SOL’s huge liquidity expectations have caused market concerns, and the aftermath of FTX’s asset sell-off will once again impact the crypto ecosystem. Is panic spreading excessively, or is the risk not yet fully priced?

Author: Frank, PANews

On February 18, 2025, FTX’s first round of creditor payments was officially launched, marking the critical stage of this two-year bankruptcy liquidation. However, market attention is focused on another potential risk: on March 1, 11.2 million SOL tokens auctioned in FTX’s bankruptcy will soon be unlocked, valued at US$1.9 billion. Although settlement of claims in fiat may seem “moderate”, SOL’s huge liquidity expectations have caused market concerns, and the fallout of FTX’s asset sell-off will once again impact the crypto ecosystem. Is panic spreading excessively, or is the risk not yet fully priced?

There are still more than 5 billion yuan outstanding in the first round

According to public information, the type of creditors who received compensation in this round is the initial beneficiary, which refers to small creditors with a claim amount of US$50,000 or less. Under FTX’s restructuring plan, they will be repaid in full and enjoy an annual interest rate of 9%. These users may eventually receive a 119% legal currency refund.

According to FTX creditor Sunil, approximately US$800 million has been paid out so far, covering 162,000 accounts, or 35% of the expected 460,000 eligible claims accounts. In addition, repayments greater than $50,000 need to wait until after May 30.

Previous reports have shown that the overall repayment plan for the first phase involves an amount of US$6.5 billion to US$7 billion. This round of payments is expected to last until March 4. However, FTX has not announced the actual repayment amount for the first round.

From the perspective of repayment, since FTX chose the payment method in fiat currency, the repayment may not cause much turmoil to the crypto market at first, and may also bring some new funds to the market.

Nearly $2 billion worth of OTC SOL tokens unlocked

The market’s panic about FTX mainly comes from auctions of crypto assets such as Solana. Documents as of 2023 show that FTX’s total assets are only US$4.77 billion, a gap of US$6.8 billion from the estimated US$11.5 billion in compensation at the time. As the crypto market ushers in a bull market in 2024, the crypto assets held by FTX have experienced a sharp rise.

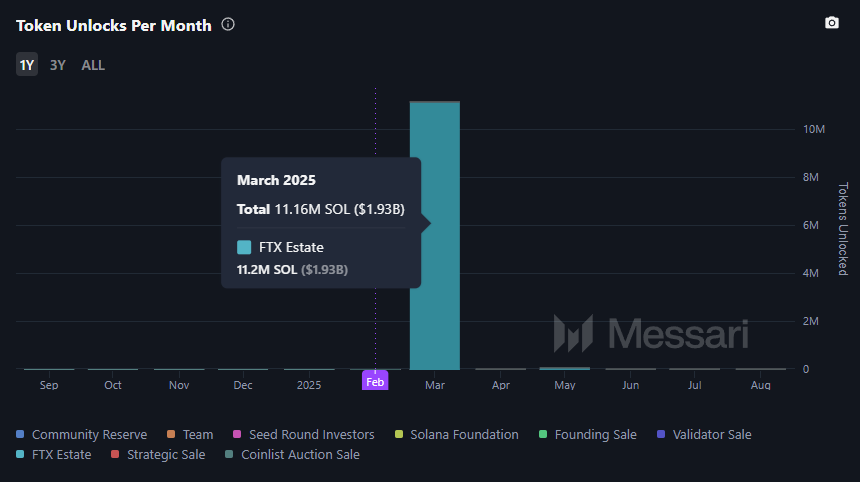

Among them, Solana has given the most blood transfusions to FTX, and the largest increase in SOL tokens since December 2022 has exceeded 28 times. As one of Solana’s main investors, FTX holds a large number of locked SOL tokens. According to monitoring data from@ai_9684xtpa, FTX has sold 41 million SOL units through three auctions as of February 17. Among them, 11.2 million will be unlocked on March 1.

According to reports, the 41 million coins were not sold directly through the secondary market, but were sold by Galaxy (buying 25.52 million coins for US$64), Pantera and other buyers (buying 13.67 million coins for US$95), Figure and other buyers (buying 1.8 million coins for US$102). Overall, these tokens brought US$2.932 billion to FTX, making it the largest type of liquidation income among the crypto asset classes.

Regarding SOL’s unlocking token, this transaction should have been completed through auction before, and only delivery will be realized after unlocking. Of course, no matter who the ultimate controller is, these tokens will enter circulation, and the known costs of these buyers are far below the market price. Therefore, there is indeed a risk of profit-selling, but these SOLs that are about to be unlocked only account for 2.3% of the current circulation.

Sui has bought back equity, but the disposal method of APT, AVAX and other assets is unknown

In March 2024, FTX announced the sale of shares and tokens it invested in Mysten Labs for US$95 million. Mysten Labs is the development company of Sui Networks. As of the end of 2024, the maximum value of these sold shares and tokens is US$4.6 billion. For the market, if FTX retains these tokens, then the SUI market will face greater pressure.

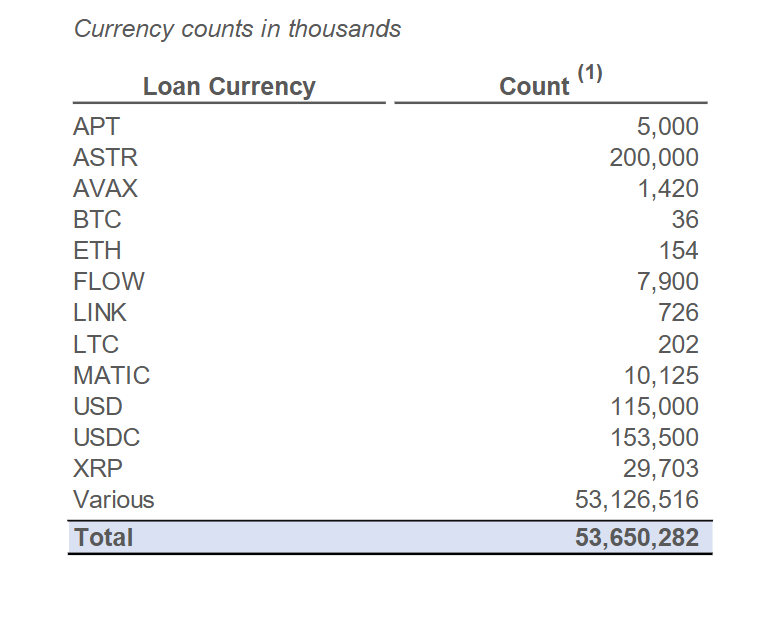

In addition to Solana and Sui, Aptos was also one of the public chains that FTX initially invested in. According to media data, in 2022, FTX Ventures and Jump Crypto led Aptos ‘$150 million financing. However, as of now, Aptos has not announced the final disposal results of this stake. According to the data provided by FTX in March 2023, the number of APT tokens held at that time was 5 million. However, in the FTX chain address of ARKM, no data information of APT tokens has been found currently. Based on February 19 prices, the value of this part of the APT is approximately US$31.65 million.

As of February 19, among the addresses on the FTX chain, the largest holding of tokens was FTT, holding a total of 257 million tokens with a value of approximately US$505 million. The total market value of FTT is only US$657 million. If its positions are sold, price shocks may become the biggest risk. FTX once asked users to fill in the price of purchasing FTT, but FTT is temporarily counted as 0 in fiat currency denominated compensation, and it is unclear how the holder of FTT will receive compensation.

In documents disclosed in 2023, FTX also holds 1.42 million AVAX (worth US$33.76 million), 36,000 BTC (worth US$346 million), 154,000 ETH (worth US$410 million), and 29.7 million XRP (worth US$76.32 million). However, as of February 19, these assets were no longer visible on the wallet address disclosed by FTX, and the sale had been completed during the liquidation period. As of February 19, the value of FTX’s on-chain address positions was approximately US$1.269 billion.

As FTX’s repayment began, the FTX bankruptcy event was finally coming to an end. After more than two years of transformation, the entire encryption industry has begun a new pattern, and the impact of FTX on the industry has increasingly become a part of history. The so-called recent market decline caused by FTX seems to be more like speculation or panic during the current period of market turmoil.