Lower the threshold? Supervision has been strengthened!

Authors: Iris, Bai Qin, Huang Wenying

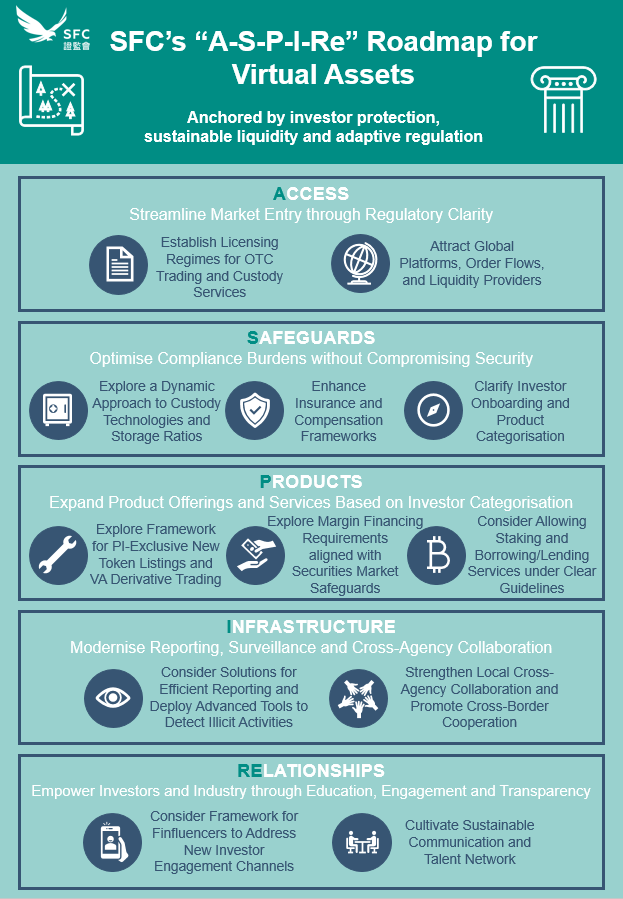

On February 19, 2025, the Hong Kong Securities and Futures Commission (SFC) released the latest regulatory roadmap “A-S-P-I-Re” for the virtual asset market, aiming to further improve the supervision of the virtual asset market and introduce more types of virtual asset products and functions balance innovation and risk management in Hong Kong’s Web3 industry.

The roadmap proposes that the Hong Kong Securities and Futures Commission will adopt five pillars next, namely Market Access, Safeguards, Product Innovation, Infrastructure and Relationships, as well as 12 actions, including but not limited to optimizing the licensing system, promoting the supervision of OTC and custody services, studying allowing professional investors to trade derivatives and Staking, and building Hong Kong into a compliant and trustworthy virtual asset flow center.

For Lawyer Mankiw, the release of this regulatory roadmap also means that the compliance direction and path for starting a Hong Kong Web3 project are becoming clearer. Therefore, in this article, Lawyer Mankiw will first summarize and summarize the roadmap and refine key regulatory directions and compliance matters related to the entry of Web3 projects in Hong Kong for practitioners to understand.

Pillar A: Expand access

In 2024, the Hong Kong Securities and Futures Commission will officially implement the virtual asset trading platform (VATP) licensing system, and multiple virtual asset trading platforms in the Hong Kong virtual asset market have been approved for operation.

However, market entry barriers still exist, especiallyOTC(OTC)andhosting servicesIt has not yet been incorporated into the regulatory framework, which not only affects the integrity of the market structure, but also limits investors ‘trading options. To this end, SFC proposed to establish under Pillar AIndependent licensing system for OTC trading and custody services, enable non-VATP businesses to operate under a compliance framework. OTC transactions are crucial for bulk transactions, and custodians are a key link in ensuring asset safety. The new licensing system will fill market gaps and enhance the security and transparency of the Hong Kong market.

At the same time, Hong Kong’s virtual asset market cannot rely solely on local virtual asset trading platforms, such asLiquidity providers (LPs), global virtual asset trading platformIt can also bring new blood to Hong Kong’s virtual asset market. Therefore, the Hong Kong Securities and Futures Commission also plans to appropriately lower the threshold in 2025 and introduce this type of provider in compliance, allowing local investors to access a wider range of global trading order books, while reducing transaction costs and improving market liquidity.

For Web3 companies, the launch of Pillar A meansChanges in market entry thresholds。Companies planning to provide OTC trading or custody services in Hong Kong need to pay close attention to new licensing requirements, and licensed trading platforms will also face greater competitive pressure from international platforms. At the same time, the opening up of global liquidity will make Hong Kong a more attractive virtual asset center, but it will also put forward higher requirements for companies ‘compliance capabilities.

Pillar S: Optimizing compliance requirements

At the end of 2024, the Hong Kong Securities and Futures Commission summarized the licensing process and results of the year, and believed that it was necessary to optimize the compliance process and increase the licensing rate while ensuring market security. At the same time, the global regulatory environment continues to evolve, and overly strict compliance requirements may reduce the attractiveness of the Hong Kong market and hinder the entry of global liquidity.

Therefore, inPillar SAt the beginning, SFC proposed a series of adjustment plans toOptimize custody, storage ratios, insurance compensation mechanisms and investor access rulesEnsure that while maintaining market security, unnecessary compliance costs are reduced and market competitiveness is improved.

For example, Hong Kong’s current custody requirements and cold storage ratios are too rigid, which may cause VASPs to face liquidity management difficulties during periods of high transaction volume. In the next adjustment, SFC plans to allow trading platforms to choose custody methods and optimize the proportion of hot and cold storage based on their own risk management strategies. At the same time, they will be supplemented by independent auditing, real-time monitoring and other mechanisms to ensure fund security and improve operational efficiency. In addition, mandatory insurance and compensation mechanisms will also be more flexible. In the future, VASPs will be able to select appropriate insurance solutions based on their own business models, rather than one-size-fits-all uniform standards.

In terms of investor access, SFC plans to adopt a clearer product classification framework to enable Web3 companies to clarify their own compliance paths when product launches and market access. For example, different types of virtual assets such as securities tokens, stablecoins, and RWA (real-world asset tokenization) may be subject to different regulatory requirements to reduce compliance uncertainties and ensure market transparency for investors.

For Web3 companies, Pillar S’s adjustment means a reduction in compliance costs, but it also puts forward higher technical and risk control requirements. Trading platforms and custodians need to adjust their storage and security strategies based on the new regulatory framework, while project parties planning to enter the Hong Kong market need to more clearly position the regulatory attributes of their products to ensure compliance operations.

Pillar P: Expand product range

Currently, Hong Kong’s virtual asset trading market mainly focuses on the spot market. At the same time, taking HashKey Exchange, Hong Kong’s largest licensed exchange, as an example, currently only offers a few mainstream currencies (such as BTC and ETH), and the overall product diversity in the market is low. Compared with the global market, Hong Kong’s trading ecosystem still has greater room for expansion, especially inDerivatives, Staking, Lending, Structured Productsand other financial instruments.

Therefore, the proposal of Pillar P means that the Hong Kong Securities and Futures Commission plans to expand a wider range of tradable products under the compliance framework to meet the needs of professional investors for risk management tools and market depth. The core idea of the regulatory authorities is not to fully liberalize, but toInvestor Adaptability PrinciplesUnder the Investor Suitability Principle, we will first open up some high-risk products to Professional Investors (PI), while strengthening transparency and market supervision.

First, the SFC plan allows professional investors to trade new tokens and virtual asset derivatives. The listing of new tokens will be based on stricter Due Diligence and information disclosure requirements to ensure that only tokens that meet the standards can enter the market for trading. At the same time, the Hong Kong Securities and Futures Commission will also study the regulatory framework for virtual asset derivatives to support professional investors in hedging, arbitrage and risk management.

In addition to the expansion of trading products, the Hong Kong Securities and Futures Commission also proposed to explore a compliance framework for pledge and lending businesses under Pillar P. At present, pledge and lending businesses have become mainstream virtual asset investment strategies in the global market, but Hong Kong’s supervision of these services is still in a gray area. In the future, the SFC is expected to allow regulated trading platforms to provide pledge and lending services, but may require them to meet specific custody, risk management and information disclosure standards.

The implementation of this series of measures means that the product types in the Hong Kong market will move closer to international standards, but it also requires Web3 companies to invest more resources in compliance and risk control. For projects planning to provide quality or loan services in Hong Kong, establishing a safe asset custody mechanism and a transparent revenue distribution model may become key elements of compliance.

Pillar I: Strengthening regulatory capabilities

There were various airdrop fishing incidents before, and then the president recommended MEME coins suspected of insider trading. The Web3 market has never been “short of” market manipulation, fraudulent transactions, money laundering and other issues. However, at present, the SFC, or regulators in most countries and regions, mainly rely on event triggers, that is, action will only be taken when a security incident occurs. thispost-event supervision modeObviously, there is obvious lag, making it difficult to effectively prevent market manipulation or fraudulent transactions.

Therefore, under Pillar I, SFC plans to build new technologies through new technology tools and infrastructureOptimize the regulatory reporting mechanismand introduceData-driven monitoring toolsto enhance regulatory capabilities within the market. SFC proposes to study ways to directly report digital asset information and explore various data-driven monitoring tools, including transaction monitoring, blockchain intelligence, wallet tracking, etc., to identify fraud, financial crimes and market misconduct earlier.

Meanwhile, SFC plansStrengthen cross-agency cooperation, including but not limited to cooperating with the Hong Kong Police, the Hong Kong Monetary Authority (HKMA), the International Securities Regulatory Organization (IOSCO) and other institutions to jointly combat market manipulation and illegal transactions.

For Web3 companies, especially virtual asset trading platforms, Pillar I’s regulatory upgrade means stricter data reporting obligations and higher transaction transparency requirements. Therefore, companies need to strengthen compliance management and risk control systems to ensure compliance with future regulatory standards, especially in terms of transaction data reporting, asset flow monitoring and anti-money laundering compliance.

Pillar Re: Popularization of market education

The complexity and high risk of the virtual asset market make investor education and industry transparency issues that cannot be ignored. Pillar Re in the roadmap focuses on Web3Market education, industry exchangesandregulatory transparency, is designed to help investors better understand the market and promote interaction between Web3 companies and regulators.

One noteworthy move is that the Hong Kong Securities and Futures Commission plans to targetFinfluencers (financial bloggers)Establish a regulatory framework. In recent years, social media has been flooded with a large number of investment suggestions on virtual assets, and someKOL(Opinion Leader)Through misleading publicity to influence investors ‘decisions, even a small number of KOLs have become part of the scam. Therefore, SFC plans to ensure that investors can better understand virtual asset investment and protect their own interests by promoting responsible behavior and accountability among financial influencers. Once this measure is implemented, for Web3 companies and KOL, it may mean that marketing compliance requirements in the Hong Kong market will be stricter, and KOL and social media promotion will be subject to higher standards of supervision.

In addition to measures targeting KOL, regulators also plan to launchInvestor Education programme, in order to enhance the awareness level of market participants and reduce investment risks. Pillar Re also emphasizedEstablish an industry exchange platformImprove policy transparency. Hong Kong Securities and Futures Commission plans to passvirtual assetsAdvisory Group (VACP)Strengthen communication with Web3 companies so that market participants can more directly understand regulatory policies and provide feedback during the policy formulation process. In this way, Web3 companies will be able to leverageOfficial industry exchange platformEstablish closer communication with regulatory agencies to ensure business compliance and sustainability.

Lawyer Mankiw concluded

The “A-S-P-I-Re” roadmap released by the Hong Kong Securities and Futures Commission (SFC) is undoubtedly an important milestone in the compliance process of Hong Kong’s virtual asset market. Judging from the five pillars and 12 measures, SFC is trying to find a balance between risk management and market development. For Web3 companies, the launch of this series of new regulations not only means that the compliance threshold in the Hong Kong market is clearer, but also means that compliance costs, market competition and regulatory requirements will be comprehensively upgraded.

As a Web3 lawyer who has long been concerned about the regulation of Hong Kong’s virtual asset market, Lawyer Mankiw has always maintained close communication with Hong Kong regulators and deeply participated in the license applications, business compliance and regulatory adaptation of Web3 companies in Hong Kong. Faced with this upcoming SFC regulatory upgrade, Mankiw lawyers will pay close attention to it and develop compliance solutions to optimize the business structure and improve market adaptability for virtual asset trading platforms, crypto funds, Web3 start-ups and cross-border business teams under the compliance framework.

As a Web3 lawyer who has long been concerned about the regulation of virtual assets in Hong Kong, Lawyer Mankiw has always maintained close communication with SFC and deeply participated in the license application and business compliance adaptation of Hong Kong Web3 companies. Faced with this regulatory upgrade, Lawyer Mankiw pays close attention to policy changes and helps trading platforms, crypto funds, start-ups and cross-border business teams to optimize business structures and improve market adaptability within the compliance framework.