The crypto market can be said to be troubled internally and externally, and it is covered with “negative buffs”.

Author: Glendon, Techhub News

Since Bitcoin fell below the US$90,000 mark on February 25 and the cryptocurrency market plunged across the board, the market has been sliding down like a slide. In the early hours of this morning, Bitcoin once fell to around $82200, setting a new low since November 12, 2024; Ethereum also fell to around $2100, erasing all gains since August 2024.

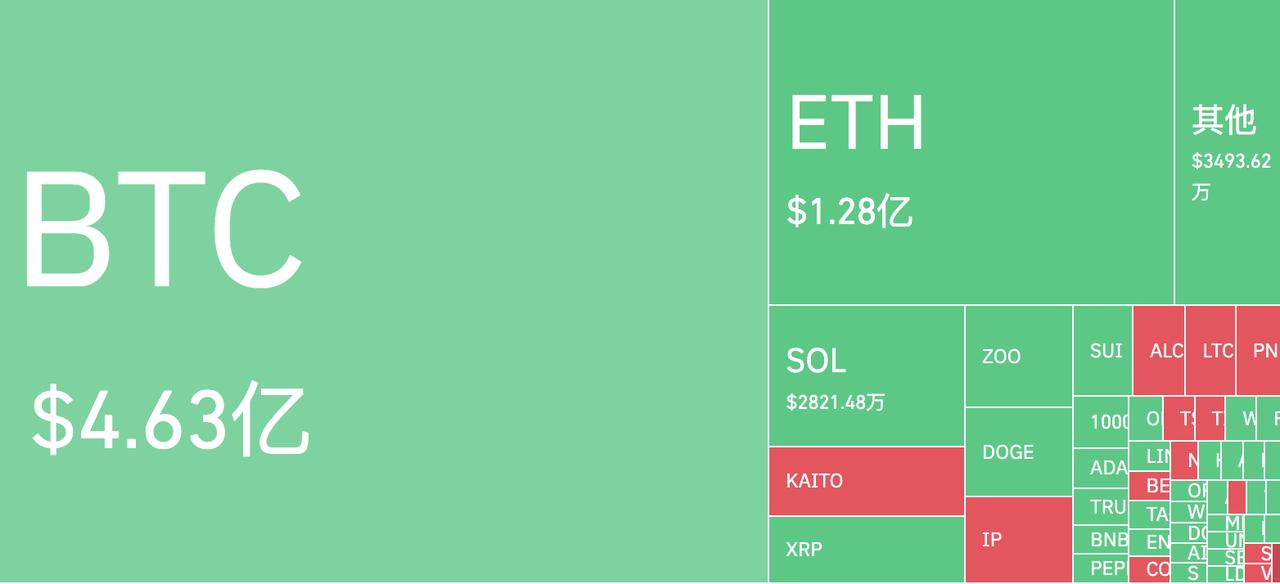

According to Coinglass data, as of writing, the amount of open positions on the entire network in the past 24 hours exceeded US$772 million, of which Bitcoin and Ethereum accounted for 60% and 17% respectively. A large number of long positions in altcoins were also in the past two days. It was subject to collective liquidation.

As market sentiment continues to be in a state of “extreme panic”, although Bitcoin and Ethereum have fallen so sharply, there is still no sign of stopping the decline. So the question arises, why did this round of collapse in the cryptocurrency market start?

Based on various factors and analysis, the author believes that this market crash may be a “panic stampede” phenomenon under the resonance of multiple negative bears.

Macropolicy economic factors

At the macro level, we can combine factors such as the uncertain impact of Trump’s recent policies, the U.S. stock bubble, and the failed expectations of the Federal Reserve to cut interest rates.

First of all, although Trump has publicly expressed his support for Bitcoin as a “strategic reserve asset,” he has not actively promoted the formulation of relevant cryptocurrency policies after taking office. But in fact, long before Trump came to power, market conditions had been pushed to a peak by various optimistic expectations of investors. With Trump’s continued tariff plans (such as imposing tariffs on imported goods on Mexico and Canada), some analysts pointed out that this has aroused public concerns about a trade war, which has caused risk aversion to heat, leading to investors. They chose to sell risky assets such as Bitcoin.

In addition, the review process of U.S. state bitcoin-related bills has also begun to be blocked. At present, more than 30 states in the United States have proposed bills involving strategic bitcoin reserves and digital asset investment, but some state governments have vetoed relevant proposals. The most influential one is the South Dakota Legislature that seems to delay but actually kills the “Allow the State Government to Invest in the Bitcoin Act”. During the same period, the strategic bitcoin reserve bills proposed by Montana and Wyoming were also vetoed.

The occurrence of this series of events also exposed differences between the Trump administration and state policies. Investors suddenly found that the passage of the Bitcoin bill did not seem to be as smooth as they imagined, and when expectations fell short again and again, it would undoubtedly weaken the market’s confidence in the Trump administration’s “Crypto friendly” commitment to a certain extent.

On the other hand, the U.S. stock bubble and the distant Federal Reserve’s interest rate cut have also had an impact on the cryptocurrency market.

According to the First Financial Report, as of February 26, U.S. stocks have suffered selling for four consecutive days. Hot star technology stocks have plunged high, with cumulative declines ranging from 10% to 35%. Some analysts pointed out that this selling sentiment on highly valued technology stocks is also gradually spreading to the cryptocurrency field. Investors are worried that the U.S. stock bubble will burst and risk appetite will rapidly decrease, resulting in funds being withdrawn from highly volatile assets such as Bitcoin and Ethereum. At the same time, the Federal Reserve has been slow to cut interest rates. In the high interest rate environment, the attractiveness of the US dollar as a global reserve currency has been enhanced, which has instead caused some funds to flow back from risky assets such as cryptocurrencies to US dollar assets.

The cryptocurrency market is plagued by “negative buffs”

The cryptocurrency market has been plagued by internal and external troubles recently, and it is covered with “negative buffs”.

Since February this year, Bitcoin Spot ETF has experienced a serious “blood loss effect.” As an important inflow channel for institutional funds, its capital flow data is also one of the key indicators affecting market confidence. However, throughout February, almost all Bitcoin spot ETF funds experienced net outflows, including large net outflows of over 100 million US dollars.

According to iChaingo data, from February 18 to 26, the U.S. Bitcoin Spot ETF experienced a net outflow for seven consecutive days. On February 25, the net outflow was as high as US$1.14 billion, setting a record since its launch. The largest single-day net outflow of funds recorded, which does not reflect institutional investors ‘pessimistic expectations for short-term price trends.

In contrast, although the Ethereum spot ETF is better than Bitcoin, it also experienced five consecutive days of net outflows from February 20 to 26. However, the negative factors facing Ethereum are not limited to this.

In fact, Ethereum has long been in the dilemma of expansion, which is the main reason for the relatively sluggish currency price in the past two months. Ethereum plans to alleviate the capacity expansion problem through Pectra upgrade, but the upgrade and launch process has not been smooth sailing. According to CoinDesk, the Ethereum Pectra upgrade was activated on the Holesky test network but was ultimately not confirmed. As of now, the Ethereum official has not announced the reason why the test network failed to complete.

In addition, Solana, which was once popular with Meme coins, has also suffered multiple blows recently. Under the repeated destruction of Trump Meme Coin TRUMP and Meme Coin LIBRA promoted by the President of Argentina, the potential value of the Meme Coin market has been severely reduced. A large number of investors have lost interest in Meme Coin. Many analysts even believe that the Meme Coin craze is coming to an end. Because of this, the Meme coin market that Solana relies on has also entered a sluggish state.

What is even more worrying is that Solana is about to usher in the largest “storm” of SOL token unlocking. According to Cointelegraph, Solana will unlock more than 11.2 million SOL tokens (worth about US$2 billion) on March 1, which will undoubtedly make the SOL market worse. Cryptography analyst Artchick.eth said,”More than 15 million SOL tokens (about US$2.5 billion) are expected to enter the circulation market in the next three months.” Affected by this, SOL once fell to around $130, setting a new low since September 18, 2024.

Hacking attacks occur frequently

Late at night on February 21, the cryptocurrency trading platform Bybit was hacked, and more than 400,000 Ethereum and stETH (with a total asset value of more than US$1.5 billion) were stolen, making it the largest theft in the history of the currency circle. At the same time, the security issue of cryptocurrency was again questioned and triggered panic selling by a large number of investors. Despite Bybit’s efforts to minimize the negative impact, the huge amount of Ethereum stolen by hackers has undoubtedly become a “mine” that affects the market.

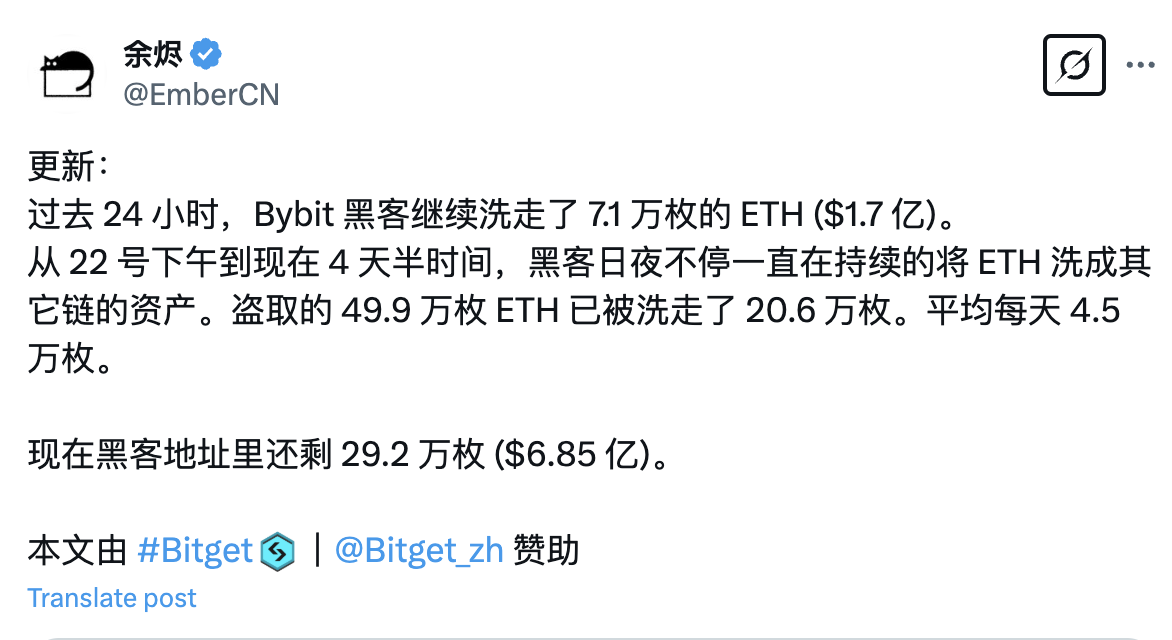

As of writing, according to X User Ember Monitoring, in the past 24 hours, approximately 71,000 Ethereum pieces (worth approximately US$170 million) have been laundered from addresses marked as Bybit hackers. So far, about 206,000 Ethereum pieces have been laundered, but the hacker address still holds 292,000 Ethereum pieces (worth approximately US$685 million). Previously, Ember had said that hackers expected to convert all the remaining ETH into other assets (such as BTC, DAI, etc.) within half a month.

In addition to Bybit, stablecoin payment platform Infini was also hacked on February 24, and nearly US$50 million in encrypted assets were stolen. Although the amount stolen is far less than the former, the successive hacking incidents have not only damaged investors ‘confidence, but also had a direct impact on market conditions.

To sum up, this round of decline is not only the market’s own demand adjustment, but also the market’s comprehensive response to the withdrawal of institutional funds, the economic impact of macro policies, hacking incidents and the bursting of the bubble. The author believes that, in essence, the continuous rise of cryptocurrencies such as Bitcoin since the end of 2024 has accumulated more profit-making orders. However, since the beginning of February, Bitcoin prices have continued to fluctuate between US$90,000 and US$100,000., failure to break through the resistance level, coupled with the lack of significant positive support, so even if there are no major negative factors, the sell-off of these profit-making orders will put huge pressure on market prices.

However, although the market is currently hit by multiple factors, it is still too early for us to conclude that the bull market is over.

Yu Jianing, co-chairman of the Blockchain Special Committee of China Communications Industry Association, said in an interview with the Beijing Business Daily,”The current decline is likely to be a technical adjustment rather than a reversal of a long-term trend.” The author believes that in the short term, we need to be vigilant about the risk of further bottoming caused by the selling crisis, but in the medium and long term, the market clearing may lay the foundation for a new cycle. In addition, if the Trump administration proposes cryptocurrency-related policies and the passage of U.S. state strategic bitcoin bills, it will inevitably bring unpredictable development to the entire cryptocurrency market.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern