After visiting many dealer stores in Guangzhou, Blue Whale Automobile found that different brands have different methods when implementing the “buy it out” price, and some brands still have many restrictions hidden in the buy it out price.

Joint-venture car companies such as GAC Toyota, Dongfeng Nissan, and Beijing Hyundai are pushing for a “one-stop price”, but interviews reveal that there is a hidden mystery

Photo source: Visual China

Blue Whale News, February 21 (Reporter Li Zhuoling)“The one-price strategy is being sought after by more joint venture car companies.

According to incomplete statistics from Blue Whale Automobile, as of now, more than 6 joint venture car companies have announced the launch of a one-price event, covering Japanese, Korean, German and other car companies, such as GAC Toyota, Dongfeng Nissan, Beijing Hyundai, Changan Mazda, and even North and South Volkswagen, the price reduction of some brand models has reached tens of thousands of yuan.

To a certain extent, the one-price activity of the above-mentioned joint venture brand is similar to the national unified selling price of the direct sales model advocated by many new forces. What is the actual implementation status of this model, which claims to eliminate the traditional price negotiation process between dealers and consumers and sells vehicles at a unified and transparent price, in the end market? Are there any additional terms? Is it a real discount or a new routine? Blue Whale Automobile has recently gone deep into the front line to find out.

Hidden threshold: replacement, phased or vehicle-limited configuration is required

At a time when some self-owned brands are adding 0 down payment and 0 interest and other car purchase plans, the joint venture brand camp is setting off a price carnival. It is reported that a one-price price means that a car company directly sets a fixed sales price and no longer conducts bargaining through dealers, thereby simplifying the car purchase process and improving price transparency.

This month alone, more than three joint venture brands launched a buy-in event. On February 5, GAC Toyota announced the launch of a one-price car purchase benefit, implementing a one-price preferential policy for its two SUVs, Fenglanda and Weilanda. Among them, the one-stop price of Fenglanda’s entire series starts at 89,800 yuan, and the original price starts at 128,800 yuan, a decrease of 39,000 yuan; the one-stop price of Weilanda’s entire series starts at 129,800 yuan, and the original price starts at 173,800 yuan, a decrease of 44,000 yuan.

On February 10, Beijing Hyundai announced that its three 11th-generation Sonata, the new Tucson L and Kusto models will be launched on the line, with direct reductions of 30,000 yuan, 40,000 yuan and 42,000 yuan respectively. After this price adjustment, the price of the 11th generation Sonata is 119,800 yuan, the price of the new Tucson L is 129,800 yuan, and the price of Kusu is 139,800 yuan.

On February 17, Dongfeng Nissan also launched a one-stop price for models such as Xuanyi, Teana and Qiake. Among them, the Xuanyi Classic starts at 69,800 yuan, the Teana Zhenxin version starts at 127,800 yuan, and the Qiake Honorary Zhenxin version starts at 99,800 yuan., and declares that the one-stop price, sincerity price, no routine, and unlimited time limit.

Photo source: Automobile company official website

So, is the actual implementation really without a routine as mentioned above? After visiting many dealer stores in Guangzhou, Blue Whale Automobile found that different brands have different methods when implementing a buy-in price, and some brands still have many restrictions hidden in the buy-out price.

First of all, the buy-in prices of some brands are only for replacement customers and cannot be enjoyed by new car buyers. Taking Beijing Hyundai as an example, some dealers told Blue Whale Automobile that its renewal price is only for replacement users, which includes state subsidies, manufacturer subsidies, etc. If there is no replacement for old cars, the price will not be so low, but you can apply for discounts.& rdquo;

Secondly, some brand models not only need to be replaced, but also need to be bound with phased financial plans to enjoy them. Take the above-mentioned Dongfeng Nissan Tianlai Zhenxin version starting from 127,800 yuan as an example. Some dealers told Blue Whale Automobile that this one-stop price is a price with installments + replacement. Without replacement, it costs more than 130,000 yuan. The price cannot be so low.& rdquo; It also pointed out that manufacturers ‘replacement subsidies require old cars to be of the same brand and local brands.

Of course, there are also the above-mentioned replacement and installment conditions, but the one-stop price of most brand models is only the bare car price, and purchase tax, insurance and other fees need to be added to the landing; at the same time, the one-stop price range of most car companies is limited to some models or versions, such as the lowest allocation, or limited power vehicles, etc., have certain selectivity in profit-making, and some hot-selling models or high-end versions still need to be negotiated.

In addition, most of these buy-out prices are limited and short-term discounts. For example, SAIC Volkswagen’s Touyue Xinrui, Passat Pro, ID.3 Smart and other models will have a time-limited one-price event until the end of this month; GAC Toyota’s above-mentioned one-price policy will apply until March 31 this year. Many dealers said that the one-stop price discount is limited for a limited time and will change with the market. Currently, some models have this discount, and it is unknown whether other models will follow up.

Photo source: Automobile company official website

Regarding the one-price policy launched by the above-mentioned brands, Dongfeng Nissan, GAC Toyota, Beijing Hyundai and other manufacturers told Blue Whale Automobile that they would have to go to find out the details and consult offline dealers and stores to wait for notice on the new policy.

The market share fell below 40%, and the knockout round began

However, despite the existence of certain hidden thresholds, from the feedback point of view, the one-price model has indeed attracted the attention of many consumers recently. Many dealers told Blue Whale Automobile that it is the off-season of the auto market recently. After the one-price event came out, many consumers came to understand and consult, which played a certain role in driving sales.

“‘A price model is actually just a sales volume, giving up profits and increasing sales volume.& rdquo; Some dealers said. Another dealer said that compared with the past, the one-price model can reduce customer comparison and inquiry time. Prices in each store are unified, and competition is concentrated on services.

From the industry’s perspective, the joint venture car companies ‘efforts to promote the one-price car purchase model are also a marketing attempt under the pressure of market competition to a certain extent.

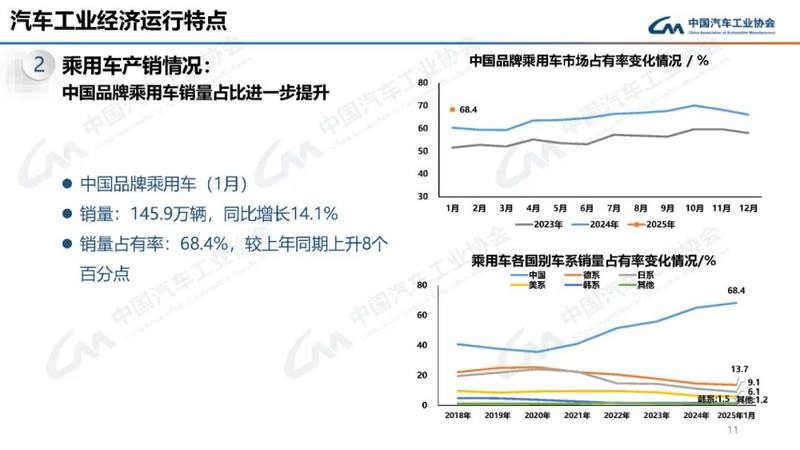

Behind the continuous rise of independent brands relying on electrification and intelligent technologies, the market share of joint venture brands is constantly being squeezed. The latest data from the China Automobile Association shows that in January this year, sales of passenger cars of China brands were 1.459 million, a year-on-year increase of 14.1%; the sales share reached 68.4%, an increase of 8 percentage points from the same period last year. In other words, after the market share of joint venture brands fell below 40%, it is constantly approaching the 30% share red line.

Photo source: China Automobile Association Official Weibo

For reference, four years ago in 2020, the market share of China brand passenger cars was only 38.4%, while joint ventures accounted for 61.6%. In just a few years, one side weakened and the other side strengthened, and the offensive and defensive trends were different.

Regarding the future of the joint venture brand, BYD Chairman Wang Chuanfu predicted in March last year that the new energy industry has now entered the knockout stage, and 2024-2026 will be a decisive battle for scale, cost and technology. The accelerated launch of new energy products by China automobile companies will encroach on the joint venture brand market. In the next 3-5 years, the joint venture brand share will drop from 40% to 10%, of which 30% is room for future growth of China brands.

It is unclear whether this prediction will come true. However, judging from the competition in the overall auto market this year, the market is still high. In addition to the price war that has been fighting for nearly two years, some self-owned brands have already launched a smart driving war to push intelligent technology down to a lower price range.

For joint venture brands, in addition to marketing model innovation, how to restructure technological advantages, reshape brand value, and how to gain more market share are more critical issues that will determine who will survive the knockout rounds. But time is running out.