Is it all Archaeopteryx’s fault?

Middle-aged ladies are no longer enough for Jiangnan commons to snatch them away

Wen| Source Sight Anran

Spring is seen in the south of the Yangtze River, and ordinary people in the south are cold.

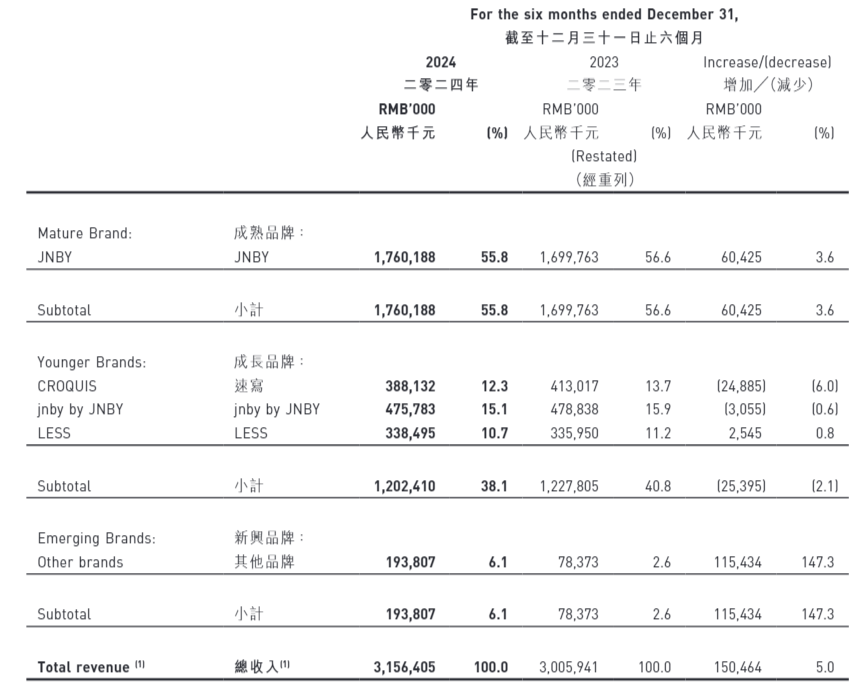

Recently, Jiangnan Buyi released its fiscal year 2025 mid-year report. During the six months ended December 31, 2024, the company’s total revenue increased by 5.0% year-on-year to 3.156 billion yuan; gross profit increased by 5.0% year-on-year to 2.056 billion yuan; net profit increased by 5.5% year-on-year to 604 million yuan.

As the domestic apparel industry is facing challenges such as insufficient consumer demand and intensified convoluted competition, and many apparel groups have generally reported a double decline in profits and even a triple digit decline in net profit, Jiangnan Clothing’s growth is commendable.

But on closer inspection, there are endless hidden worries.

On the one hand, the overall growth rate of Jiangnan Buyi has slowed down across the board. According to the first half of 2024, Jiangnan Buyi’s total revenue, gross profit, and net profit growth rates are 26.1%, 27.6%, and 54.5% respectively, which is much higher than this year’s single-digit growth.

On the other hand, the development of the company’s various brands is slightly declining. In the first half of fiscal year 2025, Jiangnan Buyi’s mature brand JNBY, which accounts for half of total revenue, only increased by 3.6% year-on-year, compared with 24% in the same period last year, and a slowdown of more than 20%.

The decline in growth brands is even more obvious. During the reporting period, the revenue growth rates of Jiangnan Buyi men’s clothing brand sketching, children’s clothing brand jnby by JNBY, and women’s clothing branch line LESS were-6%,-0.6% and 0.8% respectively, and recorded 17.2%, 36.3%, and 38.5% respectively in the same period last year.

Some emerging brands experienced impressive growth, reaching 147.3%, but they were mainly included in the performance of newly acquired brands in 2024, and currently account for a relatively small proportion. Sales during the period only accounted for 6% of total revenue, which had a small impact on the company.

Screenshot comes from the company’s financial report

Although Jiangnan Buyi consciously diversified its layout to share the pressure on its main brand, the spread of multiple brands also means the influx of more risks.

Among them, more disruptors have entered the women’s track. Sports brands such as Nike and Archaeopteryx have increased their number of women’s clothing to compete with JNBY and LESS to compete for the target customer base of middle-class women; the outdoor sports craze has attracted the attention of some male consumers, but it mainly exposes the fact that sketches are not attractive enough and members are weak.

However, jnby by JNBY’s cult design has been criticized by the public to this day. The children’s wear track may need to rely on the new brands Pengma and onmygame, but in terms of volume and sound volume, it will take a lot of time for the new brand to grow.

Perhaps, the growth myth of Jiangnan Buyi will come to an end first.

Key Women’s Dress

Fashion women’s clothing is Jiangnan Buyi’s trump card track, but now it has become the most dangerous track.

According to the official website, Jiangnan Buyi products are mainly aimed at middle and high-income groups. Among them, the main brand JNBY is mainly aimed at modern women aged 25-40 who focus on natural self-esteem;LESS further targets new workplace women aged 30-45 who pursue simplicity.

LESS 2025 Spring and Summer Series 丨 Screenshots from the brand’s official website

However, in the first half of fiscal year 2025, JNBY’s revenue growth rate dropped by 20% compared with the same period last year. Among them, LESS ranked first among all sub-brands, down by more than 37% compared with the same period last year. The performance of women’s clothing was not satisfactory.

Objectively, under the influence of factors such as domestic economic fluctuations, weakening residents ‘consumption expectations, and insufficient willingness to consume, domestic garment companies are generally under pressure.

According to data from the National Bureau of Statistics, in 2024, the retail sales of clothing products above designated size in my country will increase by 0.1% year-on-year, and the growth rate will slow down by 15.3 percentage points compared with the same period in 2023.

In 2024, the losses of enterprises above designated size in the apparel industry will reach 20.07%, an increase of 1.03 percentage points from 2023; the turnover rates of finished products, accounts receivable, and total assets will decrease by 5.07%, 2.90%, and 0.30% respectively year-on-year, and the operating pressure of the industry will increase.

In addition to Jiangnan Buyi, major domestic clothing groups have been sidelined.

In the first half of 2024, Winner Fashion, Disu Group, Anzheng Fashion, Nisbo Fashion, Xinhe Shares, etc. all experienced double declines in revenue and profits year-on-year. Among them, the net profit of Nisbo Fashion and Anzheng Fashion dropped by as much as three digits.

According to the performance reports and forecasts of several companies, throughout 2024, clothing groups such as Golis, Ribo Fashion, Xinhe, and Anzheng Fashion will suffer losses; revenue and net profit of Winner Fashion and Jinhong Group will decline.

Under the general trend of the industry seeing cold, it is crucial to find relatively dynamic targets.

According to statistics from the China Research Institute of Puhua Industry, the market size of my country’s women’s clothing industry in 2022 will be 1.07 trillion yuan, accounting for 56.16% of the clothing market.

In the same year, Ai Media Consulting data showed that the consumption of women’s clothing in China increased by 38.4% year-on-year, and the consumption frequency increased by 36.5%. Among them, there was strong demand for workplace commuting and light luxury styles.

Euronmonitor data shows that the size of China’s women’s wear market will reach 1.4 trillion yuan in 2027, with a compound growth rate of 3.91% from 2022 to 2027.

As a result, more brands will focus on women’s clothing, especially mid-to-high-end women’s clothing tracks, which will undoubtedly have an impact on Jiangnan Buyi.

The battle for middle-class women

The domestic mid-to-high-end women’s clothing market itself is divided into two categories.

There are rumors that middle-aged literary and artistic women buy Jiangnan clothes, middle-aged executive sisters buy Zhihe, and middle-aged little aunts buy brothers. rdquo;

Depending on the audience segment, middle-class female consumers themselves have gone through a round of diversion.

Among them, ICICLE, which is regarded as the China version of Max Mara, has caused great heated discussion in recent years with its most expensive women’s clothing gimmick in China, attracting higher-end audiences under brand differentiation.

Zhihe AIR COAT series 丨 Screenshots from the brand’s official website mall

According to Source Sight, the price of a single coat on sale for Zhihe is between 4,500 – 40,000 yuan, while the price of a single coat for Max Mara is between 4,000 – 73,000 yuan, and the hot sale range is between 7,000 – 30,000 yuan, which coincides with the pricing of Zhihe products., even partially lower than the selling price of Zhihe.

After acquiring Max Mara’s manufacturer, Kaigemini, a Korean-owned garment factory, inviting Bendicte Laloux, who had worked in luxury brands such as C line and Chlo, to serve as the chief designer, and densely deploying stores in high-end shopping malls across the country, Zhihe’s The image of high-end women’s clothing has gradually emerged, harvesting a high-net-worth consumer group.

According to WWD International Fashion News, Zhihe’s turnover in 2020 will be approximately 2.5 billion yuan, and will continue to grow for the next two years. It is estimated to be around 4.4 billion yuan in 2022. Data shows that Jiangnan Buyi’s revenue in fiscal year 2022 is only about 4.1 billion yuan.

The Taiwanese brand GIRDEAR based in Guangzhou is more focused on targeting professional women. Female consumers in institutions such as teachers, doctors, corporate executives, and government and unit personnel are the precise target customer group.

In order to provide comfortable clothing that suits the needs of target consumers, provide seven-day suits around the six major living conditions of profession, business, dinner, leisure, travel, and sports, and other service models to drive large-order sales, and launch efforts on Live streaming eCommerce, brother has certain dominance in the backbone market of middle-aged white-collar workers.

According to Weifu Consulting and other sources, Brother’s annual sales may reach 30 billion yuan, and the product repurchase rate can reach 60%-80%. Digital observation and monitoring data shows that as of the end of 2023, Brother has 1141 stores across the country.

It is worth noting that compared with the higher-end Zhihe and the more niche Jiangnan Buyi, the brothers stores are more located in third-and fourth-tier cities, so they are also known as the county lady brand. However, under the influence of trends such as consumption differentiation in recent years, consumption in low-tier cities is actually more dynamic.

According to Xinhua Agency, relevant agencies predict that by 2030, more than 66% of the increase in personal consumption in China will come from sinking markets including third-tier cities and below, county and township markets.

Douyin March 8th Festival consumption forecast data shows that from March 1 to 6, the total transaction volume of female consumers on the platform increased by 53% year-on-year, and the number of female consumers in cities below the third-tier increased by more than 1.3 times compared with the same period last year. These trends also provide brothers with greater prospects for development.

Jiangnan cloth, which is mixed in the original pattern, is not top-notch at the high end and is not integrated enough at the sink. The middle audience is partially divided, and some are reduced and lost under consumer conservatism.

However, the competition for women’s tracks is fierce, and the competition for middle-class female consumers is not limited to local and original track players, but also giants in other fields.

For example, Archaeopteryx, which takes advantage of the outdoor trend to promote the three treasures of the middle class, and attempts to add to the women’s clothing field and attract more middle-class female consumers. While Jiangnan Buyi’s performance is in a critical state, in 2024, Archaeopteryx’s parent company, Amafen, successfully turned a profit.

According to Amafen executives, Archaeopteryx’s revenue in 2024 exceeded US$2 billion. In the fourth quarter, the brand achieved strong growth in all regions, channels and categories. The growth rate of footwear and women’s clothing categories is particularly strong, exceeding the overall growth rate of the brand.

Archaeopteryx CEO Stuart Haselden said that the overall penetration rate of Archaeopteryx’s female product line business increased by a few percentage points in the fourth quarter and the whole year of last year, accounting for nearly 40% of revenue. The male and female product lines are expected to achieve a balance in sales.

In addition, in February this year, American sports giant Nike announced a partnership with social celebrity Kim Kardashian to launch a new women’s brand Nike SKIMS.

According to research data from Ai Media Consulting, the top three types of clothing preferences among consumers in the apparel industry in China are casual style, sporty style and fashionable styles that follow the season, accounting for 59.5%, 45.6%, and 29.0% respectively. Among them, casual style and sporty youth style are also popular choices for middle-class female consumers.

In Nike’s revitalization plan led by Elliott Hill, the women’s clothing business is an important addition to development.

According to official reports, Nike SKIMS will provide a wide range of sportswear, footwear and accessories to attract more women into the sports and fitness field. The brand’s first products will be available on its official website and some retail stores this spring, and is planned to be promoted globally in 2026.

According to Jiangnan Buyi’s financial report, the number of active member accounts of the group in 2024 will be 540,000, a decrease from 2023. In the world of women’s clothing where there is a shortage of people, the battle for customers continues.

Pioneer Design AB Face

Of course, in addition to the main women’s wear, Jiangnan Buyi also has a lot of extravagance in the field of men’s wear and children’s wear, but it is currently subject to design controversy.

The Group’s men’s wear design brand sketching saw the largest decline in revenue among growing brands in the first half of 2025, down 6% from 413 million yuan in the same period last year to 388 million yuan; single-store revenue fell 7.8% year-on-year to 1.22 million yuan.

Wu Huating, CEO of Jiangnan Buyi, believes that the fluctuations in sketching performance are mainly due to the popularity of outdoor sports tracks, which puts pressure on the overall men’s wear track. ldquo; There is no way I can change men’s habits of dressing and preferences.

Indeed, swept by the outdoor craze, many male consumers flocked to popular outdoor clothing fields such as emergency jackets, which pushed up the performance of outdoor brands such as Archaeopteryx and Disant rapidly.

But Wu Huating also realized that in addition to sports scenes, there are still many male consumers who need dressing options suitable for other occasions. rdquo;

As a male design brand, the target audience of sketches is men aged 25-40 who pursue the fun of dressing. Art, elegance, playfulness, etc. are brand keywords, which coincides with the adventurous concept of outdoor sports and the need for clothing technology. Not high.

In the final analysis, the slowdown in sketches reveals more that the brand’s design is not attractive enough, making it difficult to capture more male consumers and stabilize them into a core high-stickiness consumer group.

In terms of children’s clothing design, Jiangnan Buyi seems to be a little indulgent and out of control.

In 2021, according to multiple media reports, some netizens revealed that jnby by JNBY’s clothes had many uncomfortable English words, and were equipped with strange patterns such as Satan, skull, broken hands and feet, and thousands of swords through the heart. They questioned the inclusion of suspected child abuse, sexual suggestion and other elements, belonging to children’s cult, which triggered strong public resistance.

In the following years, when jnby by JNBY, whose low-key development, was mentioned again, it still couldn’t get rid of the influence of the controversy. In 2024, Jiangnan Buyi will acquire the children’s sports brand onmygame, with the help of the emerging children’s wear brand Pengma, or help the group’s children’s wear sector.

But in the field of children’s clothing, Anta, which is already a giant, has not relaxed its energy. At the end of 2024, ANTA KIDS’s sales volume exceeded 10 billion yuan, becoming the first domestic children’s sports brand to exceed 10 billion yuan, causing diversion and deterrence to other children’s wear brands.

Faced with setbacks at the business level and hidden dangers of customer loss, Jiangnan Buyi’s inventory has become high.

Huaxi Securities Research News mentioned that as of the first half of 2025, Jiangnan Buyi’s inventory was 991 million yuan, a year-on-year increase of 32%; accounts receivable were 223 million yuan, a year-on-year increase of 1.8%; accounts payable were 418 million yuan, a year-on-year increase of 60.3%; accounts payable turnover days were 56 days, an increase of 5 days year-on-year.

Or in order to cope with the crisis of declining customer sources, Jiangnan Buyi, which has been cautiously expanding in the past, has significantly expanded its stores in the first half of fiscal year 2025, adding more than 100 new stores during the period. In contrast, in the whole of fiscal year 2024, the Group has only 34 new stores.

However, the newly opened stores are basically distribution and franchise stores, which has an impact on the Group’s gross profit and profitability.

Founder Securities Research Report pointed out that as of the end of 2024, the company had a total of 2126 stores, a net increase of 106 stores from the end of June 2024. Among them, there are net stores opened by direct sales and franchises respectively-24 and +125 stores.

The gross profit margins of Jiangnan Buyi’s direct sales and distribution channels are 73.6% and 59.0% respectively, and the profit level of direct sales is significantly higher than the distribution level. As a result, in the first half of fiscal year 2025, Jiangnan Buyi’s overall gross profit margin dropped slightly by 0.1 percentage points to 65.1%.

In addition, according to the financial report, in the first half of 2025, Jiangnan Buyi’s net cash flow from operating activities was 823 million yuan, compared with 1.057 billion yuan in the same period last year, a year-on-year drop of 22.2%, which also caused investors to have certain concerns about the company’s operations.

However, despite the hidden dangers, judging from the core competitiveness of the main brand, compared with high-end women’s clothing brands such as Zhihe, JNBY’s unique, loose and more inclusive literary and leisure design is still irreplaceable in the domestic market.

While the number of large-scale active members has declined, the number of highly loyal members and retail sales with total purchases exceeding 5000 yuan in 2024 have increased compared with 2023.

Perhaps, Jiangnan Buyi can break a new situation by refining member operations and cultivating and developing highly loyal customers.

Some pictures come from the Internet. If there is any infringement, please inform us to delete them.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.