Wen | Wave Wave, author| Xiao Lu Yu, Editor | Yang Xuran

According to disclosures from foreign media The Information, DeepSeek is considering introducing external funds for the first time, and giant companies such as Alibaba and China Investment Corporation have all expressed investment intentions. This news quickly attracted widespread attention in the industry and affected the stock prices of some companies.

DeepSeek officials responded quickly, making it clear that these financing rumors are purely rumors.

Prior to this, there had been a rumor around February 7. At that time, it was reported that Alibaba Investment planned to invest US$1 billion to subscribe for DeepSeek’s equity at a valuation of US$10 billion. The rumor was later refuted by Alibaba.

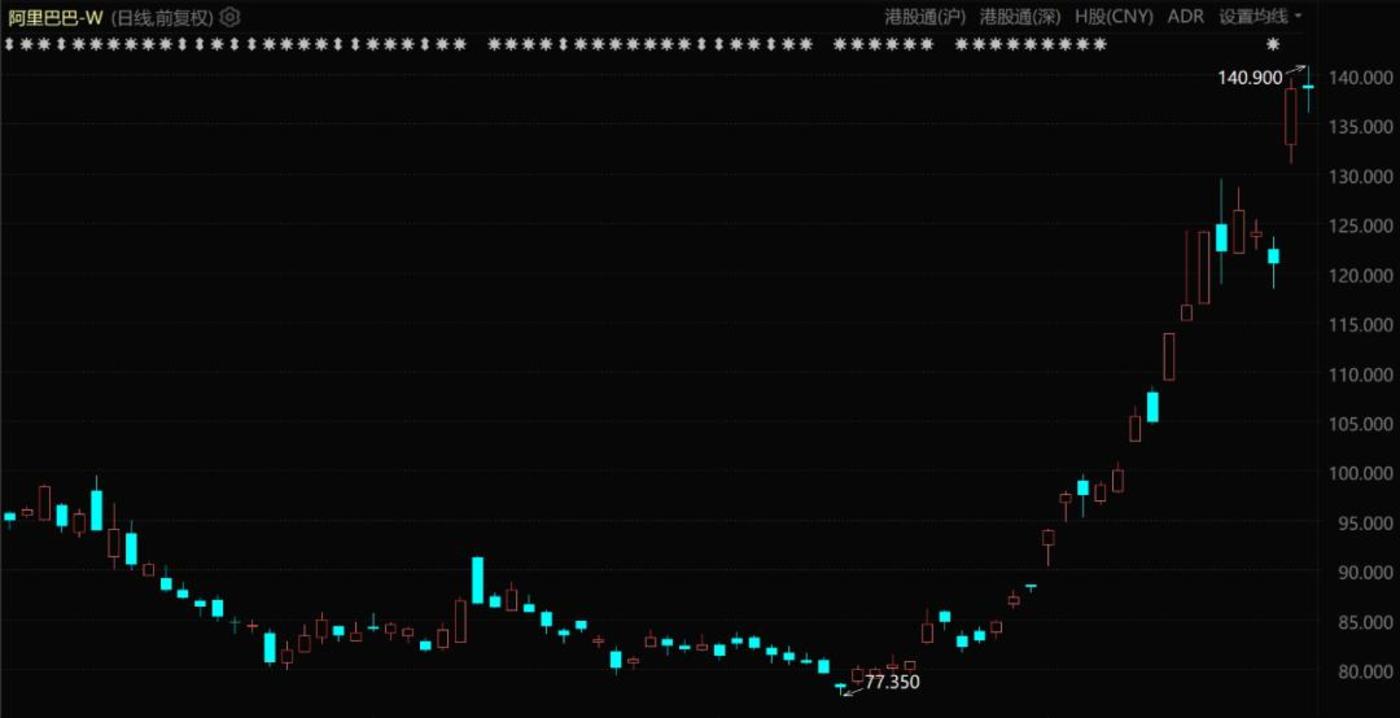

But no matter what, after establishing a seemingly intangible capital relationship with DeepSeek, Alibaba’s share price has been completely ignited by the market, and the big market that has not been seen in years has continued to rise, with no intention of stopping.

Alibaba’s share price performance (since November 2024 to present)

When refuting the rumors, Ali executives particularly emphasized that the two companies are both Hangzhou companies, which in turn strengthens the outside world’s imagination of the implicit connection between the two parties. Whether or not it can really reach equity-level cooperation with DeepSeek, Ali’s face in the capital market has been completely renewed.

There is nothing wrong with Ali using rumors to flaunt his intelligence, but this is not necessarily what DeepSeek wants, let alone what China officials who attach great importance to DeepSeek want.

01 Testing

Ali and DeepSeek have started normal business cooperation, which is to support DeepSeek’s model through Alibaba Cloud’s infrastructure and technology platform, and at the same time improve their own intelligent service levels with DeepSeek’s technical capabilities.

The market may misunderstand this normal business cooperation as a prelude to equity investment.

In addition to the obvious reasons to support domestic products to become bigger and stronger and serve the needs of domestic users well, those who spread DeepSeek financing rumors also have a hidden motive, which is to restructure the AI track valuation system.

The main contradiction facing the current valuation of AI companies is that the research and development costs of large models are extremely high, but the commercialization path is not yet clear, resulting in the complete failure of traditional price-earnings ratio and price-to-sales ratio valuation methods. The market is in urgent need of new indicators (such as single parameter valuation, computing power efficiency ratio), but a consensus has not yet been formed.

Even OpenAI’s valuation is unconvincing.Masayoshi Son invested in OpenAI this year. Many people think that this is just a disguised gift of money to the United States, not because OpenAI is really worth US$300 billion.

Currently, industry experts have huge differences on DeepSeek’s valuation. According to Bloomberg data research and domestic media reports, DeepSeek’s valuation is expected to be between US$1 billion and US$150 billion, with a median valuation of US$2 billion to 30 billion.

More aggressively, it is already benchmarking against half of OpenAI’s valuation, which is about US$150 billion. Based on this figure, Liang Wenfeng can already book the position of the richest man in China.

Based on these remarks and reports, it can be seen that the market has repeatedly hyped DeepSeek to start financing, which may be related to the attempts of domestic and foreign capital forces to conduct some kind of test on the valuation of AI companies through informal channels.

Releasing the false news of Ali’s US$1 billion investment in DeepSeek can not only observe whether DeepSeek is tempted and waiting for its positive feedback, but also see whether Tencent and Byte will follow up or even raise their prices. We can even observe the market’s acceptance of the valuation of artificial intelligence companies through the increase in relevant concept stocks in the secondary market.

As long as the secondary market is crazy enough, the primary market can offer a higher valuation price.

Before the market explores a consensus on the valuation method of AI tracks, this kind of financing rumor hype about DeepSeek may be repeated. Feedback can be obtained by releasing the news. Through feedback, expectations can be judged. By judging expectations, we can find out the true attitudes of all parties towards the artificial intelligence market and valuation.

There was no end to the outside world, but Liang Wenfeng and DeepSeek performed particularly quietly. One of the few appearances was to attend major meetings organized by the central government, such as the private enterprise symposium on February 17.

02 Quiet

It is widely rumored on the Internet that anyone who wants to see Liang Wenfeng now has to go through the approval of the Zhejiang Province government.It is completely impossible for some investors with unclear origins and unclear ownership of their funds to talk about investment in this era of turmoil.

In addition to the government’s tough attitude, Liang Wenfeng and DeepSeek also seem to have no shortage of money at all.

Compared with other AI projects, DeepSeek’s incubation path is quite special. The core purpose is to build a collaborative ecosystem of AI and quantitative transactions, rather than pursuing independent listing exit, and does not even require absolute success in commercialization.

The parent company’s magic square quantification does not need to rely on DeepSeek to make money, but also bears the high labor and computing power costs in the early stage. In 2024, 70% of DeepSeek’s revenue will come from royalties from the magic square system, and no external funds will be required.

Even DeepSeek can achieve cash flow balance through B-side model subscriptions, such as providing quantitative strategy generation services to financial institutions.

However, for C-side customers who use it for free, it is still inevitable to encounter a busy system.

Therefore, in the rumored version of The Information at the beginning, it is said that DeepSeek is considering financing mainly because user demand has increased significantly. The company has launched internal discussions on increasing resource investment to meet user needs, which in turn triggered whether to introduce more investors. issues.

This seemingly reasonable and piercing reason obviously enhances the spread of rumors.

Recently, there has been another situation in the market where the scale of quantitative management of hyped magic squares has shrunk. It seems that DeepSeek has a more sense of urgency to make money, but magic square quantification only responds calmly. This is normal.

For entrepreneurs like Liang Wenfeng, who have strong technological fundamentalism characteristics and have no overseas background, the priority of financing may not be high.

Moreover, judging from the current trend of the government, state-owned enterprises, and schools vigorously promoting DeepSeek, the company can no longer be observed through traditional business logic and the growth framework of Internet companies.

CCTV reports DeepSeek handles government affairs

Since the beginning of the New Year, government systems in many places such as Beijing, Guangdong, Jiangsu, Liaoning, Jiangxi, and Inner Mongolia have been connected to the DeepSeek series of large models, especially the 12345 commonly used by citizens. Futian District of Shenzhen recently launched 70 new smart government employees, which has been directly on hot searches.

It is hard to imagine that if DeepSeek was a company with a complex equity structure and a large amount of overseas capital involved, such a scene would still happen. How official government agencies would dare to use it on such a large scale.

By maintaining a relatively closed equity status, DeepSeek can avoid technical constraints caused by geographical conflicts, technological wars or backstabbing by foreign shareholders by avoiding international capital intervention. It is also more likely to gain preferential access to national computing networks and access to scarce resources such as government data. Tilt.

Therefore, it is not a surprise that venture capital and Internet capital cannot invest in DeepSeek, but it will be a surprise if they actually invest. It’s a pity that China’s top technology companies always seem to be out of reach for ordinary investors.

03 Amendment

At present, the best technology companies in China, including Huawei, DJI, and DeepSeek, seem to have a tendency to avoid listing.Every time these companies bring technological breakthroughs and the imagination of the industry’s prospects cannot be realized in the primary market, market funds will find related targets through the secondary market, even if they are just based on name.

For example, the fermentation of the topic of AI companions has aroused the popularity of Fun Sleep Technology, and its share price has soared by 47% in three days, forcing the company to quickly announce that it currently has no corresponding business in the field of humanoid robot parts.

Although the Hang Seng Technology Index has a criminal record, the business scenarios of large constituent stocks such as Tencent and Ali are strongly related to AI applications after all. They can be regarded as alternative assets that can truly receive the dividends of AI technology breakthroughs at the moment, and they have also welcomed a large amount of funds. The influx.

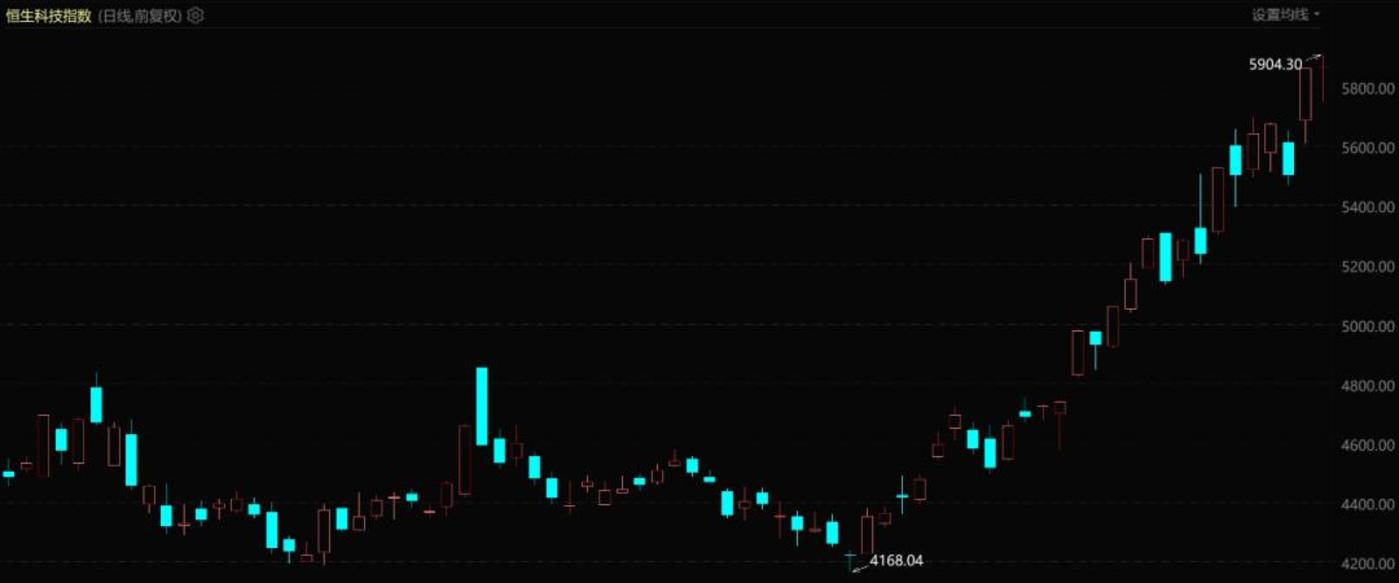

Performance of the Hang Seng Technology Index (since November 2024)

As of February 21, the Hang Seng Index has increased by more than 17% during the year, and the Hang Seng Technology Index has increased by 31.14% during the year. Compared with its low in February last year, the Hang Seng Technology Index has risen 94.93%, and the Hang Seng Index has risen more than 51%.

Buyer sentiment and buying power are important reasons supporting this round of strength in Hong Kong stock technology stocks. Behind the buyer’s sentiment is DeepSeek’s algorithmic breakthrough and cost advantage, which truly shook the market ‘s past fallacy that China’s technology lags behind others. The Hong Kong stock market took the lead in making substantial cognitive corrections.

On the one hand, due to its international nature, the Hong Kong stock market has become one of the few places that can accommodate the high valuations of China technology giants and have regulatory flexibility. Because it connects domestic application scenarios and overseas capital at the same time, Hong Kong stocks can naturally become the main battlefield for domestic and foreign investors to compete with the development prospects of China’s AI.

On the other hand, Hong Kong-listed technology giants not only have AI implementation scenarios, but also have good cash flow and financial performance to support valuation repairs. Their profitability and certainty are much more reliable than most A-share technology stocks.

If Tencent and Ali’s financial reports in the future can reflect the incremental benefits brought by accessing DeepSeek, then even if DeepSeek has not accepted external investment, the imagination of Hong Kong stock technology giants ‘valuation will still become larger.

Tencent products have begun to connect to DeepSeek

The secondary market is turbulent in the spring, as is the primary market.

“Qunhei Technology, one of Hangzhou’s six dragons, submitted its prospectus to the Hong Kong Stock Exchange on February 14, preparing to sprint for an IPO with a heavy burden of losing more than 1.7 billion yuan in less than three years. Yushu Technology, which has previously completed nine rounds of financing, is said to start a new round of financing, and its valuation is expected to exceed the 20 billion mark by then.

It is worth noting that among the many customers who want to subscribe for Yushu’s old shares, 40% come from overseas markets, which fully demonstrates that China’s scientific and technological progress is not just the self-satisfaction of China.

04 Written at the end

“I think the market’s reaction to R1 was Oh, my God, artificial intelligence is over! It fell from the sky and we no longer had to do any calculations!& rsquo; Huang Renxun said, but the truth is just the opposite. rdquo;

However, the U.S. stock market has just experienced Black Friday. The Dow and the S & P 500 fell 1.69% and 1.71% respectively, both of which hit the biggest one-day declines this year. Nvidia’s share price also fell 4.05% that day. On the contrary, Chinese stocks bucked the trend and rose. The China Golden Dragon Index closed up 1.65% on Friday.

Nasdaq Index Performance (since November 2024 to present)

Investors ‘worries about American technology companies are obviously increasing, and Huang Renxun’s leniency has not been demonstrated in the capital market.

On the one hand, this concern stems from the chaos in U.S. domestic and foreign affairs, and on the other hand, it stems from the emergence of DeepSeek, which exposes the assumption that some U.S. technology companies monopolize the world and technology.

The emergence of DeepSeek in China is bound to trigger a round of chaos in the valuation of global technology assets. In the future, those whose value needs to be repeatedly demonstrated include not only Nvidia and several major American technology giants, but also a number of China technology companies and DeepSeek itself.