① Wenyuan Zhixing U.S. stocks rose more than 27% before the market, and the stock surged more than 83% in the previous trading day;

②OpenAI considers setting up special voting rights to resist hostile takeovers;

③ Musk’s xAI releases Grok 3 model and introduces DeepSearch function

④ Tesla’s new version of Model Y was officially mass-produced at the Shanghai Super Factory.

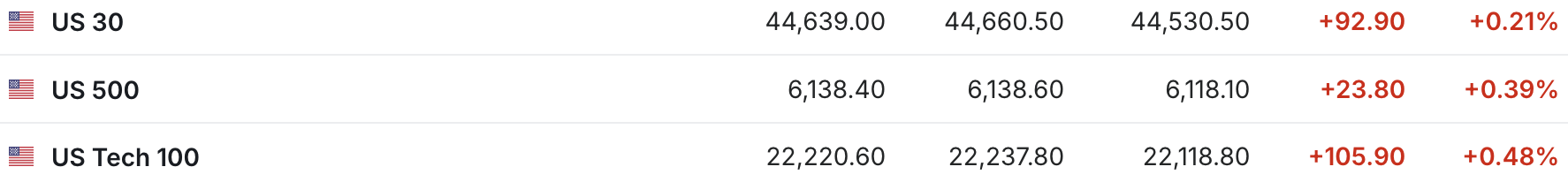

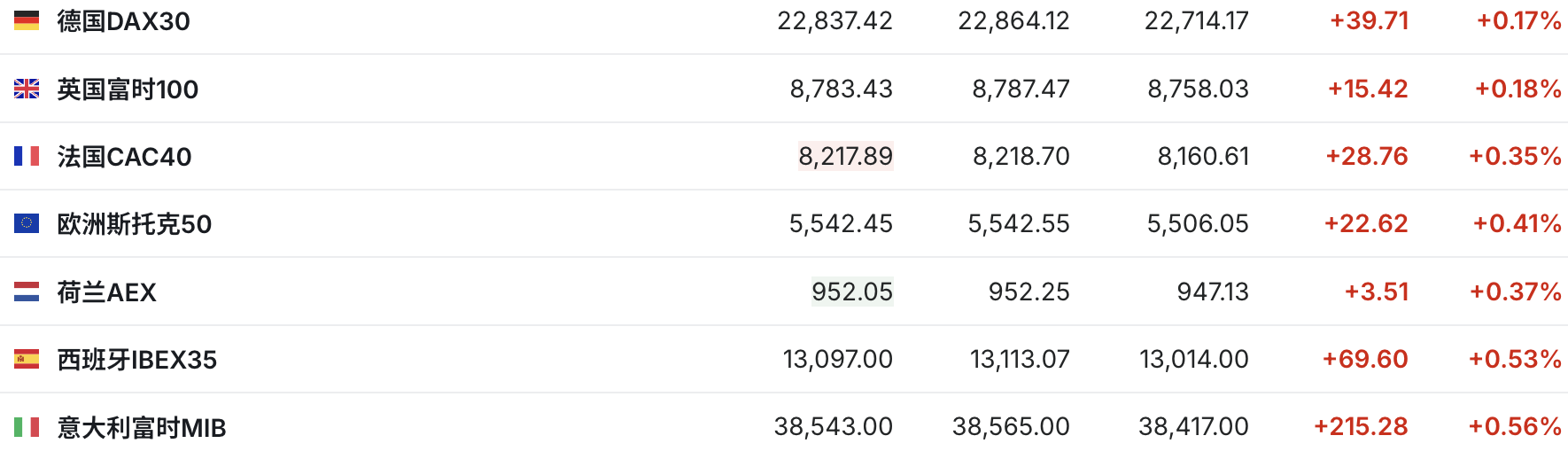

Cailian News, February 18 (Editor Xia Junxiong)Before the market on Tuesday, the three major U.S. stock index futures collectively rose, while major European indices generally rose.

(Source: YingweiCaijing)

After last week’s rally, major U.S. stock indexes are close to all-time highs. The Dow and Nasdaq are about 1% away from record highs, and the S & P 500 is only 0.2% away from its all-time high. The U.S. stock market was closed on Monday for Presidents ‘Day.

“Most companies are starting to buy back shares, key elements of the bear market rhetoric are disintegrating, and the likelihood that the S & P 500 will break through the trading range it has been in since the election is increasing,” said Mark Hackett, chief market strategist at Nationwide.

Some investors are also nervous about signs of excessive optimism in the market that they believe pose potential threats to stocks, such as growing trade tensions between the United States and other major economies.

China asset ETFs and popular Chinese stocks continued their gains before the market. As of press time, China ETF-Direxion rose by more than 4% when it tripled the rich; Xiaopeng Automobile rose by more than 4%, Alibaba rose by about 3%, and Ideal Car and Pendmore rose by about 2%.

Wenyuan Zhixing U.S. stocks rose more than 27% in pre-market trading, and the stock surged more than 83% in the previous trading day. Reports said that Wenyuan Zhixing obtained 1.74 million shares held by Nvidia.

company news

[OpenAI considers setting up special voting rights to resist hostile takeovers]

According to people familiar with the matter, OpenAI is considering strengthening its governance structure by granting its nonprofit board special voting rights to withstand a $97.4 billion hostile cash takeover initiated by Musk.

OpenAI CEO Sam Ultraman and other board members plan to introduce a new governance mechanism including excessive voting rights on the non-profit board after the company transforms into a traditional for-profit enterprise. This move will ensure that non-profit entities retain control in the restructured company, which can overturn the decisions of existing investors such as Microsoft and SoftBank.

Although no final decision has yet been finalized, the special voting rights design will not only prevent external acquisitions, but also hopefully respond to Musk’s doubts that “OpenAI deviates from the original intention of developing AI to benefit mankind.”

Earlier on the 10th, Musk led a group of investors to propose to acquire ChatGPT’s R & D company OpenAI. Ultraman later said that the company was “not for sale” and Musk’s proposal for the acquisition was likely to delay the company’s development.

[OpenAI plans open source project]

OpenAI CEO Sam Ultraman issued a post on February 17 local time saying that for the next open source project, consider making an “o3-mini model that is quite small but still needs to run on a GPU” or “the best mobile phone-sized model that can be done.”

[The EU is preparing to make a decision next month on whether Apple and Meta will comply with the Digital Markets Act]

EU Competition Commissioner Teresa Rivera said in an interview that the EU is preparing to make a decision next month on whether Apple and Meta Platforms comply with the EU Digital Market Act. In addition, it is also investigating whether social media platform X violates EU regulations on illegal content.

[Musk’s xAI releases Grok 3 model and introduces DeepSearch]

On February 18, Musk’s artificial intelligence company xAI officially released the Grok3 model and conducted a live demonstration.

According to xAI, the Grok 3 inference model introduces a new feature called DeepSearch, which scans the Internet and X platforms to analyze information and provide summaries to respond to queries.

[Tesla’s new version of Model Y is officially mass-produced at Shanghai Super Factory]

At noon on February 18, Tesla announced that the updated version of Model Y would be officially mass-produced at the Shanghai Super Factory. Earlier, the delivery time of the updated Model Y model was updated, and the car will begin delivery in late February. It is understood that the first version of the model will be sold for a limited time until February 28. The rear-wheel drive version will be priced at 263,500 yuan, and the long-life all-wheel drive version will be priced at 303,500 yuan.

[Tesla launches India recruitment plan]

Tesla has begun a recruitment plan in India, a clear sign that the company plans to enter the Indian market soon after CEO Musk meets Indian Prime Minister Modi in the United States. According to a job advertisement posted on its LinkedIn page on Monday, Tesla is recruiting for 13 positions, including customer-facing positions and back-office support positions. At least 5 positions (including service technicians and multiple advisory positions) are open for recruitment in Mumbai and New Delhi at the same time, while the remaining positions, such as customer engagement managers and delivery operations specialists, are limited to the Mumbai region.

[iQiyi: Revenue in 2024 will be 29.2 billion yuan, a year-on-year decrease of 8%]

iQiyi released its fourth quarter and full-year financial report for 2024 on February 18. Its revenue in 2024 was 29.2 billion yuan (US$4 billion), a year-on-year decrease of 8%; its net income was 764.1 million yuan (US$104.7 million), a decrease of 60% from 2023.

Among them, revenue in the fourth quarter was 6.6 billion yuan, down 14% year-on-year; net loss was 189.4 million yuan (US$25.9 million).

In 2024, member service revenue will be 17.76 billion yuan (US$2.43 billion), a decrease of 13% from 2023.

Events worthy of attention during the U.S. stock market period (Beijing time)

February 19

00:30 U.S. government bond auction to February 18