By the bonfire of the digital jungle, hold your cognitive weapon tightly.

Written by: Daii

Since Trump came to power, the crypto market has become the “policy market” of the United States. In the past two days, the price of Bitcoin has jumped between Trump’s words and deeds. The highest reached 95,000, and the lowest almost fell below 80,000 again.

This violent price shock will undoubtedly make investors nervous. Some people may feel excited and chase the stimulation of short-term speculation; others may feel anxious and worry that the assets in their hands will shrink instantly. However, as we will discuss in depth next, this seemingly impermanent price fluctuation is precisely the most true portrayal and vivid manifestation of the emerging thing of “crypto capitalism.”

Cryptocurrency is not only a technological innovation, but also a digital mirror that reflects human nature, with greed and fear intertwined. Every rise and fall in the price is like a ripple on this mirror, reflecting the complex and subtle mentality of the participants.

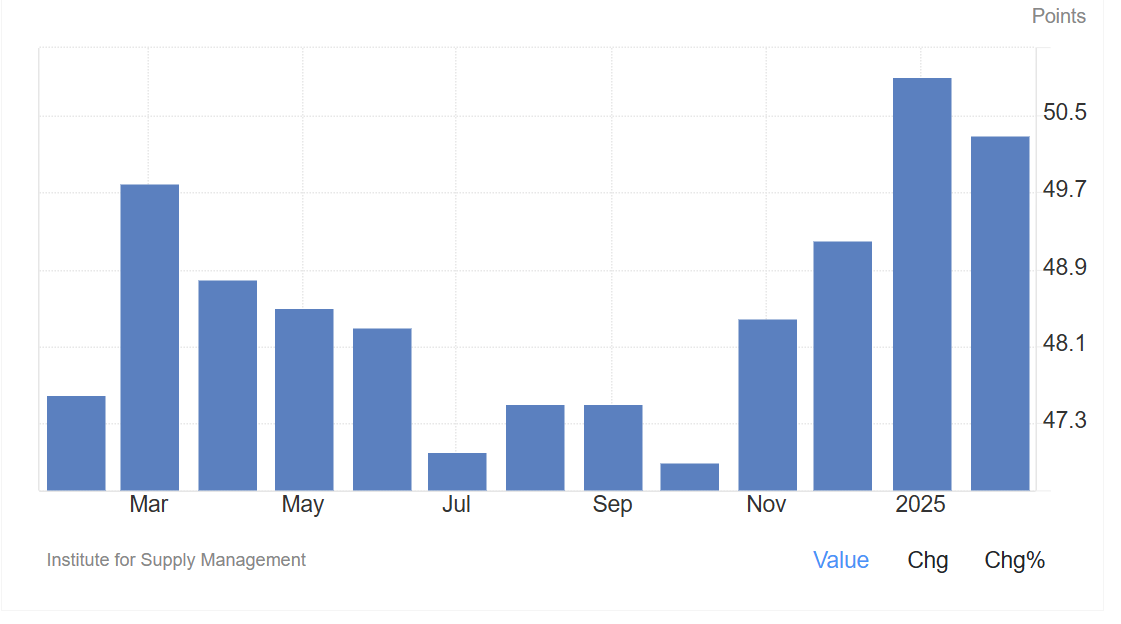

There are two good news for you regarding market trends. One is the PMI (Purchasing Managers ‘Index) in the United States. After contracting for 26 consecutive months, it has been above 50 for two months (January and February 2025)(see the figure below), indicating that the economy has begun to recover. Studies have shown that this indicator has accurately predicted every economic turning point for 14 years.

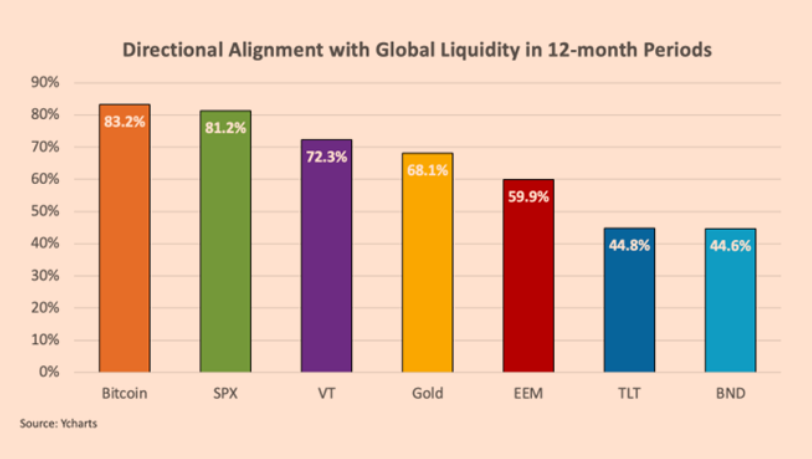

Another piece of good news is that global M2 has begun to surge since 2025 (see figure below). Research by Real Vision shows that Bitcoin prices lag behind global M2 changes by about 10 weeks.

Analyst Lyn Alden also noted that over any 12-month timeframe, Bitcoin follows global liquidity (M2) 83% of the time, a correlation higher than any other major asset class.

Whether it is PMI or M2, they all tell you from the fundamentals that Bitcoin’s good days are not far off. However, don’t forget that the decision on Bitcoin’s price lies not in the fundamentals, but in the centralized exchange. If you still have questions about this, I suggest reading this article.

In fact, if you are truly optimistic about the long-term value of Bitcoin and have confidence in the technical logic and future potential behind it, then short-term price fluctuations are like waves on the sea. Although there are ups and downs, they will eventually calm down. There is no need to worry and panic about this. The only thing you need to do is to control your desires and not use too much leverage.

Next, we start today’s topic of crypto capitalism.

In the 17th century, the Dutch traded tulip bulbs for entire streets of property, in the 19th century, the American West set off a wave of gold diggers and fugitives dancing together, and in the 21st century, we faced the flashing K-line chart and wrote a new Bible of wealth on the blockchain. Crypto-capitalism is not just a revolution in technology, but also a digital mirror image of human greed and fear. It uses mathematical certainty to package the uncertainty of human nature, making each participant a god and gambler in his own wealth script.

In this new world built by algorithms, Bitcoin is just the first iceberg to emerge from the water. The real drama lies in this: when financial sovereignty shifts from national central banks to distributed ledgers, and when the value of labor is redefined by hash power, we are witnessing the wildest evolution of capitalism.

Crypto-capitalism is like an open Pandora’s box, with wealth and risk following each other. Once this magic box is opened, it can no longer be closed. There are no central bank presidents here, only smart contracts that never sleep; there is no roar of physical factories, only the aria of wealth emitted by the mining machine array.

Today, let’s take a deeper look at what kind of wealth game “crypto-capitalism” is and see if there are still opportunities for you and me?

1. What is crypto capitalism?

Imagine if there was a currency that did not belong to any country, was not controlled by any bank, and existed only based on code and consensus on the Internet. Would you think this was a fantasy?

Bitcoin is such a digital currency that subverts traditional perceptions.

In 2009, Bitcoin was born, opening the first year of cryptocurrency. This new type of digital asset, known as “cryptocurrency,” is not issued by a central bank, but is operated through cryptography and distributed ledger technology (blockchain). Bitcoin is like digital gold, with a limited amount, generated through complex calculations (mining), and circulated freely in a decentralized network.

Crypto-capitalism is a new wealth system and economic phenomenon built based on the cryptocurrency represented by Bitcoin. Simply put, it refers to the form of capitalism with cryptocurrency as the main carrier. In this system, the accumulation, growth and distribution of wealth all revolve around cryptocurrency, and its operating rules are both similar and significantly different from the traditional capitalism we are familiar with.

Unlike traditional capitalism, where factories, land, stocks, etc. are different as capital forms, the core of crypto capitalism is the digital token itself. These digital tokens, such as Bitcoin, Ethereum, etc., are no longer just payment tools, they themselves become carriers of value storage and appreciation. Their value is driven entirely by market supply and demand and the consensus of participants, rather than by government credit endorsement.

This means that anyone who owns cryptocurrency is like owning the “land” or “gold” of the digital age and has the opportunity to share the dividends of the development of the digital economy. Crypto-capitalism breaks down the barriers of the traditional financial system and makes the process of wealth creation and accumulation more direct and decentralized.

However, like two sides of the coin, while crypto-capitalism shows great opportunities, it also naturally carries asymmetric genes. It is not destined to be a “utopia” where everyone gets rich equally, but more like a “gold rush” where a few people feast.

2. What are asymmetric wealth opportunities?

To understand the “asymmetry” of crypto capitalism, we must first understand what “asymmetric wealth opportunities” are.

Simply put, asymmetric wealth opportunities refer to the wealth distribution pattern in which a few people can use information, technology or first-mover advantages in a specific period of economic or technological change to accumulate wealth at a speed and scale far beyond ordinary people, while the vast majority of people are difficult to reach and may even suffer losses as a result.

This “asymmetry” is not unique to cryptocurrencies. Every major technological revolution and industrial transformation in history has been accompanied by similar wealth effects. For example:

During the Industrial Revolution, factory owners and entrepreneurs who took the lead in mastering new technologies such as steam engines and textile machines became trendsetters of the times and quickly accumulated huge amounts of wealth. However, the broad working class faced exploitation and poverty in the early days. Dilemma.

During the Internet revolution, entrepreneurs and venture capitalists who first joined the Internet industry, such as Bill Gates, Jeff Bezos, etc., also became a new generation of wealth giants, and most of them were just users of the Internet.

The core characteristics of asymmetric wealth opportunities are “winner takes all” and “first-mover advantage.”

In the early days of change, information and resources were often in the hands of a few people. With their keen vision and advanced actions, they seized the opportunity and built a strong competitive advantage, thus occupying a dominant position in the new wealth distribution pattern. However, due to lagging information and lack of resources, latecomers often can only passively accept the rules of the game and even become “takeovers.”

The emergence of cryptocurrencies has once again created a typical “asymmetric wealth opportunity.” Bitcoin has changed from “unattended code” to “digital gold”, which is full of information gaps and cognitive biases.

Those who recognized the value of cryptocurrency in the early days and dared to take risks were like Columbus discovering the New World and taking the lead in occupying the beachhead of wealth. When the concept of cryptocurrency became well known to the public and the price rose,”gold diggers” who had been aware of it came back to the market, often competing for the few remaining “gold sands” in crowded mines, and even accidentally digging out “slag”.

3. Why is crypto-capitalism an asymmetric wealth opportunity?

Among them, this is due to the characteristics of cryptocurrency itself, and is also closely related to the development stage of the cryptocurrency market.

3.1 Early birds have huge dividends

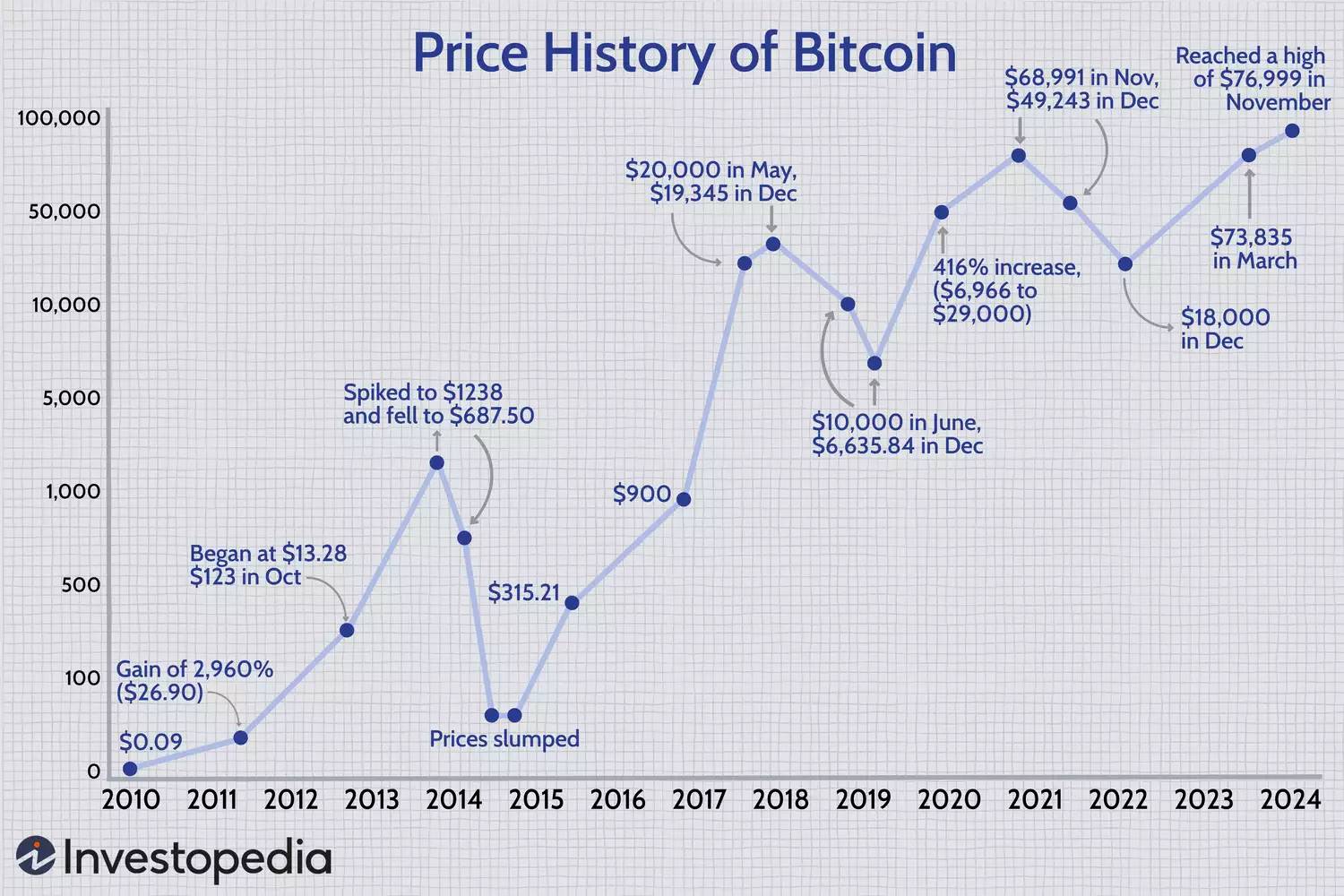

Bitcoin’s creation block was born in 2009. At first, it had almost no value. Hundreds or even thousands of bitcoins can be purchased for one dollar. Only a very small number of cryptography enthusiasts and technology geeks believe in the future of this “air coin”. These people became the “first pioneers” of crypto capitalism.

Norway man Christopher Koch bought 5000 bitcoins for $27 in 2009. At the time, the investment was almost negligible. However, a few years later, when the price of Bitcoin soared, he realized that this “inadvertent” investment was already worth nearly a million dollars!

There is also the story of “Bitcoin Pizza Day”, where programmer Rasle Haunets bought two pizzas with 10000 bitcoins. At that time, 10000 bitcoins were worth only $41, but today, these bitcoins are worth hundreds of millions of dollars!

These seemingly “overnight wealth” myths are not fictions, but real stories that happened to early participants in cryptocurrencies. Just because they recognized and accepted Bitcoin earlier than others, they received a return of wealth unimaginable to ordinary people. This “early bird dividend” is infinitely amplified in the cryptocurrency field.

As a famous saying in the investment community: “The secret of investment is not to run fast, but to stand early.” In the game of crypto capitalism, this sentence seems particularly appropriate.

3.2 The “gain without work” effect is strong

It is a “currency standard” wealth growth model that allows the rate of “capital interest earning” in the cryptocurrency market to far exceed that of “getting rich through labor.”

In the traditional economy, the accumulation of wealth mainly relies on labor to create value, and then adds value through investment, operation and other methods. The cryptocurrency market, on the other hand, presents a completely different picture.

Holding cryptocurrency itself has become a major “way to make money.”

Imagine that an ordinary office worker who works hard for a year may increase his salary by 5%-10%, and the interest on bank deposits will be negligible.

However, the price of Bitcoin may double, several times, or even more in a year or even months! In 2017, Bitcoin soared from less than US$1000 at the beginning of the year to nearly US$20,000 at the end of the year, an increase of more than 20 times! At the end of 2020, Bitcoin launched another bull market, rising from around US$20,000 to nearly US$69000 in November 2021, an increase of more than three times! Today, although Bitcoin has dropped from a peak of around 110,000, there are still more than 80,000.

People who hold Bitcoin simply “hold” this act, and their wealth is like sitting on a rocket and expanding rapidly. And those who do not own cryptocurrencies, no matter how hard they work, will grow their wealth at an unmatched rate. This difference in the speed of “capital interest earning” makes the distribution of wealth under encrypted capitalism more obvious asymmetry.

The “currency standard” wealth growth model makes it easier for people who hold crypto assets to achieve wealth freedom, while ordinary workers appear to be more “thankless.”

3.3 serious polarization

It is the “volatility” and “risk” of the cryptocurrency market that amplifies the polarization of wealth distribution.

The cryptocurrency market is like a free arena without “traffic lights”. Prices fluctuate violently and bulls and bears change rapidly. This high volatility not only brings the possibility of “getting rich overnight”, but also hides the risk of “returning to zero in an instant.”

When the market is in a bull market, early holders and “giant whales”(investors who hold large amounts of cryptocurrencies) are the biggest beneficiaries. They can enjoy the appreciation of wealth by selling high and absorbing low, or simply holding on to it. When the market turns into a bear market, those “retail investors” chasing gains at high levels often become the biggest victims. They may watch their assets shrink sharply or even lose their money, such as investors who have failed to control their desires and increased leverage.

At the end of 2021, the price of bitcoin reached its historical peak, attracting countless investors who “knew behind the scenes” to flock to the market. However, the good times will not last long. In 2022, the cryptocurrency market will usher in a “great crash”. Bitcoin prices will plummet by nearly 80%, and other cryptocurrencies such as Ethereum will also be cut in half. Countless investors who took over at high positions had their assets shrunk significantly and even left the market.

According to statistics, in 2022, the market value of the entire cryptocurrency market will evaporate by US$2 trillion! You can imagine how much of this is the hard-earned money of ordinary investors.

The volatility of the cryptocurrency market is like a “double-edged sword”. It not only allows early entrants to quickly accumulate wealth, but also allows late chasers to evaporate their wealth instantly.

This rapid switch between “heaven and hell” further exacerbates the asymmetry of wealth distribution in crypto-capitalism.

3.4 Severe market manipulation

Information asymmetry and market manipulation in the cryptocurrency market make it even more difficult for the “latecomers” to get involved.

Although the cryptocurrency market is known as “decentralized”, in fact, information and resources are still highly concentrated in the hands of a few people. Early participants, project parties, exchanges, media, etc. often have more and more timely market information, and they can influence market sentiment and price trends in various ways.

For example, some “project parties” will harvest the wealth of retail investors through false publicity, pulling and cutting leeks and other means. Some “giant whales” can jointly manipulate the market to create a “fake bull market”, trick retail investors into taking over the market at a high level, and then cash out themselves and leave the market. Ordinary investors, due to limited information channels and insufficient professional knowledge, often have difficulty distinguishing between authenticity and falsehood, and are more likely to become harvested “leeks”.

In the crypto market with asymmetric information and imperfect rules, the advantages of “foresight and foresight” are further amplified, while ordinary investors who “know later” are more likely to become targets of harvest. This asymmetry of information and resources also makes the wealth distribution of crypto-capitalism appear a more obvious “winner-takes-all” situation.

Finally, we use data to confirm the asymmetry of crypto capitalism.

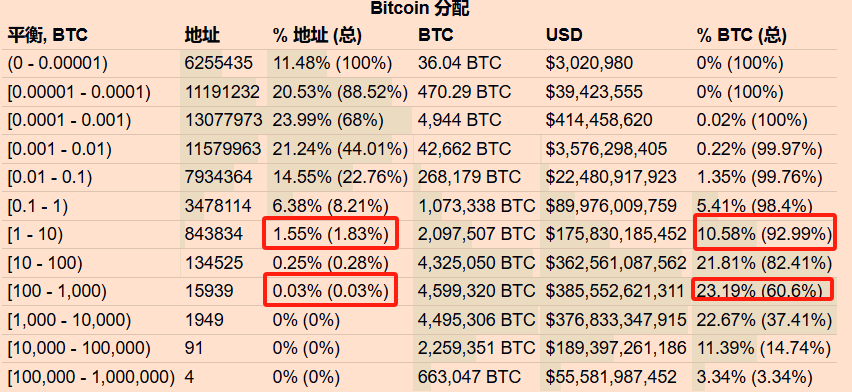

Data from the blockchain data analysis company shows that nearly 93% of bitcoins are controlled by less than 2% of addresses, and only 0.03% of addresses control more than half (60.6%) of bitcoins on the entire network! Some analysts pointed out that about 2000 addresses hold 37.41% of the world’s Bitcoin!

This concentration of wealth far exceeds that of traditional capitalist society!

Conclusion: By the bonfire of the digital jungle, please hold your cognitive weapon tightly

The ultimate paradox of crypto capitalism is that it uses decentralized technology to promise equality, but amplifies inequality in more cruel ways; it breaks down the high walls of traditional finance, but builds a new castle of computing power and information.

When we stare at this 24-hour wealth perpetual motion machine, what really needs to be fought against is not the fluctuations of the market, but the speculative instinct hidden in human genes.

Remember that in this digital gold rush field with no geographical boundaries, the biggest risk is not to miss the opportunity to get rich quickly, but to forget the human cost behind it. When everyone is talking about “financial freedom,” the real freedom is not to grasp the code of wealth, but to be able to remain alone after seeing through the rules of the game. Wealth may be annihilated with the loss of the private key, but human greed will last forever on the blockchain. This is the most profound revelation that crypto capitalism has left us.

In crypto “casinos”, the most precious chip has never been Bitcoin, but the ability to think independently. When the fireworks of algorithm carnival disperse, those who can retain real wealth will always be those who anchor their self-awareness in the torrent of numbers.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern