Technical route determines life and death

Who defeated Panasonic TV?

author| Value Planet Bamboo Inscription

Panasonic TV is closing.

Recently, it emerged that Panasonic is considering selling or scaling back its troubled TV business. Matsushita Holdings President Nami Yuki said frankly that no company will acquire this business at present, but Panasonic will consider various options.

Panasonic TV, which once had a high-profile moment, is now in a situation where no one takes over, which makes people sigh. You know, in 2007, Panasonic TV sales once reached 1 trillion yen, and its products were popular around the world, making Panasonic a fortune.

However, after entering the era of flat-panel TVs, Panasonic has continued to make mistakes in key technical route choices. At the same time, China’s home appliance industry has exploded, and domestic brands have risen strongly. TV products of domestic brands such as Hisense, Skyworth, and TCL have also been favored by more people overseas, and have gradually become important players in the global color TV market.

The exit of Panasonic TV also reflects the weakening influence of Japanese TV brands. The global color TV market is entering a new round of reshuffle, and China color TV brands are beginning to occupy the C position.

Panasonic TV: From highlight to fall

In 1952, Panasonic launched Japan’s first black and white TV set ET-501, and introduced color TV in the 1960s. At that time, televisions, washing machines and refrigerators were known as the three major artifacts in Japanese life. China built its first TV set in 1958, named it Beijing, and is known as China’s first screen. That year, there were no more than a few dozen TVs in China.

In the 1970s, Panasonic launched National brand color TVs. This product uses cathode ray tube (CRT) technology, which makes the color projected by the TV very accurate and was at a very advanced level at the time. At that time, televisions were still a rare species. Panasonic relied on advanced picture tube technology to make its own TV products clearer and brighter in colors, which quickly attracted global attention. Panasonic TVs were once regarded as the king of home appliances and were sold all over the world.

In 1978, China introduced the first production line for manufacturing color TVs. In 1979, Matsushita Electric became one of the first Japanese companies to enter the China market. In the 1980s and 1990s, Panasonic TVs with the Panasonic logo became a luxury item among the four major household appliances in China. At that time, many Chinese people were proud to own a Panasonic TV. Zhang Lin (pseudonym) bought a Panasonic TV when he got married. People in the whole building crowded to his house to watch TV. He became the most fashionable guy on the street.

In the 1980s and 1990s, Panasonic TV once accounted for 20% of the global market share and became one of the representatives of Japanese manufacturing. It can be said to have unlimited fame. In 2003, Panasonic became popular around the world with its VIERA plasma flat-panel TVs. This TV has captured the hearts of many consumers with its excellent image quality and advanced display technology.

While many people think that Panasonic TV will prosper all the way, it is gradually going downhill.

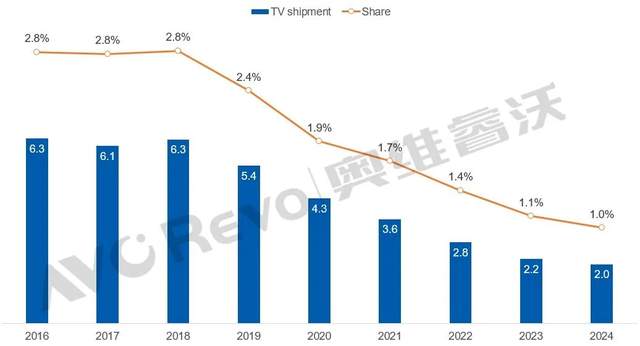

Data shows that global shipments of Panasonic TV have dropped from 6.31 million units in 2016 to 2.02 million units in 2024, leaving only 1% of the global market share. Even in Japan, Panasonic TV’s market share has dropped from 16.8% in 2018 to 8.8% in 2024, ranking sixth.

Panasonic Holdings ‘data for fiscal year 2024 shows that its Lifestyle and Automotive (automotive electronics) businesses are the two largest businesses in revenue, accounting for 41.2% and 17.5% respectively. In contrast, the operating income of the black home appliance business, including cameras, televisions, etc., last year is expected to be 284 billion yen, accounting for only about 3% of the group’s overall revenue.

When Panasonic decided to sell or exit its TV business and dissolved Matsushita Electric in late 2025, the capital market was unusually welcoming and Panasonic’s share price soared 15%, the largest intraday gain in nearly 10 years. It can be seen that capital is not optimistic about Panasonic’s TV business and electrical business.

So, how did Panasonic TV fall from a height?

Why fell from a height?

In the TV industry, technology is the core driving force.

From Panasonic’s cathode ray tube (CRT) technology to later HDR technology, OLED technology, etc., every technological innovation has greatly changed the user experience of TV sets and promoted industry progress. If TV manufacturers bet on the wrong technology, they can easily make the wrong step in the wrong direction and eventually collapse. Panasonic TV is a typical example.

At the beginning of the new century, the global TV market has reached a technological crossroads. Prior to this, the mainstream market was CRT TVs, which were the kind of thick and ugly big TVs many people had at home when they were children. They were quickly replaced by thin flat-screen TVs with better display. At this time, there were two technical routes for flat-panel TVs: plasma and liquid crystal.

Panasonic was a staunch supporter of plasma TVs at the time. Compared with liquid crystal technology, plasma technology does have advantages in display, such as higher contrast, wider color gamut and wider viewing angle. Therefore, Panasonic continues to increase its bargaining chip in plasma TVs: in the 2000s, Panasonic acquired the plasma divisions of Hitachi and Pioneer, becoming synonymous with high-end plasma TVs. In 2008, its 103-inch plasma TV set the world’s largest size record at that time.

Although Panasonic has achieved good results in the field of plasma TVs, plasma technology has problems such as high energy consumption, high cost, and difficulty in mass production of large size. The market is more inclined to LCD TVs with low energy consumption and easy production. Especially after Samsung, LG and other brands continue to invest in the field of LCD TVs, this trend is even more obvious.

However, Panasonic still insisted on plasma technology, and soon it tasted the bitter fruit.

In 2012, there were 200 million LCD TVs worldwide, while only 13 million plasma TVs were shipped. In 2013, Panasonic had no choice but to close its plasma factory and announced its withdrawal from the plasma business. As LCD TVs gradually dominate the global color TV industry, Panasonic continues to be marginalized and its market share continues to be eroded. Although Panasonic also switched to LCD after withdrawing from plasma, the market has been occupied by other brands. In 2018, Panasonic TV shifted its business focus to the commercial sector, but it failed to recover its decline.

In addition to being on the wrong side of its technical route, Panasonic has encountered competitive pressure from Chinese and Korean TV brands, which is also an important reason for its decline.

After 2000, China’s color TV industry ushered in a ten-year golden period of development. In 2012, China’s color TV brands accounted for 25% of global color TV shipments, becoming one of the most important color TV markets in the world. Japanese media disclosed that in the first three quarters of 2024, China brands accounted for 49.9% of sales in the Japanese TV market. Among them, Hisense ranked first with a proportion of 40.4%, far exceeding Sony’s 9.7% and Panasonic’s 9%.

South Korea’s Samsung and LG are quite strong in the field of display technology and have also brought a lot of pressure to Panasonic TV. For example, Samsung has outstanding performance in liquid crystal display technology and quantum dot technology, while LG has a leading edge in OLED display technology. The products launched by the two are excellent in image quality, color, contrast, etc.

The end of Panasonic TV conveys one truth to the market: technological advantage does not equal market success. Panasonic bet on plasma technology, but failed to transform its technological advantages into public demand. Instead, it was dragged down by cost and functional shortcomings. It can only be said that in addition to technology, the core of TV brand competition also includes cost control, ecological integration and the ability to quickly respond to the market.

Looking to the future: patterns and trends

On a global scale, it’s not that TV is failing, it’s just that Panasonic TV is failing.

Statistics from global market research firm Counterpoint Research show that global TV shipments in the third quarter of 2024 increased by 11% year-on-year to 62 million units, and achieved year-on-year growth for two consecutive quarters. Among them, Samsung ranks first with a global market share of 17.6%, but its market share shows a downward trend;TCL ranks second with a market share of 14.3%, Hisense and LG tie for third, with both market shares of 13.2%.

According to Japanese and Korean media reports, China’s global TV market share surpassed South Korea for the first time from January to September last year, reaching 30.1%, ranking first in the world. In terms of specific data, the combined market share of China brands TCL, Hisense and Xiaomi is 30.1%, while South Korea’s Samsung and LG Electronics have a combined market share of 29.4%.

It can be said that the current pattern of the global TV industry is the competition between China and South Korea. Domestic TV brands such as Hisense, TCL, Skyworth, Changhong, and Xiaomi have occupied a dominant position in the domestic market with their technological innovation, product cost-effectiveness and complete after-sales service, and their share in the global market has also continued to increase.

Next, more advanced display technologies such as OLED, QLED, and Mini LED will continue to improve and popularize, bringing a better picture quality experience. Manufacturers such as Samsung, TCL, Hisense, etc. that master these technologies will have more advantages in market competition. For example, TCL’s Mini LED light-control lighthouse microlens technology and quantum dot Pro2023 technology have raised LCD TV quality to new heights. Hisense’s world-first RGB three-dimensional color-controlled liquid crystal display technology has surpassed quantum dot technology in several aspects such as color purity and color gamut area, and comprehensively crushed QD-Mini LEDs.

Looking into the future, high-end may become the main battlefield for China TV brands to surpass South Korean brands.

According to Counterpoint Research, product shipments in the global high-end TV market surged 51% in the third quarter of 2024, setting a record high. Samsung’s share in the high-end market dropped from 43% to 30% within one year. Hisense and TCL shipments more than doubled year-on-year, surpassing LG, occupying second and third places in the high-end market respectively. In addition, China has a complete display panel industry chain from raw material supply to terminal manufacturing. It has obvious advantages in cost control and can launch high-end products at more competitive prices.

In short, China’s TV industry is making great strides ahead of South Korea and Japan. Panasonic TV, which left in despair, became a microcosm of the decline of the Japanese TV industry. It also reveals an unchanging business truth: no company can always rest on the laurels, and the courage to innovate and adapt to the situation are the magic weapons to always stand at the forefront of the trend.

Otherwise, when the times abandon you, you really won’t even know how to say hello.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.