① Most large technology stocks fell, with Apple rising more than 2%;

② Most popular Chinese stocks fell, with the Nasdaq China Golden Dragon Index falling 1.66%;

③ Apple and Alibaba are said to cooperate to develop AI functions for China iPhone users.

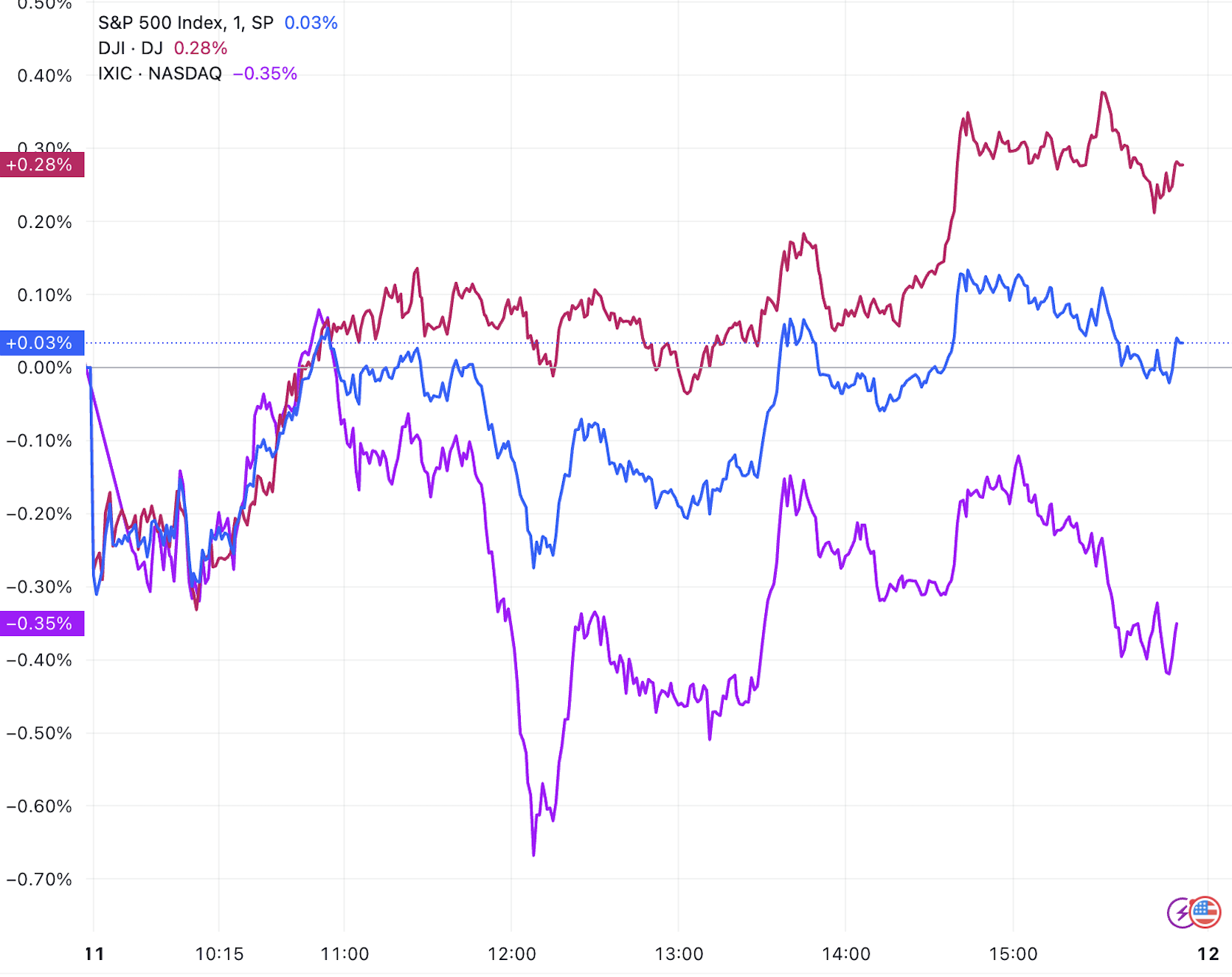

Cailian News, February 12 (Editor Xia Junxiong)On Tuesday, U.S. Eastern Time, investors weighed Federal Reserve Chairman Powell’s latest remarks. The three major indexes were mixed, with the Dow rising slightly, the S & P 500 index rising slightly, and the Nasdaq falling slightly.

(Minute charts of the three major indexes, source: TradingView)

At the close, the Dow Jones index rose 0.28% to 44,593.65 points; the S & P 500 index rose 0.03% to 6,080.50 points; and the Nasdaq index fell 0.36% to 19,643.86 points.

Powell said in a speech before the Senate Banking Committee on Tuesday that the Fed does not need to rush to cut interest rates further. He will appear before the House Financial Services Committee on Wednesday.

“Because our policy stance is much looser than before and the economy remains strong, there is no need for us to rush to adjust our policy stance,” Powell said.

He called the economy “overall strong” and the labor market “solid” and pointed out that inflation was easing but still above the Fed’s 2 percent target.

Two major inflation data will be released this week: the U.S. January Consumer Price Index (CPI) on Wednesday and the January Producer Price Index (PPI) on Thursday.

According to FactSet data, about two-thirds of companies in the S & P 500 index have released financial results so far, with 77% of companies having exceeded expectations.

“Markets really need to deal with these opposing forces,” said Tony Welch, chief investment officer at wealth management firm SignatureFD. He pointed out that on the one hand, the market is facing potential challenges from tariffs; on the other hand, corporate fundamentals are performing quite well.

Apple rose more than 2%. According to media reports, Apple is working with Alibaba to develop and launch AI features for iPhone users in China.

Tesla fell more than 6%, falling for five consecutive days on the daily line, hitting a new low since November 14 last year and the largest one-day decline since December 18.

Intel rose more than 6%, the largest one-day gain since January 21. The latest processor Core Ultra 9 275HX tops the rankings.

Performance of hot stocks

Most large technology stocks fell, with Apple rising 2.18%, Microsoft falling 0.19%, Nvidia falling 0.58%, Google falling 0.62%, Amazon falling 0.16%, Meta rising 0.33%, Tesla falling 6.34%, and Intel rising 6.07%.

Most popular Chinese stocks fell. The Nasdaq China Golden Dragon Index fell 1.66%, Alibaba rose 1.31%, Jingdong fell 3.25%, Pinduo rose 0.98%, NIO Automobile fell 6.70%, Xiaopeng Automobile fell 6.79%, Ideal Automobile fell 4.93%, Beili Beili fell 3.98%, Baidu fell 4.70%, Netease rose 0.53%, Tencent Music fell 0.24%, and Iqiyi fell 4.58%.

company news

[Apple and Alibaba are said to cooperate to develop AI functions for China iPhone users]

Apple and Alibaba will collaborate to develop AI features for China iPhone users. According to people familiar with the matter, the move is part of Apple’s strategies to deal with declining sales in China, aiming to provide more attractive software features.

People familiar with the matter said that Apple has been testing different artificial intelligence models from well-known China artificial intelligence developers since 2023 and chose Baidu as its main partner last year.

People familiar with the matter said that Apple has begun to consider other options in recent months, evaluating models developed by Tencent, ByteDance, Alibaba and Deepseek.

[Altman: OpenAI won’t sell Musk’s takeover proposal is ‘ridiculous’]

Sam Altman, CEO of the U.S. Center for Open Artificial Intelligence Research (OpenAI), said Musk’s proposal to acquire OpenAI was “ridiculous.” Altman said the company would not be sold, another tactic Musk tried to disrupt them. On the 10th local time, a consortium led by Musk offered US$97.4 billion to seek control of OpenAI. Musk’s lawyer Mark Toberov said the offer had been submitted to the OpenAI board of directors.

[Gilead Science’s fourth-quarter revenue of US$7.57 billion was higher than market expectations]

Gilead Science’s fourth-quarter revenue was US$7.57 billion, and analysts expected US$7.13 billion. Fourth quarter revenue was $7.57 billion, with analysts expecting $7.13 billion; fourth quarter Veklury revenue was $337 million, with analysts expecting $380.1 million; fourth quarter Trodelvy revenue was $355 million, with analysts expecting $321.5 million. The company expects adjusted EPS in 2025 to be US$7.7 -8.1, and analysts expect US$7.54; the company expects product sales in 2025 to US$28.2 billion to US$28.6 billion, and analysts expect US$28.07 billion; the company expects Veklury’s revenue in 2025 to US$1.4 billion.

[JPMorgan Chase: Trading and investment banking businesses are expected to achieve double-digit growth in the first quarter]

JPMorgan Chase’s trading revenue and investment banking revenue may both grow by more than 10% in the first quarter, and volatility and capital market recovery continue to benefit Wall Street. Chief Operating Officer Jenn Piepszak told a conference hosted by Bank of America on Tuesday that in terms of percentages, transaction revenue may grow by “low double digits” year-on-year, while investment banking revenue may grow by “medium double digits.”

[Ultramicro Computer expects net sales of US$5.6 billion to US$5.7 billion in the second quarter. The company originally expected US$5.5 billion to US$6.1 billion]

Ultramicro Computer expects net sales of US$5.6 billion to US$5.7 billion in the fiscal second quarter, compared with the company’s original forecast of US$5.5 billion to US$6.1 billion. The adjusted EPS for the fiscal second quarter is expected to be US$0.58 -0.6. Analysts expected US$0.64. The company originally expected US$0.56 -0.65. Net sales for the full year are expected to be US$23.5 billion to US$25 billion, compared with the company’s original forecast of US$26 billion to US$30 billion.

Ultramicro computer delays submitting its 10Q report to the U.S. Securities and Exchange Commission (SEC). The company attracted subpoenas from the U.S. Department of Justice and the SEC over allegations by short sellers. The company is cooperating with the U.S. Department of Justice and the SEC to issue documents.

[Lenovo Group joins hands with IBM to create artificial intelligence solutions]

The Saudi Arabia Electronics Technology and Information Technology Exhibition (LEAP), the largest science and technology event in the Middle East, recently opened in Riyadh, the capital of Saudi Arabia. Lenovo Group presented at LEAP2025 with a number of cutting-edge technological achievements. During the exhibition, Lenovo Group and IBM also officially announced a plan to expand their strategic technology partnership to jointly create artificial intelligence solutions consisting of IBM’s watsonx artificial intelligence product portfolio technologies. The solution integrates the Saudi Data and Artificial Intelligence Authority (SDAIA) open source Arabic Large Language Model (ALLaM) and Lenovo’s advanced infrastructure. These innovative solutions are expected to help Saudi government and corporate customers accelerate the application of artificial intelligence.