Kun KUN solves the challenges faced by cross-border payments by building and operating a compliance bridge between stablecoins and fiat currencies: low timeliness, high cost and cumbersome processes. With its efficient, compliant and secure overall digital payment solution, Kun KUN has become an effective complement to the SWIFT system.

Kun KUN, a trusted global digital payment service provider, completed a ten-million-dollar seed round of financing, led by BAI Capital, with GSR Ventures, Hash Global and others participating. The funds raised will be used to further improve compliance, risk control and licensing systems, and build a global cooperation and operation network.

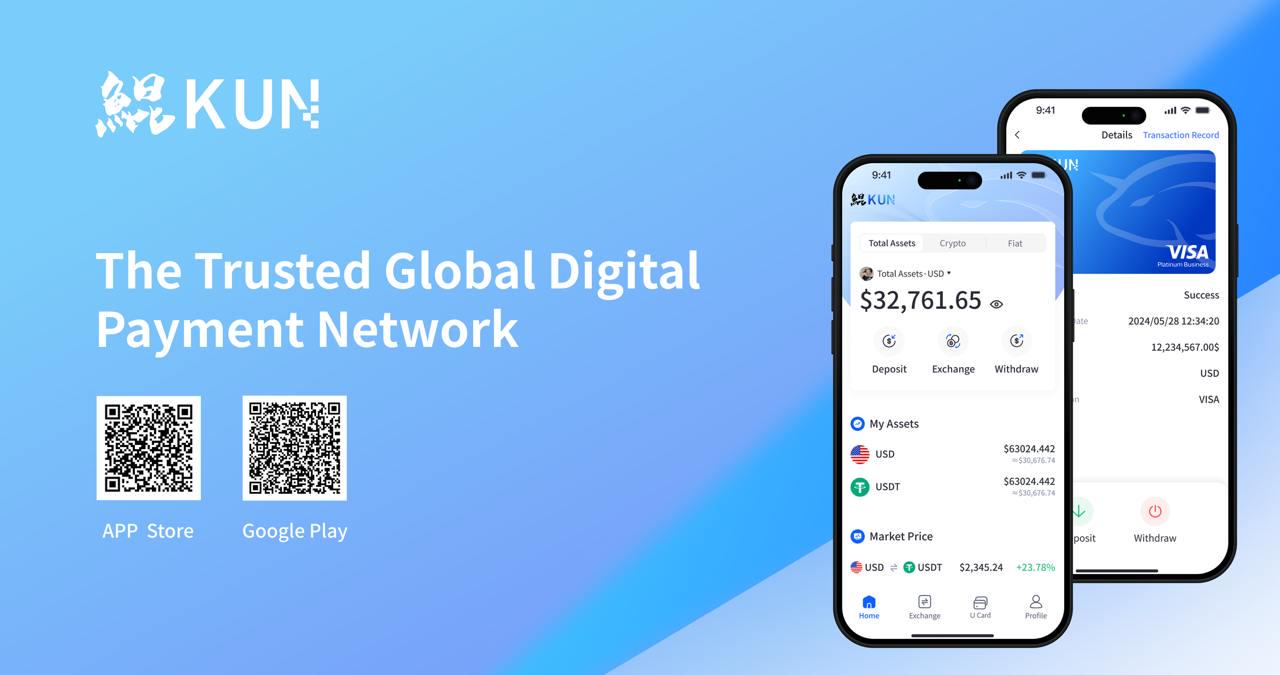

Kun KUN is an innovative financial technology company positioned as a Web2+ Web3 one-stop digital payment service. Based on the payment license and encryption compliance systems in Hong Kong, Singapore, the Middle East, the European Union and other regions, we focus on providing situational digital payment solutions for enterprises and high-net-worth individual users in cross-border trade, offshore services and Web3 industries. The company’s business covers emerging markets such as Asia, Latin America, and Africa, and is committed to building a credible global digital payment network.

Kun KUN solves the challenges faced by cross-border payments by building and operating a compliance bridge between stablecoins and fiat currencies: low timeliness, high cost and cumbersome processes. With its efficient, compliant and secure overall digital payment solution, Kun KUN has become an effective complement to the SWIFT system.

William, partner at BAI Capital, said: “We are pleased to support Kun KUN’s vision of building a new generation global digital payment network. Financial services must be rooted in the real economy. The Kun KUN team has forward-looking market insights, excellent operational efficiency and end-to-end solution capabilities, demonstrating huge potential on the rapidly developing digital payment track.”

Jefferson, partner of GSR Ventures, emphasized: “Kun KUN’s team has decades of experience in the payment industry. It has always insisted on investing in compliance, risk control, and security systems. It has established market trust and customer reputation, and achieved remarkable growth. We are very optimistic about the sustainable development of Kun KUN.”

KK, founder of Hash Global, said: Kun KUN is an important part of our investment layout in the field of “Web3 Business Applications and Infrastructure”. With efficient, secure, and compliant Web2+ Web3 one-stop fund processing capabilities, KUN provides convenient payment solutions for Web3 commercial applications in our ecosystem, and promotes on-chain data flow and value realization. 34;

“The original intention of founding Kun KUN was to serve the unmet needs of cross-border payment links and optimize the efficiency of global capital flow. Stable coins and blockchain are the best infrastructures for the new digital payment system. We will provide optimal solutions for Web2+ Web3 payments through application innovation and scenario solutions, becoming an effective supplement to SWIFT and the traditional banking system.” Liu Jialiang, founder and CEO of Kun KUN, said.

“Customer value has always been the core goal of KunKUN in building a global digital payment network. We will persist in continuous investment in licensing, risk control, and security systems, use stablecoins and blockchain technology to optimize cross-border payment efficiency in emerging markets, and promote The convenient and compliant flow of global funds truly empowers the real economy.”