① In the early morning of Saturday (February 15), Beijing time, Hillhouse’s fund management platform HHLR Advisors, which focuses on secondary market investment, released its 13F report as of the end of the fourth quarter of 2024.

② The overall position situation still shows HHLR Advisors ‘continued focus on China assets.

Cailian News, February 15 (Editor Xiaoxiang)In the early morning of Saturday (February 15), Beijing time, Hillhouse’s fund management platform HHLR Advisors, which focuses on secondary market investment, released its 13F report as of the end of the fourth quarter of 2024.

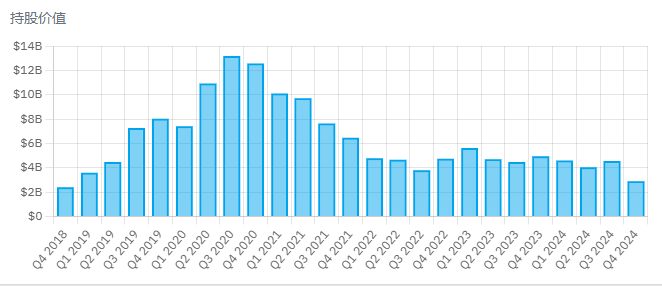

Data showed that the total market value of HHLR Advisors ‘holdings decreased significantly in the fourth quarter, from approximately US$4.6 billion in the third quarter to approximately US$2.9 billion. Currently, U.S. stocks are at historical highs. In addition to locking in earnings, HHLR Advisors ‘relevant adjustments to positions in the fourth quarter may also be considered to control risks.

It is worth mentioning that although HHLR Advisors has reduced its holdings of some Chinese stocks that have risen sharply before, the overall position still shows HHLR Advisors ‘continued focus on China assets.

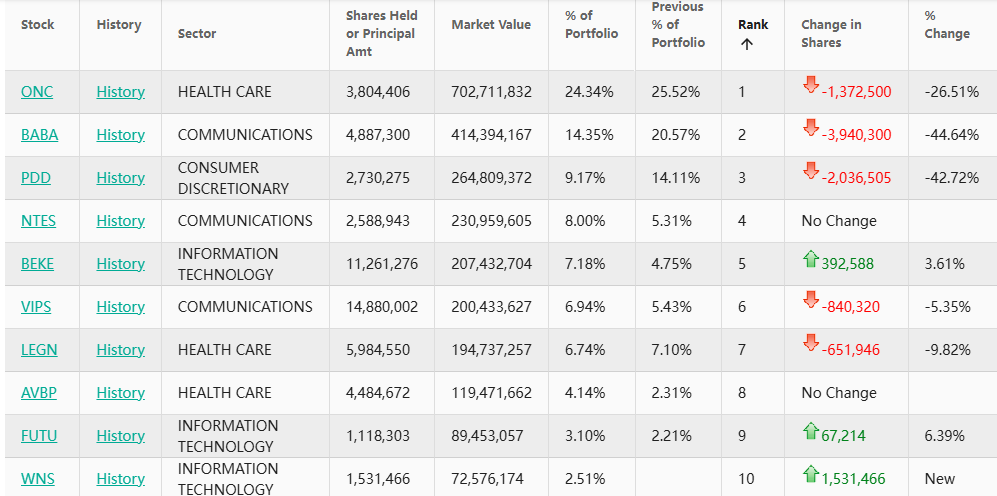

Overall, among HHLR Advisors ‘top ten positions in the fourth quarter, the number of Chinese stocks still accounted for as many as eight positions.

Among them, the rankings of Baekje Shenzhou, Alibaba and Pinduo have not changed-they still occupy the top three positions.

Other mid-listed stocks among the top ten heavy positions include Netease, Shell, Vipshop, Legendary Biotech and Futu Holdings.

The only two are not the top ten biggest positions in the China Stock Exchange: Biopharmaceutical company ArriVent BioPharma and Business Process Management WNS.

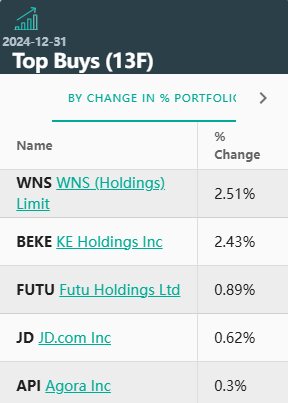

Among them, WNS was a new stock purchased by HHLR Advisors in the fourth quarter, but this time it entered the top ten heavy positions list. The company, a business process management company headquartered in Mumbai, India, has risen more than 30% since mid-January.

Trend of China Stock Exchange

Among the four stocks newly purchased by HHLR Advisors in the fourth quarter, 2 were Chinese stocks, namely Shengwang and Momo.Among them, HHLR Advisors purchased a total of more than 2.09 million shares of Sound Network during the quarter, accounting for 1.98% of its investment portfolio.

In the fourth quarter, HHLR Advisors also increased its holdings of 10 stocks, of which as many as 4 were mid-listed stocks.– -Shell, Futu Holdings, Jingdong and Dada Group respectively. Among them, HHLR Advisors increased its holdings of 392588 shells in the quarter, a month-on-month increase of 3.61%; the number of shares it increased in Futu Holdings was 67214, a month-on-month increase of 6.39%.

The performance of these newly added and increased Chinese stocks may have brought considerable returns to HHLR Advisors.

Market data shows that the growth rate of Sound Network since the end of September 2024 has exceeded 200%. Since the fourth quarter of 2024, Futu Holdings has also experienced the highest increase of more than 100%.

In terms of reducing holdings, HHLR Advisors reduced its holdings of a total of 11 stocks in the fourth quarter, including heavy positions such as Baiji Shenzhou, Alibaba, Pinduo, Ctrip and Sohu that performed well in the early period.

Baiji Shenzhou is the largest holding stock of HHLR Advisors, and its related investments can be traced back to 2014. HHLR Advisors participated in and supported eight rounds of financing from Baiji Shenzhou, holding positions for more than 10 years. In the fourth quarter of last year, HHLR Advisors reduced its holdings of Baiji Shenzhou (-1,372,500 shares), which actually coincided with Baiji Shenzhou’s share price reaching a one-and-a-half-year high-from April to October last year, the stock rose by more than 80%.

Some other Chinese stocks that have reduced their holdings also have similar characteristics as stock prices rise to stage highs.

Overall, judging from the newly disclosed 13F documents, HHLR Advisors ‘new and increased companies in the fourth quarter of last year covered many fields such as technology, renewable energy, high-end equipment manufacturing, and integrated circuits, reflecting its diversified investment strategy layout.