Do public funds with thick eyebrows and big eyes have running institutions?

“Mutual Recognition Fund Veteran” Xingjian Assets withdraws from the asset management industry, and its Internet celebrity Kim Jong is looking for a successor

Photo source: Visual China

Blue Whale News, February 10 (Reporter Ao Yulian)When the Mutual Recognition Fund was in flames, the veteran institutions retreated unscathed.

As three of the company’s partners plan to retire, Hong Kong local asset manager Zeal Asset will close its asset management business before the end of 2025 and refund management funds. As one of the first batch of mutual recognition fund managers, the company’s mainland business has also been affected.

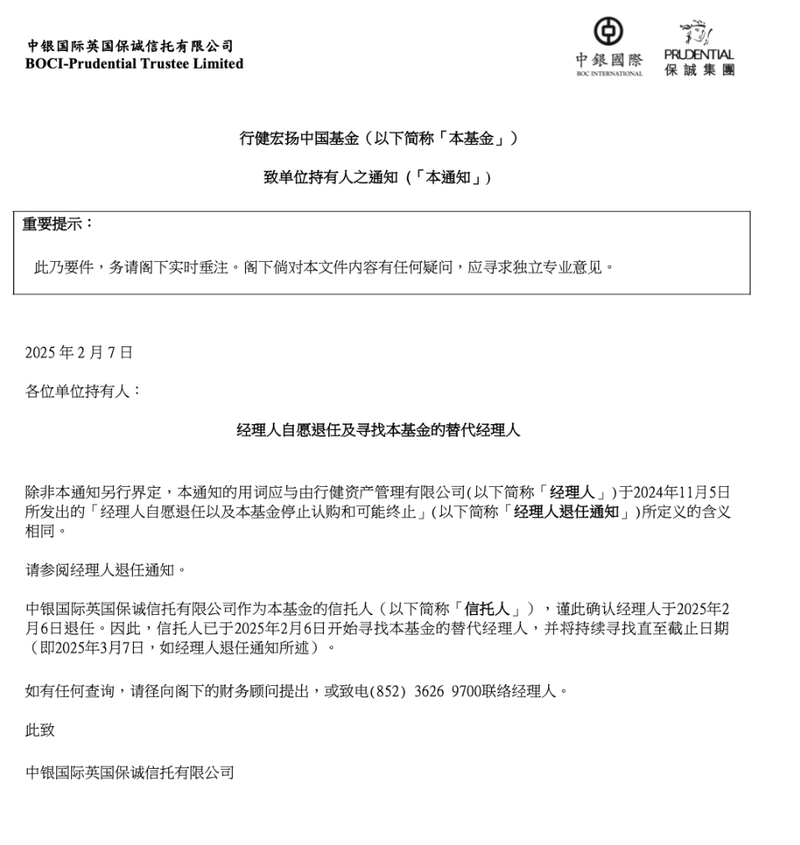

Xingjian Assets is the manager of the Beishang Mutual Recognition Fund Xingjian Vision China. On February 6, Xingjian stepped down as the manager of the fund. The next day, BOC Prudential Trust (Hong Kong), the custodian of the product, announced that it would find a takeover institution for the product from now until March 7.

Currently, the product is in a blank period for managers.

There are two options facing this first-generation mutual recognition fund: either find a receiver before March 7, or liquidate it.

There are two options facing this first-generation mutual recognition fund: either find a receiver before March 7, or liquidate it.

According to previously disclosed information, if liquidating, the termination cost is expected to be HK$960,000, accounting for 0.07% of the net asset value at the end of October 2024. This fee will be deducted from the fund’s assets and ultimately paid by the holder. The other outcome is not easy to find a receiver, despite the aura of mutual recognition funds investing overseas.

As early as early as early November 2024, Xingjian Asset Management said that it had spent some time trying to find a new manager, but to no avail. Many Hong Kong asset managers such as Huili recently told reporters that they had no intention of taking over.

Since the beginning of the New Year, mutual recognition funds have caught the flow of overseas investment, and many products have sold out in one day. Why is it that no one has taken over the original mutual recognition fund of Xingjian Hongyang China?

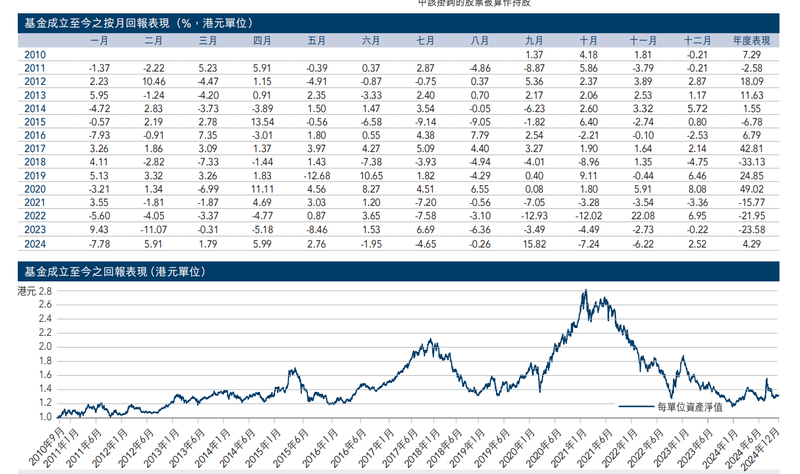

Just looking at the company’s GEM China fund, the quality is not good enough and has underperformed the performance benchmark for four consecutive years.

At the end of 2015, Xingjian Hongyang China Fund obtained the qualification for mutual recognition in the north and was allowed to be sold in the mainland. Two other managers were approved during the same period: JPMorgan Chase and Hang Seng. Looking at the list of managers who have been mutually recognized in the north, we can see that Xingjian Investment is the least famous company.

Former star fund manager at Value PartnersTsai Yasong co-founded Xingjian Investment in 2009. Since its establishment, it has anchored assets in Greater China and used Hong Kong as the fund registration place, which was rare in the Hong Kong market at that time. The person in charge of Xingjian said in an interview with the media that the purpose is to meet with mainland investors through interconnection and other mechanisms.

After obtaining the mutual recognition qualification, Xingjian cooperated with Tianhong Fund, a major mainland traffic manufacturer. The latter became a mainland agent responsible for product promotion and distribution.

Thanks to Tianhong’s channel advantages, Xingjian Hongyang China Fund has been included in Alipay’s fund recommendation list many times. In 2020, its revenue reached 46.99%, outperforming the Hang Seng Index by 50 percentage points. It also won the Golden Bull Award of overseas funds, and has no other success.

However, performance then began to decline: down 10.26% in 2021, down 21.95% in 2022, and down 23.74% in 2023. In 2024, it rose by 4.29%, but the Hang Seng Index rose by 22.93% during the same period, still underperforming the broader market significantly. Looking at the product contract, this fund has extremely low overseas content: no less than 70% of its assets are invested in Hong Kong stocks, and 0-20% are invested in A shares.

Regarding this performance, some investors complained in the stock bar: In 23 years, they underperformed the Hang Seng Index by 13 points and in 24 years, they underperformed the Hang Seng Index by 20 points, but now the manager has to step down and run away. For basic citizens in China, it is indeed rare for them to buy a public fund with thick eyebrows and big eyes without running away, but the manager has run away.

In addition to the poor performance of product net worth in recent years, some foreign sources said that currently, supervision has lowered the issuance threshold for northbound mutual recognition, allowing mutual recognition funds to delegate investment management functions to overseas affiliated institutions within their group.

“In the past, the Northbound Mutual Recognition Fund could only be managed by the Hong Kong team. Now all the teams within the group can, such as the Singapore team, the European team, and the American team. The equity products and mixed stocks and bonds they manage meet the requirements and can all be reported to Northbound Mutual Recognition. rdquo; The above-mentioned foreign investors explained. This means that the threshold for northbound mutual recognition application has become lower, expansion is expected, and taking over existing products is not attractive enough.

In fact, mutual recognition funds have been booming since the beginning of the new year, but funds mainly flow to bond products. Wind data shows that the size of stock-based mutual recognition funds is 45.2 billion yuan, while that of bond-based funds is 88.7 billion yuan.

According to SAFE data, as of the end of 2024, the cumulative net remittance of Northbound Mutual Recognition Funds reached 42.665 billion yuan, a record high. However, the new regulations implemented in early 2025 will increase the sales volume of mainland China to four times.

The concept of global allocation is becoming more and more popular, and mutual recognition funds may have a broad world. It was also at this time that the first generation veteran Xing Jian touzi and left with a sigh.