In 2024, 74 unlisted property and casualty insurance companies with comparable data achieved a total net profit of 7.72 billion yuan, a year-on-year increase of more than 50%.

A guide to the profits of unlisted property and casualty insurance companies in 2024: nearly 80% are profitable, and the comprehensive cost ratio of more than 50 companies exceeds 100%

(Photo source: Visual China)

Blue Whale News, February 8 (Reporter Shi Yu)Against the background of the overall recovery of profitability in the insurance industry, property insurance companies are no exception.

Recently, the 2024 performance data of unlisted property insurance companies have been unveiled one after another, which is consistent with the trend of life insurance companies, and the profit side has also performed well. The reporter did not completely sort out. The 75 property insurance companies that disclosed profit data achieved a total net profit of 5.26 billion yuan. Among them, the 74 property insurance companies with comparable data achieved a total net profit of 7.72 billion yuan, a year-on-year increase of about 57%.

Profits collectively recovered, and the profits of major troops were less than 100 million yuan

Along with the disclosure of the insurance company’s solvency report for the fourth quarter of 2024, the full-year results of unlisted property insurance companies in 2024 were also released. Overall, the 75 property insurance companies that have disclosed profit data have achieved a total net profit of 5.26 billion yuan, and the 74 property insurance companies with comparable data have achieved a total net profit of 7.72 billion yuan.

Among the 75 property insurance companies that disclosed profit data, a total of 58 will achieve profits in 2024, of which only one has a net profit of more than 1 billion yuan, another 3 have a net profit of more than 500 million yuan, and 38 have a net profit of less than 100 million yuan.

Specifically, in 2024, China Life Property Insurance ranked first in the net profit of non-listed property insurance companies, achieving a net profit of 1.9 billion yuan for the whole year, a year-on-year increase of 37%. In the same period, China Life Property Insurance achieved premium income of 110.926 billion yuan, paid compensation of 76.779 billion yuan, and maintained and appreciated state-owned capital at a value-added rate of 111.62%.

China United Property Insurance, ranked second, achieved a net profit of 944 million yuan, a year-on-year increase of more than 40%; Yingda Taihe Property Insurance and Dinghe Property Insurance achieved net profits of 878 million yuan and 700 million yuan respectively, both compared with the previous year. Some decline, ranking third and fourth.

The profits of Zijin Property Insurance and Zhongyuan Agricultural Insurance will increase significantly in 2024, achieving net profits of 483 million yuan and 422 million yuan respectively; Huatai Property Insurance’s profitability will remain stable, achieving a net profit of 403 million yuan in 2024, basically the same as the previous year.

It is worth mentioning that in addition to Zhongyuan Agricultural Insurance, professional agricultural insurance institutions such as Guoyuan Agricultural Insurance, Sunshine Agricultural Insurance, and Anhua Agricultural Insurance also maintained a growth trend in profits last year, achieving net profits of 373 million yuan, 373 million yuan and 205 million yuan respectively.

Although the industry’s profit performance has generally improved, most insurance companies are still at a low profit, with a total of 38 insurance companies having profits of less than 100 million yuan. Among them, there are many insurance companies that have turned losses into profits. For example, Everyone Property and Casualty Insurance achieved a net profit of 25 million yuan in 2024 after losing 345 million yuan in 2023; Yanzhao Property Insurance, which made a profit of 04 million yuan in 2024, lost more than 450 million yuan in the previous year.

In the property insurance industry where the Matthew effect is serious, small and medium-sized property insurance companies have no advantages in terms of size, service network, and operating costs. Fortunately, in recent years, they have continued to explore the path of specialization and differentiation, breaking the past. Development path and seeking a path of steady development.

Among the loss list, Sheneng Property Insurance reported a net loss of 2.457 billion yuan in 2024. Shenneng Property Insurance, which opened on January 16, 2024, was led by Shenneng Group and has a registered capital of 10 billion yuan. In August of the same year, Sheneng Property Insurance was approved to transfer Tianan Property Insurance’s insurance business. In October, Sheneng Property Insurance completed the transfer of Tianan Property Insurance’s insurance assets, including but not limited to policy claims, information systems, staff, institutional outlets, etc., while inheriting and continuing previous underwriting, claims settlement and service experience. Sheneng Property Insurance, which is carrying the burden of the past, still needs a longer timeline to observe its development.

In addition, Asia Pacific Property Insurance, Chengtai Property Insurance, BYD Property Insurance, Modern Property Insurance, and Qianhai Property Insurance will lose 100 million yuan in 2024.

(Net profit of unlisted property insurance companies in 2024, unit: 100 million yuan; tabulated: Blue Whale News)

The comprehensive cost ratio of nearly 60% of insurance companies has been optimized, and the comprehensive cost ratio of BYD Property Insurance remains high.

Behind the overall recovery in profits of unlisted property and casualty insurance companies in 2024, on the one hand, it is related to the positive driving of investment-side returns. According to industry statistics, the comprehensive investment return rate of unlisted property and casualty insurance companies in 2024 is 3.96%, an increase of 1.83 percentage points year-on-year.

For property insurance companies, controlling underwriting costs is the key to improving long-term profitability. In 2024, a total of 42 unlisted property and casualty insurance companies will optimize their comprehensive cost rate data, accounting for 58% of the insurance companies with verifiable data.

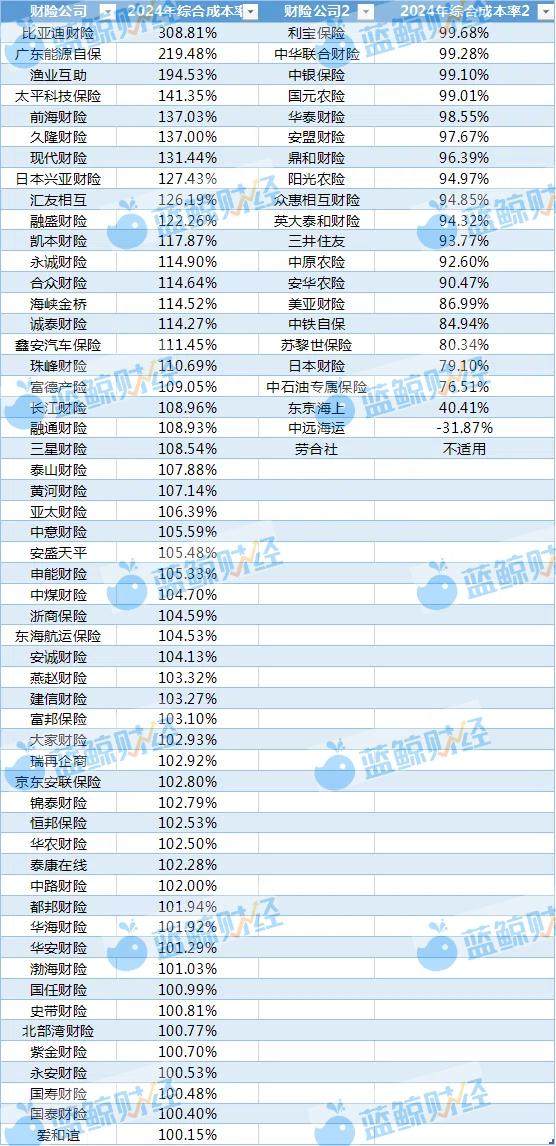

Based on 2024 data, excluding Lloyd’s, whose data is not applicable, there are 54 insurance companies with comprehensive cost ratios higher than 100%, and 20 companies with comprehensive cost ratios lower than 100%. The pressure drop still needs to continue. Among them, 17 property insurance companies have a comprehensive cost ratio higher than 110%, 37 are in the range of 100%-110%, and 12 insurance companies have a comprehensive cost ratio lower than 100% but higher than 90%.

At the company level, the one with the highest comprehensive cost ratio is BYD Property Insurance, which was established by Huanxin. Entering the insurance industry as a new force in car building, BYD Property Insurance, a subsidiary of BYD, has not only its unique attribute of undertaking Yi ‘an Property Insurance business, but also attracts industry attention as an observation sample for new energy auto insurance planners. In 2023, BYD Property Insurance completed the approval of capital increase and auto insurance business respectively. In May 2024, the State Administration of Financial Supervision disclosed the approval of BYD Property Insurance’s compulsory traffic accident liability insurance terms and rates.

In 2024, BYD Property & Casualty Insurance’s comprehensive cost ratio will be 308.81%. Although it is still much higher than the industry average, it is significantly optimized from 11242% in 2023. In 2024, while the comprehensive cost ratio data remains high, BYD Property & Casualty Insurance’s comprehensive loss ratio and comprehensive expense ratio are 233.92% and 74.88% respectively, while handling fees and commissions account for only 0.01%.

In recent years, new energy vehicles have gradually experienced high risk rates and maintenance costs, mismatch between insurance risks and prices for some models, poor insurance coverage for a few vehicles, high premiums for some models, and continued losses in new energy auto insurance operations. In January this year, the four departments issued the “Guiding Opinions on Deepening Reform and Strengthening Supervision to Promote the High-Quality Development of New Energy Auto Insurance”, which will promote the two reforms of supply and demand of new energy auto insurance and systematically resolve the current problems of continued losses in new energy auto insurance operations. Driven by policies, the operating costs of new energy auto insurance are expected to effectively drop.

(Comprehensive cost ratio of unlisted property insurance companies in 2024; tabulated: Blue Whale News)

In the same period, the comprehensive cost ratios of Meiya Property Insurance, China Railway Insurance, Zurich Insurance, Japan Property Insurance, PetroChina Exclusive Insurance, Tokyo Maritime, and COSCO Shipping were better, and none of them exceeded 90%, achieving profits on the underwriting side.