Ali’s three major battles in 2025: AI, e-commerce, and instant retail.

Ali, I’ve recovered with AI

author| Fixed focus One Su Qi

At the beginning of 2025, Ali has a great chance of turning around.

The Spring Festival is the off-season for e-commerce sales, but Ali frequently goes out of the circle because of AI. First, influenced by DeepSeek, Ali Tongyi Qianwen, which is also a large open source model, attracted attention; then on the first day of the New Year (January 29), Ali released the latest model Qwen2.5-Max, which was evaluated and its performance surpassed DeepSeek V3.

After the construction started, on February 11, heavy news that Ali and Apple had reached a cooperation on AI business came out, and the market’s enthusiasm for Ali reached a higher level.

AI is a story that Jack Ma has told for many years, and now Ali has finally relied on it. Internally, Intelligent Cloud Group has shouldered the banner of company profit growth; externally, AI has stopped Alibaba’s share price from falling. Since the release of Qwen’s latest model, Alibaba’s share price has risen by more than 36%, with the latest closing price of HK$120.9/share., the market value soared by HK$800 billion to HK$2.3 trillion.

AI is also the direction that Wu Yongming vigorously promotes. Since he became CEO of Alibaba Group in September 2023, he has identified two strategic user priority and AI-driven, and has made many adjustments to Alibaba throughout 2024.

On February 20, Ali’s latest financial report was a test of the results of this year.

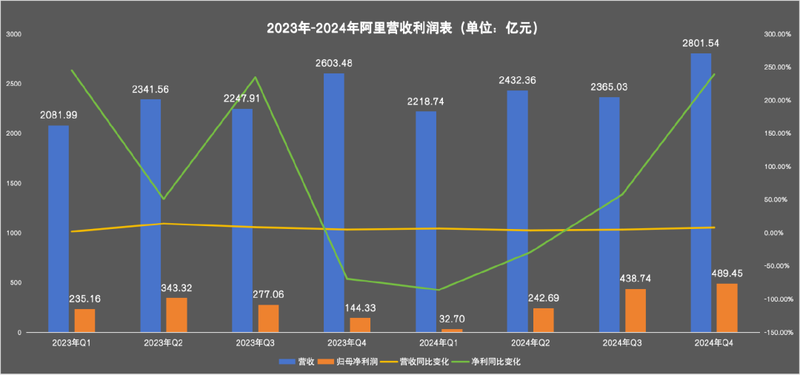

The financial report shows that Ali performed steadily in Q4 in 2024, with revenue increasing by 8% year-on-year to 280.154 billion yuan, and net profit attributable to the parent company increasing by 239.12% year-on-year to 48.945 billion yuan. For the whole year of 2024, Ali’s revenue was 981.767 billion yuan and its parent’s net profit was 220.3 billion yuan.

On February 17, Jack Ma appeared at a major private enterprise symposium, attended by a group of star private entrepreneurs in the technology, manufacturing, and retail industries. This is regarded by the outside world as a sign that Ali has set off again and turned defense into offense.

Ali, which has returned to its main e-commerce business and has undergone several adjustments, has brought a new atmosphere to its AI business at the beginning of the year. Can e-commerce business create growth in 2025, and how will non-core businesses perform in 2025? Let’s wait and see.

Ali came back

Judging from the revenue in 2024, Alibaba’s revenue performance in each quarter is better than that in 2023, but the growth is not much, with an average growth rate of around 5%.

At present, the Alibaba ecosystem includes five vertical and two horizontal. The five vertical are China commerce (accounting for 43.99% of revenue), international commerce (accounting for 12.20% of revenue), local life (accounting for 5.49% of revenue), Da Entertainment (accounting for 1.76% of revenue) and others (accounting for 17.17% of revenue). The two horizontal refers to the two major infrastructure businesses of Cainiao Logistics (accounting for 9.13% of revenue) and Cloud Intelligence (accounting for 10.26% of revenue). In addition to other businesses, the top three companies in terms of revenue are Taotian Group, International Digital Commerce, and Cloud Intelligence.

These seven major businesses can be divided into three levels.

The first is cloud intelligence and international business. They are well-deserved growth engines. One ensures profit growth and the other ensures revenue growth, becoming the core driving force.

Among them, Cloud Intelligence Group remained profitable and had the fastest profit growth among the seven major businesses in the first three quarters of 2024, with year-on-year growth of 45%, 155% and 89% respectively. By the fourth quarter of 2024, Cloud Intelligence Group will still be profitable, with an adjusted EBITA of 3.138 billion yuan, a year-on-year increase of 33%, ranking third in growth rate.

Regarding the reason for the decline in profits, the financial report explained that part of the profits were offset by customer growth and increased technology investment. Judging from the latest large model released by Alibaba Cloud during the Spring Festival, there should be a lot of investment behind it.

In addition, the international digital business group led by Jiang Fan has the highest revenue growth rate for four consecutive quarters in 2024, with year-on-year growth of 45%, 32%, 29% and 32% respectively, mainly driven by AliExpress and Trendyol (Turkish e-commerce retail platform). Driven by revenue growth.

Secondly, there is China business with Taotian Group as its core. It is Alibaba’s most stressful and most adjusted business in 2024. Its year-on-year revenue growth has stalled in almost all four quarters of 2024, at 4%,-1%, 1% and 5% respectively.

In order to resist competition from competitors, Ali had followed up with a low-price strategy. As a result, advertising fees and commission fees could not rise, which caused Ali’s customer management revenue to plummet. The solution given by Ali is to increase revenue by adjusting the charging policy, and announced that starting from September 2024, the original fixed fees will be adjusted to dynamic GMV charges.

This series of adjustments did have an effect, because of online GMV growth and the year-on-year increase in Take rate (thanks to the impact of basic software service fees), Alibaba’s customer management revenue grew from 1% in mid-2024 to 9% at the end of the year. However, this growth rate is still ranked second to last among the seven major groups, and Taotian Group still has a tough battle to fight.

The third is that local life groups, including Gao De and Emailo, are facing the important task of turning losses and coping with industry competition.

The local life business has been ranked among the top three in revenue growth in the four quarters of 2024, but it has only reduced losses but not turned losses for more than ten consecutive quarters. The reason behind this is that competition in the industry has intensified and subsidies, investment and other costs have not been low. However, in the fourth quarter of 2024, its adjusted EBITA was a loss of 596 million yuan, which has been significantly reduced from a loss of 2.1 billion yuan in the same period in 2023. The group may be expected to turn a loss into a profit in 2025.

This year, the instant retail track is becoming more and more popular, and the local lifestyle business needs to bear the pressure of competition.

Overall, Ali has recovered in 2024:

In terms of profits, it recovered the decline in parent net profit in the first quarter and hit new highs in the third and fourth quarters. Among them, the profits of Taotian, Smart Cloud and Cainiao all hit new highs for the whole year in Q4 of 2024.

At the business level, it sold part of the retail business that continued to lose money, stabilizing the fundamentals of domestic e-commerce, and at the same time, the growth engine performed well.

At the stock price level, Ali’s price will continue to rise in 2025, rising by more than 36% since February.

The global layout of e-commerce and the development of AI business have become the key to Alibaba’s performance growth in 2025. The capital market has finally no longer valued Ali just based on its e-commerce business, but has transformed into technology + e-commerce.

Years of investment in AI have finally yielded results, and international e-commerce has burned money while booming.

In this financial report, the outside world is most concerned about Ali’s performance in AI.

On the one hand, the emergence of DeepSeek has attracted people’s attention to the competitiveness of the open source model, and also made people realize that the status of the Tongyi Thousand Questions Model in the open source ecosystem is far underestimated. On the other hand, Apple chose Ali as a partner to develop artificial intelligence functions for the China version of the iPhone, once again boosting Ali’s industry position.

Investors in the technology industry told Focus One that Apple has very strict requirements on suppliers and chose Alibaba over DeepSeek or other companies because of its end-cloud hybrid capabilities, customer service capabilities and multi-modal capabilities of the large model. It is a more comprehensive strength.

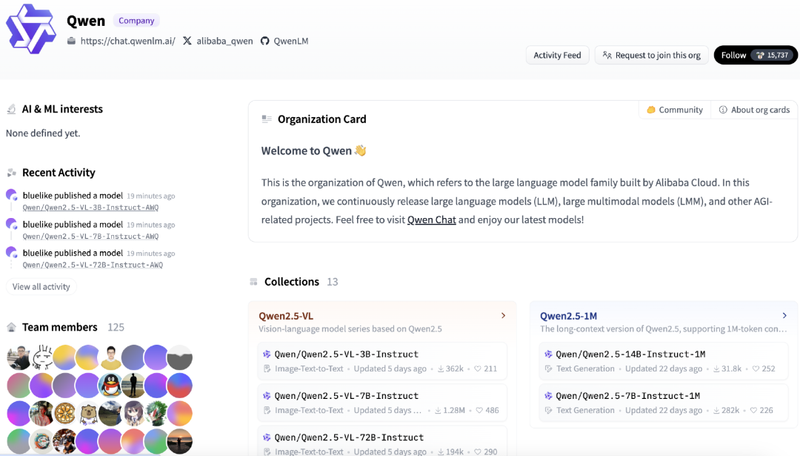

In the well-known open source community Hugging Face, you can see that as one of the earliest companies to deploy large models, the Alitong Yiqian series of models covers a variety of large language models and multimodal models. In terms of model performance, its recently released Qwen 2.5-Max has demonstrated comparable performance with mainstream models such as DeepSeek V3, o1-mini and Claude-3.5-Sonnet in multiple authoritative benchmarks.

Photo source/ Hugging Face

In addition, the combination of large model + cloud infra+ computing power allows Ali to deploy Apple in end-cloud hybrid, and there is also a complete engineering team to provide customer service and technical support. Ali also has a huge consumption based on e-commerce and local life businesses. and payment databases, these are Ali’s advantages.

Alibaba Cloud has invested a lot of manpower, material and financial resources in infrastructure construction in the past, making it a cloud infrastructure provider and major investor in many large domestic model companies. Among the six big domestic models, Alibaba has invested in Intelligent Spectrum, MiniMax, Dark Side of the Moon, Baichuan Intelligence, and Zero Everything. While Alibaba Cloud helps them train large models, it is also being fed back and iterated.

Years of AI layout have finally paid off. Many industry insiders believe that Tongyi Qianwen’s influence and reputation in the mass market are less than those in the developer community because Ali lacks large-traffic AI applications. However, since the beginning of this year, Ali has begun to develop its AI To C business (mainly planned by Quark) and explore directions such as AI glasses.

Like the AI business, what represents Ali’s future growth space is its international business business. This business has now formed a pattern of cross-border business (AliExpress, International Station)+ overseas local business (Lazada, Miravia, Trendyol, Daraz).

Ali International Business has been mentioned as an important strategic position without Jiang Fan. After Jiang Fan took office in early 2022, he invested and transformed AliExpress. Simply put, he transformed AliExpress from the original Taobao-like platform model to a direct sales model, fully managed platform merchants, and optimized sales at low prices through bulk procurement and warehousing logistics to attract a large number of users.

In March 2023, AliExpress launched its Choice service, providing 90-day guarantees for unwarranted returns and delivery timeliness, competing with competitors for users. Subsequently, in order to seize merchants and increase merchants ‘operating rights, pricing rights and profit margins, AliExpress opened up semi-custody, overseas custody and other models.

AliExpress homepage

In recent years, Alibaba International e-commerce, which has been deployed early in overseas markets but has made late efforts, has carved a path through the attack of many rivals and become Alibaba’s fastest-growing business. However, on the one hand, AliExpress needs to provide the bottom line for merchants ‘warehousing and performance, on the other hand, it needs to provide subsidies on the consumer side (a subsidy of tens of billions has been launched), and it also needs to compete for territory with rivals such as SHEIN, Temu, TikTok and Amazon. It requires a lot of capital investment and close cooperation from rookies.

This has also made the international e-commerce business the most costly and loss-making business among the seven major businesses. However, this loss will expand by 7 times and 6 times year-on-year in Q2 and Q3 in 2024, and narrow to 0.57 times in Q4. Cainiao Group’s profit margin is also shrinking. It suffered a brief loss in Q1 of 2024 and made profits in three consecutive quarters. By Q4, the adjusted EBITA was 235 million yuan, a year-on-year decrease of 76%.

Another bad signal is that Cainiao Group’s revenue growth rate has declined for four consecutive quarters in 2024, from 30% in Q1 to 8% in Q3, and even a negative growth of 1% in Q4. This may be due to the impact of price wars in the logistics industry and increased difficulty in fulfilling contracts.

Taotian seeks growth while maintaining stability, and instant retail is at war

Throughout 2024, Alibaba has carried out drastic reforms in its domestic retail business, including e-commerce and new retail. The overall idea is to focus on both online and offline.

In terms of online retail, Taotian Group has undergone a series of adjustments in 2024. The main purpose is to break out of the low-price cycle in the e-commerce industry and stabilize the group’s revenue: first, it charges basic software service fees, and the rate is 0.6% of the confirmed transaction amount for each order; second, it uses experience points as the core basis for traffic allocation, and at the same time relaxes the refund-only regulations to enhance merchants ‘service awareness; third, Taobao has demolished the wall and successively connected Weixin Pay and Jingdong Logistics.

After a year of continuous preparation and debugging, Wu Yongming put domestic e-commerce and international e-commerce together and handed it over to Jiang Fan for management. In conjunction with this personnel transfer, Cainiao also reported news of organizational structure adjustment in early 2025. The team dedicated to AliExpress has been integrated into the integrated Alibaba e-commerce business group. All signs indicate Jiang Fan’s focus on e-commerce business. Centralized management and scheduling.

According to media reports, Jiang Fan recently held a meeting and made it clear that Taotian should be more open in 2025 to help brands, especially small and medium-sized brand merchants, grow bigger across the network, in order to increase Ali’s revenue.

This is in line with a series of changes in Taotian in 2024. Some clothing sellers told “Focus One” that Ali has changed its path of relying on traffic revenue, with the goal of uniting and binding merchants, improving the overall GMV, and seeking growth.

At present, Alibaba’s e-commerce fully covers B2B, B2C, and C2C models. The above-mentioned merchants said that AI efficiency improvement + integration of domestic and foreign trade will be Ali’s main theme this year. However, the more expectations, the greater the pressure.

Concurrent with the online adjustment is the divestment of non-core assets such as offline retail and the vigorous development of instant retail business.

“New retail once represented Ali’s ambitions in the retail industry, so it did not hesitate to enter at high prices and bought a series of offline retail assets. However, other businesses, including Yintai, Hema, Gaoxin Retail, etc., have continued to lose money in the past few years, ranking second among the seven major businesses, second only to international e-commerce, which has increased Alibaba’s overall profit burden.

In order to optimize profits, Ali has sold Intime and RT-Mart one after another. Ali’s new core retail assets are only the box horse integrated with stores and warehouses. Not long ago, Jack Ma appeared at the Hema Changsha Vientianhui store and was regarded by the outside world as stabilizing the military’s morale.

According to data disclosed by Hema, Hema opened 72 new stores in 2024, and nearly one-third of them are located in second-and third-tier cities. According to Yan Xiaolei, the new CEO of Heima, Heima has achieved double-digit growth on the basis of achieving overall profits for nine consecutive months. However, the performance of Box Horse in 2025 depends on whether its sinking strategy can bring comprehensive profits and at the same time, whether it can attract users to repurchase, thereby improving efficiency and running through model.

The contraction of new retail business does not mean that Alibaba has given up the exploration of integrating online and offline retail channels. This year, as JD added a new takeout business based on JD’s Instant Delivery, the instant retail industry is in flames again. There are also Meituan and Douyin on this track. Hungry, you need to prove yourself again.

Objectively, the competitive barriers to instant retail are very high. Some people in the retail industry analyzed to “Focus One” that front-end apps require a huge user volume and stickiness, mid-end apps require stable delivery performance and rich SKU options, and back-end apps must have the platform’s ability to organize and manage offline physical formats.

On February 11, Emalo made a new round of personnel adjustments. Emalo Chairman Wu Zeming concurrently served as CEO, and former CEO Han Liu (former head of Hummingbird Distribution) was in charge of the real-time logistics center. This shows that delivery performance is still a key point for real-time retail.

Enamo’s merchant resources, user base, and logistics and distribution performance capabilities have accumulated a certain amount, bringing about steady growth in its orders. According to calculations, for the whole year of 2024, the revenue of Local Life Group will increase by an average of 14.25% year-on-year. However, Meituan continues to suppress and Douyin continues to subsidize at low prices. Competition with rivals has increased Hunger’s costs and brought losses. Hunger needs to further improve operating efficiency and optimize costs.

After Alibaba focused on its main business (domestic and foreign e-commerce), the pressure was spread to other business groups. It is actually not easy to make mistakes and make achievements under the pressure.

Some industry insiders have concluded that Ali’s inertia is to guard every pair and attack every single pair. After the adjustment in 2024, Ali has slowed down. In 2025, both main and non-main businesses need to be revitalized again.

It is not allowed to reproduce at will without authorization, and the Blue Whale reserves the right to pursue corresponding responsibilities.