In 2024, the subsidy policy overdraws market demand in advance. At the beginning of 2025, overcapacity of automobile companies led to a backlog of inventories, and price wars have become an inevitable choice to clear inventories.

The price war in China’s auto market is heating up again, squeezing the profit space of listed auto companies

Wen| Automobile K line

In 2024, the subsidy policy overdraws market demand in advance. At the beginning of 2025, overcapacity of automobile companies led to a backlog of inventories, and price wars have become an inevitable choice to clear inventories.

2025 has not yet begun, and China’s auto market has ushered in an unprecedented price storm.

So far, more than 35 car companies/brands have announced price cuts, from self-owned brands to joint-venture car companies, to luxury brands, and from fuel vehicles to new energy vehicles. This price battle not only reflects the fierce competition in China’s auto market and cruelty, but also reveals the potential deep structural overcapacity contradiction in the auto industry.

Data released by the Passenger Car Market Information Joint Branch of China Automobile Dealers Association (referred to as the Passenger Car Association Branch) shows that the profit margin of the automobile industry in 2024 will be 4.3%, which is significantly lower than the average profit margin of downstream industrial enterprises of 6%.

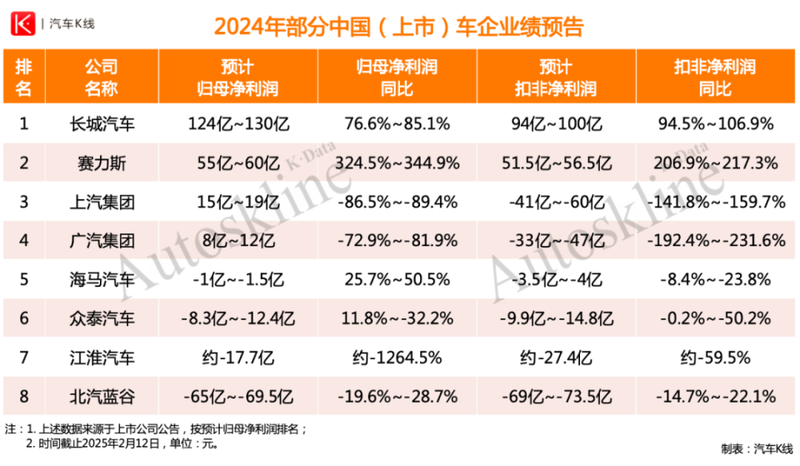

As of February 12, according to the 2024 performance forecasts of some China’s listed car companies based on the “Automobile K-Line” statistics, most of the listed car companies that have announced performance forecasts are under huge performance pressure, especially after deducting non-recurring gains and losses. Net profits have shrunk significantly and losses have expanded.

Derivatives with overcapacity

At the end of 2024, leading new energy vehicle companies such as BYD and Tesla took the lead in launching price cuts. Soon, Changan Automobile, Geely, and Chery quickly followed up on New Year’s Day.

Subsequently, joint venture car companies such as FAW-Volkswagen and GAC Toyota also joined the battle.

In this wave of price reduction war, various car companies have not been soft in their efforts. The price reduction generally exceeds 10,000 yuan, and some models have even reached broken prices.

However, while car companies are fighting hard, consumers seem to be increasingly calm.

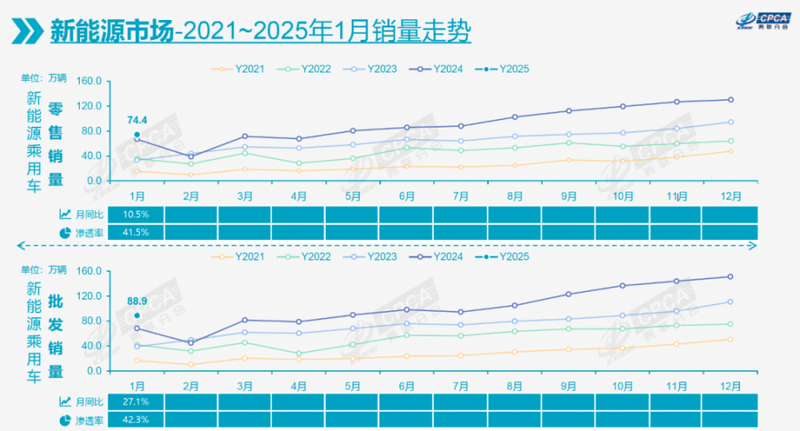

“Photo source: Passenger Federation Branch”

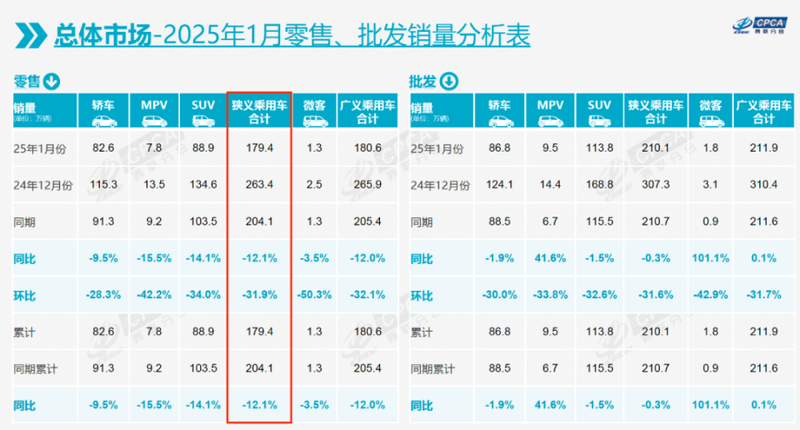

On February 11, the National Passenger Car Market Analysis Report for January 2025 released by the Passenger Car Market Information Joint Branch of China Automobile Dealers Association (referred to as the Passenger Car Federation Branch) showed that the retail sales of China’s passenger car market in January were only 1.794 million units, a year-on-year decrease of 12.1%, and a month-on-month decline of 31.9%, becoming the third lowest in the same period in the past 10 years, only higher than the retail sales in January 2020 and 2023.

In this year’s China auto market, although the Passenger Federation Branch predicts that it will open at a lower level and move at a higher level, the relatively sluggish market performance in January is in sharp contrast to the price war among auto companies.

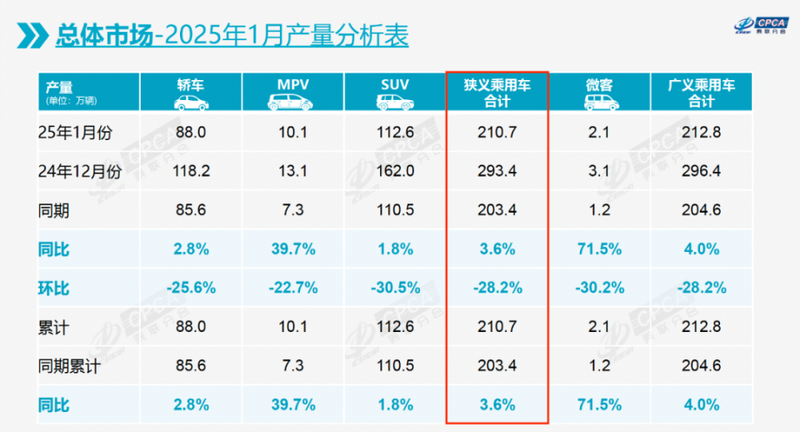

At the same time, statistics from the Passenger Federation Branch showed that passenger car output in January was 2.107 million units, a year-on-year increase of 3.6%, only 190,000 units lower than the historical high of 2.3 million units in 2018. Compared with retail sales, the difference between production and sales reached 313,000 units.

“Photo source: Passenger Federation Branch”

Regarding the huge differences between supply and demand, Cui Dongshu, secretary-general of the Railway Federation Branch, pointed out that the subsidy policy in 2024 overdrew market demand in advance, while overcapacity of automobile companies in early 2025 led to a backlog of inventories, and price wars became an inevitable choice to clear inventories.

However, according to data from the Passenger Federation Branch, manufacturers ‘inventories increased by 10,000 units in January, and channel inventories decreased by 70,000 units. This phenomenon of an increase in manufacturers and a decrease in channels shows that car companies are rushing wholesale sales through strong production, but terminal retail has not fully absorbed inventory, and the market is still in a destocking cycle.

In other words, inventory pressure has not yet shifted from the OEM to the dealer. This also explains why this round of price wars at the beginning of the year was directly initiated by the main engine factory.

But in today’s situation, dealers are probably jittery and have even begun to have anxiety about destocking. In particular, joint-venture brand dealers have generally faced pressure on capital turnover due to declining sales and lengthening inventory cycles, and have to withdraw funds through substantial price cuts.

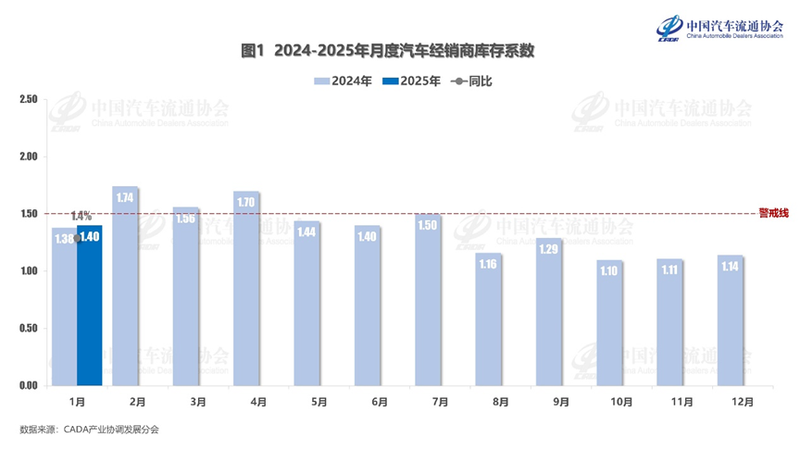

This is also reflected in the January car dealer inventory coefficient released by China Automobile Dealers Association on February 12.

“Photo source: China Automobile Dealers Association”

In January, the comprehensive inventory factor of car dealers was 1.4, a month-on-month increase of 22.8% and a year-on-year increase of 1.4%. Although the inventory level is still below the warning line, this is also because most manufacturers have not yet issued new sales target indicators to dealers. In order to reduce business risks, dealers are not willing to replenish stocks before the Spring Festival.

Now that the Spring Festival holiday is over, if one day the main engine factory sends an official letter to the dealers to force inventory, it will undoubtedly put a heavy shackle on the dealers ‘already overwhelmed shoulders.

There are new ways to play the price war”

In addition to the adverse impact of car companies on new car sales in order to hedge against the end of the two new national policies at the end of 2024, the undetermined window period of policies in 2025, and the Spring Festival holiday, the first round of price wars in 2025 will have on new car sales, and the economic growth will slow down. Under the background, consumers have become more sensitive to prices and generally prefer cost-effective models, forcing car companies to trade prices for volume.

In addition, the reverse effect formed by the new energy transformation in China’s automobile market is also an important reason.

“Photo source: Passenger Federation Branch”

In January, the retail sales of new energy vehicles were 744,000 units, a year-on-year increase of 10.5%, and the penetration rate was 41.5%. Compared with the situation since July last year, when the penetration rate of new energy exceeded 50% for five consecutive months, it seems that fuel vehicles have returned to the mainstream of the market.

However, the fact that leading companies such as BYD and Geely have squeezed the fuel vehicle market through the same price strategy for oil and electricity, forcing traditional car companies, especially joint venture car companies, to cut prices to survive still exists.

This situation has further intensified market differentiation. Relying on the transformation of new energy, independent brands resold 1.09 million domestic vehicles in January, down only 2% year-on-year, and their retail market share was 61%, a year-on-year increase of 5.9 percentage points.

Retail sales of mainstream joint venture car companies dropped sharply by 27% year-on-year to 490,000 units, leaving only 27.3% of their market share.

After the Spring Festival holiday, the price war heated up again.

Tesla was still the first to take action. On February 5, Tesla launched a time-limited insurance subsidy and a five-year zero-interest loan and charging rights for all Model 3 models. The starting price dropped to 227,500 yuan, setting the lowest price in the world.

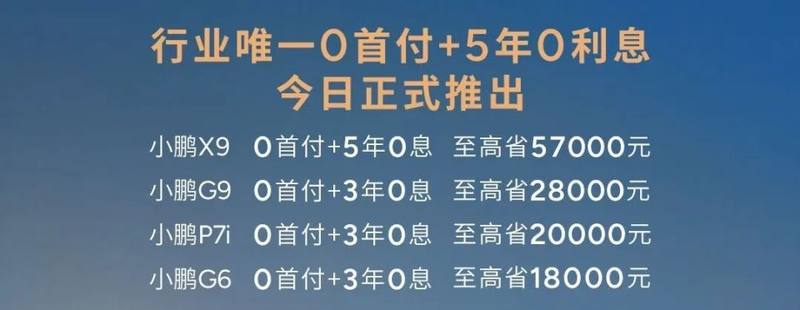

Xiaopeng Automobile followed closely and launched the industry’s first 0 down payment +5-year 0 interest policy. Nilai and Hongmeng Zhixing’s smart brands… Also join the ranks of hidden price cuts.

“Photo source: Xiaopeng Automobile’s Weixin Official Accounts”

In addition, joint-venture car companies such as GAC Toyota and Dongfeng Honda have successively released preferential policies, and even Chery Automobile has announced that its models will launch a time-limited one-price promotion with an average price reduction of more than 10%.

It is not difficult to see that this wave of price wars after the festival presents different competitive characteristics from the past.

Car companies no longer stick to simple price cuts, but compete for the market through financial policies, technological upgrades and differentiated services that will not directly impact the brand price system. The previously formed inventory pressure and the adjustment of the two new policies have further complicated this scuffle between car companies.

For example, BYD released the Eye of God smart driving system on February 10 and began to decentralize high-end smart driving functions to markets below 100,000 yuan.

From the perspective of “Automobile K-Line”, while BYD calls for intelligent driving for all people and accelerates intelligent equality, it is precisely a disguised price war, but this method of adding allocation but not increasing price is obviously smarter.

In 2025, the price war in China’s auto market may be difficult to alleviate, and the focus of competition has begun to shift to the field of intelligence (including smart cockpit and smart assisted driving).

In this regard, Cui Dongshu believes that intelligent driving technology will become the next focus of competition, but most car companies need to rely on external cooperation to achieve technological breakthroughs.

It is in this process that BYD and Geely quickly consolidated their market position while reducing production costs through vertical integration of supply chains and technology iteration.

But at the same time, the profit margins of a considerable number of car companies have been compressed to critical points. Some relatively weak brands risk withdrawing from the market due to cash flow breaks.

Views of AutosKline:

This price war is essentially the pain of the automobile industry’s transformation from the fuel era to the new energy era.

In this process, who can have cost control capabilities, technological innovation and global vision can survive the cruel knockout rounds.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.