The key to trading is big opportunities, not the pursuit of trading every day.

Author:Delta

Compiled by: Shenchao TechFlow

Whether you are a full-time trader or a part-time trader who uses off-duty hours to trade, you can experience those maddening days. You sit in front of the screen, keep an eye on price movements, waiting for a trading signal all day long. You stare at the X-minute chart (chosen based on your time frame) and watch it move slowly like a snail, as if it is draining your patience and energy bit by bit, like the Dementors in the movie sucking up your happiness. However, four hours later, no trading signals appeared on the screen.

You decide to take a break, smoke a cigarette, go to the bakery next door to buy lunch, or go to the toilet and take a shower. But when you come back, you find that the chart has just appeared with a perfect trading signal that fits all the rules, a textbook signal, but you missed it.

You sit back in your chair and continue to stare at the screen. Another four hours have passed, and you still see nothing but tiring and boring price fluctuations. At this point, you begin to feel like you have wasted the whole day and blame yourself: you have wasted your time by not getting anything done today. rdquo; The brain starts to question: Trading is your job, right? But no transactions were executed today, is that still work?” rdquo;

Not willing to let the day end fruitless, you start looking through various copycats, trying to find a barely passable trading opportunity. In the end, you chose a random copycat to place an order and lost $1000.

You were so angry that you smashed the keyboard in anger.

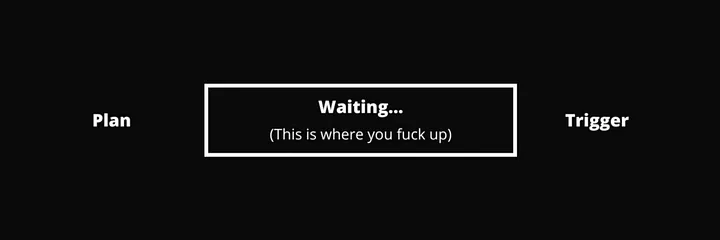

On days like this, if you make irrational decisions out of boredom and frustration, it can become one of the worst experiences a trader can have. Many people start to trade blindly because they are tired of waiting or feel that they have not finished the work, without any advantages or plans at all. Transactions without clear advantages and plans are almost doomed to lose money. Even for advantageous trading strategies, the data shows that only by strict implementation over the long term can we gradually achieve profitability. Therefore, all you need to do is execute the trade as planned every time, allowing the account balance to grow over time.

However, due to lack of patience, some people choose to increase leverage in an attempt to make a quick profit. The result was not only heavy losses, but also completely disrupted the originally effective trading strategy, ultimately losing the gain.

“The hardest deal is no deal.& rdquo;

In fact, most of the time trading is a game of patience, and only when the market provides the right opportunity can transactions be executed decisively.

As many traders have said, 2% of my career I spend executing trades and 98% of my time waiting patiently. rdquo;

If you already have a clear advantage system that lets you know that your trade is more likely to make a profit than it is to lose, why not wait patiently?

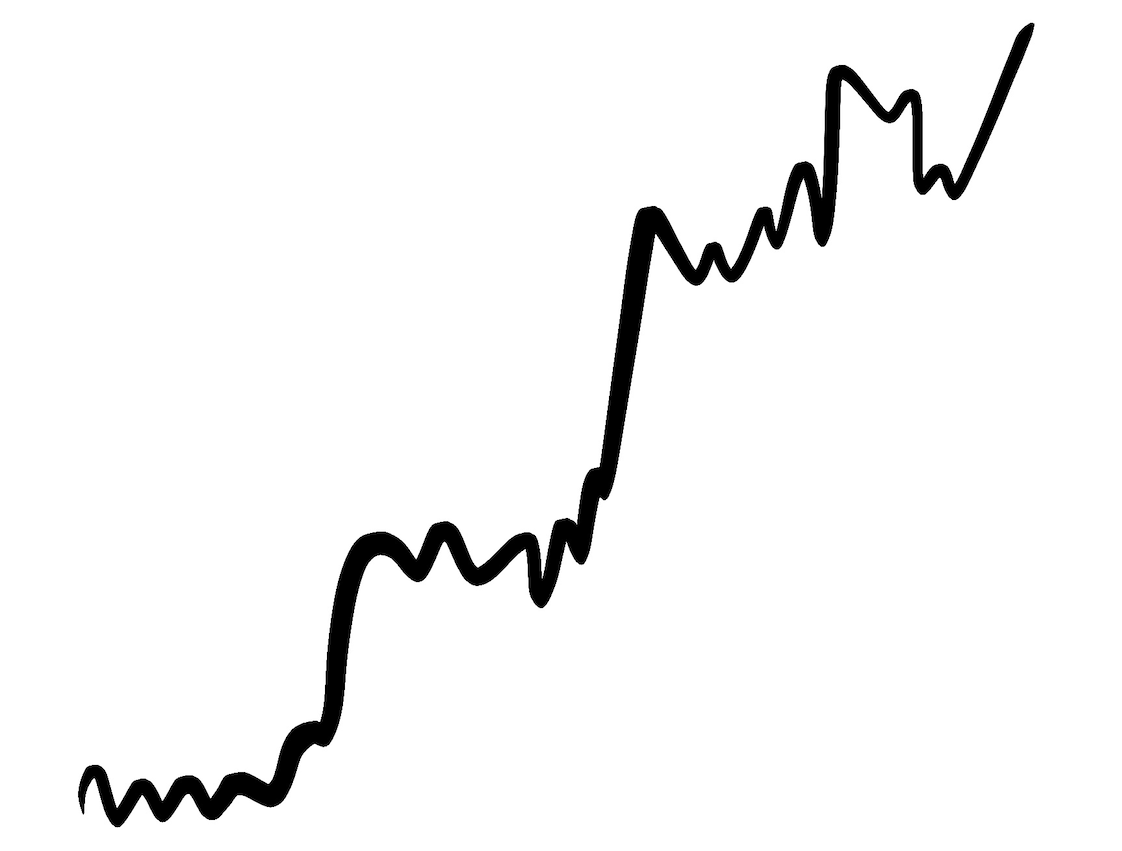

The ideal profit and loss (PNL) curve for most traders should look like this:

Slow but steady growth, with occasional large upward jumps, represents a successful trade with confidence and a large position in rare market opportunities.

Trading is a long-term game. It’s not every day that you have a trading opportunity, and it’s not every day that you make a profit. Your primary goal is to stay in the market for as long as possible to seize big opportunities when they arise.

As mgnr said on Twitter:

“The key to trading is big opportunities, not the pursuit of trading every day.& rdquo;

Of course, if you are a short-term trader, these advice may not apply.

But you can still get inspiration from it:Most of the growth in your portfolio may come from major deals that are concentrated, high-confidence. Before these opportunities arise again, your task is to gradually accumulate capital through concentration and strict discipline.

If you feel bored, you can try the following methods to enrich yourself:

In my Trading Log 101 (upcoming) article, I mentioned that the main purpose of keeping a trading log is to help you answer the following three important questions about trading:

-

How to make more money from profitable transactions?

-

How to minimize losses in loss-making transactions?

-

How to find more profitable trading opportunities?

——TOM DANTE

If you continue to work hard to optimize your advantage system, such as looking for more trading triggers or exploring new trading advantages, you can create more jobs or trading opportunities for yourself while keeping yourself busy. If you don’t want to change your existing trading system, develop a hobby. For example, playing video games, running, sharing opinions on Twitter, chatting with friends on Discord, playing poker, etc. can all relieve you from boredom.

Personally, I like playing Runescape or some PS5 games.

So, how to solve this problem?

Unfortunately, there are no perfect solutions to dealing with boredom in trading, and there are no so-called key secrets.

The most effective way for me is to promise myself that no matter what happens, no matter how boring, I willWe will only act when we comply with systematic trading rules or when we truly feel that the time is right, and we will never place an order blindly out of boredom.

Never trade because you are bored or just want to try it, because it’s completely random gambling. The purpose of our participation in trading is not to gamble on luck, but to conduct transactions with positive expectations. Positive expectations mean that in the long run,These transactions can bring stable profits.If I just wanted to gamble, I might as well go play blackjack.

Learn to control yourself. If you find yourself losing control, learn to get out of the market in time to avoid making stupid decisions.

Traders are everywhere who lose money due to lack of patience, so don’t let yourself be one of these statistics.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern