After struggling to survive 2024, the photovoltaic industry finally received some good news at the beginning of 2025.

According to data released by InfoLink Consulting, a new energy research institution, the prices of photovoltaic silicon materials and batteries both experienced a long-lost surge in early January, with some N-type silicon wafers and P-type batteries rising by as much as 20%. This performance is one of the few among the price cuts in the past two years.

However, it is a pity that in this price increase momentum, only the middle reaches are rising, and the two ends are still difficult to see improvement. The price of silicon material, the most upstream of the four main materials, is still at the bottom, and has not changed significantly in the past two months; As a terminal product, the price of the component with the strongest wind vane attributes, continued to decline in early January, and then only temporarily stopped falling, and the future trend remains confusing.

When InfoLink first announced the prices of the photovoltaic industry chain in 2025 on January 8, the prices of silicon wafers and cells increased considerably compared with the end of December 2024, but component prices were still falling.

Silicon material: The market game is fierce and prices have not improved

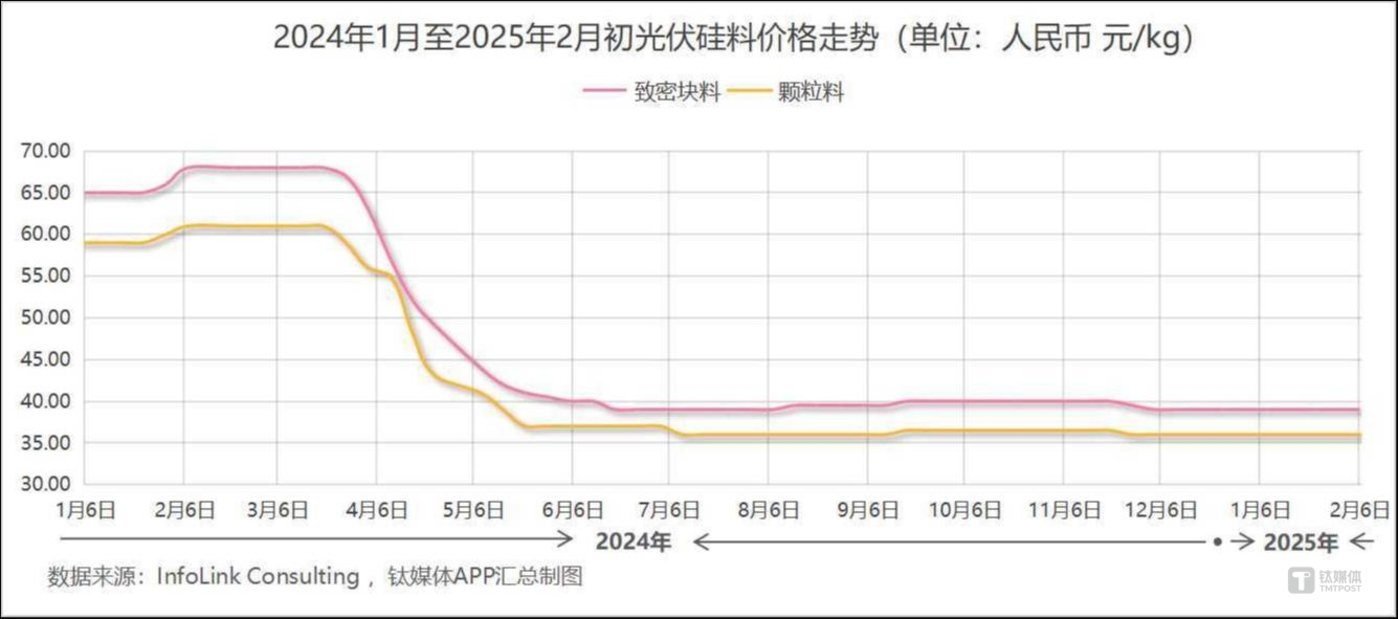

In terms of silicon materials, according to data released by InfoLink, after dense materials and granular materials fell to 39.5 yuan/kg and 36 yuan/kg respectively from November 27 to December 4 last year, as of February 6 this year, the average transaction price has not changed, and the decline is close to 40% compared with the beginning of last year.

However, market transactions in this segment are not as dull as the average transaction price seems,In the two weeks before the Spring Festival, there was a fierce game in the silicon material market, the highest and lowest transaction prices are also constantly changing.

According to InfoLink’s analysis, the key to the game lies in the obvious differentiation of upstream and downstream strategies. After continuing to reduce production in the second half of 2024, silicon material manufacturers are increasingly willing to bid for prices. However, most downstream silicon wafer factories have already had sufficient stocks before, and considering factors such as production suspension during the Spring Festival, they are reluctant to pay higher prices to purchase silicon materials.Buyers and sellers continue to pull, and the trading price range fluctuates, but the average price remains in place。

The Silicon Industry Branch of China Nonferrous Metals Industry Association also said that silicon materials companies have actively increased their quotations since December last year, but downstream acceptance has always been low. In January this year, although silicon materials inventories have shifted from upstream to downstream, the stock is still considerable, and price repair in this link will still require a period of inventory digestion.

However, the Silicon Industry Branch also placed great hope on the silicon material market after the Spring Festival in its recent analysis. The agency believes that due to the steady advancement of industry self-discipline, the listing of polysilicon futures, and the hoarding and consumption of downstream raw materials during the Spring Festival, silicon material prices are expected to continue to rise to a relatively reasonable range after the year.

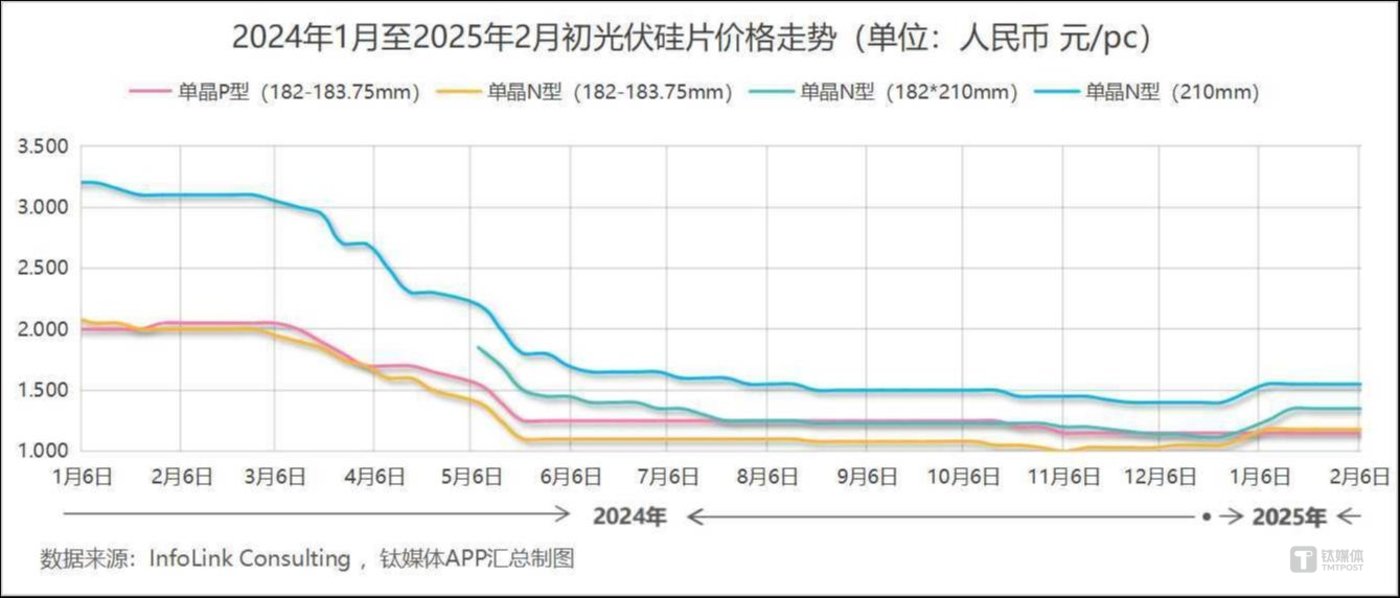

Silicon wafer: Prices rise first, ushering in a good start in 2025

In terms of silicon wafers, after continuing to reduce production and control prices, the supply and demand situation has improved significantly, ultimately promoting a surge in the beginning of 2025. According to data released by InfoLink on January 8, the prices of N-type silicon wafers in various categories increased by more than 10% in the current period compared with the end of December. In the following week, N-type silicon wafers in 182*210mm size continued to rise. Although the signing of orders basically stopped around the Spring Festival and the price did not change again, the market is still full of expectations for its continued upward attacks after the holiday.

Specifically, as of February 6, the average trading price of single crystal P-type silicon wafers with a size of 182-183.75mm was 1.15 yuan/piece. As P-type silicon wafers are in the trend of being replaced by N-type silicon wafers, transactions are relatively flat, and the price is still the same as at the end of December last year, down 42.5% since January last year; The average trading price of single crystal N-type silicon wafers in the 182-183.75mm size is 1.18 yuan/piece. The price fell by 50% last year, but the price has increased by 12.38% this year; The average trading price of single crystal N-type silicon wafers in the 182* 210mm category is 1.35 yuan/piece, which has the most fierce recent increase“”. The price has increased by 20.54% this year; The average trading price of 210mm single crystal N-type silicon wafers is 1.55 yuan/piece, the largest drop last year, reaching 56.25%. Since the beginning of this year, the price has rebounded by 10.71%.

The strengthening of silicon wafer prices has to a certain extent strengthened the industry’s confidence that self-discipline control of production and improvement in supply and demand can effectively stimulate price recovery. ButAs a midstream sandwich link in the photovoltaic supply chain, the price trend of silicon wafers is most affected by upstream and downstream. When the trend of silicon materials and components is unclear, it is difficult for this link to stand alone.”。InfoLink also warned in its outlook that this link must pay special attention to the dynamic changes in the market after the Spring Festival. If silicon wafer prices continue to rise, it may prompt companies to adjust their production scheduling plans. Once companies increase their crop power rates in response to market changes, it is not ruled out that after the holiday, prices may reverse downward.

It is worth mentioning that last year, the performance of silicon materials and silicon wafers before the Spring Festival was stable, and even showed a trend of stabilization and recovery. However, as trading gradually became active after the holiday, prices began to weaken, and then suffered a historic level in the second quarter. Continuous plunge.

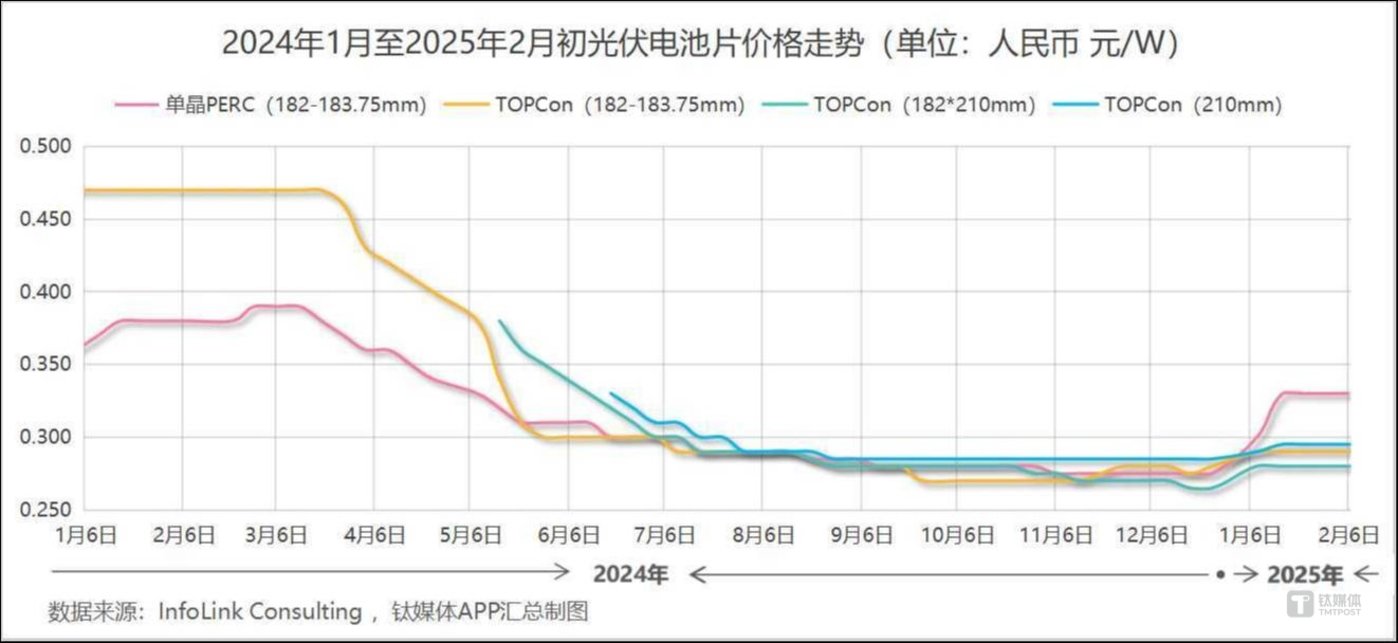

Battery slices: Supply and demand continue to improve, and prices finally pick up

After silicon wafers, last year, the battery sector also opened the road of controlling production and ensuring prices. The prices of some products showed signs of recovery in the fourth quarter, but they failed to form an upward breakthrough force. By the beginning of this year, this link finally ushered in a general increase. As of February 6, single crystal PERC (182-183.75mm) The average trading price of batteries is 0.33 yuan/W, which has risen 20% this year and has returned to the level of early May last year.(Last year, the price of this product fell by 23.61%. Taking into account this year’s rebound, the decline narrowed to 8.33%); In terms of N-type, the price of TOPCon batteries in 182-183.75mm size dropped by 40.43% last year, and has increased by 3.57% since the beginning of this year, with an average transaction price of 0.29 yuan/W; the current average transaction price of TOPCon batteries of 182* 210mm is 0.28 yuan/W, up 5.66% since the beginning of the year; The current average trading price of 210mm size TOPCon batteries is 0.295 yuan/W, an increase of 3.51% since the beginning of the year.

At the end of last year, the inventory of battery cells was basically digested. Coupled with the sharp rise in the price of silicon wafers, the price of battery cells was also increased.。In terms of P-type batteries, affected by last year’s vigorous N-type replacement, the remaining production capacity was small and supply was obviously in short supply. In the short term, a mismatch between supply and demand was formed, and prices were also greatly increased. In contrast, the rise of N-type batteries is more stable.

Before the Spring Festival, battery and component production lines had early holidays in the middle of the month as usual, and the rally was suspended.As the trend of industry integration becomes more and more obvious, the binding between battery chips and components is also deepening day by day. Whether the price of battery chips can continue to rise after the holiday ultimately depends on the face of the components.”。

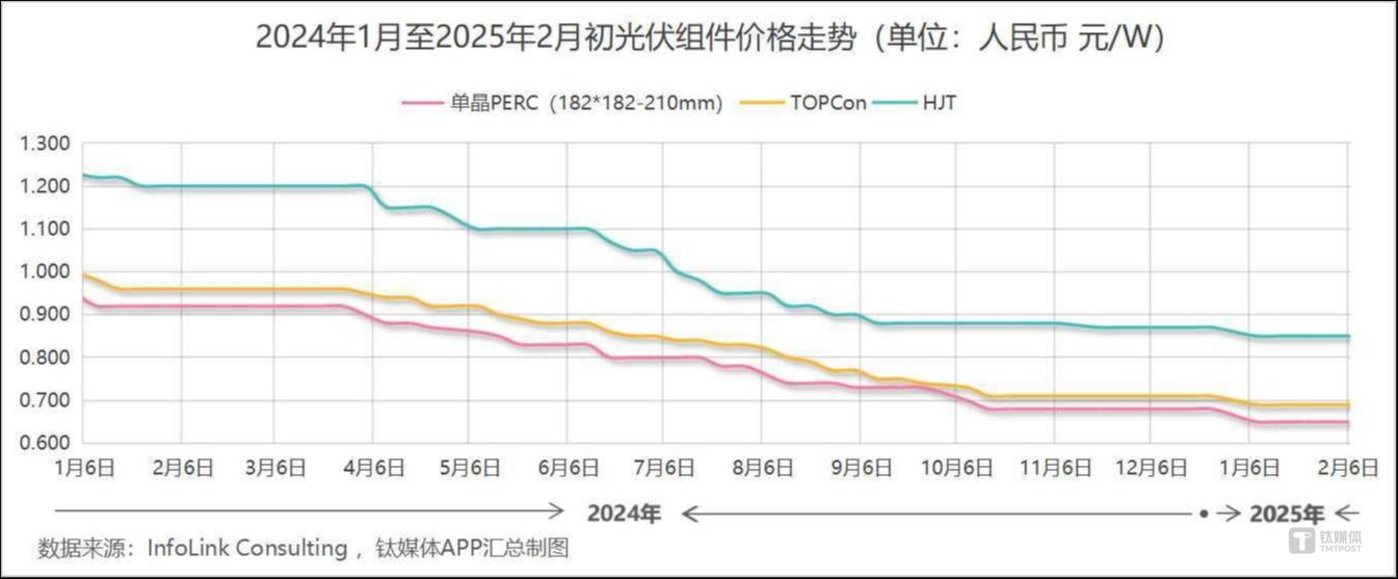

Components: Photovoltaic is the most difficult part, and prices are still falling at the beginning of the year

Modules are the most important end products in the photovoltaic industry chain, and their prices are also the most concerned by the industry. For the whole year of 2024, the price of monocrystalline PERC (182*182-210mm) modules will drop by 28.42%, the price of N-type TOPCon modules will drop by 29%, and the price of N-type HJT modules will drop by 29.27%. The average transaction price of all categories will almost fall below the cash cost line. The fashionable business that used to make money every day has also turned into a loss-making business.

From the end of last year to the beginning of this year, component prices are still being explored offline.In the data released by InfoLink on January 8, the average trading price of single crystal PERC (182*182- 210mm) components was 0.65 yuan/W, which was 4.41% lower than the price announced on December 25 last year; The average trading price of N-type TOPCon components was 0.69 yuan/W, down 2.82% from the price announced on December 25 last year; the average trading price of N-type HJT components was 0.85 yuan/W, down 2.3% from the price announced on December 25 last year. Subsequently, component manufacturers stopped production and holidays one after another, and the transaction price did not change as of February 6.

However, according to InfoLink’s explanation, among the component prices announced at the beginning of the year, the decline was more due to the few days at the end of 2024. It is also common for major manufacturers to lower their quotations at the end of the year to impact shipment targets. From the current situation this year alone, the spot market price of components has not changed much. The silicon industry branch said thatThe component sector has entered the off-season for installation in January and the inventory in the early stage is high. Prices are still under certain pressure, making it difficult to break through like silicon wafers and battery chips.。

Judging from the latest developments after the holiday, the component sector can be said to be mixed. In the bidding results of Inner Mongolia Energy Group’s 3.5GW components announced on February 5, the winning bid prices were mostly below 0.7 yuan/W, and the lowest winning bid price was 0.661 yuan/W., the trend of low-cost bidding is still there. At the same time, European module prices have experienced a long-lost surge. Although my country’s photovoltaic module export flows have become increasingly diversified in recent years, Europe is still the largest market. The recovery of the regional market will also help photovoltaic companies recover their blood.

According to past experience, most component production lines will gradually resume normal production in mid-to-early February, and subsequent price trends have also attracted market attention. According to research and analysis by Digital New Energy DataBM.com, the pace of component recovery is expected to slow down after the year, the start of production lines may be delayed, and there is greater upward pressure on prices. Major manufacturers also have differences in their judgments on the price trend in this link. Small and medium-sized manufacturers consider that battery price increases will push up costs, and more believe that component prices should rise accordingly. Leading manufacturers believe that there is still a problem of oversupply of components and make an upward breakthrough. It is not easy.

It is worth noting that if component prices cannot recover or even continue to decline, the price increase trend of silicon wafers and battery chips is likely to end.

Before the Spring Festival, 2024 performance forecasts for photovoltaic companies were released one after another.More than 20 major photovoltaic factories have a total expected loss of nearly 60 billion yuan. In the past, they were known as the photovoltaic industry.LONGi lvnengEstimated losses of 8.2 – 8.8 billion yuanThe company has increased income and profits for many consecutive years, and its net profit exceeded 10 billion for two consecutive years from 2022 to 2023. However, in just one year, it slipped from a net profit of over 10 billion to a net loss of nearly 10 billion. When disclosing performance forecasts, most companies also mentioned that product prices continued to fall, transaction prices were lower than the industry’s cash cost, and a large amount of inventory price fell, resulting in losses for companies.The price dilemma has also led to the problem of larger production capacity and greater operating lossesAmong the top 5 revenue of the A-share photovoltaic sector as of the third quarter of last year, the annual results of the four companies all forecast significant losses, onlyjingke energyIt is still expected that there will be a profit of 80 million yuan to 120 million yuan, but this figure is only 1.1%-1.6% of the company’s 2023 net profit. After the first quarter ended,The annual report season is approaching, and the gloom of the photovoltaic industry is expected, but what is more important is whether the first-quarter results disclosed during the same period can improve.。If industrial chain prices, especially component prices, still do not improve in the first half of this year, I am afraid there will be really not much time left for photovoltaic manufacturers.(This article is launchedtoGuShiio.com Stock Market Smart APP, author|Hu Jiameng, editor|Liu Yangxue)