Guess who is trashing ETH?

original| Daily Planet

author| Azuma

During this cycle, ETH’s performance lags far behind the overall market. Some people attribute this to the “heavy car”, some people accuse the Ethereum Foundation (EF) of being “unworthy of its position”, and this recent weekend, Layer2 has become the target of criticism from the community.

On February 9, Andre Cronje (AC), the god of DeFi in the previous cycle and now co-founder of Sonic, issued an article on X,Angry Layer2 has become a parasite on Ethereum by continuing to profit from selling sorters.

Become Layer2ˇ Run a centralized sorter ˇ Charge $120 million ˇ Pay Ethereum $10 million for DA and security ˇ Then sell $110 million for profitˇ Then call it the “Ethereum Alliance”… I don’t understand how the Ethereum community convinced itself to accept this logic.️️️Layer2 has become the main reason for Ethereum’s resurgence of inflation.

Sorter benefits for Layer2

The controversy over Layer2 ‘s sorter revenue is a cliché topic.

The sorter is an indispensable role in Layer2. Its main functions are: 1) collect user transactions and package them into batches in a specific order;2) provide users with instant transaction confirmation before the transactions are finally linked;3) Compress transaction data and submit it to Layer1 to reduce gas costs.

Decentralization of sorter operations is an essential step in Layer2 ‘s decentralization vision,But the reality is that almost all Layer2 sorters are run by the development team, which has been one of the biggest criticisms surrounding Layer2 for a long time.

Why has Layer2 been unable to complete the decentralization of sorters? Of course, there are certain technical and operational reasons for this, but another major reason that cannot be ignored is–In a real environment, running sorters is a very “profitable” business.

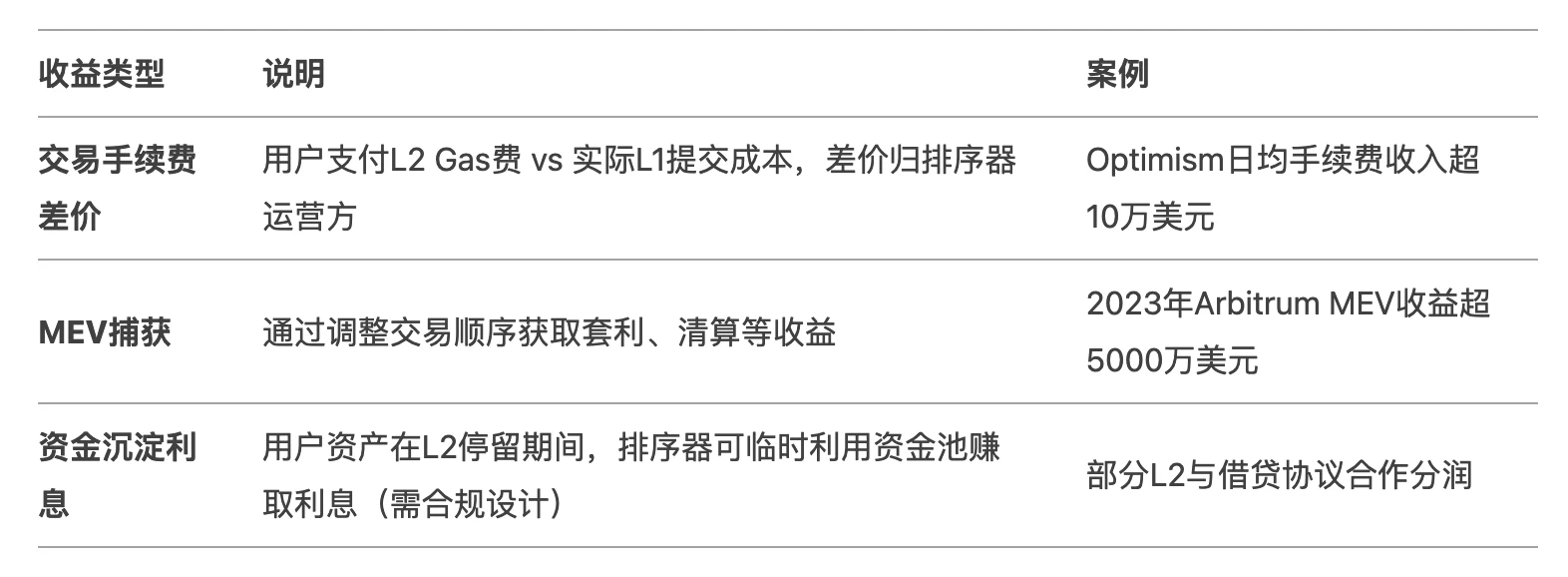

The direct income sources from the operation of the sorter mainly include: 1) transaction fee differences;2) MEV capture; and 3) interest on funds deposited.

Odaily's note: The picture shows Teacher DeepSeek's further understanding.

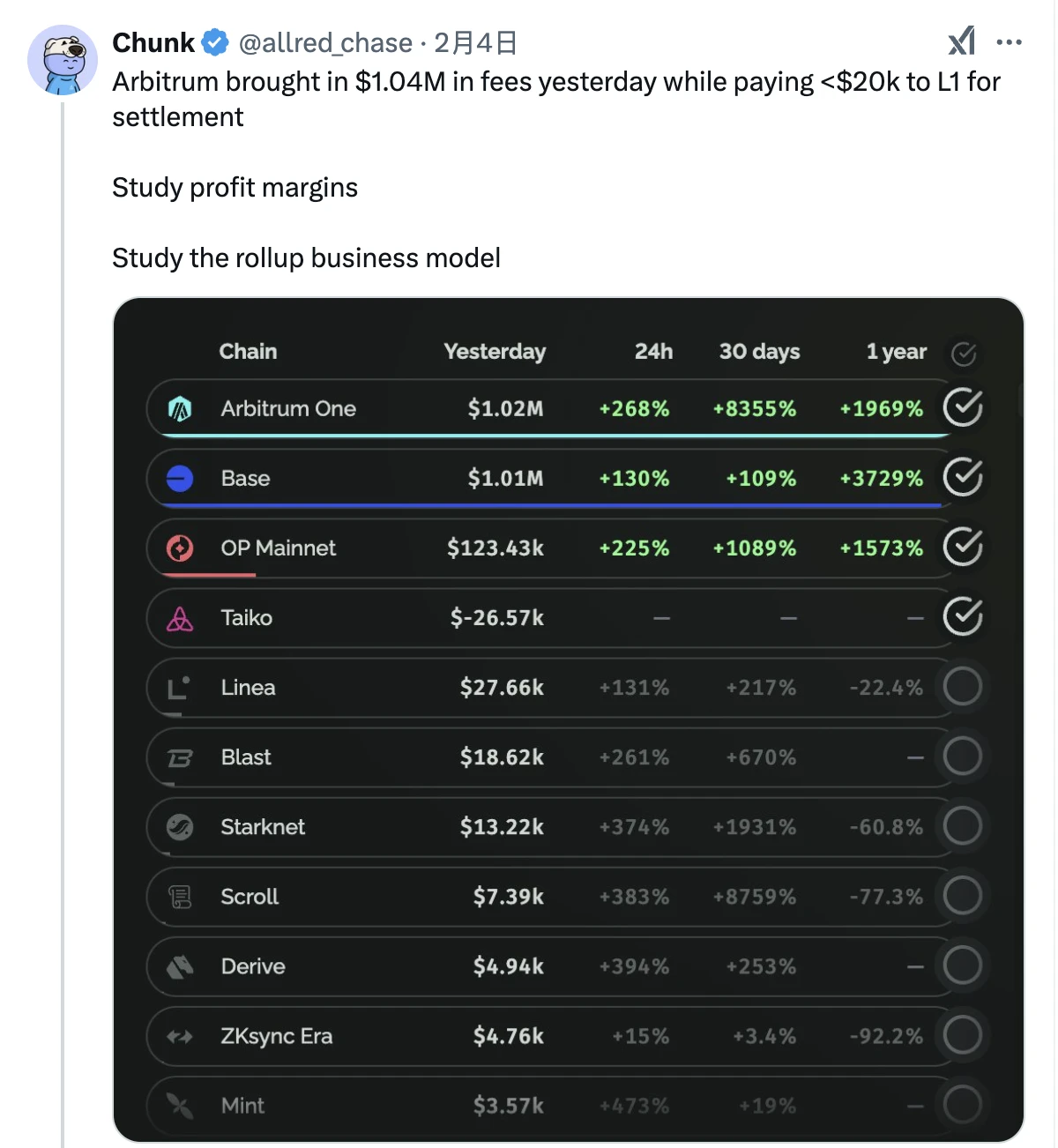

How profitable is this business? We can take a rough look at the data for a single day on February 4.

On February 4, affected by collective market fluctuations, Arbitrum charged US$1.04 million in fees at the Layer2 level in a single day, while the final settlement cost paid to Layer1 was less than US$20,000-which means that in just one day, the chain earned millions of dollars in revenue through trading fee spreads.

Target Base

As the most active Layer2 network in the Ethereum ecosystem, Base has long been at the center of relevant public opinion. As the debate over the benefits of the Layer2 sorter intensified, the community began to target Base.

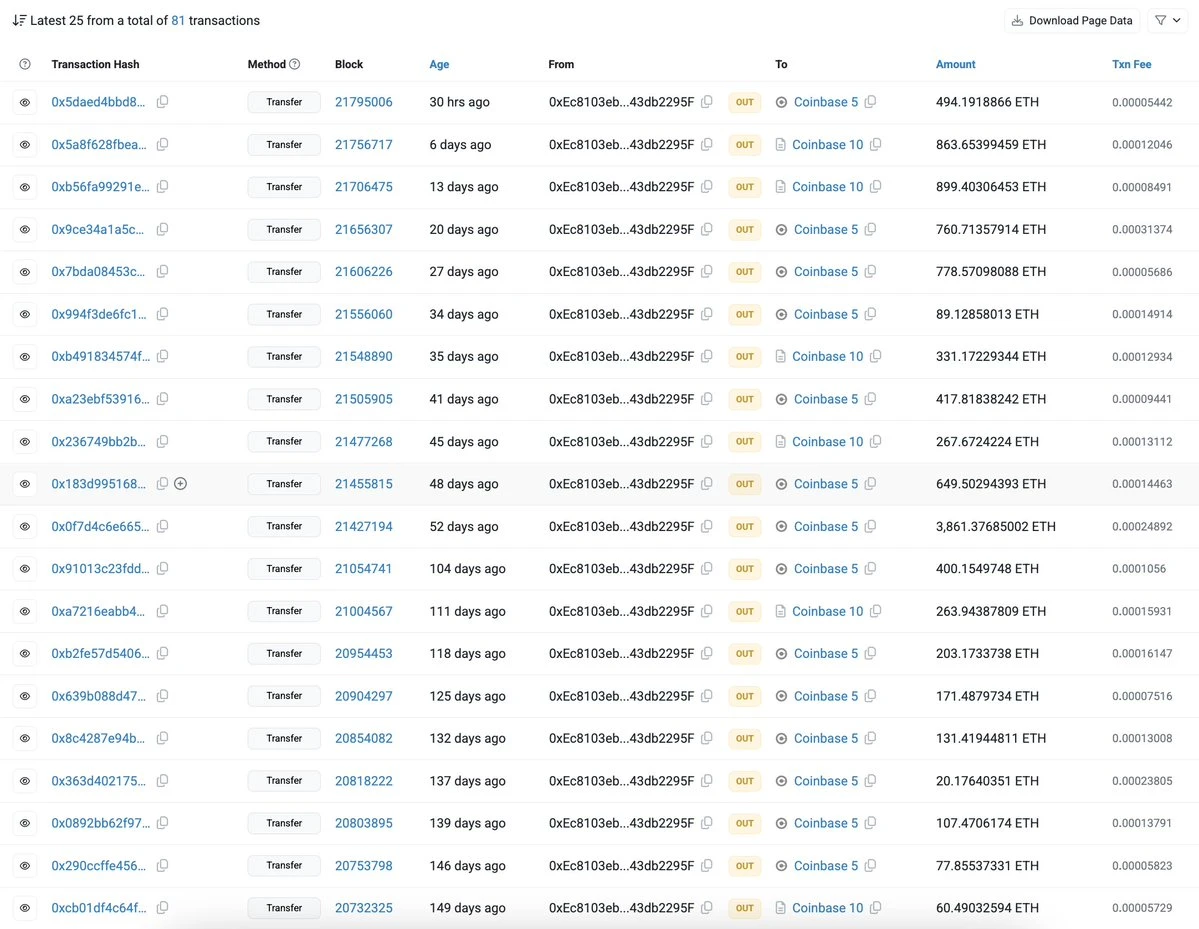

Lucity CIOSantisa took the lead in X, accusing Base of transferring all sorter revenue to Coinbase since its launch online. There is reason to suspect that these ETH have been sold off.

Since its launch, BASE has been transferring sorter fees to Coinbase. We don’t know if they have sold it, but we know they haven’t deployed the funds on Base or kept it on the chain. Due to the lack of further transparency, we can reasonably assume that they have sold. They do not align with Ethereum’s position.

Odaily Note: The picture shows the revenue address of the Base Sorter (0xEc8103eb573150cB92f8AF612e0072843db2295F).

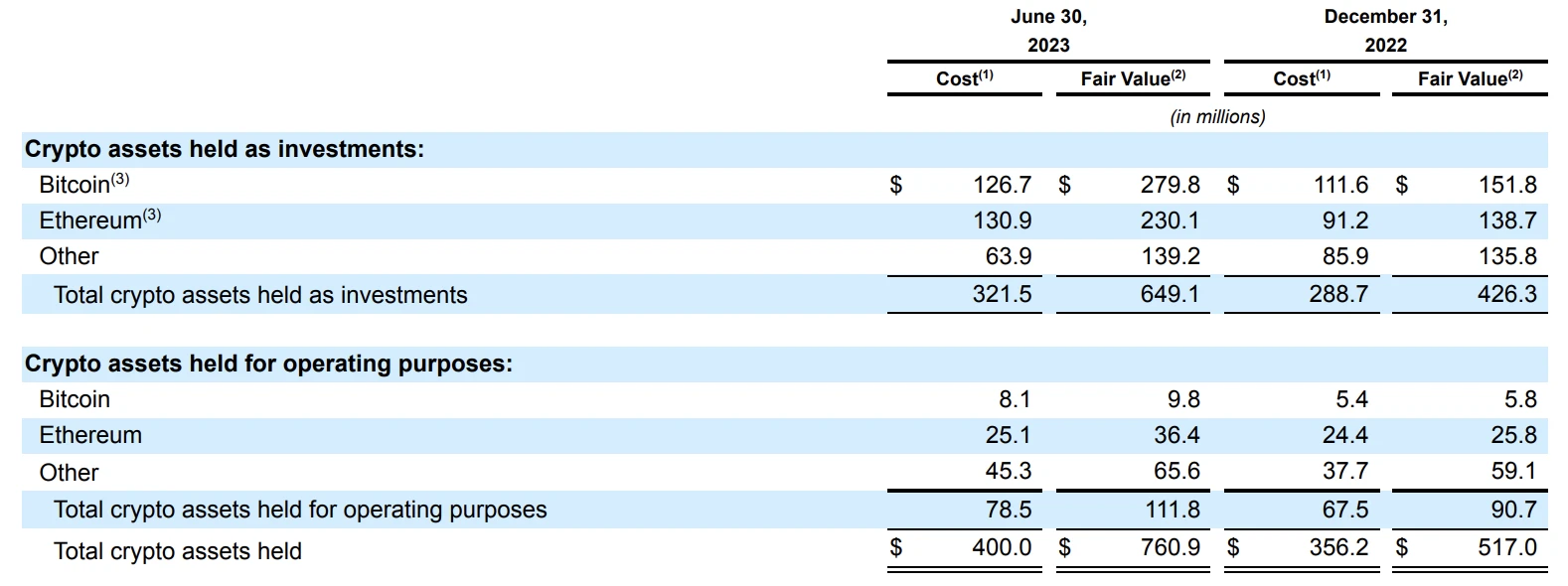

Later, Sonic team member The Assistant further relayed and combined Coinbase’s financial report data to analyze whether Base had sold these ETH.

The Assistant pointed out that the data on the chain can be checked (refer to the address posted by Santisa above),Base has earned more than US$100 million in revenue from sorters in the past 12 months, with a profit margin of over 90%, and all of these fees have been transferred to the exchange through Baseˇ EthereumˇCoinbase’s path.

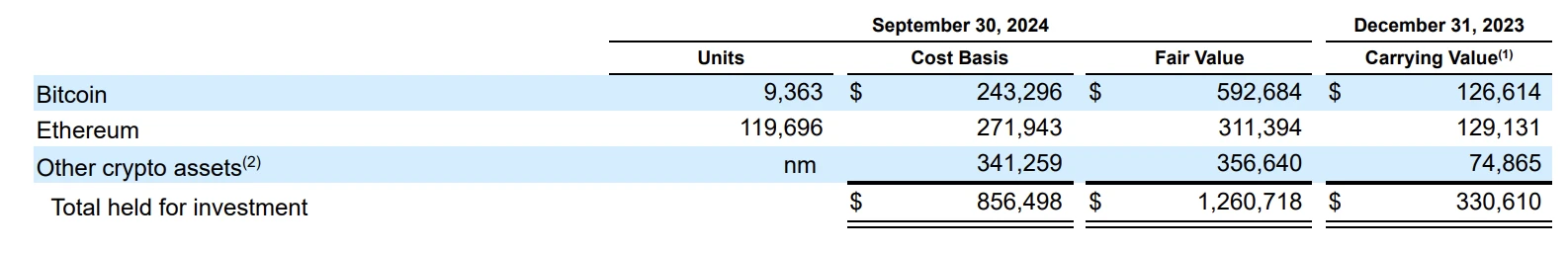

According to Coinbase’s public financial report data, as of June 30, 2023 (See page 66 of the 2023 Q2 earnings report), Coinbase held approximately US$230 million in ETH on its balance sheet. At the time, the ETH price was US$1934, which means that Coinbase held 118924 ETH; As of September 30, 2024 (see page 22 of the 2024 Q3 earnings report), Coinbase held 119696 ETH on its balance sheet.

The Assistant finally questioned,Since Base was launched, Coinbase has only increased its holdings by 772 ETH on its balance sheet. So where has the hundreds of millions of dollars worth of Base sorter revenue gone? There seems to be only one answer…

Some people may question that Base, as a (nominally) independent network, should not be included in Coinbase’s balance sheet. This doubt is equally unreasonable because Coinbase has highlighted the increase in Base’s revenue in many previous earnings reports.

Using The Assistant’s investigation content, AC forwarded it again and opened fire further:

The Ethereum community is proud of their Layer 2, but what Layer 2 does every day is to transfer fee revenue from Layer 2 to Layer 1, and then transfer it to Coinbase to sell. This is the leader in the Ethereum ecosystem. Ethereum community, wake up.

What is Vitalik’s potential attitude?

As of the publication, Vitalik has not yet responded to the accusations of AC and other community members. However, in a personal article on January 24 (“Under the Pressure of Public Opinion, Vitalik issued a Message to L2: Go Back to Support ETH”), we can roughly see that Vitalik is dissatisfied with the current operating status of Layer 2.

Vitalik mentioned in the article that it is necessary to clarify the economic model of ETH to ensure that ETH can continue to accumulate value in a Layer 2-intensive world. At the execution level, Vitalik encourages Layer 2 to support ETH by contributing a certain percentage of the fees, which can be achieved by destroying part of the fees, permanently mortgaging, and donating the proceeds to the Ethereum ecosystem public goods or some other option.

Simply translate this passage:Don’t eat too badly at Layer 2, it’s time to give up some cake.