① The performance of ETFs in the first week of the Year of the Snake was differentiated, with some technology ETFs performing well;

② Looking at the inflow of funds, broad-based ETFs are favored by funds, and the share of robot ETFs has increased more;

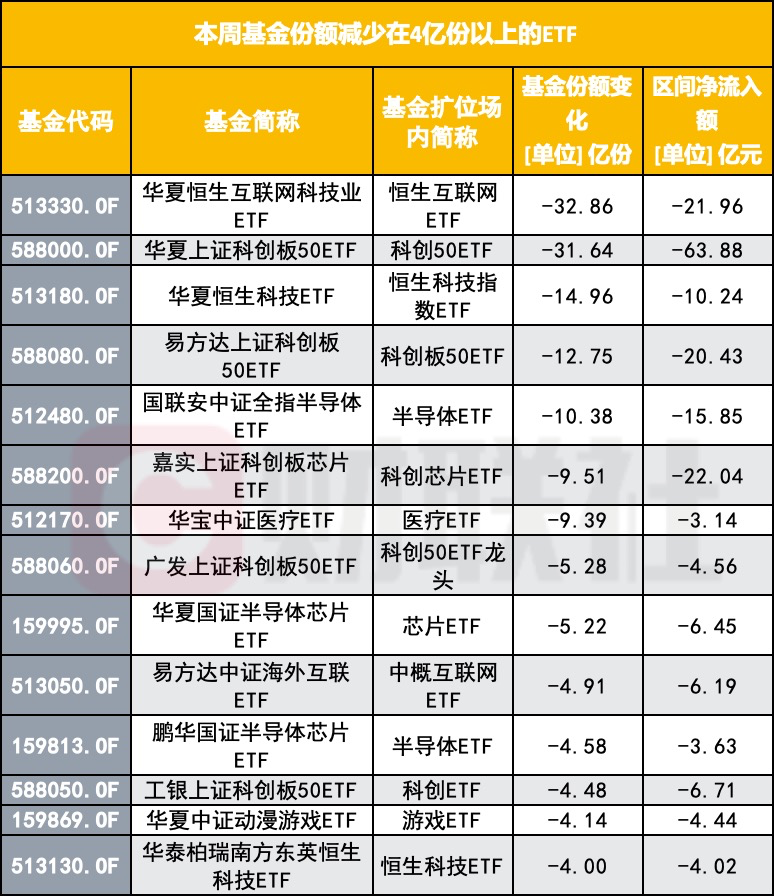

③ Looking at the outflow situation, ETFs such as semiconductors, chips, and science and technology innovation were sold off by funds this week.

Cailian News Agency, February 8 (Reporter Wu Yuqi)At the end of the first trading week of the Year of the Snake, which ETFs are sought after by funds?

Overall, during the range from February 5 to 8, the net outflow of market-wide ETFs (including currency ETFs) was 11.228 billion yuan. Among them, broad-based index ETFs received more capital inflows, such as the Shanghai and Shenzhen 300ETF, China SSE 50ETF, etc. From an industry perspective, artificial intelligence and robot-related ETFs are favored by funds this week, while semiconductors, science and technology innovation, and chip-related ETFs have suffered a sell-off of funds.

ETF performance diverged this week

Judging from the performance of ETF in the first week of the Year of the Snake, it is generally divided. The largest cumulative increase in the four trading days was the Xingyin China Securities Hong Kong Stock Connect Technology ETF, with 26.02%. The Guangfa China Securities Hong Kong Stock Connect Automobile Industry Theme ETF rose 17.68%, ranking second. The Hong Kong stock ETF performed better or because Hong Kong stocks opened. Some tracks performed strongly.

In addition, due to the popularity of DeepSeek, some technology (such as software, Xinchuang, computer, etc.) ETFs performed well this week. The Wanjia China Securities Software Services ETF rose by 17.45% this week. Huitianfu China Securities Information Technology Application Innovation Industry ETF rose by 16.11%. The China Securities Software Service Index ETFs under Harvest Fund and E Fund rose by 16.07% and 15.84% respectively. A total of 60 ETFs rose more than 10% this week, most of which are technology ETFs.

On the other hand, cross-border ETFs and currency ETFs performed poorly. Among them, Castrol Germany’s DAXETF, which had soared before, closed the largest decline this week, at 21.94%, Huatai Tiantian Gold ETF fell 14.53%, China Life Currency ETF fell 12.09%, Rongtong Currency ETF, Castrol Express ETF, Guangfa Currency ETF, Guoliu Riying Currency ETF, Golden Eagle Gain Currency ETF, etc. fell by more than 6%.

Broad-based ETFs are favored by funds, and the share of robot ETFs has increased more

From the perspective of capital inflows, many broad-base ETFs are favored by funds. Wind data shows that the net inflow of Huatai Bairui Shanghai and Shenzhen 300ETF this week was 2.431 billion yuan, and the change in fund shares reached 554 million. The net inflow of China SSE 50ETF was 2.187 billion yuan, and the change in share was 672 million yuan. The net inflow of the Southern China Securities 1000ETF and the Southern China Securities 500ETF exceeded 1 billion yuan this week.

In terms of fund shares, a total of 33 ETFs increased their shares by more than 100 million this week. Among them, China China Securities Robot ETF increased the most, reaching 683 million, with a net capital inflow of 529 million yuan. A number of industry ETFs also gained increased shares. Huitianfu China Securities Shanghai State-owned Enterprise ETF increased its share by 489 million shares this week, with a net inflow of 411 million yuan. Huatai Bairui China Securities Kung Fu Industry ETF increased its share by 364 million shares, with a net inflow of 277 million yuan. Yuan, E Fund China Securities Artificial Intelligence ETF increased by 314 million shares, with a net inflow of 291 million yuan.

To sum up, from an industry perspective, technology ETFs such as artificial intelligence and robots are favored by funds.

Recently, many institutions have also continued to be optimistic about investment opportunities in industries such as robotics. Schroeder Investment said that in the digital era, smartphones, Internet connections, cloud computing, e-commerce and electronic payment methods are becoming more and more popular, coupled with the changes in working models after the epidemic, which have led to the rapid growth in data processing, storage and electricity demand. The revolutionary development of artificial intelligence technology has become a major super trend in the global economy, reshaping almost all walks of life. However, this relies on huge data consumption to further drive electricity demand.

Xingzheng International believes that artificial intelligence industry stocks are facing a rising trend. The exposure of DeepSeek technology has brought popularity and prosperity to the AI industry, including AI computing chips, cloud industry, AI PCs and servers, AR industry, smart driving and other sectors that have been sought after by funds. The performance of relevant sectors was brilliant, which also drove the overall investment atmosphere of Hong Kong stocks to a high level, and radiated to other industries, including pharmaceutical outsourcing, pharmaceuticals, aerospace military and other industries. Many industries have the opportunity to benefit from the vigorous development of artificial intelligence, and shares in different fields are sought after by funds.

Semiconductor, chip ETFs sold off this week

Although driven by the positive explosion of DeepSeek, some technology ETFs have been sold off by funds, such as science and technology innovation, semiconductors, chips, overseas interconnection and other related products.

Specifically, this week, China Hang Seng Internet Technology Industry ETF shares decreased the most, with a net outflow of funds reaching 2.196 billion yuan. E Fund’s Shanghai Science and Technology Innovation Board 50ETF shares decreased by 3.164 billion, with a net outflow reaching 6.388 billion yuan. The shares of China Hang Seng Technology ETF, E Fund’s Shanghai Science and Technology Innovation Board 50ETF, and Guolian Security All Index Semiconductor ETF decreased by more than 1 billion, and the net outflow of funds reached 1.024 billion yuan. 2.043 billion yuan, 1.585 billion yuan.

In addition, fund shares such as Harvest Shanghai Science and Technology Innovation Board Chip ETF, Huabao China Securities Medical ETF, Guangfa Shanghai Science and Technology Innovation Board 50ETF, and China National Securities Semiconductor Chip ETF have decreased by more than 500 million shares. The share of China Securities Animation Games ETF decreased by 414 million, the cross-border product Huatai Bairui Nanfang Dongying Hengsheng Technology ETF decreased by 400 million, and the share of multiple semiconductor chip ETFs decreased by more than 100 million.