Focus on encryption ecosystems that focus on decentralization and provide an intelligent user experience.

Author:Duo Nine⚡YCC

Compiled by: Shenchao TechFlow

The market is undergoing a significant transformation. There are clear signs that the successful strategies of the past no longer apply.

In this environment, you must choose: Do you adjust quickly to adapt to the new reality, or be abandoned by the times?

Next, I will explore five emerging trends that cannot be ignored to gain an in-depth understanding of these emerging changes.

1. The return of safe havens and the rise of gold

Before discussing cryptocurrencies in depth, let’s talk about gold first. In case you haven’t noticed yet, gold (XAU) hit a record high this week, with prices approaching $3,000 an ounce. Compared with two years ago, the price of gold has almost doubled. What happened behind this?

The answer is simple: Someone is buying gold in large quantities.

But why would they do this?

This is largely to hedge market risks and geopolitical uncertainties.

From my observation, these buyers may be some countries and large investors. They have realized that the future global situation may be full of uncertainty. If a trade war or even a military conflict breaks out in the world, gold is undoubtedly one of the safest assets.

For example, extreme remarks about Trump, such as wanting Canada to become the 51st state of the United States, taking over the Panama Canal, seizing Greenland from Denmark, and even plans to turn the Gaza Strip into a real estate project, have upset global investors. In addition, the United States ‘move to impose additional tariffs on various countries will only further aggravate this concern.

However, another important factor driving gold prices up is that BRICS+ countries (including Brazil, Russia, India, China, South Africa and their allies) are gradually moving away from the US dollar’s dominance in international trade. This shift has put tremendous pressure on the dollar and also encouraged these countries to support their currencies with as much gold as possible.

In the past, international trade relied almost entirely on the US dollar, but today, more and more countries are choosing to trade in their own currencies backed by gold. This new demand has driven gold prices soaring.

So, what does this have to do with cryptocurrencies?

Bitcoin is called Gold 2.0. If the price of gold continues to rise, this will undoubtedly be a positive signal for Bitcoin. Moreover, the impact may be far beyond your imagination. Please continue reading the next section for more details.

2. The decoupling of Bitcoin from the market

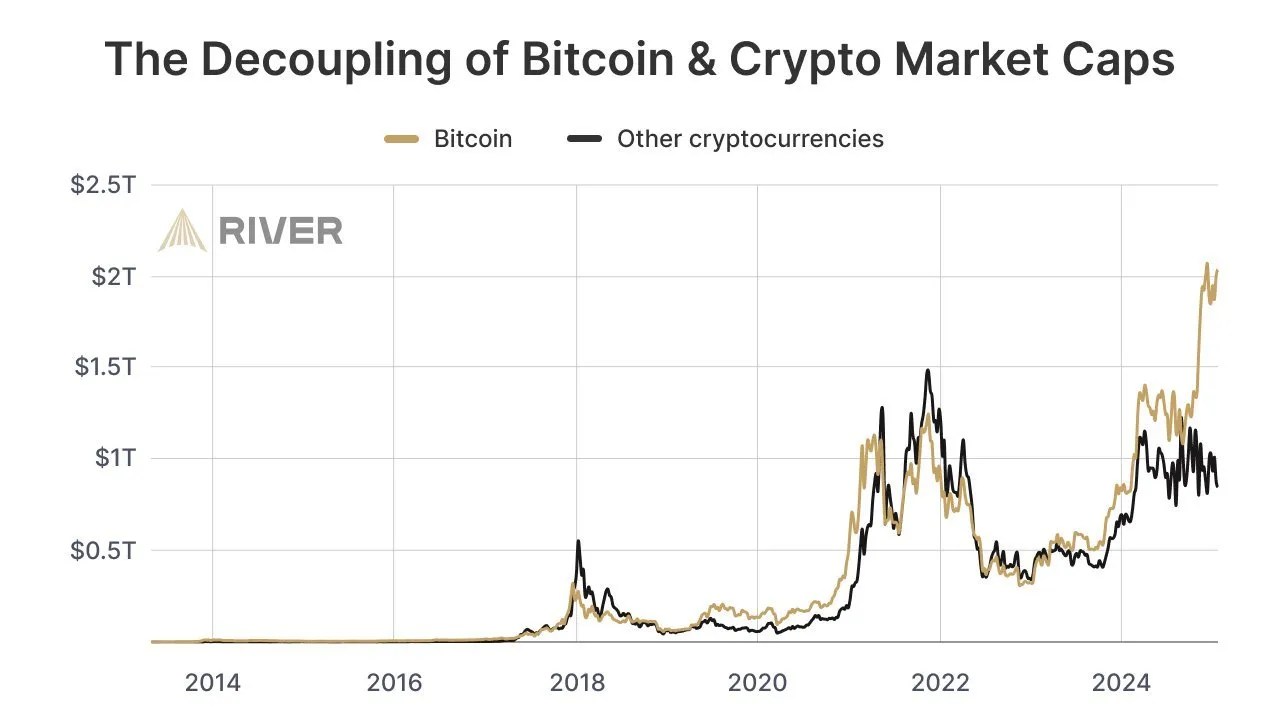

If you look closely at the current market, you will notice an unprecedented phenomenon: Bitcoin’s price trend has been significantly decoupled from other parts of the market, especially altcoins.

Please see the picture below. While Bitcoin continued to hit new highs, the overall shanzhai failed to follow suit. This has not happened since Bitcoin was born in 2009.

Bitcoin has now been separated from copycats in terms of price performance and has gradually become an independent asset class. It is no longer closely related to other parts of the crypto market, but rather demonstrates greater independence. In the future, Bitcoin may move closer to gold than other assets.

This is why this article quoted the gold price chart at the beginning of the article.

The turning point in this change will occur in 2024. When Bitcoin ETFs were officially launched, Bitcoin gradually developed into an asset that could compete with gold. Soon after, the price trend of Bitcoin began to be significantly differentiated from the copycat market, as shown in the figure above.

So, what is the conclusion?

The future of Bitcoin and gold is worth bullish.

This trend may continue for a long time. In particular, this trend may intensify further as countries continue to issue additional fiat currencies to fund trade wars or other conflicts.

In addition, this change may have a profound impact on Bitcoin’s four-year halving cycle. Will Bitcoin’s price continue to experience sharp rises and falls as it has in the past, or will it find a new path? We will wait and see.

3. Dilution and inflation of shanzhai

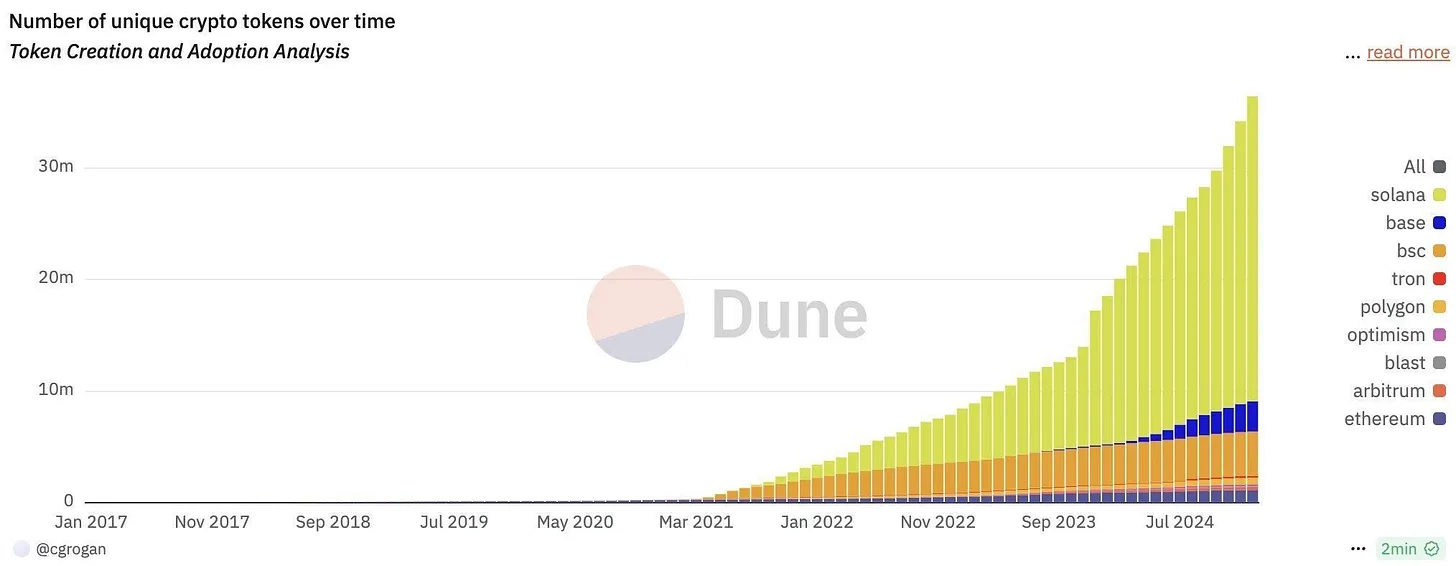

Another important reason why copycats lag behind Bitcoin in market performance is their increasing number.

Take the Solana ecosystem as an example, where the network mints millions of new tokens every month. However, the overall liquidity of the crypto market has not increased simultaneously.

I also mentioned this in a discussion on the X platform. The logic is very simple:

When the same funds are spread across more tokens, prices are unlikely to rise. On the contrary, in terms of net effect, every type of copycat will be negatively affected by reduced liquidity.

This phenomenon is undoubtedly a negative signal for the long-term development of shanzhai.

By issuing more tokens, you cannot create value out of thin air. Although Solana diluted the altcoin space by issuing millions of additional tokens and captured a lot of value from it, this approach is not sustainable, especially if there is no significant increase in total liquidity across the entire copycat market.

In this competitive market, there will always be people who will lose, and your goal is to make sure you are not among them. If you want to adopt a more prudent strategy (because the market environment is not friendly to you), the best option is to avoid the copycat market entirely.

Imagine it. In the past two years, you can almost double your money by investing in gold alone; if you invest in Bitcoin, you can even make five times your income. In terms of risk-adjusted returns, these investments have far outperformed almost all copycats. So why risk participating in the copycat market?

4. User experience takes precedence over blockchain terminology

Solana’s success clearly demonstrates one thing:Users prefer simple and intuitive applications rather than complex technical systems. They don’t care about the technical details behind them. Simplicity and ease of use are the key to success.

When users buy and sell Meme, no one wants to study how Gas fees or other fees are calculated. No one wants to transfer funds across chains or use bridging tools. And no one wants to approve a transaction first and then confirm it as they do on Ethereum. This design is too complex and unfriendly for ordinary users.

In fact, most users don’t care about technical concepts such as Layer-2 networks, decentralization, consensus mechanisms, or network security. These issues are not their focus. Solana understands this deeply and focuses on providing users with easy-to-use applications.

As a result, they succeeded.

A large number of users flocked to the Solana platform to participate in Meme Token transactions. As the number of users increases, so does mobility, as more developers join and develop more applications for their ecosystem. This positive feedback mechanism (flywheel effect) is fully activated, even though its driving force is mainly due to greed and Meme culture.

However, this success has also eclipsed other players in the copycat market, such as Ethereum.

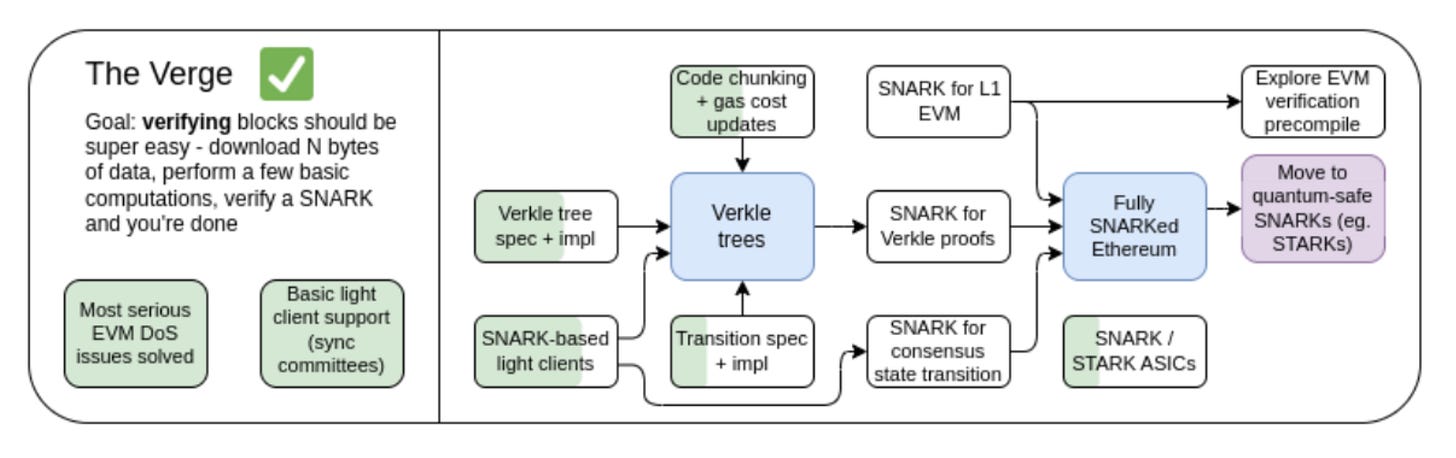

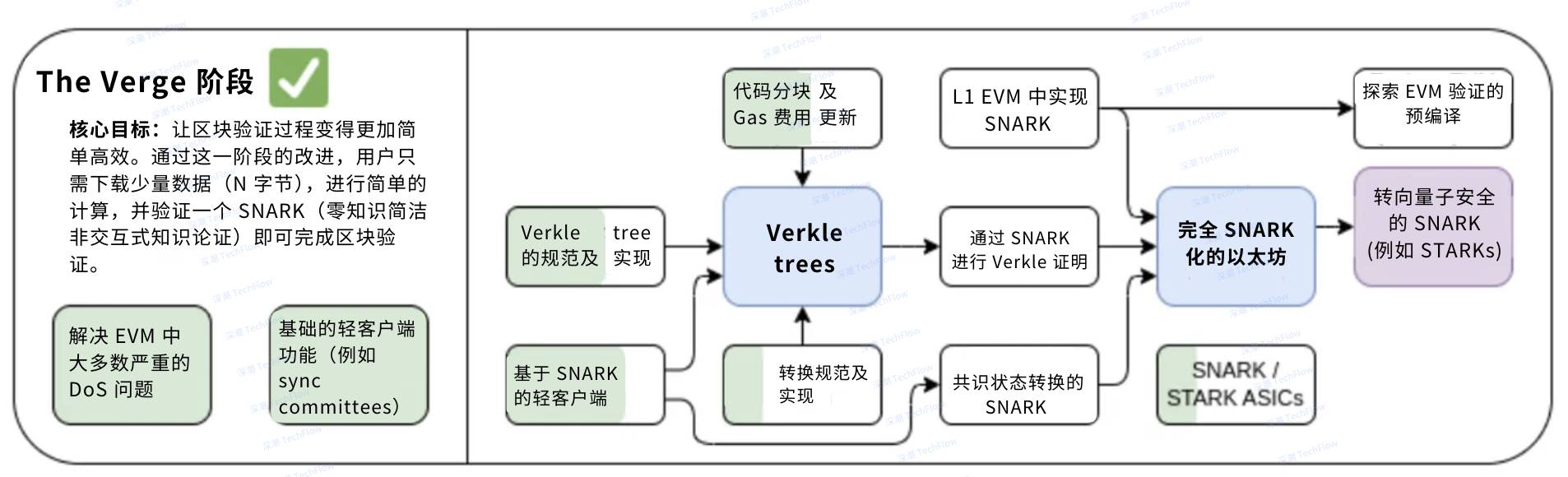

From a certain perspective, this change is normal. The cryptocurrency industry is gradually shifting from the language of engineers with blockchain technology at its core to application scenarios centered on ordinary users. In this process, technical language gradually becomes secondary or even niche. However, Vitalik (founder of Ethereum) does not seem to fully realize this. He is still focused on technical development and has failed to keep up with changes in user needs.

Take a look at the Ethereum roadmap below and you will understand this.

(The original picture is from Duo Nine YCC and compiled by Shenzhen TechFlow)

Cryptocurrency has long since left the geek circle and is no longer limited to a niche area that solves the Byzantine Generals Problem. This phase ended years ago. Today, the real investment opportunity lies in where users go, not in complex technical jargon.

Take Solana as an example. It is temporarily leading the race, but more competitors will emerge in the future. These emerging areas are the directions worthy of attention and investment.

5. Decentralized Exchange (DEX) Centralized Exchange (CEX)

In the past, centralized platforms (CEX, cryptocurrency exchanges such as Binance) were the dominant force in the market. This is mainly because they provide a simple and convenient interface that allows users to easily enter the cryptocurrency world.

However, in recent years, decentralized applications (DApps) have gradually emerged in terms of user experience and cost, and have even surpassed centralized platforms in some aspects. This trend is becoming increasingly obvious.

For example, I discussed a case in detail in Alpha Post #52. In addition, TRUMP tokens launched in January this year relied entirely on decentralized tools for issuance, while traditional centralized exchanges were excluded, and later hastily tried to gain relevant market share.

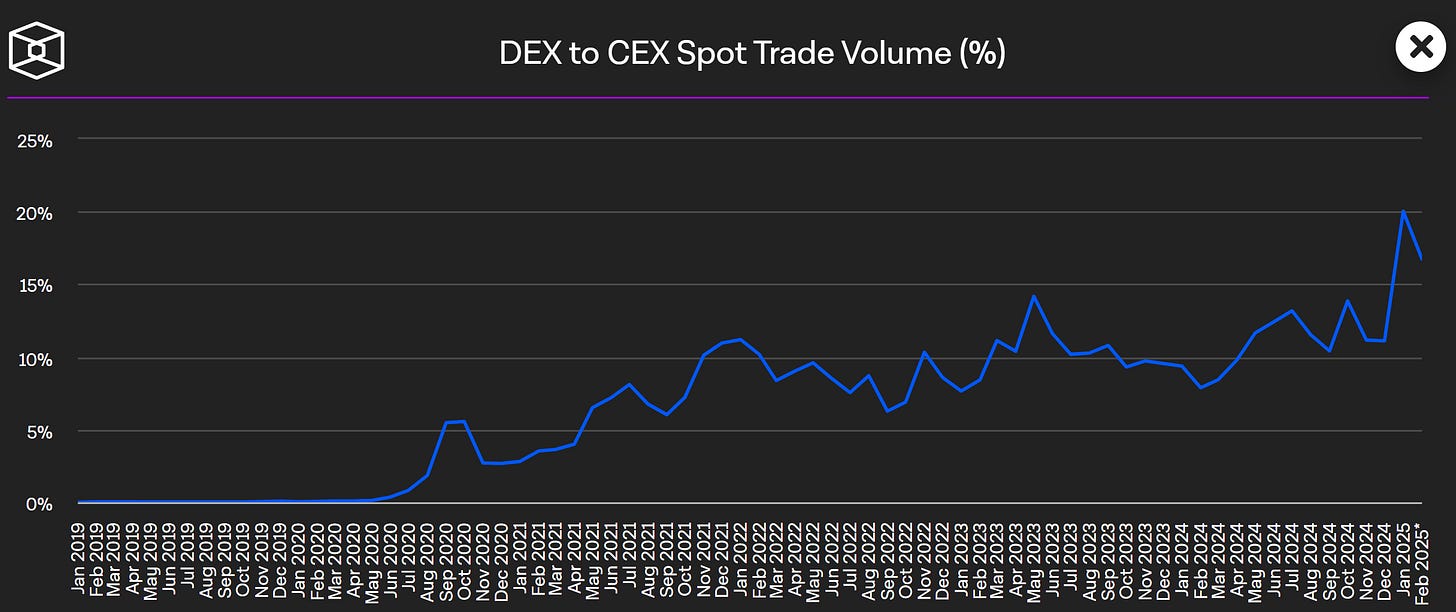

In the long run, I believe that decentralized applications will gradually replace the current centralized market platform and eventually become the dominant force. This trend can be seen in the growth in transaction volume on decentralized exchanges (DEX). Data shows that DEX transaction volume will increase significantly in 2024 (see chart).

So why choose a centralized exchange like Binance instead of a decentralized platform?A decentralized platform not only allows users to receive additional rewards, but also allows them to share a portion of the profits through the use of these applications.What’s more, users always have complete control over their crypto assets, and the user interfaces of these platforms are more friendly. In this area, AAVE is a particularly prominent example, with widely recognized product design and user experience.

Finally, I want to emphasize one point:Focus on encryption ecosystems that focus on decentralization and provide an intelligent user experience.These ecosystems are likely to be future winners, as centralized institutions are often slow to innovate and adapt to market changes and struggle to keep up with user needs.

Although Solana currently leads the market, they also face two significant issues. First, the centralized nature of its network has caused some users to question its security and decentralized attributes. Centralization means that control of network nodes is concentrated in the hands of a few entities, which may weaken blockchain’s openness and censorship resistance. Secondly, Solana has diluted the ecosystem by issuing millions of tokens and the market has become saturated. This approach may weaken the value of existing tokens and may also affect long-term investor confidence.

Therefore, it is recommended to pay close attention to emerging ecosystems that can overcome these issues and find a balance between decentralization and user experience.

Welcome to join the official social community of Shenchao TechFlow

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern