Recently, Le Shushi submitted a prospectus to the Hong Kong Stock Exchange for the first time and plans to list on the main board of the Hong Kong Stock Exchange.

King of African diapers: Has Le Comfort’s low-price strategy failed?

Wen| Finet

The decline in the domestic birth rate and the increasingly cautious consumer market have posed growth challenges for personal care product companies such as Heng ‘an International (01044.HK) and Haoyue Care (605009.SH).

Le Comfort Co., Ltd.(hereinafter referred to as Le Comfort), a subsidiary of Senda Group, has jumped away from the business idea of deeply cultivating the domestic market and extended its reach to emerging markets such as Africa, Latin America and the Middle East. Although there is competition in these markets, their growth potential is significantly better than that in China. This also allows Le Comfort, which has a first-mover advantage, to catch the fast track of development and become a voice in the field of sanitary products in Africa.

But at the same time, factors such as intensified competition and declining local purchasing power have also affected the growth momentum of Le Comfort, and the company’s proud low-price advantage has been challenged.

Recently, Le Shushi submitted a prospectus to the Hong Kong Stock Exchange for the first time and plans to be listed on the main board of the Hong Kong Stock Exchange. CICC, CITIC Securities and Guangfa Securities (Hong Kong) are co-sponsors.

King of baby diapers in Africa

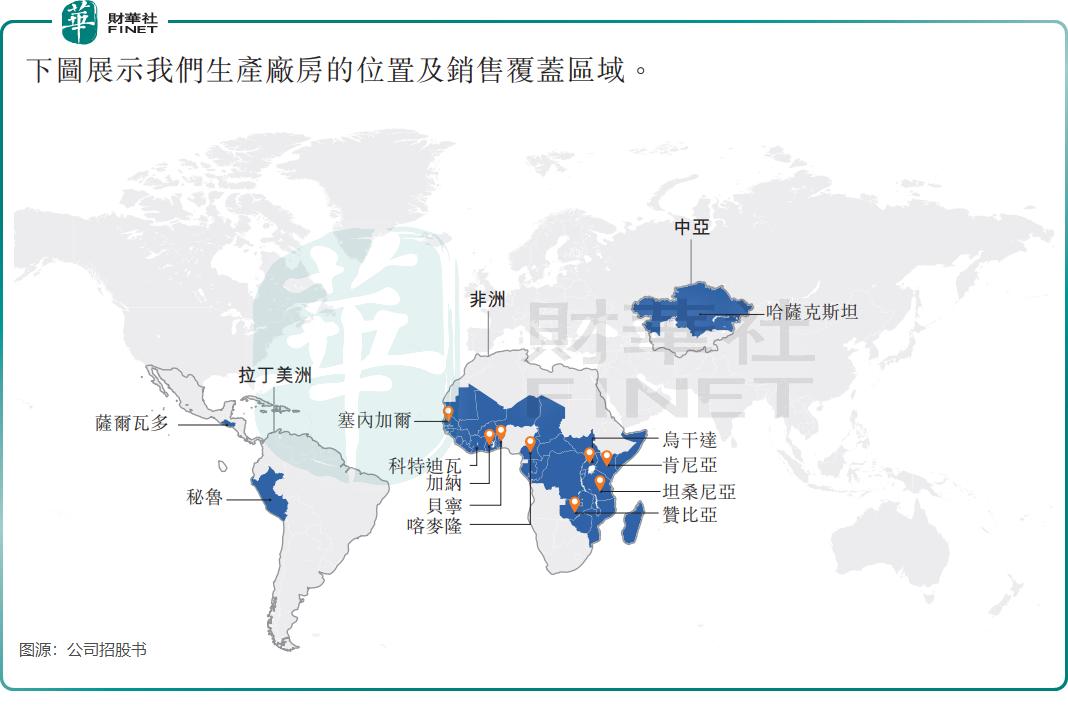

Le Comfort started with the international trade business of sanitary products launched by Senda Group in 2009. Starting from Ghana, Africa, Le Comfort has continued to build factories in Africa. As of the end of September last year, it had deployed 8 production plants and 44 production lines in Africa.

Relying on its experience and success in Africa, Le Comfort has expanded its reach into more emerging markets. In 2020, it will expand its business to Peru in Latin America, to Kazakhstan in Central Asia in 2024, and recently it will sell products in El Salvador in Latin America. Today, the company’s sales network covers more than 30 countries in Africa, Latin America and Central Asia.

In terms of product portfolio, Le Comfort has developed a rich product line, covering more than 200 SKUs of baby diapers, baby pull-up pants, sanitary napkins, and wet wipes in the field of infant and feminine hygiene products. Among them, the number of baby diaper SKUs increased from 143 at the beginning of January 2022 to 224 at the end of September 2024.

After many years of deep cultivation in Africa, Le Comfort has grown into the king of Africa in some segments of hygiene products.

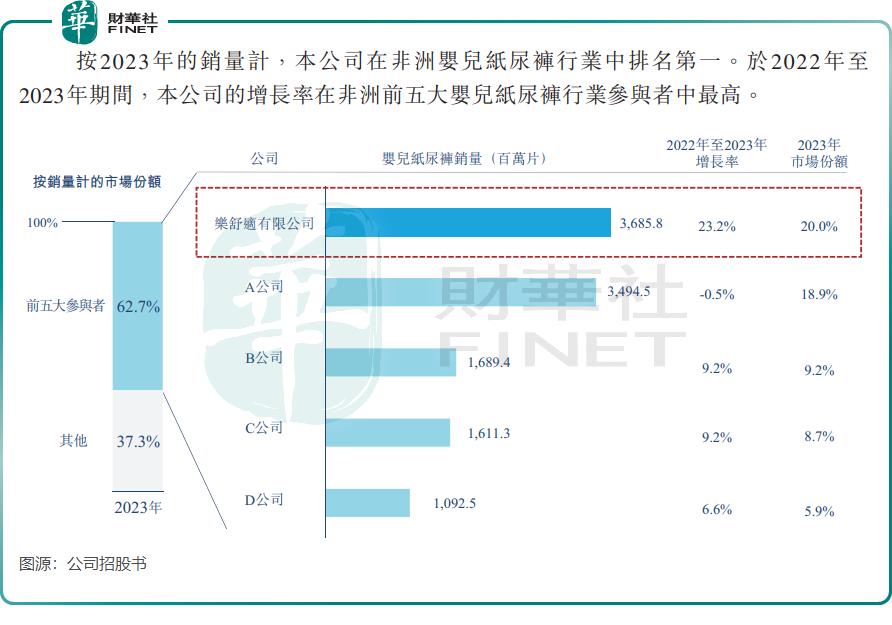

Based on sales in 2023, Le Comfort ranks first in the baby diaper market and sanitary napkin market in Africa, with market shares of 20.0% and 14.0% respectively. Africa’s baby diaper market shows a pattern of two superpowers and multiple powers. The second largest market share is P & G from the United States, with a market share of 18.9%, close to Le Comfort.

However, in terms of revenue, Le Comfort can only rank second in the African baby diaper and sanitary napkin market, with a market share of 17.2%. This shows that Le Comfort has a certain gap with multinational giants such as P & G in terms of brand value.

Income is slowing down and low prices are not working?

The African market where Le Comfort has deeply cultivated is very similar to the China market 20 years ago, namely: rapid population growth and strong consumer demand.

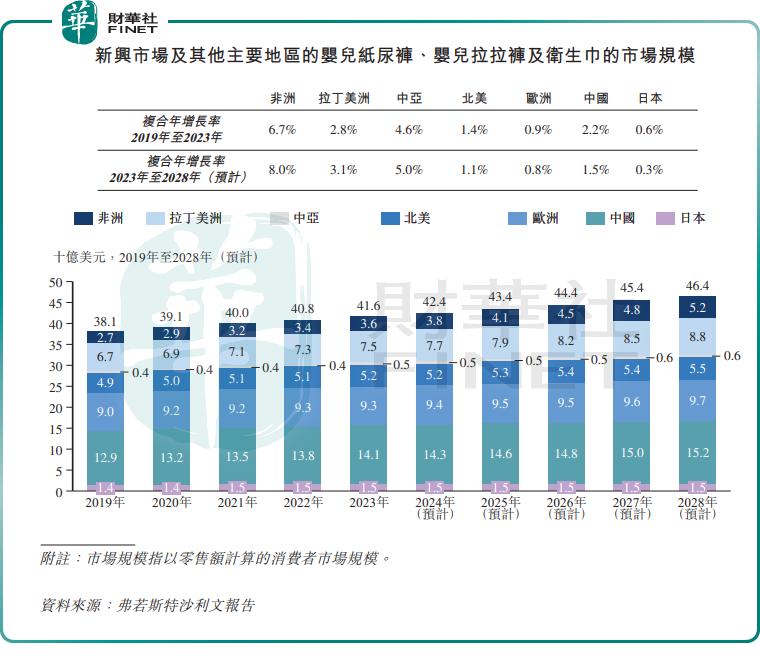

Data shows that from 2019 to 2023, Africa’s compound annual growth rate of 1.5%, ranking first among all continents in the world. The proportion of the population under the age of 20 exceeds 50%, and the population structure shows significant growth potential.

These factors have made the African sanitary products market significantly higher growth space than other regions.

The Frost and Sullivan report shows that from 2019 to 2023, the compound annual growth rate of the market size of baby diapers, baby pull-ups and sanitary napkins in Africa is as high as 6.7%, which is significantly higher than that of China, North America and Europe during the same period. The compound annual growth rates are 2.2%, 1.4% and 0.9% respectively. It is expected that from 2023 to 2028, the size of this market in Africa will also maintain rapid growth, reaching 8%.

Le Comfort has successfully gained a share of the pie in Africa and achieved rapid growth in 2023.

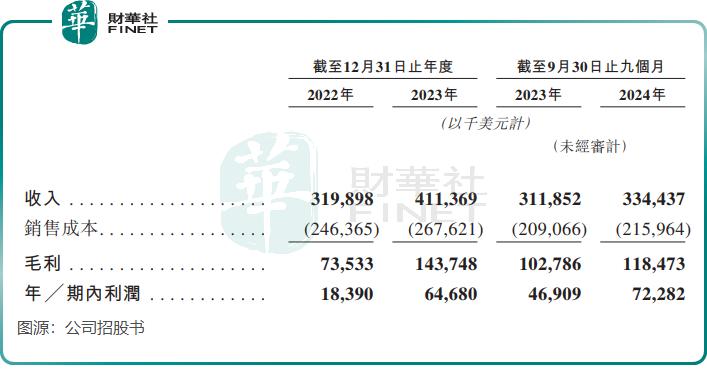

The prospectus shows that in 2023, Le Comfort’s revenue will be US$411 million, a year-on-year increase of 28.6%; profit for the period will be US$64.8 million, a year-on-year increase of 251.7%. However, in 2024, Le Comfort’s revenue growth suddenly slowed down significantly. In the first three quarters of the year, revenue was US$334 million, a growth rate dropped to 7.2%. Profit during the period maintained rapid growth, increasing 54.1% year-on-year to US$72.282 million.

At the end of 2024, Le Comfort made a surprise dividend before its IPO and declared an interim dividend of US$35 million to its shareholders.

Baby diapers are Le Comfort’s main source of income, accounting for 75.3% of total revenue in the first three quarters of 2024. In the current period, the revenue growth of baby diapers was sluggish, reaching US$252 million, a year-on-year increase of only 2.4%.

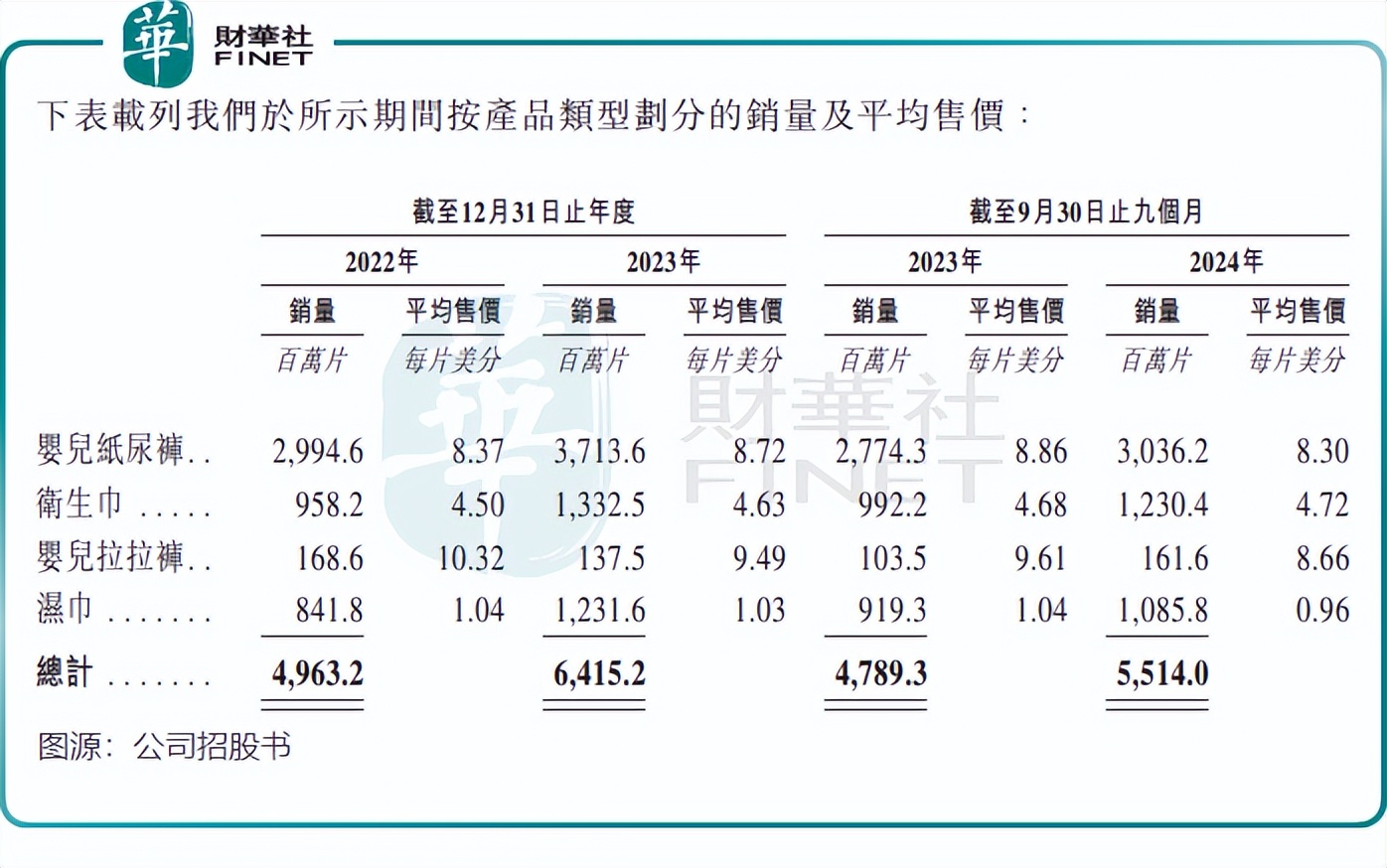

Caihua found that baby diaper products dragged down Le Comfort’s revenue growth in the first three quarters of 2024 because the product lowered its price based on its already low price, and the average selling price per diaper dropped from 8.86 cents in the same period last year to 8.30 cents. In addition, the prices of current baby pull-up pants and wet wipes products have also been lowered.

Therefore, although sales of all major products recorded growth in the first three quarters of 2024, the total revenue of Le Comfort slowed down due to the decline in overall selling prices. In other words, Le Comfort’s price-for-volume strategy has still failed to drive significant revenue growth.

Based on calculations of sales and sales data, the average selling price of Le Comfort baby diapers in Africa in 2023 is US$0.0896/piece, which is far lower than P & G’s average selling price of US$0.1158/piece, and significantly lower than other leading companies. The average selling price.

Le Comfort did not explain in the prospectus why revenue growth slowed down in the first three quarters of 2024 and the prices of major products were lowered. Caihua Society believes that either due to the more intense market competition and the challenge of slowing growth in emerging markets, Le Shushi chose the strategy of exchanging price for volume in order to cope with market competition and expand market share.

It is worth mentioning that Le Comfort does not focus on research and development. In 2023, the company’s R & D expenditures will be only US$341,000; as of the end of September 2024, Le Comfort’s R & D team has only four employees.

Against the background of fierce market competition and consumption upgrades, if Le Comfort does not increase research and development efforts and enhance product innovation, its low-priced products may be abandoned by consumers.

However, Le Comfort still maintains a high degree of enthusiasm for expansion and is ambitious in terms of production capacity and market expansion.

The company said in its prospectus that we plan to build a new production plant in Ghana, Tanzania, Uganda, Benin, Cote d’Ivoire, Peru, El Salvador, Kazakhstan and Mexico. There are also plans to expand existing production plants in Senegal, Kenya and Zambia, as well as a future production plant in Peru (after the completion of the first phase).& rdquo;

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.