The regulatory fines also point to problems such as inadequate verification of Guoxin Securities’s sponsored projects and failure to perform their duties. It is also a torture of whether it fulfills its responsibilities as a “gatekeeper” in the capital market.

Guosen Securities, the former “sponsor king”, faded its “golden brand”. During the year, the IPO withdrawal rate was 60%, and the lack of internal control was frequently punished

(Photo source: Visual China)

Blue Whale News, March 7 (Reporter Wang Wanying)By 2025, the former sponsor of Wang Guoxin Securities (002736.SZ) is no longer popular. The reporter noticed that since the beginning of this year, Guosen Securities has withdrawn three projects, with a withdrawal rate of 60%, and its project reserves have also dropped rapidly to four. This veteran brokerage firm had excellent investment banking business in its early years. From 2007 to 2015, Guosen Securities ranked first in the industry in the number of underwriting A-share IPOs on several occasions, and it was quite wolf.

But today, the performance of Guosen Securities Investment Bank continues to decline. From 2021 to 2023, the company’s net fee income from investment banking business was 1.979 billion yuan, 1.816 billion yuan and 1.363 billion yuan respectively; in the first three quarters of 2024, the net income from investment banking business was 646 million yuan, a year-on-year decrease of 41%.

Regarding the decline of Guosen Securities investment bank, some investment bankers believe that Guosen Securities had a large team and many projects in its early years, but its model was relatively extensive and compliance management was weak. It could not keep up with the growing requirements of the market, so it declined.

In 2024, its investment banking business received at least 4 fines. The violations involved many aspects such as dereliction of due diligence on IPO and poor continuous supervision. Previous sponsorship projects also frequently experienced financial fraud in performance changes, which exposed compliance shortcomings.

In the past, there were only 4 reserve projects left by the sponsor king

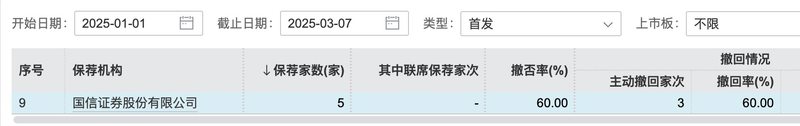

Since last year, the IPO withdrawal rate of Guosen Securities has begun to increase significantly. Wind data shows that in 2022, Guosen Securities withdrew a total of 7 IPO projects, with a withdrawal rate of 20.37%; in 2023, it also withdrew 7 projects, with a withdrawal rate of 21.62%. In 2024, a total of 8 projects will be withdrawn, and the withdrawal rate will increase to 42.11%; since the beginning of this year, 3 projects have been voluntarily withdrawn, and the withdrawal rate will reach 60%. And from 2022 to 2024, the number of sponsors will be 54, 37, and 19 respectively, which will continue to decline.

(Photo source: Wind Data)

The shrinkage of sponsorship projects has also led to a decline in investment banking performance. From 2021 to 2023, Guosen Securities ‘net fee income from investment banking business was 1.979 billion yuan, 1.816 billion yuan and 1.363 billion yuan respectively, which continued to decline. In the first three quarters of 2024, net fee income from investment banking business was only 646 million yuan, a year-on-year decrease of 41%.

Of course, the downward trend in performance has an objective impact on changes in the market environment. However, from the perspective of the quality of practice, the company’s investment banking business has repeatedly violated regulatory red lines and the compliance risk control mechanism is lax, which may not match the proactive and stable investment bank it wants to build.

The reporter sorted out that in 2024 alone, Guosen Securities ‘investment banking business received at least 4 fines. There are many companies that have changed their performance in the second year after listing and even experienced financial fraud.

For example, in May last year, due to the rapid changes in the performance of sponsored Lilda after listing, non-net profit of-18.31 million yuan was deducted in 2023, which attracted the attention of regulators. Guosen Securities and its two recommendation representatives were issued warning letters by the Zhejiang Securities Regulatory Bureau.

Looking back at the sponsorship history of Guosen Securities, it is no accident that the performance has changed. Wind data shows that from 2021 to 2023, Guosen Securities sponsored a total of 43 IPO companies to list, of which nearly 30 companies had a year-on-year decline in revenue or net profit for the year they went public, accounting for more than 60%.

Industry insiders pointed out to reporters that the large-scale performance changes in Guosen Securities ‘past projects may be related to the sponsor institution’s insufficient due diligence and lax review control. rdquo;

The regulatory fines also point to problems such as inadequate verification of Guoxin Securities ‘sponsored projects and failure to perform their duties. It is also a kind of torture as to whether it fulfills its responsibilities as a gatekeeper of the capital market.

Take Baibaolong, which he sponsored, as an example. Baibaolong will be delisted in 2024 due to long-term financial fraud. The company was sponsored by Guosen Securities in 2015 and successfully raised 611 million yuan. The following year, Guosen Securities once again served as a supervisory agency, helping Baibaolong complete a targeted additional issuance of 988 million yuan.

However, soon after, Baibaolong was found to have financial fraud. After investigation, between 2013 and 2018, the company’s cumulative inflated operating income reached 1.276 billion yuan, and the cumulative inflated profits reached 410 million yuan. This period of time coincides with the IPO sponsorship period of Guosen Securities, as well as the fixed-increase sponsorship and continuous supervision period. Guosen Securities is undoubtedly responsible for failing to detect financial fraud for such a long time.

Regarding the decline of Guosen Securities investment bank, some investment bankers told reporters that personal observation believed that Guosen Securities had a large investment bank team, many sponsors, and a large number of projects. However, the model was relatively extensive, internal management was relatively weak, and quality control was not easy to grasp. Later, as the requirements of enterprises became higher and higher, the style of play gradually became less suitable for the times.& rdquo;

Zhi Peiyuan, vice president of the Investment Professional Committee of Listed Companies of China Investment Association, pointed out in an interview with Blue Whale News that Guosen Securities ‘past advantages have not been continued for various reasons. From the perspective of the market environment, capital market reform has continued to deepen in recent years, market competition has become increasingly fierce, and some characteristic securities firms have emerged and taken a large share. Guosen Securities has failed to adapt to changes in a timely manner. At the internal level, problems arise in project quality control, frequent violations such as continuous supervision and lack of responsibility occur, which reflect loopholes in the risk control and compliance system, affecting reputation and market trust. To reshape competitive advantages, compliance and risk control system need to be strengthened. Increase the training and introduction of professional talents to ensure project quality. rdquo;

Plan to annex Wanhe Securities

At present, the market has put forward higher requirements for the professionalism, comprehensiveness and agility of brokerage investment banks; the industry competition landscape is becoming increasingly fierce, which further tests investment banks ‘asset allocation capabilities and efficiency; the newly introduced policy system also requires further strengthening of investment banks’ functions. Sexual positioning and gatekeeper responsibilities.

Guosen Securities has also tried to save the declining investment bank brand.

For example, in April 2024, Guosen Securities appointed Wu Guofang as the company’s vice president. Wu Guofang has served as Director of the Issuance Supervision Department and Deputy Director of the Legal Department of the China Securities Regulatory Commission. In 2017, he entered a market-oriented institution and served as the business director of Galaxy Securities. He has been in charge of investment banking for six years.

Given Wu Guofang’s rich regulatory experience and investment banking background, when he joined, he was once believed by the market to inject new vitality into Guoxin Securities’s investment banking business. However, in less than a year, Wu Guofang was opened for investigation. This personnel move not only failed to bring benefits, but also brought a certain negative impact on Guoxin Securities.

In recent years, Guosen Securities ‘overall performance has also been relatively volatile. Public data shows that from 2021 to 2023, the company’s revenue was 23.82 billion yuan, 15.88 billion yuan, and 17.32 billion yuan respectively, and revenue in the first three quarters of 2024 was 12.27 billion yuan; In the same period, net profit attributable to the parent was 10.11 billion yuan, 6.088 billion yuan, and 6.427 billion yuan respectively, and net profit for the first three quarters of 2024 was 4.879 billion yuan.

It should be noted that in the new round of brokerage mergers and acquisitions, Guosen Securities has also stepped in and plans to acquire Wanhe Securities, a small and micro brokerage firm.

Regarding the acquisition of Wanhe Securities, Guosen Securities stated that Wanhe Securities is located in Hainan, and the Hainan Free Trade Port is a free trade port established by the state on the entire island of Hainan Island. The free trade port has the advantages of promoting financial reform and innovation, and taking the lead in implementing financial industry opening policies. A series of institutional advantages. After the acquisition of Wanhe Securities, we can make full use of local policy advantages and existing business resources of both parties to build our subsidiary Wanhe Securities into a regional characteristic investment bank with industry-leading position in specific business fields such as cross-border asset management by Hainan Free Trade Port., achieve rapid development of international business and financial innovation business of listed companies.

However, from the perspective of investment banking business alone, the acquisition of Wanhe Securities may not be of great value. In the past three years, Wanhe Securities has mainly focused on securities underwriting and sponsorship business and financial advisory business, with revenue of less than 100 million yuan. Wind data shows that its IPO sponsorship and underwriting project has only one since 2022.

In the early years, Wanhe Securities was even supervised and bluntly stated that the internal control of investment banking businesses was imperfect, internal control supervision was lacking, and the overall level of internal control construction and standardization was low. There are problems such as imperfect internal control organizational structure, insufficient internal control departments to perform their duties, failure to build and use the electronic working paper system as required, failure to strictly implement the revenue deferred payment mechanism, and failure to check key nodes of the three lines of defense. In Runke Biotech, Le Demei, Zhenmei, Jiaqi Technology, South China Decoration and other projects, due diligence is obviously insufficient, but quality control and core are not fully paid attention to.

Zhi Peiyuan told reporters that the compliance issues of Guosen Securities ‘investment banking business have not yet been completely resolved. At this time, the acquisition of Wanhe Securities may be difficult to integrate. Moreover, the differences in corporate cultures and business models of the two companies may lead to the integration process being not smooth enough, affecting business efficiency and quality, resulting in poor synergy effects.

Overall, Guosen Securities ‘acquisition of Wanhe Securities may not improve the company’s overall operating conditions. In addition, the two securities firms have been frequently fined, or exposed internal control problems within the company. ldquo; Regulatory authorities have strict compliance requirements for securities firms, and need to build a strong risk control line in this regard. rdquo; Zhi Peiyuan pointed out. (Blue Whale News Wang Wanying wangwanying@lanjinger.com)