① Trading congestion in technology stocks has increased, and the mentality of capital game has intensified;

②6 Lianban Hangchi announced that the company’s stock trading has overheating market sentiment and a high risk of speculation;

③ U.S. President Trump said he will announce tariffs on automobiles, semiconductors, chips, pharmaceuticals and possibly wood next month or earlier.

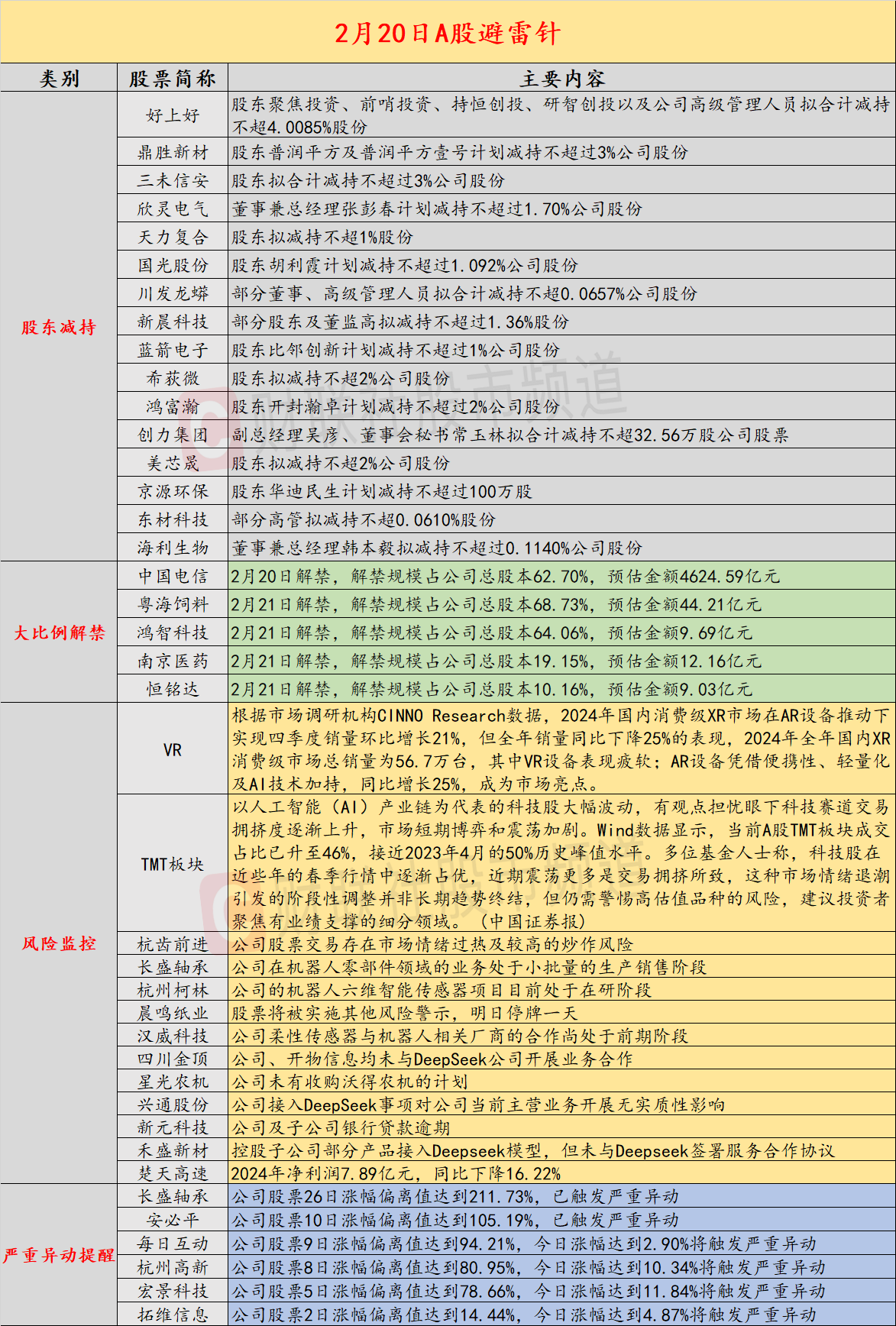

Introduction:Cailian invested in the lightning rod on February 20. Recently, potential risk events in A-shares and overseas markets are as follows. Domestic economic information includes: 1) CINNO Research said that full-year sales in the domestic consumer-grade XR market in 2024 will drop by 25% year-on-year, with VR equipment performing weak;2) Technology stock trading congestion has increased, and the capital game mentality has intensified; the company’s key concerns include: 1) The announcement of 6 consecutive board Hangzhou Chi’s advancement that the company’s stock trading has overheated market sentiment and a high risk of speculation; 2) 3 Days 2 Board Changsheng Bearing said that the company’s business in the field of robot parts is in the stage of small-batch production and sales; key concerns in overseas markets include: 1) The Nasdaq China Golden Dragon Index closed down 0.38%, and Wenyuan Zhixing fell nearly 16%;2) U.S. President Trump said he will announce tariffs on automobiles, semiconductors, chips, pharmaceuticals, and possibly wood next month or earlier.

economic information

1. According to data from market research firm CINNO Research, in 2024, the domestic consumer-grade XR market will achieve a 21% month-on-month increase in sales in the fourth quarter driven by AR equipment, but the annual sales will drop by 25% year-on-year. In 2024, the domestic XR consumer market will total sales volume of 567,000 units, of which VR equipment performed poorly;AR equipment increased by 25% year-on-year, becoming a highlight of the market.

2. Technology stocks represented by the artificial intelligence (AI) industry chain have fluctuated sharply. Some people are worried that the current trading congestion at the technology track is gradually increasing, and short-term games and shocks in the market are intensifying. Wind data shows that the current A-share TMT sector transaction ratio has risen to 46%, close to the historical peak of 50% in April 2023. A number of fund officials said that technology stocks have gradually dominated the spring market in recent years, and the recent shocks are more caused by trading congestion. This phased adjustment triggered by the ebb of market sentiment is not the end of a long-term trend, but it is still necessary to be vigilant about the risks of high-valued varieties, and investors are advised to focus on segments with performance support. (China Securities Journal)

Company warning

1. 6. Moving forward: There is a risk of overheating market sentiment and high speculation in the company’s stock trading.

2, 3 days 2 plates Changsheng Bearing: The company’s business in the field of robot parts is in the stage of small-batch production and sales.

3. Hangzhou Kelin: The company’s robotic six-dimensional smart sensor project is currently in the research stage.

4. Chenming Paper: Shares will be subject to other risk warnings and will be suspended for one day tomorrow.

5. Good: Shareholder Focus Investment, Outpost Investment, Hengheng Venture Capital, Yanzhi Venture Capital and the company’s senior management plan to reduce their shares by no more than 4.0085%.

6. Dingsheng Xincai: Shareholders Purun Square and Purun Square No. 1 plan to reduce their shares in the company by no more than 3%.

7. Sanwei Xin ‘an: Shareholders plan to reduce their shares in the company by no more than 3% in total.

8. Xinling Electric: Director and General Manager Zhang Pengchun plans to reduce his shares in the company by no more than 1.70%.

9. Tianli Composite: Shareholders plan to reduce their shares by no more than 1%.

10. Guoguang Shares: Shareholder Hu Lixia plans to reduce her shareholding in the company by no more than 1.092%.

11. Chuanfa Dragon Python: Some directors and senior managers plan to reduce their shares in the company by no more than 0.0657%.

12. Xinchen Technology: Some shareholders and directors and supervisors plan to reduce their shares by no more than 1.36%.

13. Blue Arrow Electronics: Shareholder Bilin Innovation plans to reduce the company’s shares by no more than 1%.

14. Xidiwei: Shareholders plan to reduce their shares in the company by no more than 2%.

15. Hongfuhan: Shareholder Kaifeng Hanzhuo plans to reduce its shares in the company by no more than 2%.

16. Chuangli Group: Deputy General Manager Wu Yan and Secretary of the Board of Directors Chang Yulin plan to reduce their holdings of no more than 325,600 shares of the company’s shares.

17. Meixinsheng: Shareholders plan to reduce their shares in the company by no more than 2%.

18. Jingyuan Environmental Protection: Shareholder Huadi Minsheng plans to reduce its holdings by no more than 1 million shares.

19. Dongcai Technology: Some executives plan to reduce their shares by no more than 0.0610%.

20. Haili Biotech: Director and General Manager Han Benyi plans to reduce the company’s shares by no more than 0.1140%.

21. Hanwei Technology: The cooperation between the company’s flexible sensors and robot-related manufacturers is still in the early stages.

22 and 3 Lianlian Sichuan Jinding: Neither the company nor Kaiwu Information has carried out business cooperation with DeepSeek Company.

23. Xingguang Agricultural Machinery: The company has no plans to acquire Wode Agricultural Machinery.

24.2 Lianban Xingtong Shares: The company’s access to DeepSeek has no material impact on the company’s current main business.

25. Xinyuan Technology: The bank loans of the company and its subsidiaries are overdue.

26. 2 Lianban Hesheng New Materials: Some products of the holding subsidiary are connected to the Deepseek model, but no service cooperation agreement has been signed with Deepseek.

27. Chutian Expressway: Net profit in 2024 will be 789 million yuan, a year-on-year decrease of 16.22%.

Overseas warning

1. Hot Chinese stocks were mixed, with the Nasdaq China Golden Dragon Index closing down 0.38%. Wenyuan Zhixing fell nearly 16%, Shangrong fell more than 5%, Dianduo fell more than 3%, Baidu and Beili fell more than 2%, Ideal Cars rose more than 3%, and Xiaopeng Automobile rose nearly 3%.

2. U.S. President Trump said he will announce tariffs on automobiles, semiconductors, chips, pharmaceuticals and possibly wood next month or earlier.

3. U.S. President Trump posted on social media on February 19 that Ukraine President Zelensky “had better act as soon as possible, otherwise his country will no longer exist.”

4. Russian President Vladimir Putin said on the 19th that he learned that Russian armed forces soldiers had crossed the Ukraine border in the Kursk region in the afternoon of the same day.

5. Arabica coffee rebounded in the New York market, and stocks fell sharply, exacerbating concerns about supply shortages. Futures rose 4.8% at one point, ending two consecutive trading days of declines and heading towards a record high set last week. Inventory in port warehouses monitored by the exchange fell for three consecutive days on Tuesday, reaching a nine-month low. This suggests a shortage of spot supplies and the market is expected to remain tight until Brazil, the largest exporter, starts exporting its next harvest later this year.