Backpack’s goal is not only to build a better cryptocurrency institution, but to create a new and more complete financial institution.

Written by Logan Jastremski Diego

Compiled by: Shenchao TechFlow

We are going through a transition period in the financial sector. On the one hand, cryptocurrency technology has been able to transfer billions of dollars in value in less than a second at a cost of less than a penny. However, most consumers are unfamiliar with these technological advances, have not yet benefited from them, and still rely on the traditional, slow and expensive industrial-era financial system. In order to transform the existing financial system from the industrial era to the Internet era, we urgently need a new generation of financial institutions. These institutions will adopt cutting-edge practices in encryption technology to provide users with a user experience 100 times better than existing systems. So, what changes will such a next-generation financial institution bring?

Simply put, future financial institutions should allow everyone to freely trade, borrow, earn income, pay for and manage their own assets.Specifically, they should have the following characteristics:

-

Support the deposit of any type of asset (whether digital or traditional assets) and automatically bring high interest income to users;

-

Support users to trade any asset (including spot and leveraged trading) 24/7 and 24/7 in an efficient capital utilization method;

-

Achieve instant sending and receiving of value (such as stablecoins) without having to wait days;

-

Manage all assets through one account, whether they are used to pay debt or spend credit;

-

Provide open and transparent asset support verification to ensure that assets are fully supported at a 1:1 ratio, rather than relying on a partial reserve system;

-

Users can withdraw assets (whether digital or traditional) at any time without worrying about the risk of bank runs.

This is the future Backpack is committed to building. The core mission of cryptocurrency and open finance is not only to make finance more democratic, but also to create a more efficient and transparent financial system for participants in global capital markets. This includes the use of crypto technologies such as smart contracts and stablecoins to provide global users with financial products that were previously mainly concentrated in the U.S. capital markets, such as U.S. dollar savings accounts, stock markets, commodities, and even tokenized real estate and fixed income products.

The original picture is from Frictionless Capital and compiled by Shenzhen TechFlow

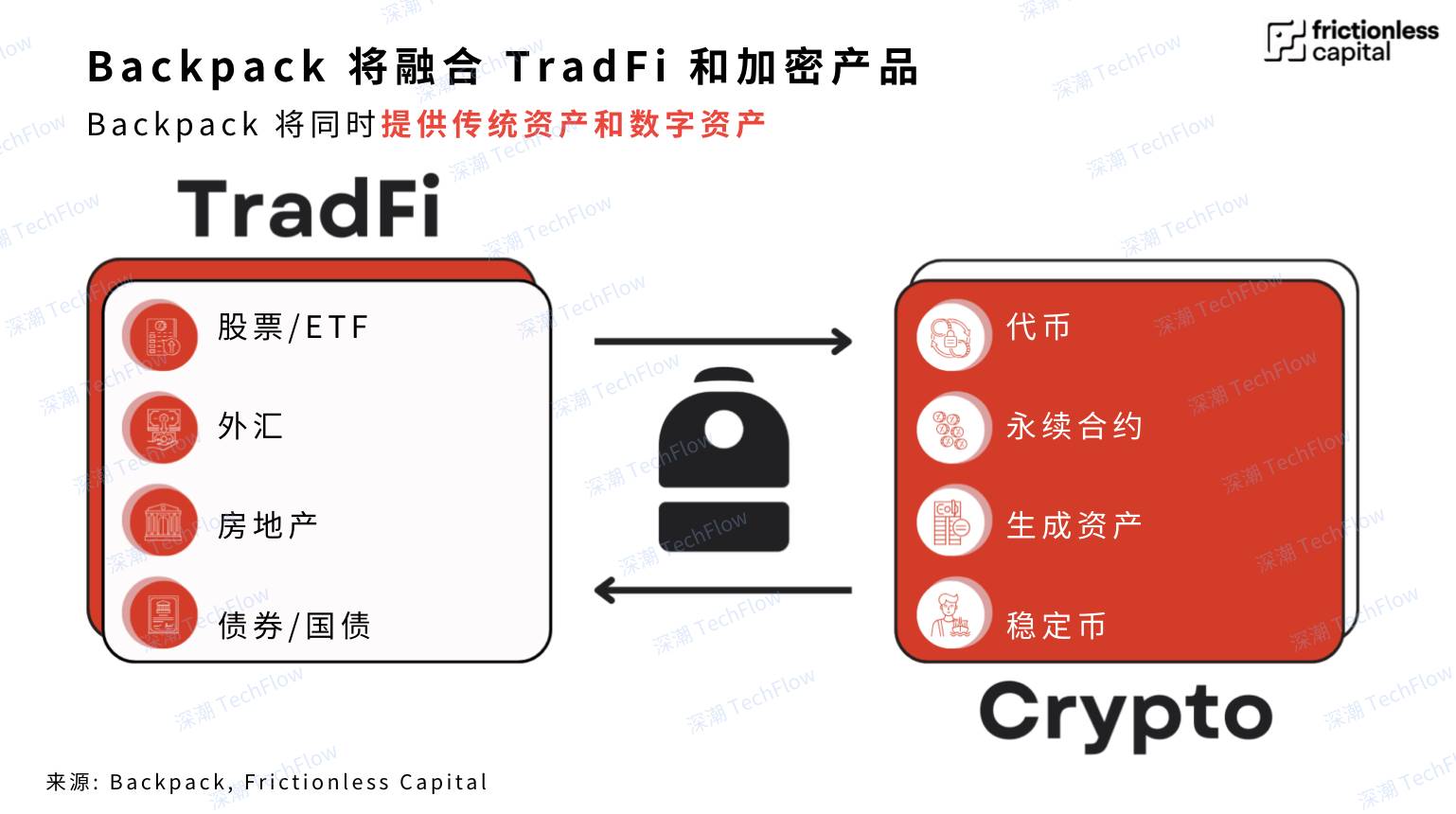

Cryptography technology is gradually subverting the traditional financial system in a way similar to the way software changes the world.Today, the integration between traditional financial products and crypto-native services is accelerating, and exchanges, as the core bridge connecting these two parallel systems, are at the forefront of this transformation. Over time, the boundary between the two will gradually blur, eventually giving birth to a new financial system. By then, crypto finance will no longer be an independent concept, but will become mainstream finance itself, just as Internet technology companies have evolved into technology companies. Backpack is striving to become a bridge between the traditional economy and the on-chain economy, integrating key products in the two systems. By migrating capital markets to the financial trajectory of the Internet era, transaction settlement times will be shortened from T+2 days to just T+200 milliseconds (one-thousandth of a second), allowing real-world assets and financial instruments to be realized in the form of encrypted assets. Unprecedented efficient transactions. As Blackrock CEO Larry Fink said in the 2022 New York Times DealBook Event:“The next generation form of markets and securities will be tokenization of securities.& rdquo;In a future where everything can be tokenized and traded on crypto tracks 24 hours a day, the opportunities for reshaping finance are clearer than ever. However, it is unrealistic to assume that century-old traditional institutions will overturn existing platforms and build from scratch based on these emerging technologies. In fact, they have been trying for decades, but they have never been able to achieve it.

To embrace this new frontier in finance, new financial institutions must combine leading crypto technology capabilities with expertise in risk management and legal compliance. Judging from past experience, many successful crypto companies have performed well in crypto-native products, but they are unable to respond to global compliance needs. This has led to deficiencies in risk management, license acquisition and operational capabilities, although these platforms are very popular among traders. Backpack is integrating these key elements to build the next generation of financial institutions from scratch. Eventually,Backpack will be more than just a trading platform, it will become the core hub for managing all assets and become the world’s first such institution.Since the birth of the crypto industry, although the functions of traditional financial systems have been partially reproduced, these products have not yet been integrated into a seamless, integrated and fully compliant system. This integration is the key to breaking through the limitations of the encryption industry and replacing traditional financial institutions with unique advantages.

The original picture is from Frictionless Capital and compiled by Shenzhen TechFlow

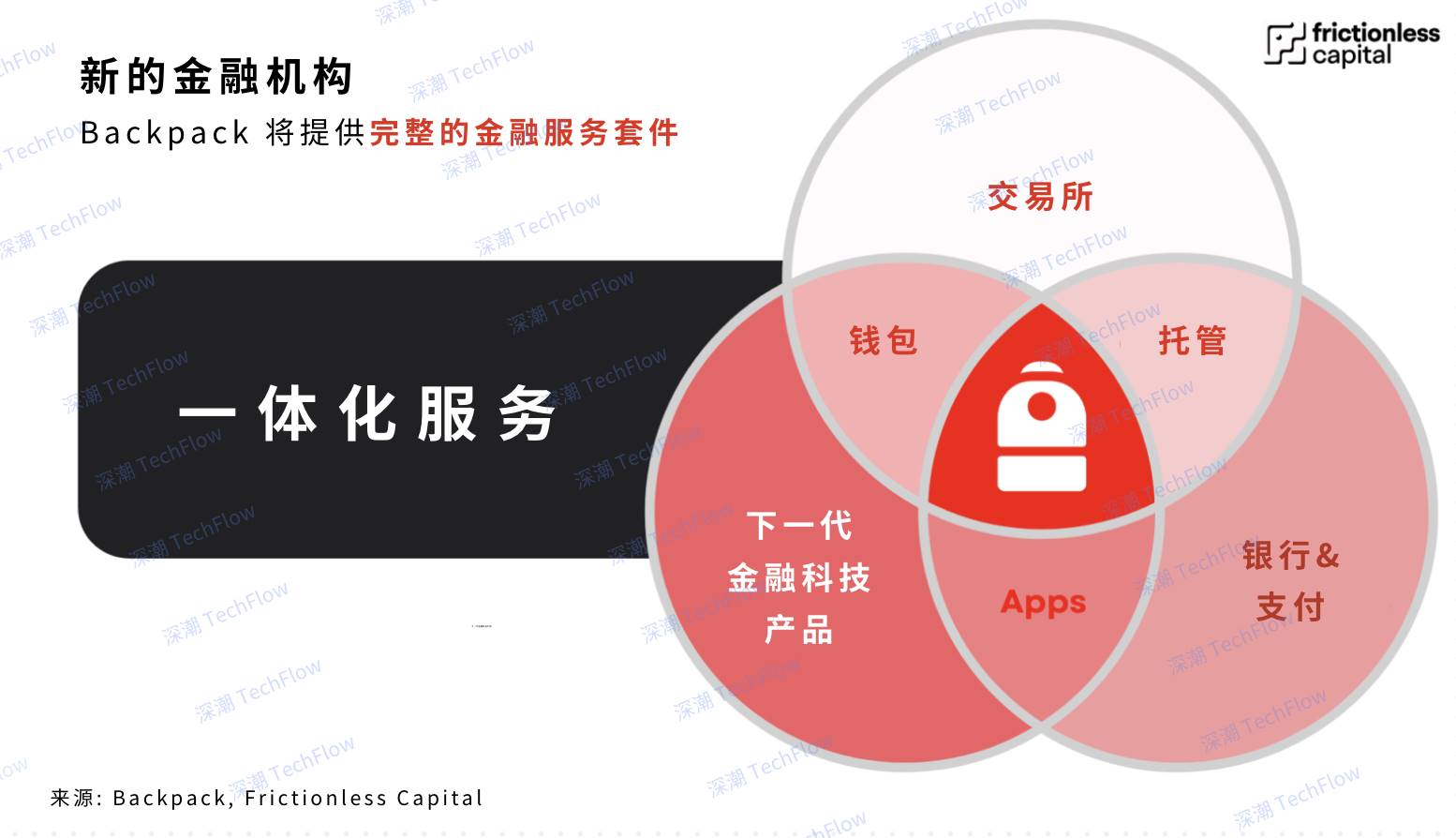

In the early stages of the development of the crypto industry, entrepreneurs focused mainly on developing independent products such as wallets, exchanges, and decentralized lending markets. However, if we want to spread innovation in encryption and open finance to the next billion users, we need to realize that these decentralized products are actually just some of the features in a larger application. The power of the whole far exceeds the simple addition of the parts. As a result, Backpack is not just a wallet or exchange, but a fully integrated suite of apps that we call the Backpack Experience. With Backpack, users only need to download an application to realize asset custody, free trading, merchant payments and seamless interaction with on-chain applications.

Wallet, exchange, bank, or global fintech application?

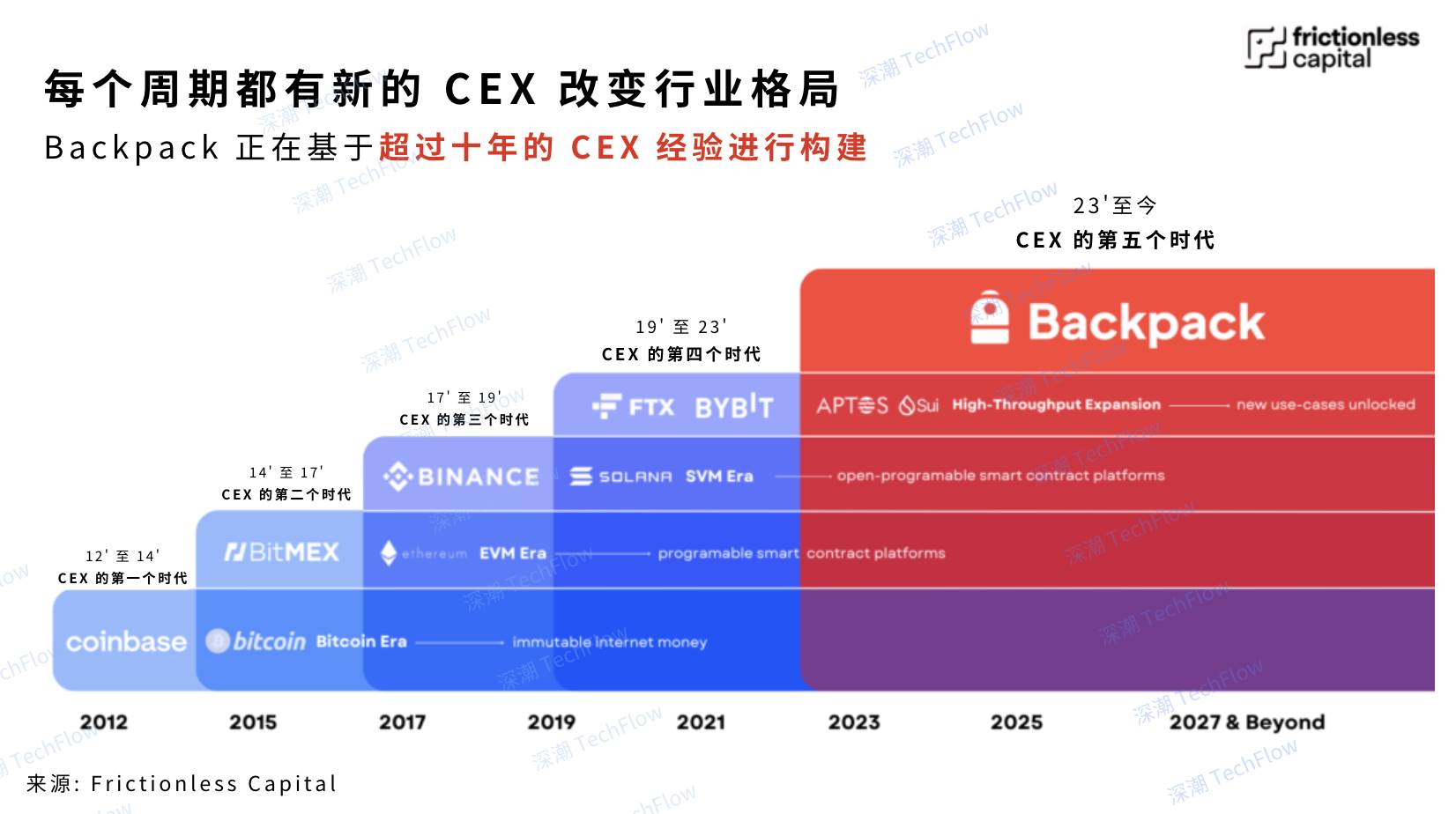

The exchange is the core basic platform of Backpack.Through the exchange, users can not only securely custody assets, but also trade freely, while enjoying compliance connectivity services with the fiat (bank) track. Each industry cycle spawns a new generation of centralized exchanges, and we believe that Backpack has learned important lessons from the experience of its predecessors and built an excellent team. Today, Backpack is rapidly moving towards its goal of becoming a universal financial application. It has built a high-performance platform from scratch and is committed to overcoming the shortcomings of previous exchanges and providing users with a more superior financial experience.

The original picture is from Frictionless Capital and compiled by Shenzhen TechFlow

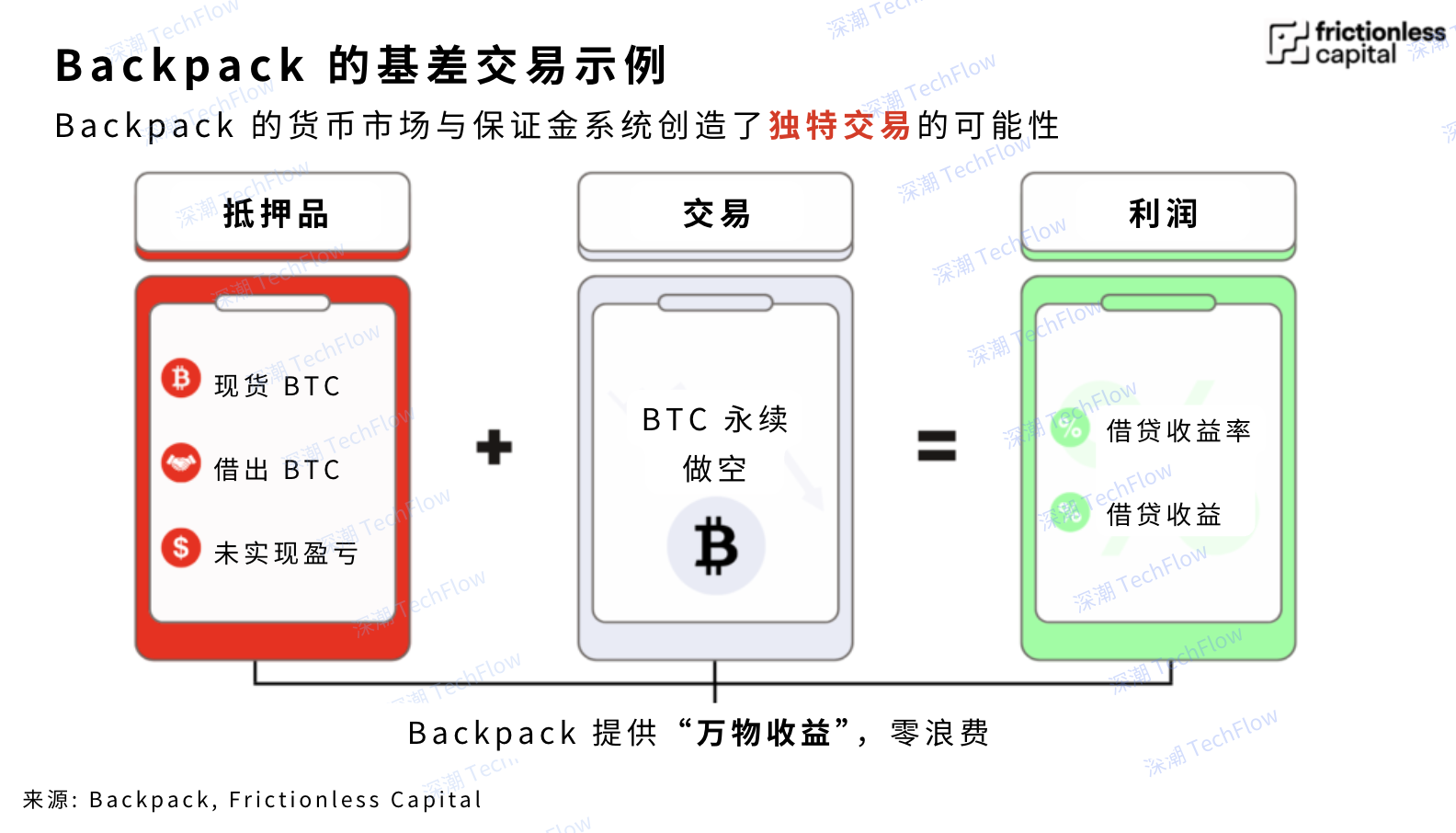

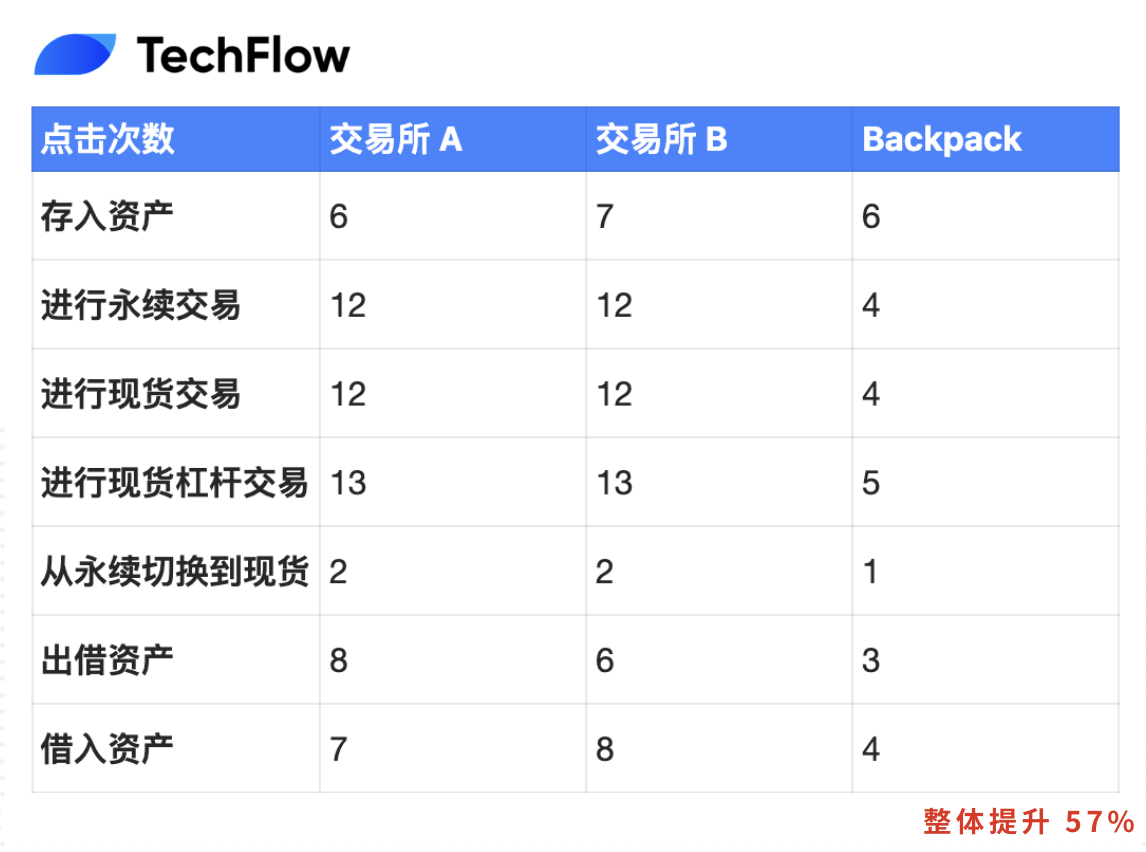

Backpack has basic functions,Further integrated into an excellent performance native lending money market.Global credit and capital efficiency are critical to financial markets, and Backpack provides this service to traders, especially institutional customers who cannot trade on platforms without KYC (Authentication) chains due to counterparty rules. In Backpack’s native currency market, traders can use assets as collateral to borrow money for trading or withdrawing cash to other blockchain networks. For users who want to make additional income by lending assets, the process is fully automated and can be completed with only one exchange account. Compared with the cumbersome process of traditional exchanges that requires multi-step operations, this design greatly improves the user experience. Unlike many exchanges that use revenue functions as an additional service, Backpack deeply integrates lending functions as a core part of its margin system.“” This means that users can automatically earn benefits on any exchange operation, such as USDC deposits, unrealized gains and losses (PnL), loan of assets, and spot collateral.

On Backpack, users can borrow any asset and withdraw it to other chains, a feature similar to Aave, but Backpack’s system can run across multiple blockchain networks and operate under a unified margin system. More importantly, assets lent by users are also counted as collateral, which means that even when trading in positions, users can still earn borrowing income or earn additional income through neutral strategies such as carry trades to hedge risk. A typical example is Backpack’s leading basis trading strategy, which provides higher yields and more efficient capital utilization compared to other exchanges.

The original picture is from Frictionless Capital and compiled by Shenzhen TechFlow

Backpack provides the most capital-efficient basis trading (Basis Trade) in the industry.

In the crypto industry, centralized exchanges (CEX) are listed as the most profitable product category alongside stablecoins. Not only do exchanges attract the most users, they are also undoubtedly one of the most profitable businesses in the entire industry. In the past ten years, centralized exchanges have generated a total of approximately US$50 billion in profits, mainly from trading in crypto assets, and often achieve profit margins of more than 80%. Every day, the trading volume of crypto futures alone exceeds US$100 billion (excluding spot trading volume). To more intuitively understand this scale, this figure is about 30 times the combined daily transaction volume of Tesla, NVIDIA, Apple, Microsoft and Amazon.

These trading indicators are expected to see significant growth over the next decade. Although centralized exchanges are the core product of the crypto industry, current market participants have not yet fully covered the vast needs of the Internet capital market, which provides an excellent opportunity for emerging participants to create a solution that covers the entire financial system.

For millions of people around the world, a centralized exchange is not just a digital asset trading platform, but more like a digital bank account. They use it to manage their personal finances, store digital dollars, complete payments, and even circumvent strict capital controls. In addition, centralized exchanges also serve as an important bridge between the traditional financial system and the on-chain economy, providing access channels between fiat currencies and cryptocurrencies. This role is crucial because hundreds of billions of dollars are traded through these channels every year.

This article will take an in-depth look at some of the key characteristics of the centralized exchange space and analyze why we believe Backpack exchanges are unique. Not only is it different from any existing centralized exchange, it also has the unique potential to capture a significant share of the market and redefine the way users manage and interact with digital assets.

In the era of encryption, the potential of building a new global financial institution is immeasurable. Taking 2024 as an example, during its preliminary trading phase, the Backpack Exchange’s paid spot trading volume reached US$60 billion, equivalent to 44% of Robinhood’s trading volume during the same period. This achievement has laid a solid foundation for Backpack’s performance in the future market.

The original picture is from Frictionless Capital and compiled by Shenzhen TechFlow

This shows that the potential of cryptocurrencies to serve global capital markets far exceeds the traditional model of serving only a single region. Just as Internet companies once replaced the traditional real economy, cryptocurrencies are gradually replacing traditional financial institutions around the world.

The key to the global market: the value of licenses

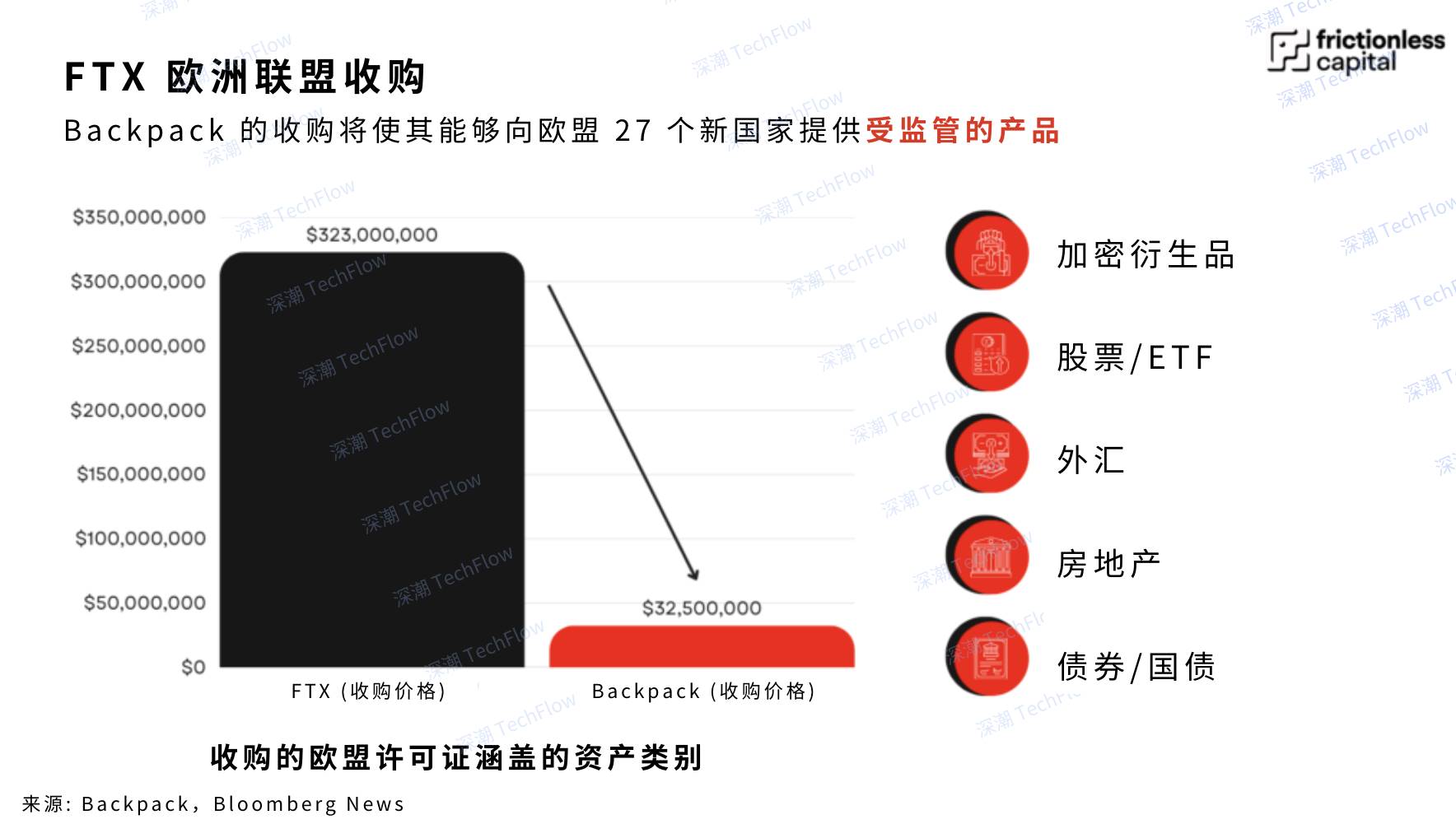

To attract mainstream retail users, cryptocurrency exchanges must provide a complete product system, including seamless integration with the banking system. If we only assume that users already own crypto assets and are familiar with blockchain transactions, this will significantly narrow the range of potential users. In order to directly promote services to users and provide convenient channels for capital entry and exit, centralized exchanges (CEX) must obtain and comply with national licenses for retail transactions. The application process for these licenses is often costly and time-consuming. For example, FTX has invested more than US$500 million in licenses to dominate the global market, allowing it to serve most of the world’s GDP regions. Backpack expects to achieve the same licensing coverage level by the second to third quarters of 2025 at a cost of less than 10% of FTX.

On January 7, 2024, Backpack announced the acquisition of FTX EU for US$32.7 million, thus gaining important strategic advantages in the European market. European users typically contribute 20-30% of global crypto transaction volume. While exchanges such as OKX, Binance and ByBit were still active in European markets, FTX’s European customer base generated more than US$200 million in annual revenue. Now that these exchanges have withdrawn from the European market, this provides Backpack with a great opportunity to launch more popular products and fill market gaps for European users.

The original picture is from Frictionless Capital and compiled by Shenzhen TechFlow

The transfer of FTX EU’s MiFID II license to Backpack will provide it with an important competitive advantage. This license could make Backpack Exchange the leading platform for retail users to trade crypto derivatives among all 27 EU member states. Crypto derivatives currently account for the vast majority of global crypto trading volume. To enhance the user experience, Backpack plans to integrate traditional payment systems to allow users to transfer funds via SEPA and wire transfers across Europe. In addition, the MiFID license is the same as the license for traditional banks, which means Backpack can expand its services in the future to include areas such as stock trading, fixed income products, and securities tokenization.

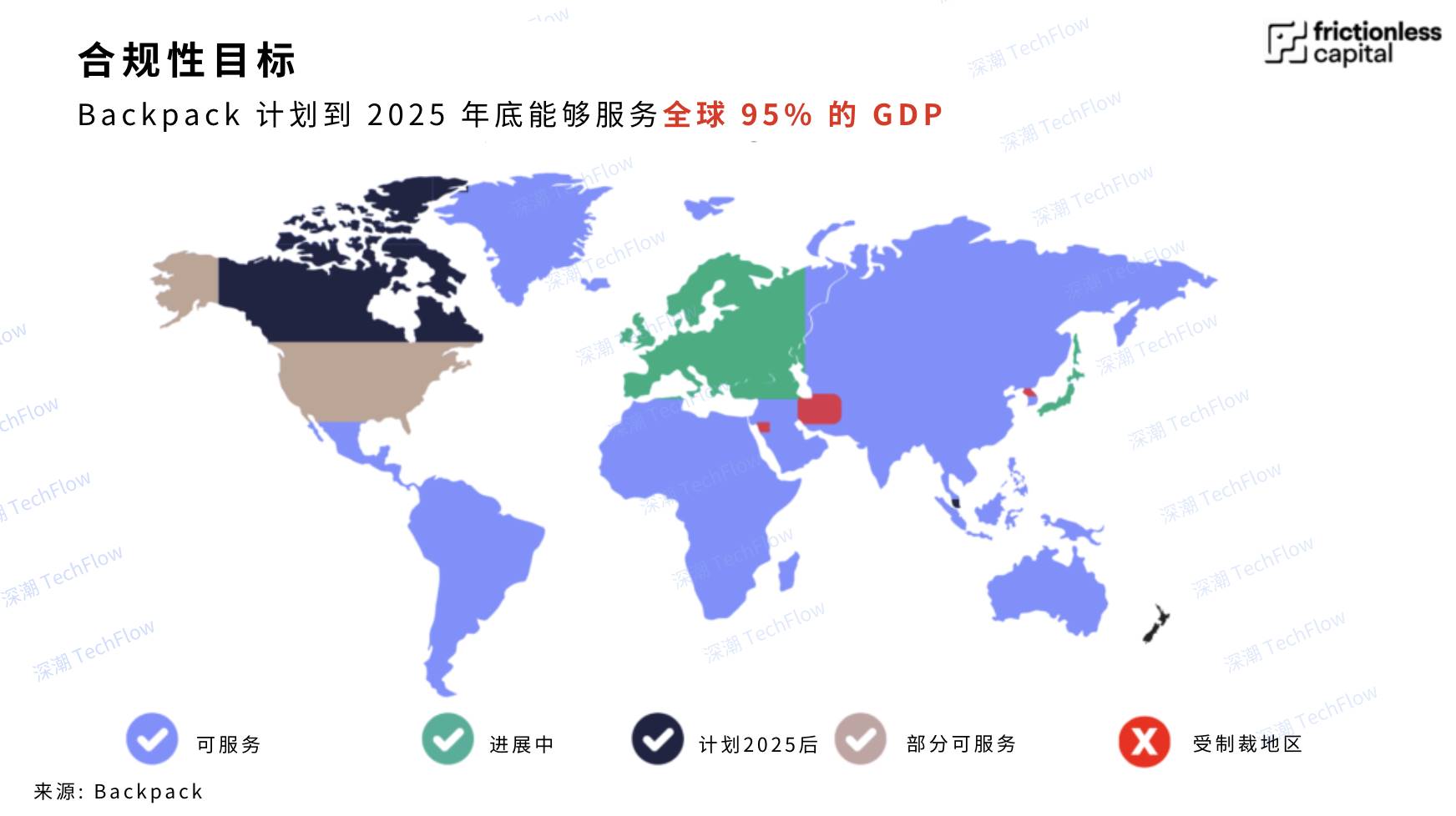

The acquisition of FTX EU business is just an important milestone in Backpack’s global regulatory landscape. In November 2024, Backpack became a member of the Japan Virtual and Crypto Asset Trading Association (JVCEA), an important part of the self-regulatory organization of Japan’s crypto exchanges. It is worth noting that Backpack is the first crypto exchange to successfully join Binance since joining the organization two years ago, which is also an important step in obtaining a Japanese crypto trading license. As early as 2023, Backpack became the first cryptocurrency exchange to receive a full market license from the Dubai Virtual Assets Regulatory Authority. In addition, the company has obtained relevant licenses in Australia to carry out crypto-asset-related marketing activities in the UK, and plans to expand its business coverage in the United States from the current 12 states to all 50 states in the future.

The original picture is from Frictionless Capital and compiled by Shenzhen TechFlow

Backpack is rapidly emerging as a global leader in cryptocurrency compliance, even surpassing established companies in the industry in many ways. Its ability to rapidly expand regulatory coverage will not only enhance the distribution potential of Backpack products, but will also build strong barriers to competition in the context of increasingly stringent global encryption regulations. It is expected that by the end of 2025, Backpack will be among the few exchanges in the world that can provide compliance services to users in 95% of the world’s GDP, allowing its products to reach hundreds of millions of potential users.

Create a new product model

In addition to the new margin system, the Backpack team has also developed a market-leading risk management system. With high reliability, strong robustness and high transparency as its core, this system can monitor the health of the investment portfolio in real time, and dynamically adjust margin and clearing rules when the market fluctuates to ensure the safety of user assets and the smoothness of transactions.

In addition, Backpack’s account system greatly optimizes the deposit process. Users do not need to transfer funds from a spot account to a derivatives account, and can directly trade futures through the deposited account. This design significantly improves operational efficiency and is particularly intuitive and convenient for experienced traders, making Backpack a more attractive trading platform.

The original picture is from Frictionless Capital and compiled by Shenzhen TechFlow

Backpack has made significant breakthroughs in the hosting field by adopting cutting-edge Account Abstraction and cryptography technologies, launching the most advanced hosting solution on the market. The safe product, developed in partnership with Squads, allows users to deposit assets in a wallet that supports multisign. This wallet not only supports users ‘self-hosting, but also provides recovery functions after the private key is lost, solving a major problem in traditional self-hosting.

This wallet system is directly embedded in the Backpack exchange. No matter what happens, users can withdraw funds at any time, fundamentally eliminating the risk of funds being locked in the exchange and unable to withdraw. By introducing a challenge response mechanism similar to Layer 2 Network (L2) technology, Backpack exchanges can regenerate lost private keys after verifying the user’s identity. This means that after transferring assets to safe, users can not only enjoy the security and autonomy of self-custody, but also get a convenient experience comparable to a centralized exchange.

This innovative solution will significantly reduce the billions of dollars in crypto assets lost each year through improper self-custody. In the past, once a user lost a private key (such as a mnemonic), these assets were often lost permanently. The complexity of private key management has always been one of the main obstacles to the popularization and widespread use of digital assets. Through safe, Backpack provides users with a new hosting option that combines security, recoverability and ease of use.

market background

Since 2021, the market landscape of the Centralized Exchange (CEX) has undergone tremendous changes. Among them, the collapse of FTX not only left a huge gap in market share, but also eliminated a key cross-mortgage priority model for product design from the market. The incident exposed the urgent need for fully compliant and regulated exchanges that need to have transparent and dynamic risk management mechanisms and provide publicly verifiable certificates of reserve. At the same time, the collapse of FTX also highlighted the importance of self-custody and the need for users to be able to withdraw assets at any time in situations of sharp market fluctuations or uncertainty.

Amid this market change,Backpack is the only emerging exchange to successfully enter the CEX space in recent times.It not only integrates the above-mentioned key functions, but also obtains relevant regulatory licenses and can legally operate in most regions of the world.

At the same time, compliance pressure is reshaping the industry landscape. Several major exchanges, including Binance, ByBit and OKX, have been forced to withdraw from some European markets.

As ByBit CEO Ben Zhou said in September 2024: All top exchanges will withdraw from the European market, especially the derivatives market, which will trigger a fierce competition.” rdquo;(Interview with Weixin, September 2024) During this period, decentralized exchanges (DEX) developed rapidly. As of the beginning of 2025, the transaction volume ratio of DEX to CEX exceeded 15% for the first time, indicating that users ‘demand for decentralized transactions continues to grow.

Another trend worthy of attention is that more and more companies are beginning to resist the high listing requirements of traditional exchanges. These exchanges typically require project parties to pay 5% to 15% of the token supply as a listing fee, and modify the token unlocking plan so that exchanges can sell the tokens before the tokens of teams or core employees are unlocked. In addition, traders are increasingly looking to be able to purchase tokens early in the token life cycle, as many tokens perform poorly after listing on a primary exchange (Tier-1 CEX), especially those with low liquidity and multibillion-dollar valuations.

As the market becomes increasingly wary of opaque exchanges, especially those that rely on internal market makers to profit from user transactions, transparency of reserves and solvency has become a core requirement for the industry. Since its establishment, Backpack has always adhered to a completely transparent and compliant operating model, standing out among many exchanges.

Integrate all elements

Backpack is moving to new heights beyond traditional centralized exchanges (CEX) and is committed to becoming the next generation of financial institutions. With global regulatory licensing and innovative product design, Backpack has created a platform whose overall effect far exceeds a single function. Currently, there are only a few exchanges with comparable distribution capabilities and compliance coverage, with valuations reaching tens of billions of dollars. In the coming months, as the product is rolled out to tens of millions of traders, the Backpack team’s design concepts and compliance experience will gradually emerge.

Most notably, Backpack’s goal is not just to build a better cryptocurrency institution, but to create a new and more complete financial institution. This vision will have a profound impact on the industry.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern