter revenue is expected to be between US$5 billion and US$6 billion, and EPS is between US$0.46 -0.62, which is also lower than expected.

The company also disclosed that it will submit its 2024 annual report and multiple quarterly reports that will trigger regulatory investigations before February 25, and is confident that it will achieve revenue of US$40 billion in fiscal year 2026. As of press time, ultramicro computers were up 6.81%.

Events worthy of attention during the U.S. stock market period (Beijing time)

on February 12

21:30 US January CPI

23:00 Federal Reserve Chairman Powell attended the House Financial Services Committee hearing, and EU Trade Ministers held a special meeting on “Trump Tariffs”

23:30 EIA crude oil inventories from the United States to February 7

February 13

01:00 Atlanta Fed President Bostick delivered a speech

02:30 The Bank of Canada releases minutes of January monetary policy meeting