Deleted team members at Kelsier Ventures found based on web snapshots

Kelsier Ventures ‘operations reveal

The following is from a survey video by BoDoggos Entertainment CEO Nick O’Neil:

In this video, I want to take a closer look at Kelsier Ventures, which has so far been actively offering token issuance services, despite the current risks faced by one of their founders, Hayden, and being embroiled in an international scandal. What I can learn today is the entire process of how Kelsier conducts token issuance, including fees, how the company is involved in money laundering, token laundering, and internal manipulation for relatives and friends. Next, I will switch to the computer screen to show my understanding of Kelsier Ventures and how they currently operate, and gradually analyze the four important components of Kelsier Ventures.

shipments

I interacted with team members and learned about their actual charging and operating process. First of all, Kelsier Ventures is still actively operating, and Hayden is currently in an undisclosed location. Although I have a rough idea of where he is, I don’t want to make this information public.

I received a quote today from the team, whose core business model is clearly still low-key, and you’ll see what I call the “launch and extract” process, which is designed to extract as much money as possible from their tokens. When you pay for their services, they discuss how to shuffle and target “sniping”. I’ll talk more about the fee structure later, but essentially they want the entire process to be untracked and will “launder” in and out.

Some people may call it wire transfer fraud, but I don’t know how they will define it themselves, leaving it to the judicial system to judge. But from the perspective of my understanding, this can basically be said.

They will also conduct market making after token issuance and provide different options. These include short-term operations, known as Melania, and long-term market making, which requires them to use 20% of their tokens to make market. The “shuffling” process I mentioned before is completed during these operations, and then funds are withdrawn from it.

charging standards

Next, let’s look at pricing. In fact, the price is relatively standard. If you have any contact with market makers in this field, you will know that this is straightforward. They will charge a 2% share of the tokens and plan to sell those tokens in the future.

I saw a recent leaked internal video that mentioned that the ratio could be 1%. In fact, they may allocate that 2% share to different people, but regardless, they are charging the 2% share of tokens and plan to liquidate as much as 1.1% of it every day. That is, if you provide 2% tokens and the service period is 20 days.

Calculate it at a service charge of $3000 per day, or charge 20% based on the amount you withdraw. If you asked them to sell $1 million today, they would charge a 20% service fee, or $200,000. Therefore, the fee structure is based on the higher amount.

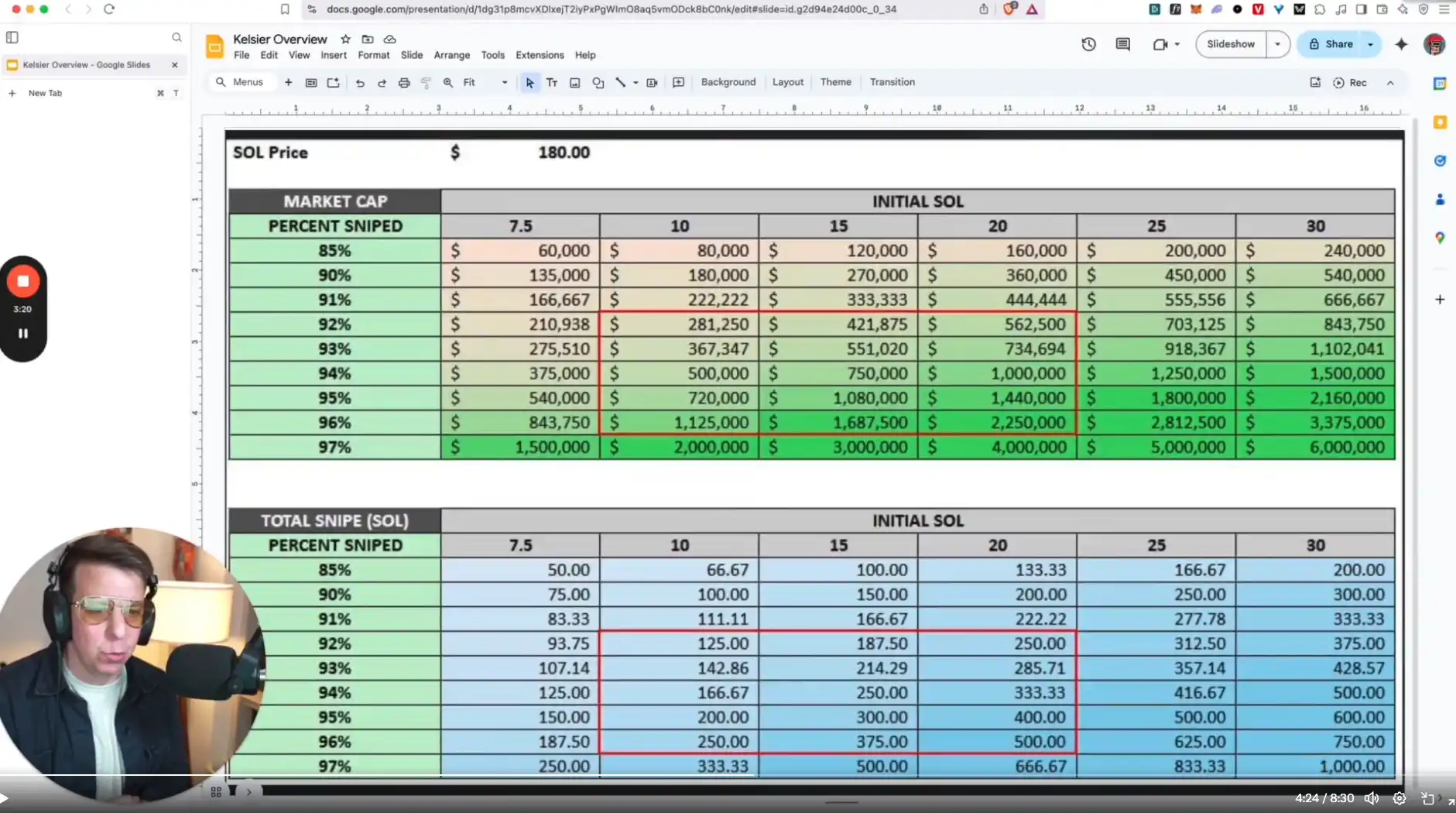

However, there is also part of the cost to start these operations, which is the chart they use internally and provide to customers, and this is the latest pricing today.

I’m not going to delve into it here because it’s not important, but I’ll give you an example. Suppose you want to set the market value of your tokens at US$1 million and plan to “shuffle” 94% of the tokens. They usually perform this “shuffle” operation at each release, with a ratio typically ranging from 85% to 97%. If you look at the issuance of Melania tokens, you will see that it fits this range. In this way, they actually entered the market ahead of time before it officially opened, basically “rushing” all other buyers.

Taking a million-dollar market value as an example, suppose you spend 333.33 Sol today to start the process, which is 333.33 times $180, for a total of $60,000, plus 20 Sol as the initial cost, plus other fees, and the final cost is $63,500.

Why choose a higher market price? That may be because there is a lot of demand and want to start at a high price. Of course, for some small projects, the market price is lower, but for larger projects such as Trump Tokens and Melania Tokens, the price will be higher, and they will reshuffle in advance.

From my perspective, this practice is almost illegal, but this is their structure. I suggest you take a deep look at the chart yourself to understand how they operate.

Finally, I want to mention one key point and I will show it further in the video. According to my sources, 90% of the “snipers” come from within Kelshear. They distribute tokens to friends or set up operations for their own robots. Although I can’t confirm this, it seems like this is the way they operate, which is ridiculous.

As I said, they are still doing these things. The operation of the entire system is based on money laundering, pre-emptive sales, and market making. In the short term, it is the typical “skyrocketing sell-off”(such as Melania tokens), and then long-term market making. As mentioned in the conversation between Hayden and Dave Portnoy, they will eventually use the money they earn to buy back the tokens and eventually “dump” them on the market.

“Video Link”