① NVIDIA and Tesla fell more than 4%;

② The Philadelphia Semiconductor Index fell more than 3%;

③ Trump: Apple will build a factory in the United States instead of Mexico;

④ The European Union may accuse Google of violating the Digital Market Act.

Cailian News, February 22 (Editor Zhao Hao)U.S. stocks sold off on Friday (February 21), and the three major indices collectively fell sharply, with the Nasdaq index falling more than 2%.

At the close, the Dow Jones index fell 1.69% to 43,428.02 points; the S & P 500 index fell 1.71% to 6,013.13 points; and the Nasdaq Composite Index fell 2.20% to 19,524.01 points.

On a weekly basis, the Dow fell 2.51%, the largest weekly decline since late October last year; the S & P fell 1.66%, the largest weekly decline since mid-January; and the Nasdaq fell 2.51%, the largest weekly decline since November last year.

Analysts believe that a series of data in the United States have aroused people’s concerns about the economy, prompting investors to buy bonds, resulting in a significant drop in government bond yields. During the day, U.S. 2-year and 10-year Treasury yields both fell more than 7 basis points.

A survey report released in early trading showed that the University of Michigan lowered the U.S. consumer confidence index in February from an initial value of 67.8 to 64.7; the survey also showed that consumers ‘expectations for long-term inflation in the next 5-10 years were revised upwards to 3.5%, the highest level since April 1995.

In addition, existing home sales in the United States exceeded expectations and fell to 4.08 million units in January; S & P’s global initial value of the U.S. service industry PMI in February unexpectedly fell from 52.9 to 49.7, a record low since January 2023 and below the 50-point line, indicating that the field is shrinking.

These economic indicators echoed Wal-Mart’s results report the previous day. The retail giant expects revenue to grow 4% year-on-year and profit to grow 5.5% year-on-year in fiscal 2025, both slowing down and falling short of Wall Street analysts ‘expectations.

Wal-Mart said 2025 will become more difficult for retailers like Wal-Mart as consumers become increasingly frustrated with inflation and worry about President Trump’s tariff policies.

During the session, Steven Cohen, a well-known Wall Street tycoon and founder of hedge fund Point 72, said that due to tariff and immigration policies, as well as factors from the Ministry of Efficiency, economic growth may slow down significantly in the second half of this year, and the stock market may pull back.

Larry Tentarelli, chief technical strategist at Blue Chip Daily Trend Report, said,”The 20 best-performing stocks in today’s S & P are all from defensive sectors: consumer necessities, utilities and health care. When concerns arise about economic growth, investors usually turn to these sectors.”

Performance of hot stocks

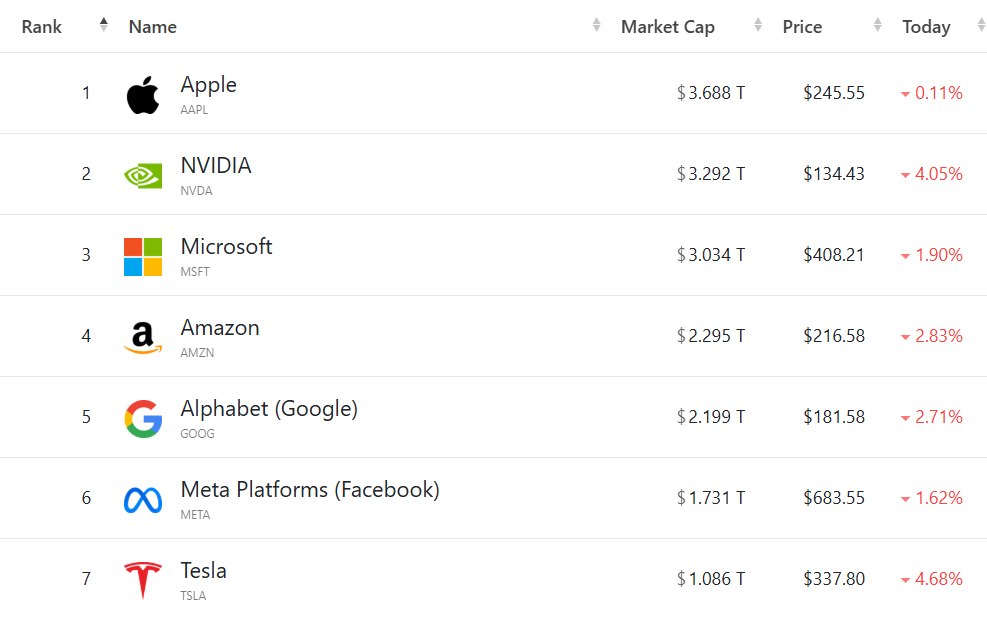

Large technology stocks fell collectively, with (ranked by market value) Apple down 0.11%, Nvidia down 4.05%, Microsoft down 1.9%, Amazon down 2.83%, Google C down 2.71%, Meta down 1.62%, Tesla down 4.68%, Broadcom down 3.56%.

The Philadelphia Semiconductor Index fell 3.28%, and all 30 constituent stocks closed down. Microchip Technology fell 5.02%, Qualcomm and Gexin fell 4.76%, and Intel fell 4.68%.

Chinese stocks strengthened against the market. The Nasdaq China Golden Dragon Index rose 1.65%, rising 1.57% this week, and has been rising for the sixth consecutive week.

Most of the popular Chinese stocks rose, with Tencent Music rising 12.08%, Alibaba rising 5.72%, Pianduo rising 5.57%, Ideal Car rising 4.13%, Xiaopeng Automobile rising 3.95%, Jingdong rising 2.99%, Baidu rising 1.82%, NIO rising 1.6%, Haofubei rising 0.7%. New Oriental fell 2.93%, and Mingchuang Premium Products fell 11.98%.

company news

[Trump: Apple will build a factory in the United States instead of Mexico]

Trump said that he met with Apple CEO Cook on February 20. Apple relocated its factory due to tariffs and would build a factory in the United States instead of Mexico.

[Apple will remove ‘Advanced Data Protection’ feature in the UK]

Apple issued a statement on February 21 saying that it will no longer provide the “Advanced Data Protection” feature (ADP) to new users in the UK, and existing users will eventually need to disable this feature. ADP uses end-to-end encryption to protect iCloud data, which requires users to choose whether to turn it on or not. Only the user can unlock it. Apple said it was deeply disappointed that it was unable to provide ADP functionality to UK customers,”We remain committed to providing users with the highest level of personal data security protection and hope to be able to do this in the UK in the future.” The statement said Apple has never built a “back door” for any product and will never do so.

[EU may accuse Google of violating the Digital Market Act]

According to people familiar with the matter, the European Commission will accuse Google of violating the Digital Markets Act. Since March last year, the European Union has been investigating Google over this. An investigation is understood to focus on whether Google favors its vertical search engines such as Google Shopping, Google Flights and Google Hotels, and whether it discriminates against third-party services in search results. People familiar with the matter said the EU’s upcoming charges are related to this issue.

[AMD is reported to be negotiating to sell its server factory at a valuation of up to US$4 billion]

People familiar with the matter said AMD is in talks with Asian companies to sell the data center manufacturing plant it agreed to acquire last year. People familiar with the matter said companies have expressed interest in acquiring, and these assets, including debt, could be valued at US$3 billion to US$4 billion. People familiar with the matter, who spoke on condition of anonymity because they discussed confidential information, said the sale could be announced as early as the second quarter. They said consultations were still ongoing and it was unclear whether AMD would reach a deal.

[The U.S. SEC decides to drop charges against Coinbase for operating an unregistered exchange and listing unregistered securities]

The U.S. Securities and Exchange Commission has agreed to drop the lawsuit against Coinbase pending approval from agency commissioners. The SEC has decided to completely drop charges against Coinbase that it operates an unregistered exchange and lists unregistered securities. Stopping regulators ‘core legal objections will shift the focus from the courts to Congress to determine the standards for operating cryptocurrencies in the United States. According to Coinbase’s chief counsel, the U.S. Securities and Exchange Commission will soon vote on the agreement negotiated with Coinbase, completely abandoning the agency’s legal pursuit of the cryptocurrency exchange.