Half a month has passed since Trump officially took office as President of the United States on January 20. During this period, the encryption market has also been on a roller coaster after roller coaster, especially after Trump announced the tariff increase. The currency circle earthquake, and the encryption circle fell into a wailing, shouting that “the bear market is here.”

Jessy (@susanliu33), Golden Finance

Half a month has passed since Trump officially took office as President of the United States on January 20. During this period, the encryption market has also been on a roller coaster after roller coaster, especially after Trump announced the tariff increase. The currency circle earthquake, and the encryption circle fell into a wailing, shouting that “the bear market is here.”

After Trump came to power, although he fulfilled his campaign promises about the crypto industry, this did not bring much confidence boost to the industry. Even because of his tariff increase, the market plunged, confusion like “whether Trump’s coming to power is a blessing or a curse for encryption” spread to the currency circle.

On the one hand, as the President of the United States, Trump is actively promoting the introduction of friendly laws and regulations related to the encryption industry, but these benefits seem to be “less than expected.” On the other hand, companies related to the Trump family are actively deploying the encryption industry, especially issuing Meme coins. The WLFI project’s behavior of using encryption to make money is also blatantly using it to make money.

At present, the market fluctuates up and down with Trump’s every move. Trump himself may not have imagined that in such an industry that regards decentralization as the norm, he is regarded as an emperor and has supreme power.

As president, Trump is actively fulfilling his campaign encryption promises

In the half month since taking office, Trump has indeed been gradually advancing the implementation of cryptography-related policies and regulations, and the promises he made during the election campaign are indeed being fulfilled one by one. Such as banning central bank digital currency, firing Gary Gensler, then chairman of the US Securities and Exchange Commission, establishing a Bitcoin and Cryptocurrency Advisory Committee, etc. A series of policies that are conducive to the development of the encryption industry in the United States are being implemented step by step.

Specifically, on January 23, 2025, Trump signed an executive order requiring the establishment of a working group under the National Economic Council, chaired by David Sacks, the White House “AI and cryptocurrency tsar”, and including the Treasury Secretary, the SEC Chairman, etc. The task of the working group is to develop a federal regulatory framework to manage digital assets, including stablecoins, and assess the possibility of creating a national digital asset reserve.

At the first press conference on digital assets held by David Sacks and several U.S. Congressional lawmakers on Capitol Hill on February 4, David Sacks first reviewed the feasibility of Bitcoin reserves, but he pointed out that the initiative is still in its early stages.

At the meeting, U.S. Senator Bill Hagerty also proposed a bill aimed at creating a regulatory framework for stablecoins. The bill includes tokens such as Tether and USDC into the Federal Reserve’s regulatory rules. The bill also stipulates the reserve requirements of stablecoins issuers-adopt the regulatory framework of the Federal Reserve and the Office of the Comptroller of the Currency for issuers issuing more than US$10 billion in stablecoins, establish supervision, inspection and enforcement mechanisms, etc.

In terms of legislation, it is planned to promote a new round of legislation based on the market structure legislation “FIT21” bill passed by the House Financial Services Committee last year, and is committed to bringing “clarity” to the regulatory framework. It is reported that it is expected to introduce cryptocurrency legislation within six months.

In addition to the establishment of a working group, in the cryptography-related executive order signed on January 23, it clearly prohibited the establishment, issuance or promotion of central bank digital currencies in the United States. It also clarifies the right of U.S. citizens to freely use the public chain-allowing citizens to develop and deploy software, participate in mining, trading, and self-custody of digital assets.

The Trump administration’s crypto-friendliness is not only reflected in administrative legislation. On February 4, it was revealed that the SEC had scaled back its department focused on crypto enforcement, removing or demoting more than 50 lawyers and staff. This is also one of Trump’s first specific measures to relax encryption regulations.

However, the launch of these measures has not brought great excitement to the market. What the market is most looking forward to is the actual implementation of the country’s Bitcoin strategic reserve. However, David Sacks also showed that the country’s Bitcoin strategic reserve is still in a very early stage of preparation. However, states in the United States have launched a race for Bitcoin strategic reserves. For example, eleven states have proposed relevant bills, and two of them have entered the committee approval stage. For example, Pennsylvania introduced bills that would allow the state Treasury to use 10% of its funds to buy bitcoins; Texas piloted green energy mining subsidies. At the federal level, the Bitcoin Strategic Reserve Act was proposed, which plans to purchase a total of 1 million bitcoins within five years, and promoted the Bitcoin Energy and Technology Innovation Act to support green mining.

On February 3, Trump also announced the establishment of a U.S. sovereign wealth fund. Industry insiders analyzed that there is a high probability that U.S. sovereign wealth funds will invest in cryptocurrencies such as Bitcoin.

Overall, Trump is indeed actively fulfilling his campaign commitment to the crypto community. However, when it comes to the national Bitcoin strategic reserve, legislation requires a fixed process. It’s just that the encryption industry seems to have no wait. Before the country’s bitcoin strategic reserve, it will fall first as a tribute.

It’s the president, but also the businessman Trump

As president, Trump, a former businessman, cannot personally participate in business operations. However, it can hand over its business empire to its family management, which is in line with U.S. law.

After Trump officially took office as President of the United States, his family’s main encryption business operation was the WLFI project. According to the WLFI token issuance agreement, the Trump family will receive 75% of the net income remaining after deducting operating expenses and initial reserves of US$30 million, which will go to DT Marks DEFI LLC, a subsidiary of the Trump family. Second, the Trump family will receive 22.5 billion WLFI tokens, worth $337.5 million at 1.5 cents of the issue price.

At present, no one who holds pre-sale tokens for the project is able to transfer and trade the tokens-forced lock-up for one year.

The vision of the project is to make DeFi, so it accumulated more tokens in DeFi fields such as ETH, CBTC, AAVE, Ondo, and ENA in the early days. Previously, the industry treated these tokens as strictly elected presidents and followed suit. It is precisely because of the president’s ability to bring goods that these tokens have become popular among investors for some time.

Or perhaps it is precisely because of the huge wealth effect brought by the “strict presidential election”, according to Blockworks, people familiar with the matter said that the Trump family’s crypto project WLFI has been in contact with the blockchain team to conduct “token swap” transactions. Simply put, this kind of transaction means that the project party transfers money to WLFI and purchases WLFI tokens. The WLFI team will also purchase the tokens specified by the project party, and the tokens appearing in the WLFI wallet will also be exposed and promoted.

TRX appeared in WLFI’s cash-holding wallet, which was the role of “token swap”. In mid-to-late January, Sun Yuchen invested a total of US$75 million in WLFI twice, and in early February, TRX appeared in WLFI’s wallet. There is a high probability that the WLFI project’s purchase of TRX this time is a “token swap”.

From the over-offering of WLFI to the “token exchange”, WLFI’s Sima Zhao’s heart is well known to everyone. The WLFI token itself is an empty project. Investors exchange their own value coins for WLFI tokens that can not be traded until one year later. The value coins obtained by the WLFI project are used to purchase the above-mentioned ETH, Ondo, AAVE, LINK, ENA, etc. It can be said that there is no cost, then the decline in these tokens is just a retraction of original profits for the WLFI project parties.

For WLFI projects, the decline is just a retracement of profits, but for retail investors, it is a loss. Another surprise move by WLFI was that the day after Trump’s second son Eric Trump called for Ethereum, the WLFI wallet showed that it had transferred more than 70,000 Ethereums to Coinbase Prime. At the same time, a large number of WBTC, AAVE, LINK, ENA, Move, ONDO, and USDC were transferred to Coinbase Prime. The relevant virtual currencies admitted to Coinbase Prime can no longer be tracked on-chain. Although the WLFI project party stated that it did not sell the cryptocurrency it held, it was just redeploying assets, but without on-chain evidence, it could not be confirmed.

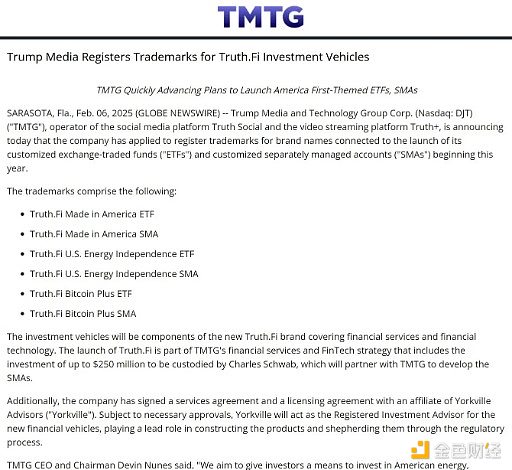

After taking office, in addition to making big profits in the encryption field, the Trump family is also involved in the traditional financial industry. On February 6, Trump’s social media company Truth announced that it has Six trademarks have been registered for its customized ETF products and separately managed account products, and specific financial products will be launched within the year. Judging from the names of several trademarks that have been launched, there is a high probability that Trump Media Technology Group will launch themed products in three directions: U.S. manufacturing, energy and Bitcoin. These products will all belong to the group’s newly established financial services brand Truth.Fi.

Previously, Trump was the company’s largest shareholder, and before being sworn in last month, Trump had transferred all his shares to a trust controlled by his eldest son, Donald Trump Jr.

However, at present, these ETFs themselves have not yet entered the application process, only applied for trademarks. Moreover, even if these ETFs are finally approved, it is doubtful how much capital will flow into them.

But these actions also clarify that the Trump family is actively involved in traditional finance and cryptofinance. However, it is still difficult to predict how much sound its products will have.

However, from issuing Meme coins before taking office to various actions by his family after taking office, it has been clarified that Trump’s most fundamental background is a businessman, and profit-seeking is the nature of a businessman. There is nothing to condemn.

summary

Businessmen are Trump’s background. As a businessman, Trump will definitely use encryption to make money and use his influence as president to make money.

On the other hand, as president, Trump did fulfill his campaign promises to the crypto industry, which also demonstrated his commitment.

The recent market plunge cannot be simply attributed to Trump’s various extreme behaviors: such as issuing coins, increasing tariffs, etc. Funds in the market will make choices based on various information. Trump cannot be responsible for a decline or rise. A mature investor should be responsible for his investment behavior.

Nowadays, encryption is increasingly integrated into the global financial market. The rise of the encryption market not only depends on cryptography-related policies, but also needs to look at the macro economic environment. At present, there are not many favorable macroeconomic policies, and the encryption industry itself is difficult to protect itself. It can only maintain a state of anxiety.

From another perspective, is an industry that advocates decentralization watching Trump’s every move every day and counting on the covet of U.S. government policies also a betrayal of the ideals of the industry?