Article source: Alphabet List

Image source: Generated by AI

Image source: Generated by AI

Tencent Yuanbao, which is bound to DeepSeek, is putting more pressure on Byte.

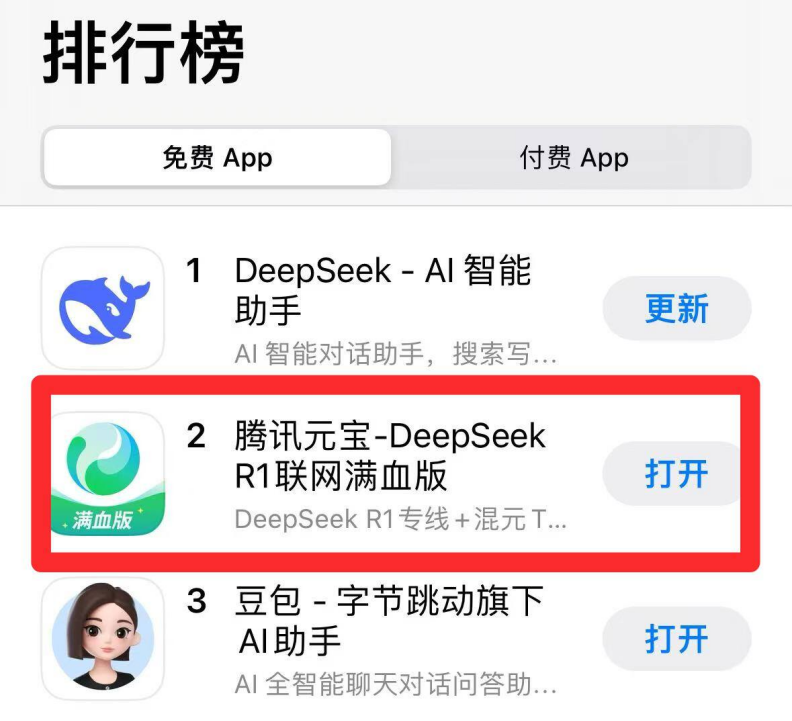

Ten days after connecting DeepSeek, starting from February 22, Tencent’s AI application “Tencent Yuanbao” has surpassed Byte’s AI application bean bag and leapt to second place in the free APP download list of the Apple App Store in China, and has remained so far.

Picture note: Tencent Yuanbao downloads exceed bytes of bean buns Source: Screenshot of Alphabet List

“When I came back at the beginning of the New Year, I heard that the product managers of Tencent’s C-side business were going to switch to AI product managers. I just didn’t expect Tencent to move so quickly.” Chen Ming (pseudonym), an employee of a large model business group in Byte, toldAlphabet List (ID: wujicaijing)At the end of the holiday and while working overtime internally to develop the reasoning model, no one expected Tencent, which has always been Buddhist, to act so violently this time.

However, compared to the huge discussion caused by DeepSeek R1 within bytes, Tencent’s T1 reasoning model does not seem to be “not enough”. Tencent did not appear too much in the chat in the pantry. They believed that“If there is a large reasoning model in China that can catch up with or even surpass DeepSeek R1, it must be bytes.”

And byte’s goal is to “surpass”.

Some relevant sources revealed to Alphabet that the large reasoning model developed by Byte is expected to be launched at the end of March. At the same time, last year, bean buns had already washed out the chatter traffic and turned to large quantities of bean buns that were put into circulation through stations B and other channels, and decided to postpone the release.

In this regard, the Alphabet List confirmed to Byte, which did not confirm the specific release time of the self-developed reasoning model, but pointed out that bean bags did not wash out chatter traffic.

On the other hand, Tencent’s entire family has been connected to DeepSeek one after another. WeChat, which has always been restrained, frequently promotes Tencent Yuanbao. In the WeChat circle of friends, Station B opens the screen page, and even the main page of Tencent Meeting hangs an advertisement for Yuan Bao.

“Tencent’s best DeepSeek experience is in Tencent Yuanbao”, which has become the new slogan for Tencent’s large-scale model C-end business. According to DataEye data, before February 15, the amount of materials released by Doubao and Kimi exceeded Tencent Yuanbao by 2-3 times. Subsequently, from February 18 to 23, Yuanbao’s volume of materials increased by 345.1% month-on-month. Tencent took over from Byte and rushed towards the next big technology company to invest money.

Byte was also pushed to the corner step by step by Tencent, which accelerated its embrace of DeepSeek.Before DeepSeek’s popularity, Doubao was a well-deserved star product for C-side applications in the past year, but now, Yuanbao, which has come from behind, is taking away some of the dazzling aura belonging to Doubao.

If DeepSeek ranked above it before, Byte can still regard it as an emergency, but now it isAfter Tencent took advantage of DeepSeek’s east wind to overtake Doubao again, the competition narrative of big models was officially upgraded to an application competition among major technology companies.Since the era of mobile Internet, Tencent and Byte, two companies that also rely on products to make their way out of the circle, have repeatedly clashed at the application level.

It can be imagined that the news that Tencent Yuanbao overtook Doubao will continue to amplify the vibration and impact on the inside of the byte.

The rise of DeepSeek is tantamount to awakening Zhang Yiming and Byte from their dream of victory in Doubao over the past year. Now, Ma Huateng, supported by Liang Wenfeng, has completely pushed Zhang Yiming into a corner, and it may be time for byte to take action.

a

In the face of Tencent Yuanbao’s attack, the most direct and effective counterattack left for Byte is to launch a new self-developed reasoning model as soon as possible.

"Tencent Yuanbao iterates 5 versions a week, from following Buddhism to walking fast. Tencent is not only trying to absorb the overflow traffic from WeChat AI search, but also betting that it cannot come up with a new reasoning model in a short period of time. quot; An algorithm engineer from a leading Internet company told Alphabet that Tencent had undoubtedly targeted the gap before the launch of the Byte Self-developed Reasoning Model.At this time, money is wasted to push gold ingots and his own T1 reasoning model is pushed hard, and the time difference is caused.

Judging from the results, Tencent’s time lag strategy has achieved certain results.

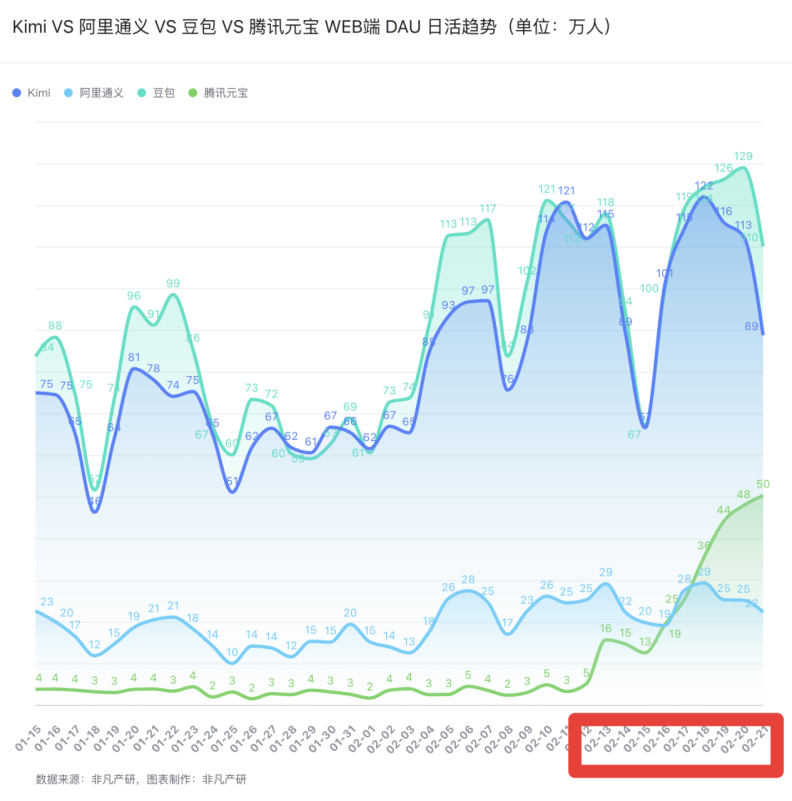

According to extraordinary industry and research data, Tencent Yuanbao announced its access to DeepSeek on February 13. To February 21, the daily activity on the web continued to rise. On February 21, Yuanbao’s daily activity data reached 500,000 people. In less than 10 days, Tencent Yuanbao’s daily activity has reached nearly 1/2 of the average daily activity of Byte Bean Bag. In Apple’s free APP download rankings, it successfully surpassed Doubao and jumped to second place.

Picture note: Bean Bao VS Tencent Yuanbao web end daily activity trend chart source: Extraordinary Industry Research

While Tencent’s T1 reasoning model is already in the internal testing stage, and Tencent Yuanbao is quickly draining the water by binding DeepSeek, Baidu has also announced that it will launch a new large model in the next 4-5 months. Ali has officially announced that it will invest in the next three years. More than 380 billion yuan to realize the AGI dream.

Big technology companies have embarked on a new arms race, and now only a few bytes remain and no new plans have yet been announced.

"Since the Spring Festival rework, I have been working overtime to develop a large reasoning model by myself. quot; Chen Ming said that the Byte office building located in Dazhong Temple in Beijing houses Byte’s Douyin business team and Volcano Engine business team. Even after 10 p.m. on the weekend, the entire building is still brightly lit.

As for the appearance of the byte self-developed reasoning model, one thing that can be clear is that the internal requirements are to align with or even exceed DeepSeek R1.

Recently, the Byte Bean Bag Big Model team also took timely action.

According to reports, Seed, the core department of Byte’s cutting-edge research on internal positioning, is rapidly adjusting its positioning and has just introduced Wu Yonghui, a big cow from Google who participated in the development of Gemini. Wu Yonghui will become Seed’s new technology leader, while Zhu Wenjia, the former general manager of Seed, will be in charge of the application side. In addition to adjusting the division of business divisions, Byte also proposed a new sparse model architecture UltraMem.

According to public data, the newly proposed architecture by the Doubao team has 2-6 times faster reasoning speed than the MoE architecture, and the reasoning cost can be reduced by up to 83%. Faster and cheaper, Byte seems to be deliberately targeting DeepSeek’s comfort zone.

However, although launching a new self-developed reasoning model as soon as possible like Musk is Byte’s best response strategy, it relies onIn addition to the drainage of technological innovation, Byte has another path to catch up with Yuanbao, which is to continue to rely on spending money to invest.

Previously, Doubao had been in the market for nearly half a year by relying on Douyin’s exclusive streaming advertising. Through investment regardless of cost, Byte has successfully made Doubao a domestic leading AI APP with a monthly income of 70 million yuan.

However, whether such high-intensity launch can continue in 2025 will undoubtedly be a question mark.

After all, although launch is quick, it costs money. According to AppGrowing data, in the second half of last year, Kimi, the most successful investor, invested more than 500 million yuan in total, and the amount invested in October alone exceeded 200 million yuan. The one that is most closely pursued is Doubao, with more than 400 million yuan invested in the same period. Even for the wealthy byte, it faces the dilemma of entering a growth bottleneck and becoming increasingly expensive to invest.

According to reports, investors ‘dark side recently decided to significantly reduce Kimi’s product launch budget. Whether to continue to burn money and invest money regardless of the cost, or to follow up and adjust the release policy, there are new choice questions in front of us.

Compared with Tencent’s glory after being blessed by DeepSeek, its past achievements have now been transformed into the shackles of connecting to DeepSeek–How much attention was paid to Doubao before, but now it is difficult to connect to DeepSeek.

While Tencent’s entire family is gradually connected to DeepSeek, Byte seems to prefer B-side businesses to embrace DeepSeek.

Recently, Byte Volcano Engine announced the launch of the R1 API giveaway. As a DeepSeek R1 model API provider, Byte encourages users to invite more friends to register and gives away vouchers of up to 145 yuan, which can deduct 36.25 million tokens for free.

However, although Byte is willing to spend money on B-terminal updates, there has been no news of connecting DeepSeek to its own fist C-terminal products, whether it is Douyin or Doubao.

Unlike Tencent, which has been quite Buddhist in the development of AI models and has never even pushed a C-side APP in its own WeChat traffic pool, the Byte All in AI stance is quite radical.In other words, the burden of bytes is too heavy.

Previously, in order to seize the lead in the big model chase, Byte was poaching people everywhere and throwing money to promote bean buns.

Take Wu Yonghui, who was recently announced to join Seed, the core AI department of Byte, as an example. Although it has not been exposed to poaching chips, in terms of his position,”the annual salary must exceed 10 million, and a large proportion of it will be represented in stocks.” said Xing Ze, founder of Jiaming, a headhunting company that serves large factories.

At the same time, in order to feed soybean buns, Byte almost turned Douyin into the exclusive traffic field for soybean buns.

On March 18 last year, Douyin issued a huge amount of advertisements to restrict AIGC software streaming. From April 2 to the end of the year, no one in non-byte products could use the huge traffic pool of Douyin and Headlines. Since August last year, although the release scale of bean buns is smaller than that of Kimi, Zhipu, Hoshino and other products, the average monthly download volume is nearly 6 million times, and it has quickly become a top application with 70 million monthly live applications.

In the field of e-commerce, Douyin can still take care of its own family while making money from friends. In order to catch up with bean buns, the huge number of bytes has become the first platform to restrict the release of other similar products.

With such a large investment, it has become even more difficult for the elephant byte to turn around.

When Baidu, which is also a major technology company that also insists on self-research and rarely invests in other large model companies, began to connect DeepSeek to its main C-side application, Byte’s insistence on not connecting DeepSeek is ushering in the outside world. More questioning eyes, at the same time, more pressure is also pouring to Byte and Zhang Yiming.

three

However, it should be noted that this AGI battle is still far from over, and a temporary lead is still difficult to determine the victory. Both Tencent and Byte have their own opportunities and challenges.

Although Tencent has shown its momentum of catching up in the competition for C-end users by binding DeepSeek. However, it should be noted that Byte still has a certain lead in multimodal technical layout.

As Tencent’s first AI product to connect to the DeepSeek R1 model, Yuanbao provides functions including AI search, intelligent document processing, AI music recommendation, AI map navigation and smart assistant.

But in contrast, Byte has been deeply involved in the field of Wensheng video for a year last year. Not only did it launch Instant Dream AI and Quick-Hand Kinetic Play, but it also recently launched VideoWorld (open source video model), which means it does not need to rely on any reinforcement learning search or reward function mechanism to perform tasks, such as reaching professional 5 stages of 9×9 Go.

Not to mention, Byte has already established a firm foothold in the B-end market through clipping. For later DeepSeek and Tencent, Byte still has a time advantage.

At the same time, according to a report by Bloomberg on February 21, considering the potential of bean buns, SoftBank Group’s Vision Fund will raise the valuation of Byte to more than US$400 billion in December 2024. From a valuation of US$300 billion last year to US$400 billion this year,Despite the impact of newcomers such as DeepSeek, the outside world is obviously still optimistic about Byte’s profit space in the AI era.

For DeepSeek, in order to maintain its leading level of technology and continue to maintain technological iteration, its research and development difficulty will undoubtedly increase exponentially. Whether new models in the future can continue to provide amazing experiences like R1 is full of unknown.

For Tencent, which has laid out a multi-modal model itself, if the traffic overflowing from DeepSeek is to truly survive, it also needs to let its own research and development progress catch up with bytes as soon as possible and catch up with DeepSeek in terms of model performance.

There is no absolute winner in the war surrounding the cognitive revolution for the time being, but it is destined to redefine the next decade of major technology companies. For the 800 million daily Douyin users, what they are about to witness may be the most dramatic paradigm shift in history.