① BlackRock Fund executives have changed again. Hong Xia, the company’s deputy general manager, left office due to personal reasons. BlackRock has undergone many executive changes in the past two years;

② As of February 21, the total number of people involved in senior management changes during the year was 29, with a total of 20 fund companies;

③ Many of BlackRock’s active equity funds are still losing money since their establishment.

Cailian News, February 22 (Reporter Wu Yuqi)As one of the world’s largest asset management companies and the first wholly foreign-funded public fund institution in China, its trends have been closely watched by the market.

Recently, BlackRock Fund executives changed again. Hong Xia, the company’s deputy general manager, resigned on February 14 due to personal reasons. According to her resume, Hong Xia joined BlackRock Fund as sales director in 2021 and served as deputy general manager of BlackRock Fund in April 2023.

A reporter from the Financial Union found that BlackRock Fund currently has only one deputy general manager, Yang Yi. Looking at the longer timeline, starting from 2023, BlackRock Fund’s management has undergone frequent changes, and many senior executives have resigned. In addition, the performance of BlackRock Fund’s products was flat, and the earliest active equity products were still losing money.

Wind data shows that in 2025, changes in senior management of public funds will continue. As of February 21, the total number of people involved in senior management changes during the year was 29, with a total of 20 fund companies. Among them, the number of chairman changes is 1, the number of general managers is 6, and the number of deputy general managers is 14; the number of chief inspector and chief information officer changes is 3 and 6 respectively.

Another senior executive leaves at BlackRock

Foreign-funded BlackRock funds have once again experienced executive changes. The announcement shows that Deputy General Manager Hong Xia has left office due to personal reasons. The departure date is February 14, 2025, and the term of office is less than two years. It is worth mentioning that at present, only Yang Yi is the only deputy general manager with a technical background and serves as the chief operating officer in BlackRock Fund.

Data shows that Hong Xia joined Fund Management Co., Ltd. in 2021 as sales director; she has served as channel business director and international business director of Shanghai Investment Morgan Fund Management Co., Ltd., general manager of business management department of Haifutong Fund Management Co., Ltd., and Fuguo Fund Management Co., Ltd. Senior channel manager and customer service director of Shanghai City Branch.

According to a reporter from the Financial Union, during her tenure at BlackRock Fund, Hong Xia was mainly responsible for the market and operations sectors, and led the construction of BlackRock’s retail channel system in China. However, with his recent departure, industry insiders speculate thatThis may imply BlackRock’s need to restructure its executive team during a strategic transition period.

Looking at the longer timeline, BlackRock Fund has experienced many executive changes, with many management changes in 2024 alone. In July of that year, BlackRock Fund announced that Lu Wenjie would step down as deputy general manager and chief investment officer on July 31 due to work adjustments. At the same time, he would step down as BlackRock’s long-term vision and BlackRock’s advanced manufacturing fund manager held for one year.

In February 2024, Fan Hua, the former general manager of BlackRock CCB Financial Co., Ltd., became the chairman of BlackRock Fund and concurrently served as the head of BlackRock Group’s China region; in February, Zhang Chi, the company’s first general manager, also resigned from the position of general manager due to personal reasons; in March, Chen Jian, the former inspector general of the company, was promoted to general manager, and in August, Xie Chao was appointed inspector general. In July 2023, Zhang Pengjun, the former deputy general manager of the company, resigned due to internal work arrangements; in August of the same year, Tang Xiaodong, the former chairman of the company, announced his resignation due to personal reasons, and General Manager Zhang Chi took over the position of chairman.

Some BlackRock’s public offering products have still suffered losses since their establishment

In just two years, the management has experienced a major reshuffle. Can frequent changes of senior executives “save performance”?

In 2021, BlackRock was approved a public fund business license, officially becoming the first foreign asset management company approved to conduct public fund business solely in China.

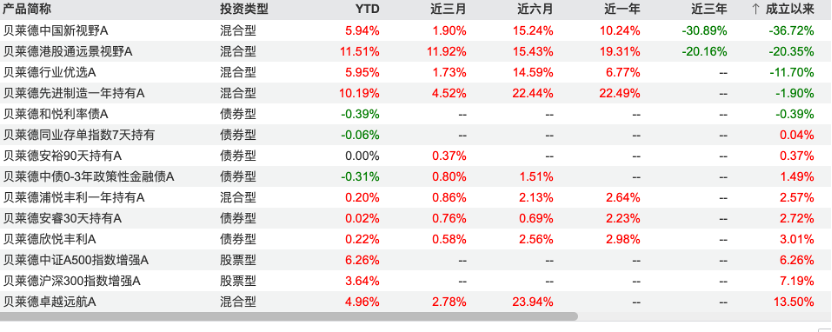

For the first wholly foreign-owned public offering to enter China, investors have always had a “halo” about BlackRock funds, but many of its active equity products have performed poorly. As of now, Wind data shows that BlackRock Fund has a management scale of 12.336 billion yuan and manages a total of 14 public funds, including 2 equity funds, 6 hybrid funds and 6 bond funds.

In terms of performance, BlackRock’s China New Vision, which was first established, is still losing money. In its fourth year of establishment, the return rate was-36.72%. Another BlackRock Hong Kong Stock Connect Vision has suffered losses since its establishment. 20.35%. In addition, active equity products such as BlackRock’s industry preference and BlackRock’s advanced manufacturing for one year have lost profits since its establishment.

A citizen who owns BlackRock’s fund products told a reporter from the Financial News Agency,”At the beginning, the market was in full swing. I invested 20,000 yuan, hoping to earn some income from foreign investment. I didn’t want to hold it for more than two years and still lose 20%. I am still in deep hedging.”

In addition, BlackRock’s index base and debt-based base have performed relatively well. For example, BlackRock’s outstanding voyage has returned 13.50% since its establishment, and the BlackRock’s Shanghai and Shenzhen 300 Index has strengthened to 7.19%. Except for BlackRock and Yue Interest Rate Bonds, the other five bond funds have achieved positive returns since their establishment.

Judging from recent voices, BlackRock is still optimistic about the China market. Lu Wenjie, investment strategist for BlackRock Greater China, analyzed that for the China market, global investors believe that China policies will have bottom protection. Under such circumstances, BlackRock holds a tactical “overallocation” view of China stocks.

Song Yu, chief China economist at BlackRock, said: Today’s China is not only a follower and imitator of innovation, but also a leader in innovation. China’s current business environment is relatively friendly to technological innovation: complete infrastructure, solid industrial foundation, huge market, and rich application scenarios. Moreover, the success of a big language model that requires massive data training makes me more confident in China’s non-manufacturing technological innovation.

Stay optimistic about the medium-term China market in the next 12 to 36 months, and be optimistic about China stocks and interest-rate bonds. Shen Yufei, chief equity investment officer of BlackRock Fund, said that from the perspective of global asset allocation, the most optimistic investment opportunities in A-shares in 2025 will be A-share Beta and Hong Kong stock Alpha.

Recently, rumors of “abandoned buildings”

In addition to executive changes and performance losses, BlackRock has recently been caught in the rumored turmoil of “cutting off its supply and abandoning its building.”

According to sources, a fund under the U.S. asset management company BlackRock decided not to repay a loan for an office building project in Shanghai and handed over the relevant assets to Standard Chartered Bank. The syndicated loan was previously led by Standard Chartered Bank and expired at the end of September last year.

The office building is located in Changfeng Building E and G on the north bank of Putuo District, Shanghai, with a total floor area of approximately 27,800 square meters. Previously, BlackRock’s funds had extended the loan for one year when the loan expired in 2023. After the first extension, BlackRock refused to extend the second time and completely abandoned the office assets in Shanghai.

On-site investigation by a reporter from the Financial Union found that the above-mentioned office buildings are still operating normally, but there are very few companies in the office buildings, and the overall occupancy rate is extremely low. The rent of the office building cannot cover the loan interest or one of the reasons why BlackRock “cut off the mortgage and abandoned the building”. As of press time, the relevant departments of BlackRock had not responded to this matter.