As a star project of Solana Ecology, Jupiter once played a core role due to its high liquidity ratio, but the implications of the Libra scandal and the overall ecological crisis plunged it into a quagmire. Despite this, Jupiter has recently been trying to send a signal to the outside world to break out against the wind through multiple strategies such as ecological expansion, token repurchase plans, and product iteration.

Author: Nancy, PANews

At present, Solana Ecology is experiencing a “blood loss” crisis triggered by the Libra coin issue scandal. The double blow of liquidity loss and market confidence has exacerbated the ecological internal challenges. As a star project of Solana Ecology, Jupiter once played a core role due to its high liquidity ratio, but the implications of the Libra scandal and the overall ecological crisis plunged it into a quagmire. Despite this, Jupiter has recently been trying to send a signal to the outside world to break out against the wind through multiple strategies such as ecological expansion, token repurchase plans, and product iteration.

Trading engines slow down? Jupiter’s multiple data still dominates Solanaecological advantages

Jupiter once used its strong market appeal to drive Solana’s ecological prosperity, but the Solana ecological confidence crisis slowed down its trading engine and made it difficult for it to stay alone.

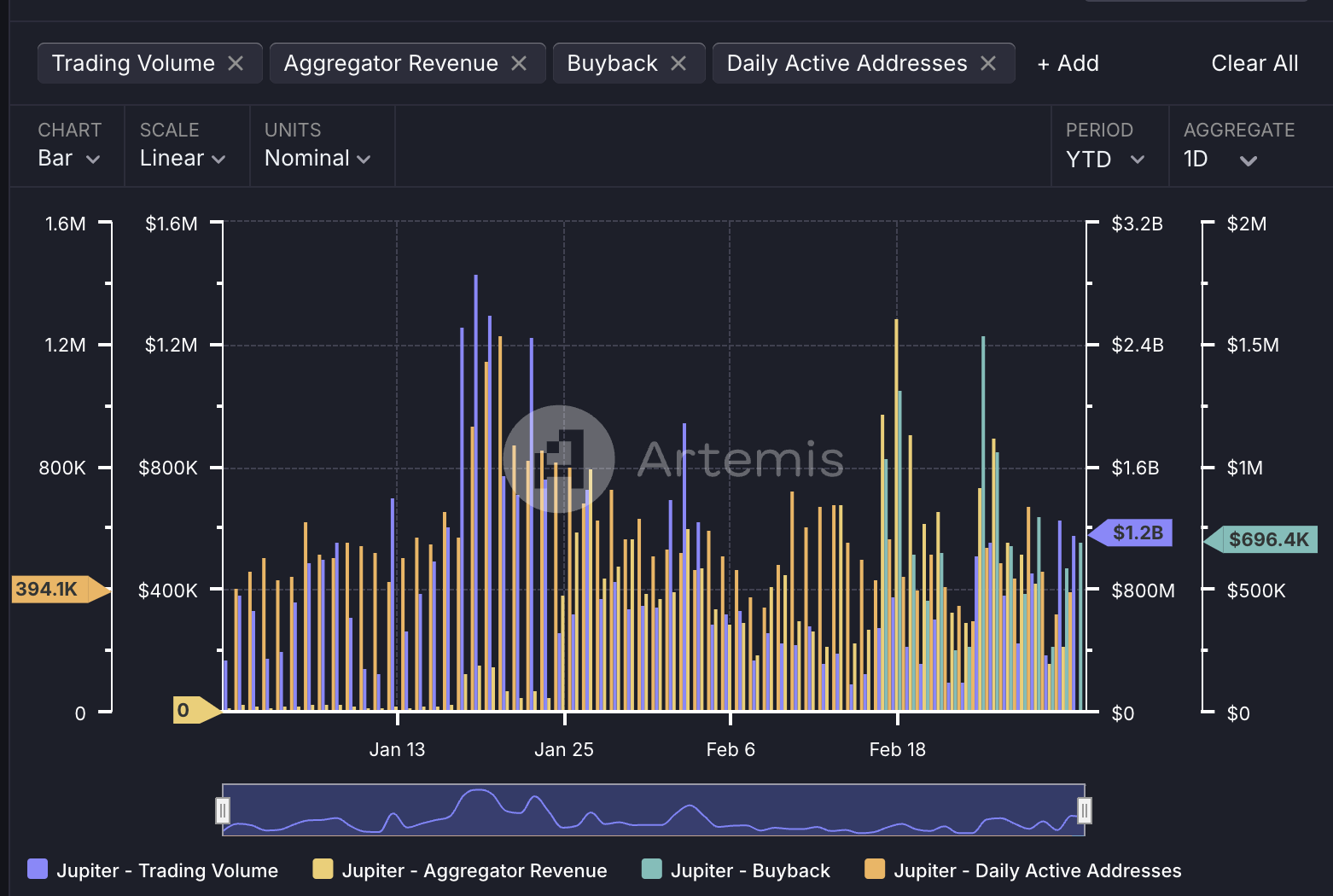

Artemis data showed that Jupiter’s daily trading volume reached a historical peak of $2.9 billion in mid-January this year. However, subsequent trading activity showed a gradual downward trend. Trading volume fell back to US$1.2 billion as of March 3, a drop of 58.6% from its peak.

Changes in the number of daily active addresses also reveal a decline in community participation. On January 20 this year, Jupiter’s active addresses hit a new high of 1.2 million, highlighting its user participation boom at that time. However, as of March 3, this number has dropped sharply to 394,000, a drop of 67.2%. The sharp drop in active addresses not only points to a slowdown in transaction activity, but also suggests that users ‘confidence in Jupiter and even the Solana ecosystem has been affected. However, Solana’s overall daily active address also dropped by approximately 48.1% during the same period, which also indicates that Jupiter’s decline is in sync with the ecological environment.

The decline in trading activity directly affected Jupiter’s revenue performance. Artemis data showed that its aggregator daily revenue fell 83.3% from a peak of $1.3 million to just $216,000 as of March 3. This weakness in revenue also reflects Jupiter’s vulnerability in the current market environment.

Despite pressure on trading activity and revenue, Jupiter’s weight in the Solana ecosystem has shown some resilience. Artemis data showed that Jupiter’s daily trading volume accounted for 11.6% of Solana’s overall, a slight increase from its peak of 10.4% in January. However, Jupiter’s daily active addresses accounted for 36.5% of the peak compared with the peak, and accounted for 9.4% of Solana’s overall as of March 3.

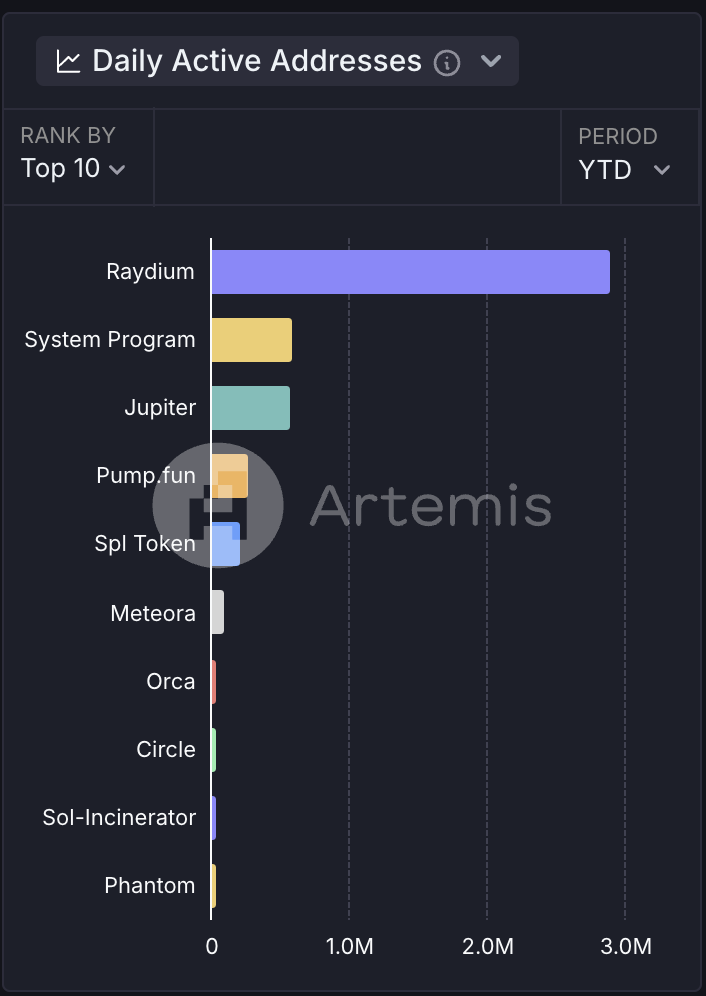

From the perspective of ecological rankings, according to Artemis data, since 2025, Jupiter has ranked second in the Solana ecosystem with a daily transaction volume of US$260 million, second only to Raydium; the number of daily active addresses has ranked third with 572,000;Gas fee consumption contributed US$45.7 million, ranking second. The data also suggest that Jupiter still maintains its role as Solana’s core liquidity pillar, but its influence has diminished.

In addition, the official website shows that the total pledged amount of JUP exceeds 580 million pieces, accounting for more than 21.5% of the circulation. This also reflects the community’s continued participation in JUP DAO governance or provides short-term selling buffer for tokens.

From crisis of trust to ism,Jupiter’s multi-line layout boosts confidence

The Libra scandal was the trigger for Jupiter’s quagmire. During the Libra insider trading scandal in February this year, Libra created a liquidity pool on Meteora, and Jupiter was accused of teaming up with Meteora to do evil due to Meow’s dual identity (co-founder of Meteora). Although Meteora co-founder Ben resigned afterwards, and Jupiter responded that he did not participate in the Libra issuance in any form, saying that he did not find any team members to raise funds, Jupiter did not get rid of its reputation crisis, and its token JUP also fell for a time.

“We talk about crypto being the future, but in reality we often show a grossly insufficient willingness to be accountable for long-term and results. One thing is certain: We believe in what we are doing, we believe we are responsible for long-term results, and we believe that the crypto industry will truly change the world in the future, no matter how drastic short-term fluctuations are.” Meow recently issued a document saying that

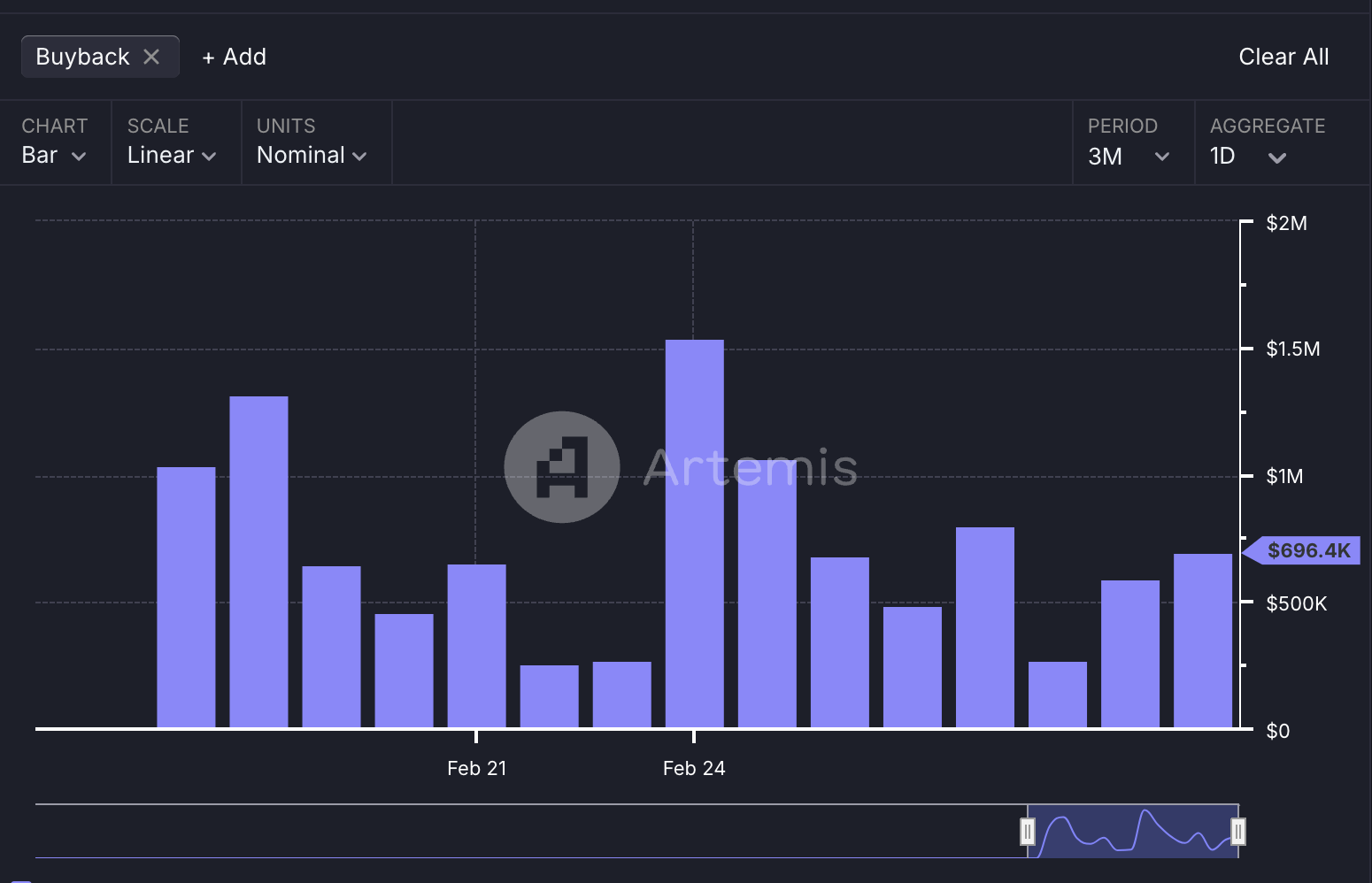

Faced with the Solana ecological slowdown and the Libra crisis, Jupiter responded with multiple strategies. Recently, it has announced multi-line layouts such as acquisition expansion, token economy adjustment and transparent governance in an effort to restore market trust.

Not only that, Meow recently proposed the “2030 Proposal”, which plans to use its 280 million personal JUP tokens for team incentives and receive 500 million JUP tokens as compensation in 2030. The proposal still needs to be decided by the community. Jupiter also recently announced the launch of the “GOAT Framework”, which aims to adopt four core dimensions-governance (Including multiple key decisions such as 30% supply destruction,”Jupuary” activities, and working group budget adjustments), organic nature (emphasizing rejection of behind-the-scenes transactions, KOL promotion or market manipulation), consistency (coordinating with holders, community and team interests) and transparency (three token audits, multi-signature wallet disclosure and large-value flow records), making JUP the best token in the crypto industry and establishing its status as a long-term token.

In addition, Jupiter also recently announced its 2030 team strategy, which will focus on decentralized mobility platforms, global community expansion and the Jupnet ecosystem in the next five years, and plans to allocate 280 million JUP to new team members in the next three years.(Currently, the start-up team still holds 1.4 billion JUP), but the source of funding requires community decision-making. There are two main options to choose from: one is to use strategic reserve allocations, which will be unlocked from July 2025 without community voting; the other is to be paid by Meow’s personal position, withdrawn from strategic reserve in 2030, and apply for an additional 220 million JUP as incentives (DAO can be adjusted).

In terms of product iteration, Jupiter merged with ApePro and renamed it Jup Trenches, which can provide functions including dual account types, private key export, real-time data, etc., and Jupiter Mobile, launched last year, will also undergo major updates.

In general, although the slowdown in trading engines has put pressure on Jupiter in the short term, its status as the core pillar of the Solana ecosystem has not been lost. Whether it can achieve ecological hemostasis and even positive growth in the future through diversified strategic layout and Solana’s recovery will still take time to verify.