① The S & P 500 index was basically flat, the Dow fell slightly, and the Nasdaq rose slightly;

② Large technology stocks were mixed, with Nvidia rising more than 2%;

③ Hot Chinese stocks generally rose, with the Nasdaq China Golden Dragon Index rising 2.27%;

④ Wenyuan Zhixing surged 83.46%, and once rose nearly 140% in intraday trading.

Cailian News, February 15 (Editor Xia Junxiong)On Friday, the three major indexes diverged, with the S & P 500 index basically unchanged, the Dow fell slightly, and the Nasdaq rose slightly.

(Minute charts of the three major indexes, source: TradingView)

At the close, the Dow Jones index fell 0.37% to 44,546.08 points; the S & P 500 index fell 0.01% to 6,114.63 points; and the Nasdaq index rose 0.41% to 20,026.77 points.

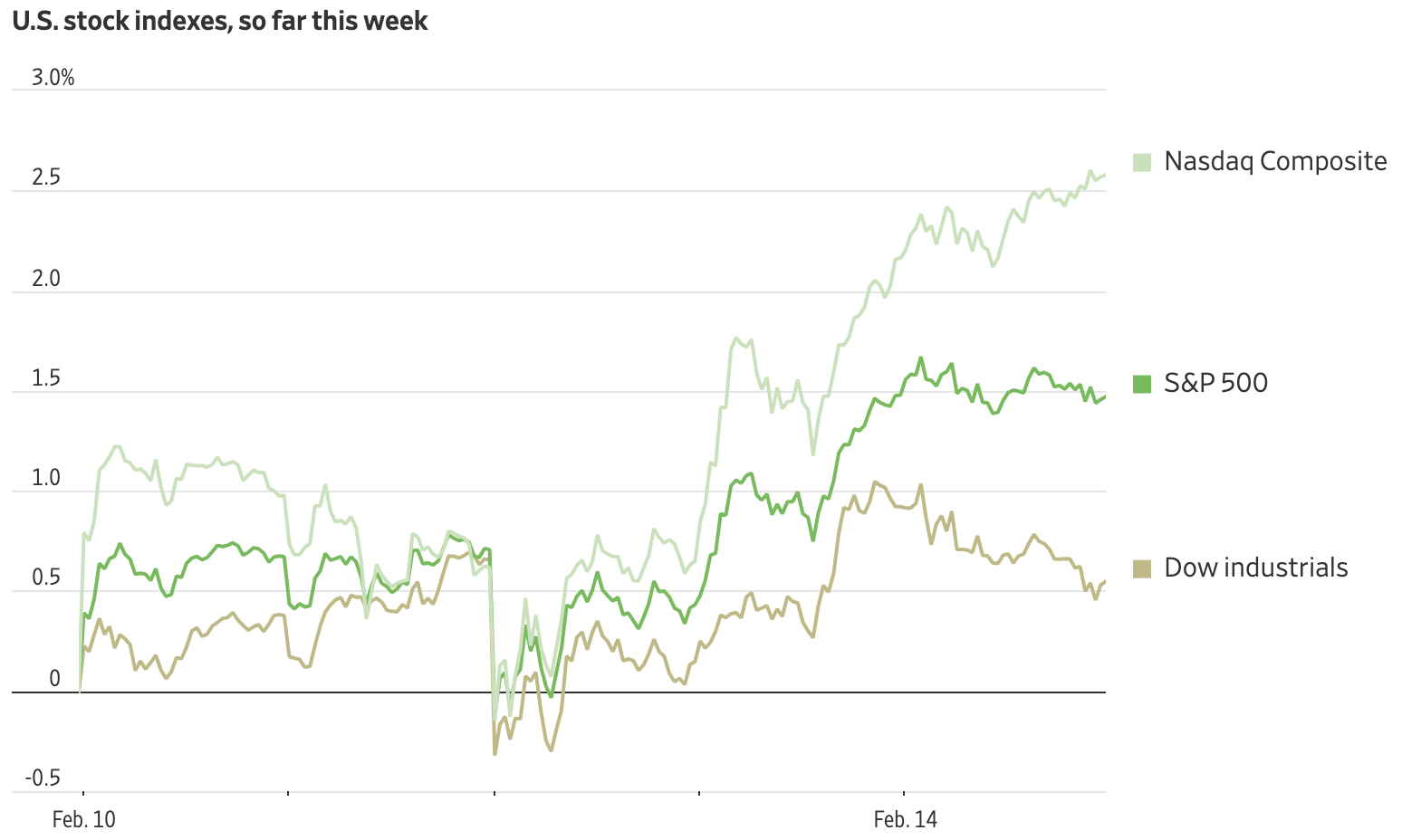

(Trend of the three major indexes this week, source: FactSet)

This week, all three major stock indexes recorded gains. Market sentiment improved after investors gained more certainty about U.S. President Trump’s tariff plan.

January retail sales data released on Friday fell 0.9% month-on-month, well below market expectations for a 0.2% decline, but the market response was relatively flat.

“Obviously, we are in a bull market,” said Chris Zaccarelli, chief investment officer at Northlight Asset Management. “All the bad news seems to be ignored by the market, while the good news is celebrated.”

The yield on the 10-year Treasury note extended its decline on Friday, falling nearly 5 basis points to 4.475%.

The price of gold fell slightly to US$2,892.50 per ounce, having previously hit record highs.

Meta rose more than 1%, recording 20 consecutive gains on the daily line. Its share price continued to hit a record high, with a total market value of US$1.87 trillion. The company plans to invest heavily in AI humanoid robots.

Performance of hot stocks

Large technology stocks were mixed, with Apple up 1.27%, Microsoft down 0.51%, Nvidia up 2.63%, Google down 0.49%, Amazon down 0.73%, Meta up 1.11%, and Tesla down 0.03%.

Popular Chinese stocks generally rose. The Nasdaq China Golden Dragon Index rose 2.27%, Alibaba rose 4.34%, Jingdong rose 4.52%, Pendoduo rose 2.16%, NIO Automobile rose 4.23%, Xiaopeng Automobile rose 4.45%, Ideal Automobile rose 2.54%, Jinshan Cloud rose 19.94%, Beilili rose 10.95%, Baidu rose 0.92%, Netease fell 1.25%, Tencent Music rose 6.66%, and Iqiyi rose 0.79%.

company news

[Insider: TSMC is considering taking control of Intel’s U.S. chip factory at the request of Trump administration officials]

A person familiar with the matter revealed that TSMC is considering whether to acquire a controlling stake in the Intel factory at the request of Trump administration officials. People familiar with the matter said that Trump’s team raised the idea of reaching an agreement between the two companies during a recent meeting with TSMC officials, and TSMC was happy to accept it. It is unclear whether Intel is open to transactions. Discussions are at a very early stage, and the exact structure of a potential partnership has not yet been determined.

[Wenyuan Zhixing surged 83.46%]

At the close of U.S. Eastern Time on Friday, Wenyuan Zhixing surged 83.46%, and once rose nearly 140% in intraday trading.

Nvidia’s SEC 13F file data disclosed on February 14, 2025 showed that Nvidia held 1.74 million shares of Wenyuan Zhixing in the fourth quarter of 2024, with a market value of US$24.65 million. According to a reporter from the Science and Technology Innovation Board Daily, the 1.74 million shares were not new purchases, but Nvidia’s early strategic investment in Wenyuan Zhixing in 2017.

[Meta plans to invest heavily in AI humanoid robots]

Zuckerberg’s Meta’s next major bet is to invest heavily in AI humanoid robots. Meta has formed a new team within Reality Labs.

[Musk’s xAI considers raising US$10 billion at a valuation of US$75 billion]

According to people familiar with the matter, Elon Musk’s artificial intelligence company xAI plans to make a new round of financing of approximately US$10 billion at a valuation of approximately US$75 billion. Existing investors, including Sequoia Capital, Andreessen Horowitz and Valor Equity Partners, are in talks to participate in the financing, people familiar with the matter said. The terms of this round of financing have not yet been finalized and may still change.

[Trump: Don’t mind Japan holding a minority stake in U.S. steel company]

U.S. President Trump said he did not mind Japanese companies holding minority stakes in U.S. steel companies. Japan is considering investments in U.S. steel companies, including debt investments.

[Dell is close to reaching an agreement to sell artificial intelligence servers worth more than $5 billion to xAI]

Dell Technology is in an advanced stage of negotiations to provide AI-optimized servers for Elon Musk’s xAI, and the deal will be worth more than $5 billion. People familiar with the matter said the company will sell servers containing Nvidia GB200 semiconductors to Musk’s artificial intelligence startup this year. Some people familiar with the matter added that some details were being finalized and could still change.

Dell closed up 3.74%.

[Italy is reported to have launched an investigation into Amazon’s alleged tax evasion of 1.2 billion euros]

According to people familiar with the matter, Italian prosecutors are investigating e-commerce giant Amazon and its three executives for suspected tax evasion of 1.2 billion euros (approximately US$1.26 billion).

[Berkshire Hathaway increased its holdings of Occidental Oil and other stocks in the fourth quarter]

Berkshire Hathaway opened a position in the fourth quarter to go long at Constellation Brands Inc., Increase holdings in Western Petroleum (OXY), Domino’s Pizza (DPZ) and other stocks; reduce holdings in Bank of America, Chartered Communications (CHTR), etc.; liquidate Utah Medical Products (UTMD) and S & P 500 ETF-SPDR (SPY).