The stock price began to fall from its high level, and major shareholders became increasingly reluctant to reduce their holdings.

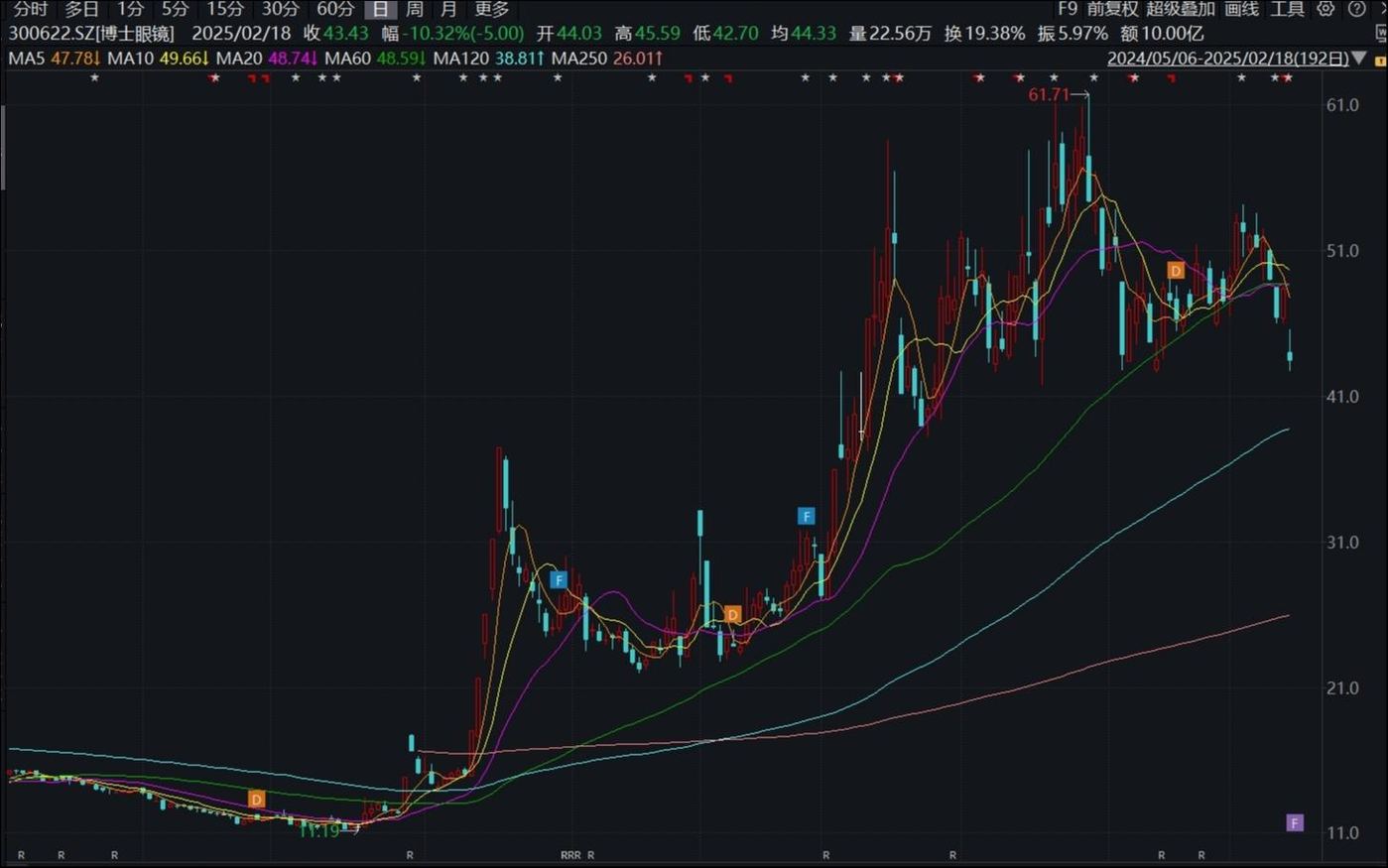

Yesterday,Doctor glasses(300622.SZ) announced that the two actual controllers plan to reduce the company’s shares by no more than 4.7185 million shares, and the estimated amount may exceed 200 million yuan. In the past six months, senior shareholders of the company’s directors and supervisors have taken advantage of the high stock price to reduce their holdings and cash in by 127 million yuan. Affected by this, Boshi Optical’s share price fell sharply today, finally closing at 43.41 yuan, a drop of 10.37%, down about 35% from its December 2024 high.

It is worth noting that, as a traditional glasses retail company, Boshi Glasses has successfully gained the lead in AI glasses through cooperation with Thunderbird, Huawei, etc., and its share price has also risen. 2025 may become the first year of AI glasses. It is the consensus of the industry, and the company’s development potential seems to be more imaginative. However, sales channels may be the key factor in the popularity of Boshi Glass by smart glasses companies. As for the quality of the AI glasses concept, the quality of the concept remains to be tested.

From major shareholders to directors and supervisors, high-style reductions continue to occur

According to the announcement, ALEXANDERLIU, one of the controlling shareholders and actual controllers of Boshi Optical, and LOUISAFAN, one of the actual controllers, plan to reduce their holdings of the company’s shares through centralized bidding or block transactions within 3 months after 15 trading days from the disclosure date of this announcement. The cumulative amount of shares in the company will not exceed 4.7185 million shares, accounting for 2.6915% of the company’s total share capital.

Based on the closing price on February 18, it is roughly estimated that the cash amount of the two actual controllers reduced their holdings this time may exceed 200 million yuan.

It is worth noting that Doctor Glasses has performed well in the secondary market recently. Since the end of July 2024, taking advantage of the concept of smart glasses, the company’s share price has fluctuated higher, hitting a new high since its listing at the end of December, during which the share price has soared more than four times. However, since then, the stock price fluctuated and fell. As of the close on the 18th, Boshi Glass reported 43.41 yuan, with a total market value of 7.61 billion yuan.

Source: Wind

In fact, as early as a few years ago, the company’s actual controller had transferred 5% of its shares to a private equity fund, which had frequently reduced its holdings in the past six months.

Relevant announcements show that on May 13, 2022, ALEXANDER LIU, one of the company’s actual controllers, signed a share transfer agreement with Feixiang (Hangzhou) Asset Management Co., Ltd., transferring 8,620,930 shares of the company’s outstanding shares under unlimited sales conditions (accounting for 5.00% of the company’s total share capital) to Feixiang Premium Fund at a price of 18.22 yuan/share, with a total transfer price of 157 million yuan.

During the period from July to August 2024, Flying Elephant Preferred Fund has reduced its holdings of the company’s shares by 546,800 shares through centralized bidding, accounting for 0.31374% of the company’s total share capital (Note: Flying Elephant Preferred Fund and Flying Elephant Premium Fund are acting in concert). After this reduction, the total shareholding ratio of the above-mentioned private equity institutions was less than 5%, which means that no disclosure obligations will be required to reduce the reduction thereafter.

In addition to the fancy reduction of holdings by major shareholders, Boshi Glasses and other directors and supervisors also began to gather together to reduce holdings early.

On November 18, 2024, when the stock price rose sharply, Boshi Optical suddenly disclosed the shareholder reduction plan. Liu Kaiyue, the actual controller of the company, acted in concert, director Liu Zhiming, director and deputy general manager Zheng Qingqiu, director and deputy general manager He Qingbai, and specific shareholder Jiangxi Jiangnan Road Enterprise Management Co., Ltd.(hereinafter referred to as Jiangnan Road), planned to reduce the company’s shares in a total of approximately 2.69 million shares.“” Affected by this, Boshi Glasses plunged to the limit on the 19th, closing at 41.28 yuan.

On the evening of December 4, Boshi Glasses issued the latest announcement. Jiang Nanchao, one of the shareholders who reduced the shares and the fourth largest shareholder, has completed the implementation of this reduction plan, with a total reduction of 1.0342% of the company’s shares. Wind shows that the reference market value of this reduction is 74.0284 million yuan, which is the largest reduction in Doctor’s glasses since 2018.

The reduction in sales on rallies has allowed major shareholders to make a lot of money. As of December 20, the above five shareholders have all reduced their holdings, with a total reduction amount of approximately 119 million yuan. Coupled with the previous reduction of Feixiang Fund, in the past six months, Boshi Glasses has been reduced by major shareholders and directors Jiangao to cash in by approximately 127 million yuan.

Regarding the reasons for the above-mentioned shareholders ‘reduction of their holdings, the announcement stated that they were personal capital needs. However, when the company’s stock price is at a high level, major shareholders take turns to reduce their holdings in the short term, which is obviously a big blow to the stock price. It is unclear whether shareholders are short of money or are not optimistic about the company’s prospects.

AI glasses concept quality to be tested

According to the official website, Boshi Optical was established in 1993 and was listed on the GEM of the Shenzhen Stock Exchange in 2017. It is the first listed company in the domestic optical retail industry.

In recent years, the performance of Doctor Glasses has shown certain fluctuations. From 2021 to 2023, the company achieved operating income of 888 million yuan, 962 million yuan, and 1.176 billion yuan respectively, a year-on-year increase of 35.22%, 8.42%, and 22.20%; net profit for the same period was 94.78 million yuan, 75.81 million yuan, and 128 million yuan respectively, with year-on-year changes of 37.02%,-20.02%, and 68.93%.

In the first three quarters of 2024, doctoral glasses will increase income but not increase profits. During the reporting period, the company achieved operating income of 915 million yuan, a year-on-year increase of 1.09%. Pressure on gross profit margins, exchange losses and increased interest expenses caused by exchange rate fluctuations further dragged down profits. The current net profit and net profit deducted from non-profit were 83.48 million yuan respectively., 73.27 million yuan, a year-on-year decrease of 14.46% and 21.98%.

Under pressure from performance, this traditional glasses retailer urgently needs to transform to a new track. Dongcai data shows that doctoral glasses have many concepts such as the concept of AI glasses, the concept of metaverse, the concept of Huawei, and the concept of virtual reality.

This time, Boshi Glass’s share price rose sharply, mainly due to the east wind of AI glasses. As the war in the smart glasses market intensifies, the industry consensus is that 2025 may become the first year of AI glasses, and the importance of traditional glasses brands in the sales of AI glasses has become increasingly prominent.

As early as 2019, Boshi Optical established a cooperative relationship with Huawei and became the exclusive partner for the offline glasses retail channel of its smart glasses products. In 2021, Doctor Glasses will continue to expand its cooperation radius and cooperate with Huawei’s third-generation smart glasses launch to provide consumers with professional online glasses matching services in Huawei Mall.

At present, Doctor Glasses has cooperated with brands such as Xingji Meizu, Thunderbird Innovation, XREAL, Jiehuan, Li Weike, and ROKID. One of the most out-of-the-loop actions is the establishment of a joint venture with Thunderbird Innovation.

In August 2024, according to Thunderbird Innovation’s official Weibo, the company cooperated with Boshi Optical to establish a joint venture company, in which Thunderbird Innovation holds 80% of the equity and Boshi Optical holds the remaining 20%. The two parties will jointly carry out the research and development, design, sales, marketing and service of the new generation of AI glasses. It is reported that Thunderbird Innovation announced the Thunderbird V3 AI shooting glasses jointly developed with the company on January 7.

However, the cooperation method between Boshi Glasses and partners is relatively simple. The main reason is that the partners are responsible for the research and development and production of smart glasses, and Boshi Glasses is responsible for providing lens fitting services and sales channels for smart glasses.

According to previous semi-annual reports, in the cooperation project with Thunderbird, Doctor Glasses will be mainly responsible for offline channel sales and promotion, participate in product research and development and design, and have joint decision-making power on key strategies such as products, channels, and marketing. At the same time, Boshi Optical said that the scale and proportion of the company’s smart glasses lens fitting services are extremely small and will not have a significant impact on the company’s operating activities in the short term.

In this context, how much AI content does Dr. Glasses have, and whether it plays a leading role in the joint venture layout of AI glasses or becomes a sales channel, these issues may affect the secondary market’s judgment of its share price.(This article is launched on GuShiio.comApp, author| Ma Qiong)