Can divestiture non-core businesses and bet on high-end and emerging markets hedge the risk of stalling in the China market?

Unilever will increase income in 2024 but not increase profits, accelerate strategic adjustment and become a “abandoned child”, and the pain of transformation still exists

Photo source: Visual China

Blue Whale News, February 14 (Reporter Wang Hanyi)On February 13, Unilever released its fourth quarter and annual financial reports for 2024.

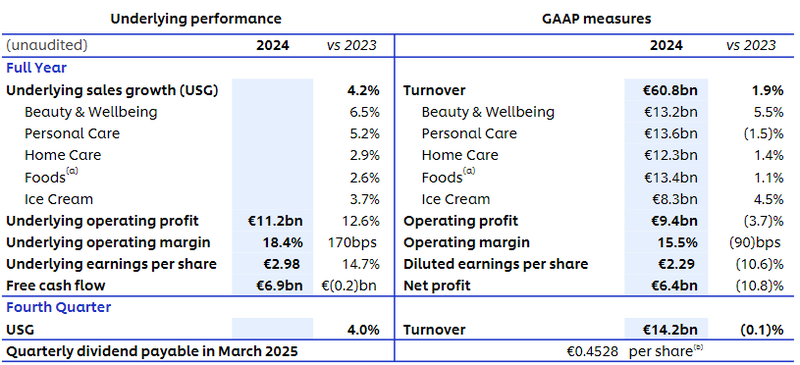

The financial report shows that for the full year of 2024, Unilever’s annual sales reached 60.8 billion euros (approximately RMB 462 billion), a year-on-year increase of 1.9%, and basic sales increased by 4.2%; but operating profit fell 3.7% year-on-year to 9.4 billion euros, and net profit shrank by 10.8% to 6.4 billion euros.

This pattern of increasing income but not increasing profits reflects the double attack of rising costs and slowing market growth under global inflationary pressure.

Photo source: Intercepted from Unilever’s financial report

Looking at quarters, sales in the fourth quarter were 14.2 billion euros, a slight decrease of 0.1% year-on-year, but underlying sales increased by 4.0%, indicating that price adjustments are gradually taking effect.

It is worth noting that Unilever has significantly optimized its optimise cost structure through accelerated growth plans, including laying off 7500 people, divesting its ice cream business (accounting for 15% of revenue) and selling non-core brands, aiming to save 800 million euros over three years.

Hein Schumacher, CEO of Unilever, bluntly said: We are moving from a bloated group to an efficient machine that focuses on core brands.” rdquo;

Division of business sectors: Beauty and health lead the way, ice cream is abandoned”

Specifically, Unilever’s five major business segments after its reorganization showed significant divisions.

The beauty and health business grew by 7.1% throughout the year, becoming the biggest highlight. Hair care brands such as Xia Lin and Dove achieved double-digit growth, while high-end beauty brands Tatcha and Hourglass performed strongly in the U.S. market, driving gross profit margins to expand by 280 basis points.

Personal care and home care are at the bottom of the growth rate, with personal care business growing by only 0.6%. Traditional categories that rely on deodorants and oral care are facing innovation bottlenecks.

It is worth mentioning that sales of the ice cream business fell by 1%. The weakness of the China market has dragged down ice cream sales around the world, becoming the direct trigger for the divestiture of the business. Unilever said that it expects to complete the spin-off by the end of 2025.

This differentiation also confirms Unilever’s slimming logic, cutting off inefficient business, concentrating resources on high-margin, high-growth beauty and health tracks, and at the same time seizing the dividends of consumption upgrades through high-end brands such as Liquid I.V. functional drinks entering China.

China Market: Crisis and Opportunity in Stall”

In terms of regions, the China market has become the most glaring shortcoming in the financial report. Annual sales recorded a mid-single-digit decline, and growth in major categories such as ice cream and personal care has been weak.

The reasons are the sluggish consumer confidence and the rise of local brands, such as the Perfect Diary, Huaxizi and changes in e-commerce channels, which have gradually caused the traditional foreign company’s big brand + strong distribution model to fail.

However, there was also a turning point in the crisis. Sima Han admitted in his financial report: China is still the world’s most potential market, but the growth logic has shifted from scale expansion to deep value cultivation. rdquo;

In terms of high-end breakthroughs, Unilever has accelerated the introduction of high-end beauty brands such as Hourglass, and reached the sinking market through new channels such as Pinduo. The food planning business has bucked the trend and grew by double digits.

In response to organizational restructuring, after taking office, Chen Ge, president of China, promoted the decentralization of regional decision-making power and strengthened localized product innovation, such as skin care lines for Asian skin types, in an attempt to bridge the gap between headquarters strategies and local needs.

At the same time, Unilever is also working hard to transform e-commerce in 2024. The financial report shows that its proportion of e-commerce channels in China has increased to 35%. It plans to reshape the brand’s youthful image through Live streaming eCommerce and social marketing.

Industry experts believe that Unilever’s 2024 financial report is a declaration of its initiative to seek change. ldquo; We can see the strategic bets in the painful period of transformation, but it is actually a microcosm of the traditional FMCG giants in the midst of globalization.” rdquo;

Can divestiture non-core businesses and bet on high-end and emerging markets hedge the risk of stalling in the China market?

Senior beauty experts told Blue Whale News that the answer may be hidden in two key variables: first, whether the speed of localized innovation can exceed the cycle of consumers liking the new and getting tired of the old; second, whether the agility of the organizational structure can truly adapt to the fragmented new retail ecosystem.

The outcome of this bet will determine whether Unilever can hold on to the territory of the FMCG empire in the next decade.