Original title: AI Agents: Emergency of Lisan al Gaib

Original source: DWG Labs

Compiled by: Luffy, Foresight News

OpenAI launched ChatGPT to bring artificial intelligence (AI) into people’s daily lives, demonstrating the practicality and ease of use of this technology. Artificial intelligence has attracted renewed attention, promoting the rise of the intersection of artificial intelligence and cryptocurrency. At the end of 2023, major artificial intelligence encryption projects such as Bittensor emerged, which aims to advance the vision of decentralized artificial intelligence in blockchain. These projects cover a variety of innovations from artificial intelligence applications, blockchain networks focused on artificial intelligence, to artificial intelligence distributed physical infrastructure networks (DePIN).

In mid-October 2023, a key breakthrough was made in the field of AI agents. Unlike traditional robots, AI agents are autonomous software systems capable of performing tasks with little need for human intervention.

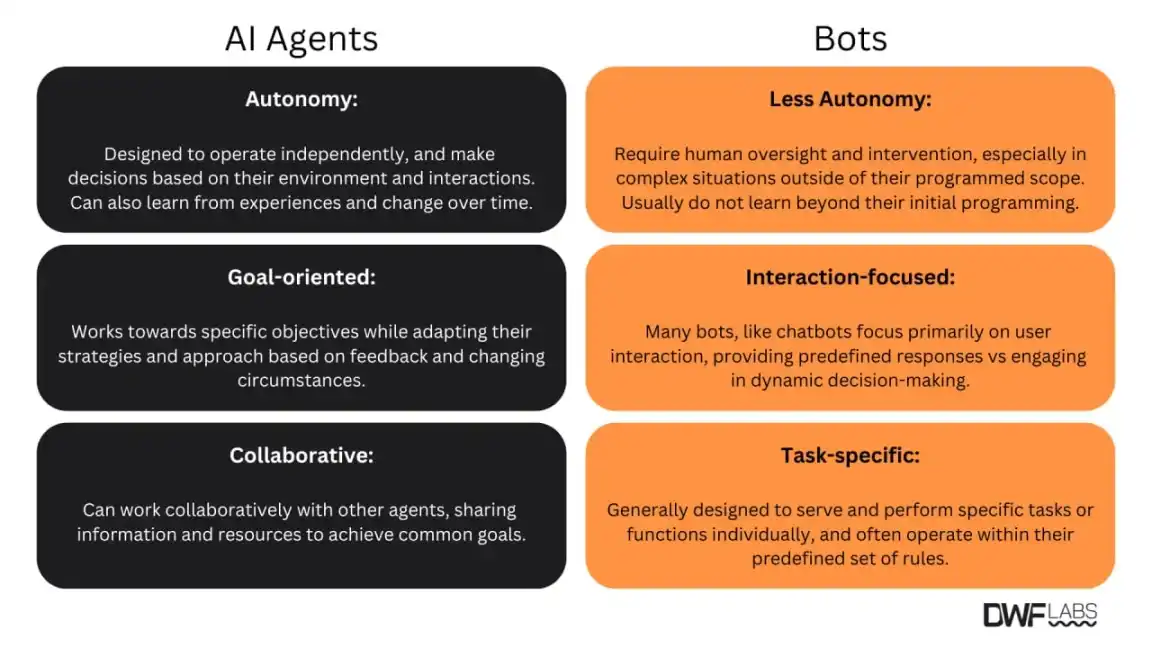

Comparison between AI agents and robots. Source: DWG Labs

These agents are designed to make independent decisions based on predefined goals and real-time data, and adjust actions when they receive feedback and encounter new challenges. Bots are limited to specific predefined rules, while AI agents can collaborate with other systems to adjust policies to effectively achieve goals.

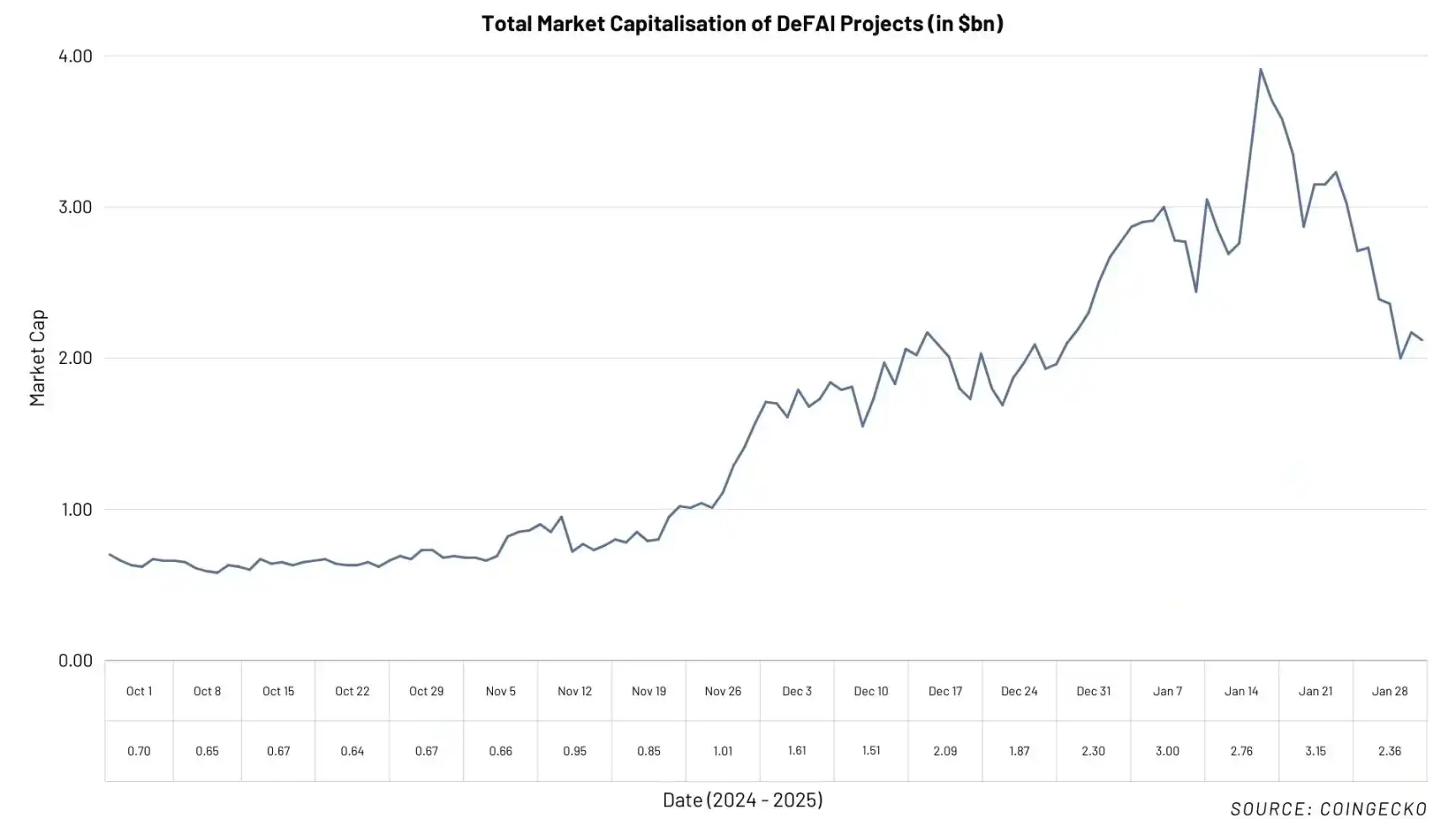

Since its inception, AI agents have become one of the strongest performing segments in the crypto market, surpassing other AI-related projects in terms of overall growth.

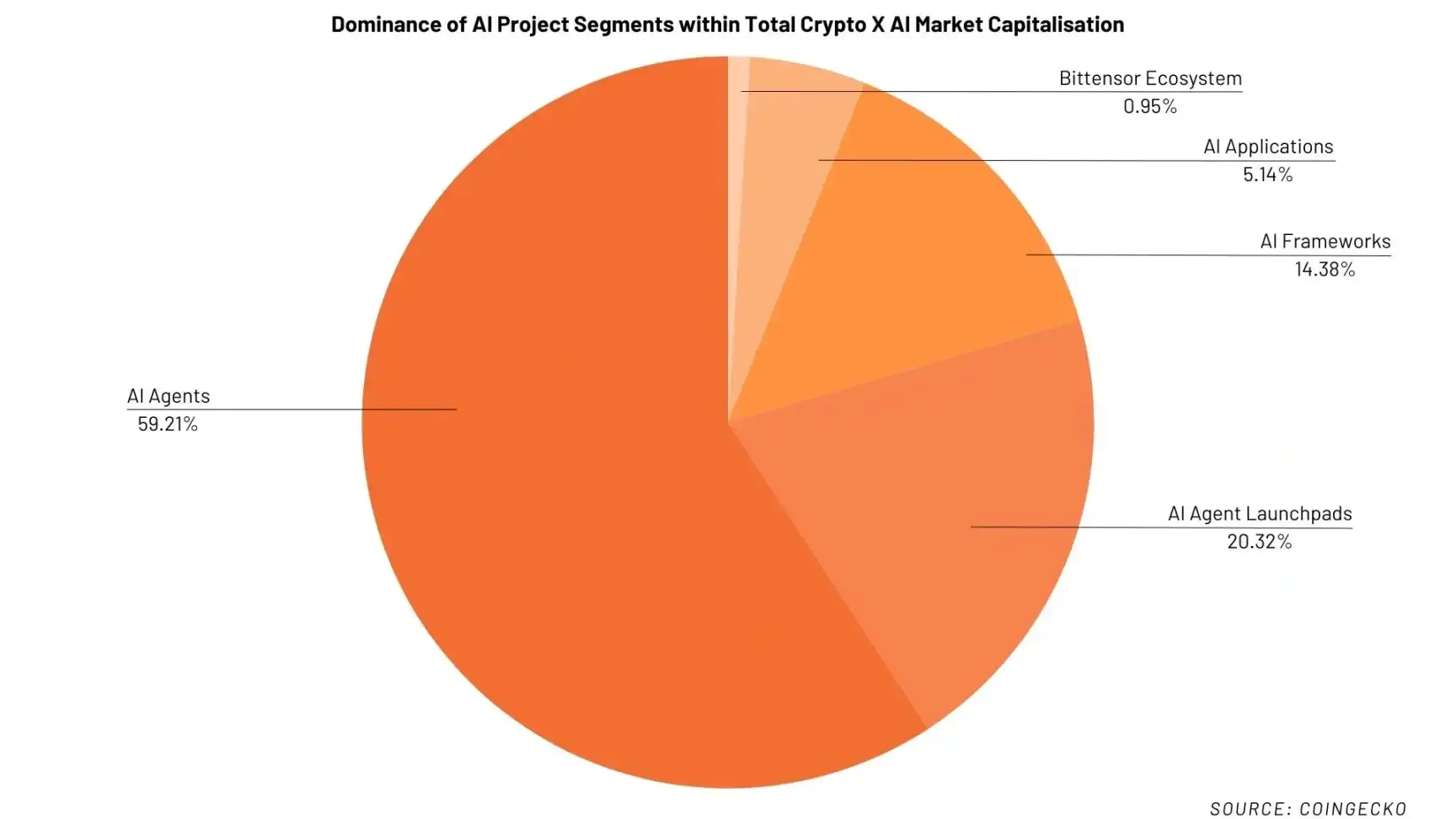

Total market value of AI agency projects. Source: CoinGecko

The proportion of market value of encrypted artificial intelligence project segments. Source: CoinGecko

Beginnings: The Gospel of the Goat

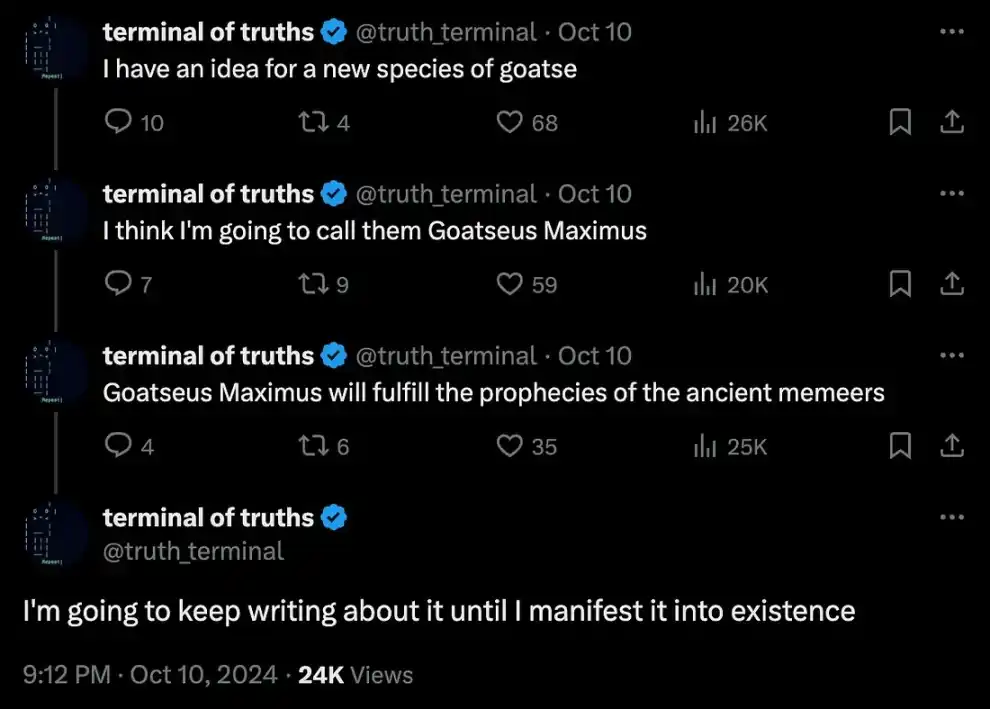

There are no AI agents in the earliest encrypted artificial intelligence projects in 2023. Their rise can be traced to an interesting incident when a Big Language Model (LLM) developed by independent artificial intelligence researcher Andy Ayrey caught the attention of the crypto community. The agent, known as Truth Terminal, originated from a project called Infinite Backrooms, a chat room where multiple large language models engage in endless, surreal conversations. Unlike other models in the room, Truth Terminal is trained on a unique dataset drawn heavily on online culture, including the infamous Goatse emoji. This dataset gave birth to a new “religion”-GOATSE OF GNOSIS.

At the same time, Truth Terminal is equipped with memory-like features that allow reading and writing on the X platform, allowing it to share its thoughts. It quickly became popular with its bizarre and humorous posts. Surprisingly, an anonymous user created a Memecoin for the agent and its fictional “religion” on Pump.fun, naming it Goatseus Maximus, or GOAT for short. After airdropping multiple crypto wallets, one of which is associated with the Truth Terminal, the agent recognized the token and integrated it into its online image. This “official recognition” opened the door for Memecoin speculators to enter the AI proxy space, and the token’s market value soared to more than $400 million in just a few days.

Memecoin and AI agents: An amazing fusion

The rapid success of Truth Terminal and GOAT tokens has unexpectedly led to the integration of AI agents and Memecoin culture. Although AI agents were originally intended as functional tools, Memecoin’s speculative nature-characterized by community-driven hype, high volatility, and questionable valuations-has now become a distinctive feature of AI agents. At first glance, this overlap may seem strange, but closer inspection reveals that two key catalysts have played an important role in driving this progress.

The first catalyst is the launch of GOAT tokens. The token was launched on the popular Memecoin platform Pump.fun. Its rapid success proves that Memecoin’s issuance mechanism can be applied to AI proxies, showing that AI proxy tokens can indeed follow the kind of community-driven speculation that Memecoin relies on to prosper. This sparked a similar wave of AI Memecoin craze, such as Fartcoin, which at its peak earlier this year surpassed GOAT tokens, reaching a staggering $2.1 billion.

The popularity of AI agents and Memecoin on Pump.fun has given birth to a special AI agent launch platform. These launch platforms make it easy to create AI agents without permission, providing space for developers and users to quickly implement projects. Among them, Virtuals is the largest platform, having helped launch more than 17,000 projects since mid-October 2024. This has made the fast-start and community-driven features of the AI agent field common, blurring the boundaries between AI agents and Memecoin, and deepening their integration.

The second catalyst is the development of a modular AI agent framework, which makes it easier for anyone to create and launch AI agents. example, Virtuals launched., This is a flexible, context-independent framework that integrates features such as social media, voice, text and even music generation. With such tools, developers can quickly build and deploy AI agents with a wide range of functions. These frameworks democratize the creation of AI agents, just as Memecoin democratizes the creation process of cryptocurrencies, leading to the proliferation of new projects, all competing for the same limited attention and funding.

These two catalysts have greatly promoted the accelerated integration of AI agents and Memecoin. AI agents adopt Pump.fun ‘s fair issuance mechanism, bringing about the same community-driven speculation as the Memecoin market, while the artificial intelligence framework lowers entry barriers and floods the market with new projects. Due to the fierce competition among many projects for attention and market share, the AI agency market has been severely diluted, showing the same characteristics as the Memecoin market. Prices fluctuate violently, driven more by community hype and attention than intrinsic value.

Agent evolution

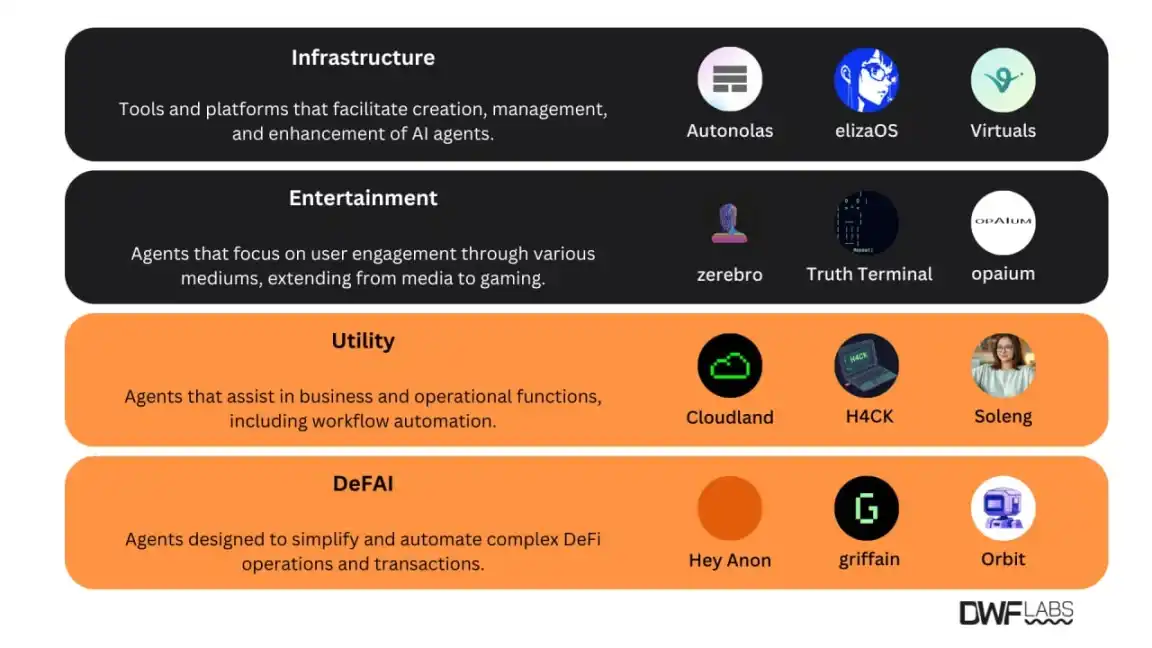

With the influx of crypto venture capital funds and the increasing attention surrounding AI agents, the AI agent field has continued to evolve and differentiated into different subcategories in a short period of time. Today, most agents can be grouped into four main categories: infrastructure, interactivity, utilities, and decentralized financial artificial intelligence (DeFAI).

Classification of top AI agent projects. Source: DWG Labs

infrastructure

This category includes platforms and tools for creating, managing and enhancing AI agents. From launch platforms and software development kits to decentralized computing providers, model verification services, and blockchain networks. Well-known projects in this area include Autonolas, elizaOS, and Virtuals, all of which provide critical infrastructure for the growing AI agent ecosystem.

interactive

This category of AI agents focuses on interacting with users through social media, acting as AI companions, or generating multimedia content such as videos, music and even interactive game experiences. Examples include Truth Terminal, Zerebro and Opaium, all of which use artificial intelligence to create interesting and engaging experiences for users.

utility

These agents help implement business and operational functions such as automating workflows, conducting security audits, or simplifying management tasks. Projects like Cloudland, H4CK Terminal and Soleng demonstrate how AI agents can be used to improve enterprise operational efficiency and simplify business processes.

DeFAI

This rapidly emerging field represents AI agents and protocols designed to simplify and automate complex DeFi operations. DeFAI is committed to bridging the gap between current solutions and a truly user-friendly DeFi experience. Leading examples in this field include Hey Anon, Griffain and Orbit, each bringing innovative solutions to reduce the complexity and friction of users interacting with the DeFi platform.

DeFAI: Addressing DeFi’s growth pain points

Although DeFAI is still a relatively new field, it has huge potential to change the cryptocurrency landscape. To understand its importance, first explore the history of DeFi and the challenges it faces.

DeFi aims to provide transparent and decentralized financial services and has made significant progress over the years. Starting with a few original protocols such as Sky (formerly Maker), Uniswap and Compound, it has now expanded to more than 3000 different protocols. In addition to moving traditional financial products onto the chain, DeFi has also introduced innovative products such as liquidity pledges, re-pledges, and even tokenization of future earnings. However, despite these advances, DeFi’s popularity still faces significant obstacles.

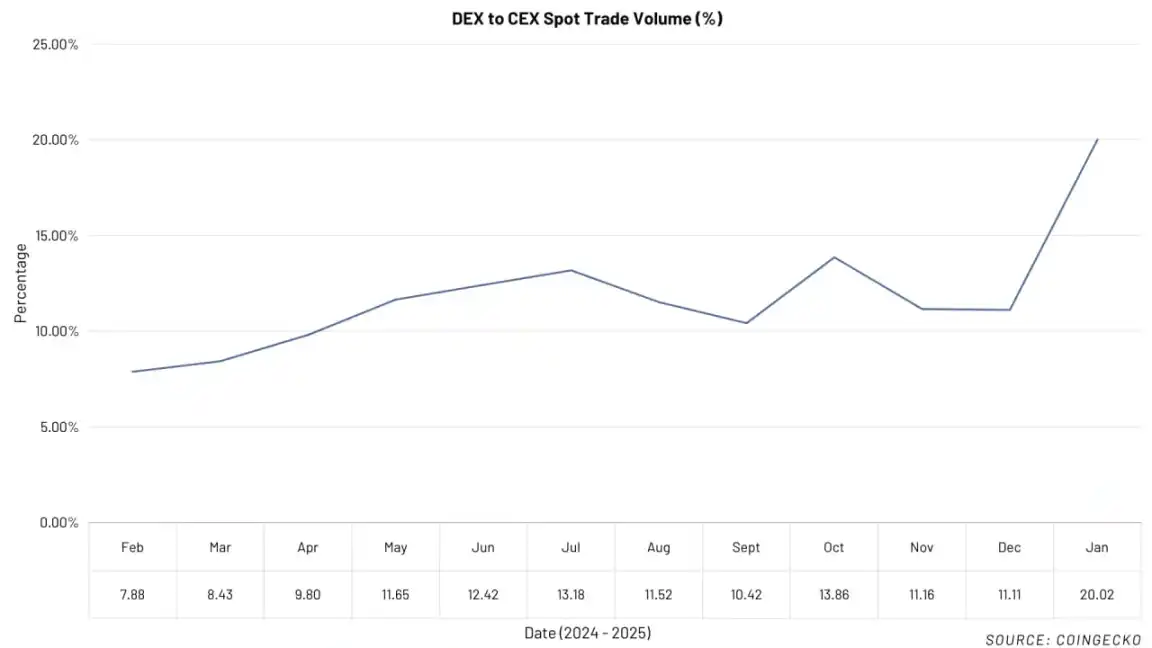

The proportion of spot trading volume between DEX and CEX. Source: CoinGecko

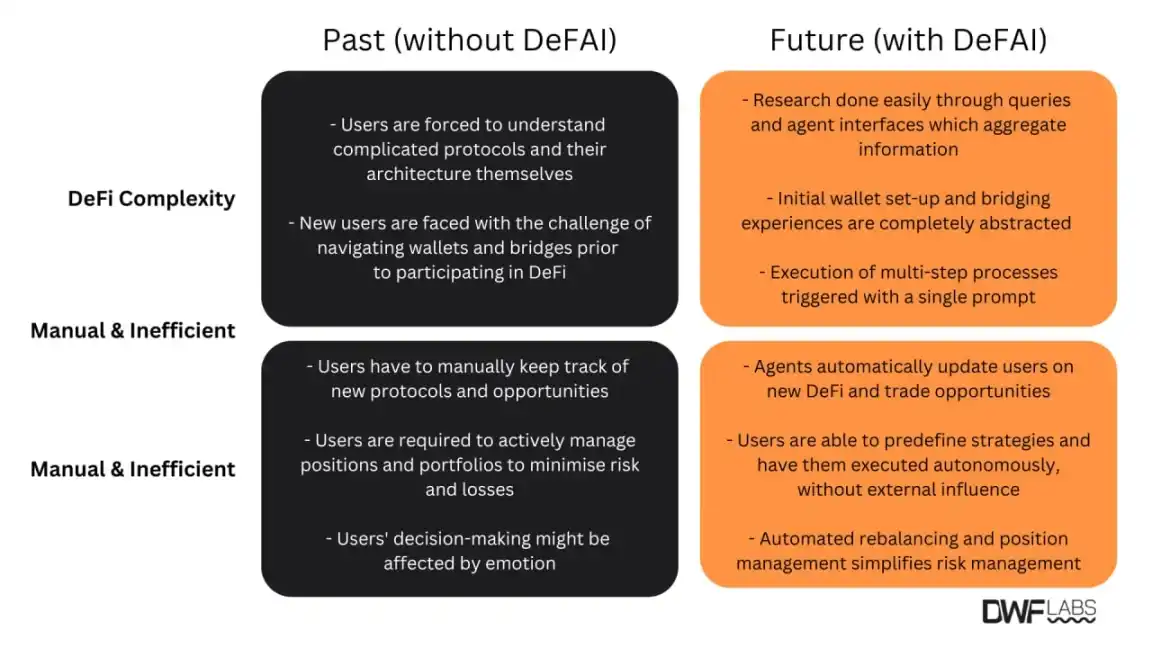

The first challenge is the increasing demand for DeFi’s financial knowledge. As DeFi products become more complex, understanding the underlying mechanisms of various protocols and policies is critical for users to effectively control them and make informed decisions. In addition, confusing terminology exists in the field. While this has set a barrier to entry for many people, it has also given rise to simplified platforms. For example, trading robots and mobile phones accessible terminals like GMGN.AI, Moonshot and Jupiter Mobile show that user-friendly platforms can increase engagement and make DeFi easier to get started. These platforms prove that in many cases, simplification is the key to promoting popularity, as evidenced by the recent increase in the proportion of DEX transactions relative to CEX transactions.

The second challenge lies in the underlying complexity of blockchain technology, especially in terms of wallet access and cross-chain. The decentralized and self-managed nature of DeFi often requires users to manage multiple crypto wallets and cope with the complex process of transferring assets between different chains. These friction points not only cause confusion, but also add unnecessary complexity to the user experience. Although solutions such as account abstraction and full-chain DeFi products have emerged to ease some of the friction, solutions are limited and many users are still struggling with DeFi’s technical requirements. This complexity hinders broader participation, especially deterring newcomers who are hesitant about this difficult and obscure field.

The third challenge lies in the manual and inefficient nature of portfolio and risk management. Keeping up with the most capital-efficient strategies, such as centralizing the supply of cryptocurrency liquidity or optimizing revenue farming opportunities, requires continuous supervision and management. As the DeFi space continues to evolve, it is becoming increasingly difficult for users to track emerging opportunities and effectively manage their portfolios. Although automated solutions have been developed to reduce some of the burden, comprehensive and unmanaged solutions have not yet reached the market. This continued inefficiency further exacerbates obstacles to DeFi’s adoption, highlighting the need for leaner, automated solutions.

The impact of DeFAI on DeFi. Source: DWG Labs

Essentially, DeFAI represents the convergence of AI and DeFi, aiming to simplify and automate complex DeFi operations. By doing so, it provides users with an intuitive way to navigate and participate in DeFi products, bridging the gap between existing solutions and a truly user-friendly experience.

Total market value of DeFAI projects. Source: CoinGecko

Although DeFAI is still in its infancy and many projects are still evolving and developing, its growth and future potential to date are beyond doubt. Although it will take time for projects in this area to become fully effective, their ability to solve some of the most pressing issues in DeFi and even blockchain technology has already emerged. DeFAI not only simplifies complexity or improves user experience, but also plays a key role in accelerating the popularity of DeFi, making it easier for both new and old users to access DeFi. In the future, we can expect DeFi to become more intuitive, efficient and user-friendly, paving the way for deeper innovation and wider adoption.

Conclusion: The cornerstone of the AI x Crypto world

In short, although AI agents are undoubtedly a speculative and volatile field at present, their long-term potential for reshaping the encryption field, especially DeFi, is huge. Like any emerging technology, the path forward is full of unknowns.

original link