Wen| Digital Force Field, Author| She Zongming

The hot searches since the beginning of the New Year have been dominated by almost two topics, one is Nezha 2 and the other is DeepSeek.

After everything you can ask DeepSeek to ride the DeepSeek craze, why didn’t DeepSeek appear in Nanjing? rdquo; Extended discussions such as why DeepSeek was not born in a large factory have added a cup to DeepSeek’s popularity.

DeepSeek gave the Chinese people a lot of adrenaline, and foreign investment banks also kept +1.

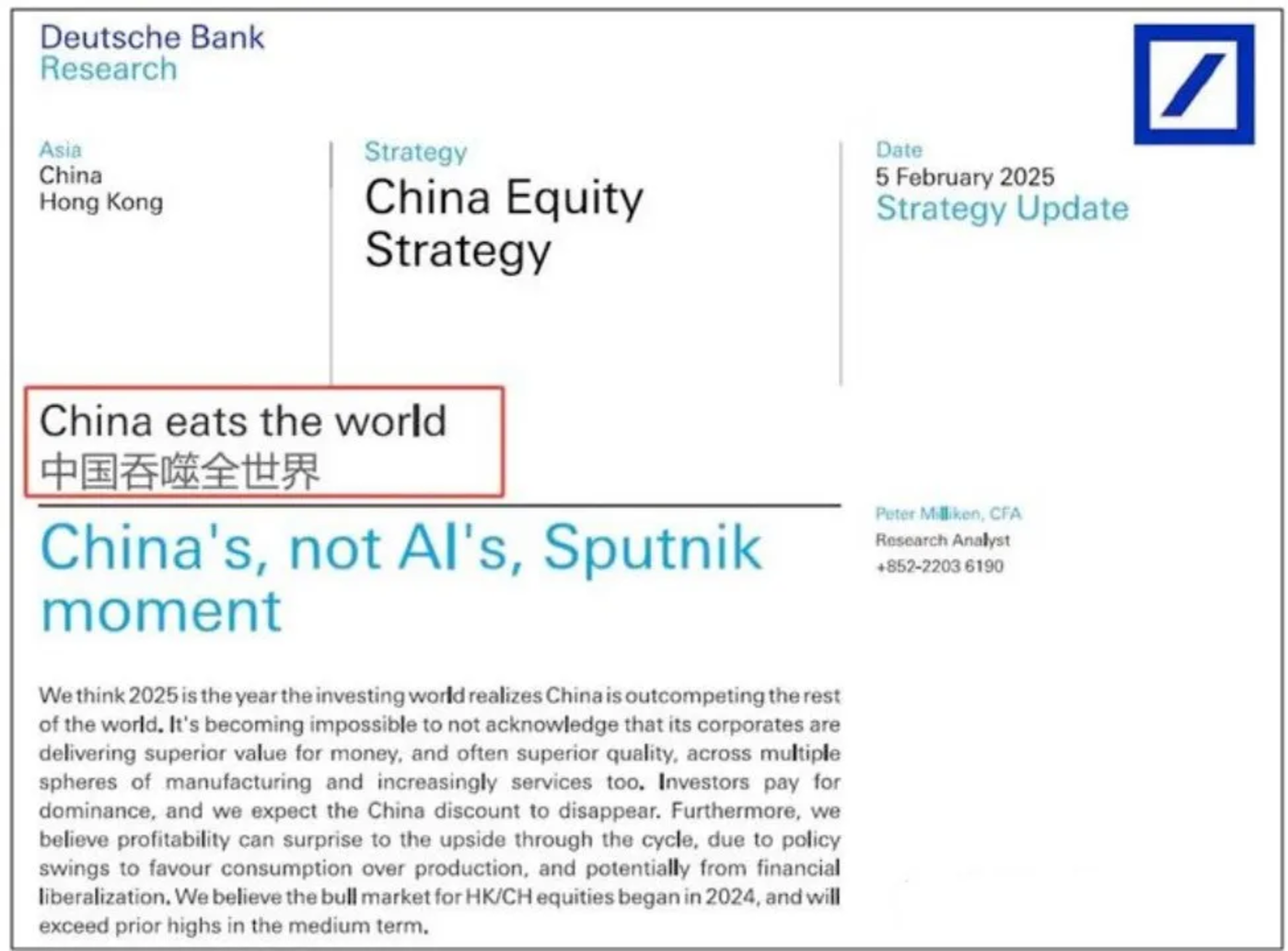

Deutsche Bank reported that the launch of DeepSeek is a Sputnik moment for China’s economy, and the valuation discount on China assets will disappear.

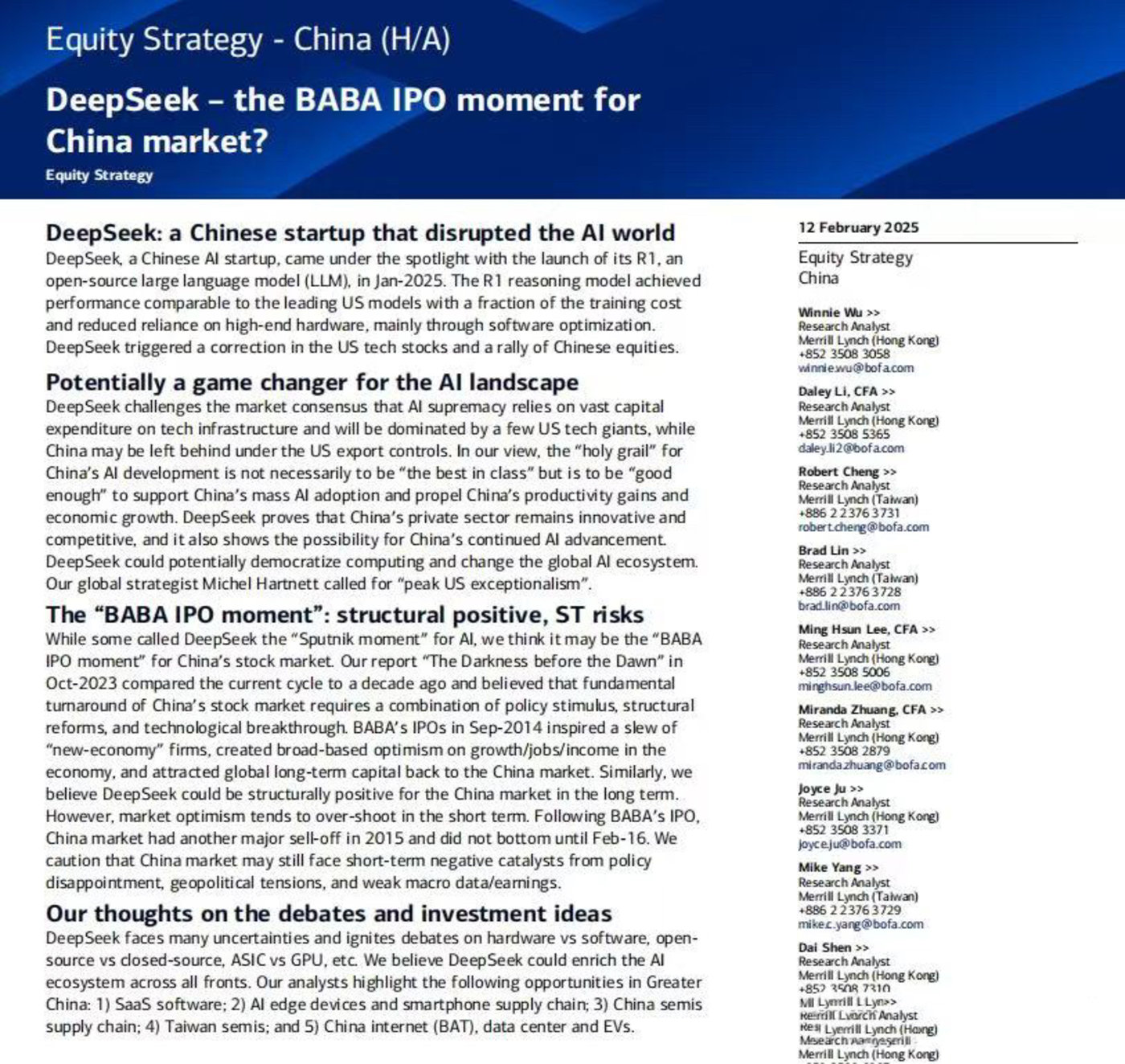

Bank of America reported that the emergence of DeepSeek is the Alibaba IPO moment for China’s stock market and may have a structural positive impact on China’s stock market in the long run.

In the Bank of America report, the emergence of DeepSeek was compared to the Ali IPO moment of China’s economy.

Born about 70 years ago, Sputnik was the first artificial satellite of the Soviet Union, marking the Soviet Union’s leading position in the space race. Ten years ago, Ali’s IPO attracted a large amount of global long-term capital into the China market, driving the rise of China ‘s new economic sector.

Looking at these two moments, the beautiful picture has been unfolded before our eyes: DeepSeek will repeat the scene of OpenAI saving U.S. stocks and become the strongest catalyst for the repair of China’s asset valuation.

Will the advent of DeepSeek be a superposition of Tepnik’s moment and Ali’s IPO moment?

Putting aside the appearance of uncertainty and looking at the core of certainty, we can see that the chain reaction brought by DeepSeek has spilled over to many areas, including the stock market. Rather than call it the Sputnik moment or the Ali IPO moment, call it the DeepSeek moment.

How much stamina and potential energy DeepSeek has at a moment depends on whether more DeepSeek will emerge in the future. I hope that the whale rises and all things are born, rather than all bubbles, just a flash of fireworks.

01

DeepSeek shocked Silicon Valley + Yushu Technology Robot Dance Yangko on the Spring Festival Gala + Nezha 2 box office broke 10 billion. What is it?

For enthusiasts of the theory of national sports, this is tantamount to sounding chicken blood rallies one after another.

I have to say that the many new weather that has poured in during the Spring Festival that has just passed are quite consistent with the image of enjoying things in spring when the snow mountains are warm due to the gentle winds and the ice bloom.

In the situation where many people have been brought into the emotional quagmire of Emo by certain realities in the past few years, many people have projected Nezha ‘s love of life on Huawei Mate60 Pro and “Black Myth: Wukong”. Under the circumstances, many people’s excitement is understandable.

At the end of the day, we need good news so much to boost the confidence of the entire society.

The national sport-level scientific and technological achievements presented by DeepSeek came at the right time.

If we talk about AI in terms of AI, the shock wave brought by DeepSeek probably stays at the level of computing power revolution and framework innovation.

But looking at AI beyond AI will find that DeepSeek will bring many far-reaching impacts, including boosting the confidence of Chinese people, stimulating innovation enthusiasm, and reshaping the overall valuation logic of the outside world for China.

The word reshaping here carries the expectations of the Chinese people for a better economy.

More than two years ago, there was a popular article on the Internet,”When the balance sheet doesn’t want to struggle anymore.” ldquo; The balance sheet did not want to struggle, which showed the social spirit at that time: the property market was sluggish, the stock market was sluggish, demand was sluggish, consumption shifted to the left, and there was also the outflow of foreign capital, which was reflected in the capital market. This is the popularity of ABC (Anywhere But China).

As economist Zhao Jian said, starting from 2022, investors will discount assets in Greater China based on deflationary assets.

Behind the discount is looking bad.

02

But now, things seem to have changed.

According to Bloomberg, strategists at Morgan Stanley, JPMorgan Chase and UBS all said that DeepSeek has triggered a fundamental rethink among investors about the attractiveness of the China market, and previous assumptions that China is lagging behind in cutting-edge technology have also been challenged.

“Fundamental reflection is equivalent to revolution deep in the soul.

Deutsche Bank’s report “China eat the world” said: China continues to achieve breakthroughs in high value-added fields and builds competitive advantages in the entire industry chain at an unprecedented speed.

Deutsche Bank analyst Peter Millikan wrote in the report: We believe that 2025 will be the year when the global investment community realizes that China is more competitive than other countries. In 2025, China released the world’s first sixth-generation fighter jet and DeepSeek, a very low-cost + high-performance open source AI model, within a week. rdquo;

Deutsche Bank’s report boasted about the advantages of China’s industrial chain.

“China praises the team leader. Who else is it?

Bank of America’s report on February 12 stated that the holy grail of AI development in China is not necessarily the best of its kind, but good enough to support large-scale AI applications in China and promote China’s economic growth. DeepSeek proves that China’s companies still have innovative capabilities and competitiveness, and also shows the possibility of China’s continued progress in the AI field.

Bank of America strategists believe that the narrative surrounding the U.S. economy’s structural dominance of its competitors (China) is fading.

Does this statement count as the Chinese spy behavior mentioned by foreign friends in Xiaohongshu?

Also joining the chorus are Goldman Sachs, HSBC, etc.

Goldman Sachs research reported that the growth investment ratio (GIR) of U.S. companies is significantly higher than that of other regions of the world, especially in the AI field. But DeepSeek’s R1 model achieves performance comparable to leading models such as GPT-4 and Llama at a cost of less than $6 million. Brighter growth prospects and technological breakthroughs will bring huge productivity gains and help narrow the valuation gap of as much as 66% between China and U.S. technology or semiconductor stocks.

HSBC reported that global attention to DeepSeek could stimulate investors to reassess China’s innovation capabilities. ldquo; In our view, this may be the catalyst for the reassessment of China’s stock market this year. rdquo;

It is equivalent to typing the word “optimistic”on the public screen.

Data speaks too: The MSCI China index has rebounded by about 15% from its January lows, outperforming other Asian stocks.

Ali and Xiaomi are all rising these days.

03

Why is this happening?

Professionals said: DeepSeek’s core value lies in building a new paradigm of technological self-reliance and open innovation, which has strategic fulcrum significance for China, which is in a critical period of the scientific and technological game.& rdquo;

To put it simply, DeepSeek has actually allowed many people to see another possibility for China’s technological and economic trends.

Teacher Zhao Jian said: The stock market has two sexy narratives, one is the release of money, and the other is the technological revolution.

Among them, monetary easing is a stimulus, and scientific and technological revolution is a driving force.

Why can U.S. stocks get out of the mad cow market in 2023 despite the stormy weather in 2022, and the benchmark U.S. stock index, the S & P 500 index, surged 25%?

ChatGPT was born and is the lead wire.

It marks two points: 1. The curtain on the AI era has begun;2. The United States has become the leader of a new round of AI-driven technological revolution.

The resulting expectations have supported the surge in stock prices of U.S. technology giants: the Nasdaq 100 index soared 55% in 2023, and the top seven companies have contributed 70% of the total increase in U.S. stocks in the past two years.

“Nvidia, the pro-cyclical king, and OpenAI, the creator of ChatGPT, have become the most beautiful boys on the street.

In contrast, China’s technology companies are following closely in AI layout. The Hundred Models War is very lively. The AI Six Tigers are gradually taking shape, but they are always beaten back to their original followers by the torture of how many years China and the United States are different.

The physical disadvantage is one, the chip supply interruption is the second, and the downward cycle drag is the third. Several of them are superimposed. Under the scaling law rule that scale is everything and computing power is seven inches, some of China’s cutting-edge technologies seem to have been blocked, and China’s overtaking space in the AI era seems to have been locked.

Such expectations are difficult to shake the bearish assumptions of the economic peak theory and form strong support to boost China’s asset valuation center.

To put it bluntly, people’s evaluation of your value is based on local debt, the property market crisis, and consumption fundamentals. Your technological competitiveness, in their eyes, is not enough to offset the reverse drag of those problems.

In this context, among the three major global capital flows to Hong Kong A shares (China assets), U.S. stocks (U.S. assets), and gold, hot money will naturally vote with its feet.

In the past three years, the Nasdaq index has risen 74%, and the A-share GEM has fallen 10%.

Originally, this momentum would continue, but facts have repeatedly proved that there will always be counter-trend forces brewing in trends.

04

The driving force for reversal comes from two levels: monetary easing and technological transition.

Last year’s 9 – 24 New Deal injected warmth into Hong Kong A shares.

What followed was that at that time, many investors switched from Anywhere But China to All-in Buy China. At the end of September last year, A-shares ushered in an epic counterattack.

However, later circumstances showed that the stimulating effect would eventually fade.

In addition to strong stimulation, there must also be strong momentum.

DeepSeek has become the person who brings strong momentum, turning the destiny of China’s assets.

In the past few days, DeepSeek has stirred up waves of public opinion that can almost match the volume of discussions stirred up by ChatGPT.

Ordinary people don’t understand the Multi-Head Potential Attention (MLA) and Group Relative Policy Optimization (GRPO) technologies, sparse activation network (MoE) architecture, CPU+FPGA+ASIC hybrid deployment and dynamic Load Balancer algorithm strategies.

But they know that Deep Seek has caused a shock in U.S. stocks and become a global focus, forcing OpenAI to open up the ChatGPT search function for free and cancel the o3 release plan to directly Stud GPT-5, attracting domestic and foreign cloud manufacturers such as Microsoft, Amazon, BAT, and Huawei to access DeepSeek. What does it mean?

Under DeepSeek’s pressure, OpenAI opened the ChatGPT search function to users for free.

What technicians see from DeepSeek may be the multi-point AI explosion of intensive computing power + actuarial algorithm leveraging.

What investment banks see from DeepSeek is the ability of China companies to break through in the face of technological blockade, the catch-up potential of China’s AI after solving the computing power dilemma, and the advanced strength of China’s transformation into a source of technological innovation. From an impact perspective, DeepSeek’s breakthrough value is by no means weaker than the launch of Huawei ‘s Mate60 Pro in August 2023.

As a result, the anchor point of valuation of China’s assets will move to a new direction of technological competitiveness.

For DeepSeek to Hong Kong A shares, there is also room for imagination for OpenAI to U.S. stocks.

It is said that China’s stock market is in a valuation depression. The average P/E ratio of the Shanghai and Shenzhen 300 (less than 13 times) is less than half of that of the Dow Jones and the S & P 500 (more than 30 times); the MSCI China Index has a record P/E ratio discount to the MSCI Global Index of 10 percentage points, close to the bottom of its valuation range.

However, the rebound in valuations cannot be achieved without a strong boost. DeepSeek is an excellent booster.

It is foreseeable that driven by monetary easing combined with DeepSeek, this wave of market will be more stable than the wave since September last year.

Goldman Sachs maintained an overmatched rating on the MSCI China Index, saying that it expects a neutral increase of 14% this year and an optimistic increase of 28%.

Deutsche Bank believes that Hong Kong stock A shares are expected to exceed the 2024 bull market high in the medium term. BlackRock Fund said it remains optimistic about the China market in the next 12 to 36 months.

This is not to encourage investors to run into the market, but to analyze the relationship between technological breakthroughs and market conditions.

It is worth mentioning that even in a bull market, there will be fluctuations. It is nothing more than that before, there were 3 advances and 2 recessions, but now the slow-bull pattern has become 4 advances and 1 recessions under the catalysis of positive factors.

According to the law that the bull market is the main reason for individual investors to lose money, most people will face the following: they do not enjoy the income of entering 4, but bear the price of withdrawing 1.

05

This depends on whether DeepSeek’s breakthroughs can create a more suitable soil and stimulate more innovations from 0 to 1.

“Innovation cannot be planned, but innovation can only grow on an inclusive, open and dynamic soil.

Providing a soil suitable for self-growth for innovation, less offshore fishing and disruption of lights and doors is a place where local governments should reflect on why DeepSeek did not appear locally.

From a corporate perspective, the AI+ opportunities brought about by the rise of DeepSeek will benefit many companies.

Among them, these include those technology giants that cover the most cutting-edge AI models + powerful cloud AI computing power systems + complete AI application software developer platforms. Some institutions have predicted that the grand occasion of global capital flooding into U.S. cloud computing giants (Amazon, Microsoft) in 2023-2024 will also occur among China technology giants.

But for many domestic companies, while sucking dividends, they also need to do more in innovation from 0 to 1.

In an exclusive interview, Liang Wenfeng once said that the United States is good at technological innovation and China is good at applied innovation:

What we see is that China AI cannot always be in a following position. We often say that there is a year or two gap between China’s AI and the United States, but the real gap is the difference between originality and imitation. If this does not change, China will always be a follower, so some explorations cannot escape.

The reason why DeepSeek can ignite the fuse of the outside world to reassess the China market is that it is based on zero-based thinking and has found a new path outside of scaling law, bringing a new path for AI competition.

Only by having disruptive innovation can we stand at the commanding heights. Standing at the commanding heights, industries, and enterprises can be more competitive. This is a law that Apple, Tesla, and Nvidia have all verified.

If China’s mobile phone companies want to reach Apple’s market value and new energy vehicles want to reach Tesla’s market value, I am afraid they must first overcome the hurdle of disruptive innovation. Otherwise, there will be intergenerational gaps and may be hit by dimension reduction.

China technology companies have been accustomed to application-oriented innovation in the past, which corresponds mostly to progressive innovation from 1 to N, rather than disruptive breakthroughs from 0 to 1.

Relying on huge markets and massive scenarios, some industries can also achieve overtaking in corners. But this is ultimately a partial catch-up and will face a growth ceiling. The part outside the local area is still the limitation of the future. Limitations are bottlenecks. To break through bottlenecks, we can only rely on those original innovations to break through. This is what the pain of being stuck in the neck teaches us.

This is not to oppose technological innovation and application innovation, nor to return to the dualistic thinking of hard technology versus soft applications, but to express some hope, as Liang Wenfeng said——

“We believe that as the economy develops, China should gradually become a contributor rather than always being a free rider. In the IT wave over the past three decades, we have basically not participated in real technological innovation. We are used to Moore’s Law falling from the sky, and better hardware and software will come out after 18 months at home. China inevitably needs someone to stand at the forefront of technology. rdquo;

These are nothing more than a restatement of basic principles and are easy to be questioned: That’s easy to say, but why don’t you tell me how to achieve disruptive innovation and how to spawn more DeepSeek?

To be honest, I don’t know the answer, I just know——

If there are more DeepSeek moments, it is better to believe in many specific young people than to believe in the so-called theory of national destiny. Their love, courage, and hard work will bring many unexpected changes.

I believe that the future of China society will not depend on the group of young people who uphold the creed of “Go to Fight” and shout populist slogans on the Internet, but young people like Liang Wenfeng and Wang Xingxing who dare to think and do.