“LIBRA’s coin issuance was not ‘cutting leeks’, but the failure of the plan led to a market collapse.”

Written by: Yuliya, PANews

Since Trump issued coins on January 18, Pump.Fun’s zero-threshold coin issuance mechanism has gradually exposed two sides: on the one hand, it injects liquidity into the market, and on the other hand, it also provides a breeding ground for the breeding of black and gray industries. This mechanism brings increasing hidden dangers, and of course also provides hackers with more profitable wealth opportunities. (Stealing a social account and giving a CA) Congratulations for not delving into the person behind the project and getting on the bus successfully.

On February 15, Argentine President Milei made a high-profile support for the LIBRA token on social media, pushing this project, whose market value had soared to US$4 billion, to its peak. However, after Milei suddenly deleted the tweet and issued a clarification statement, the LIBRA token fell off a cliff, with its lowest market value shrinking to US$130 million, 96% lost from its peak. According to people familiar with the matter, as early as a week before the token issuance, it emerged that someone had paid $5 million in bribes to senior officials close to President Milei in exchange for Milei’s public support. This change has caused the market’s enthusiasm for meme coins to fade sharply, and the year-long Pump.Fun craze is fading. Platform agreement fees have dropped by 84.57% from a historical peak of 72,506 SOLs on January 1, and today’s single-day revenue is only 11,188 SOLs.

Accidentally angering top white-hat hackers

When KIP Protocol announced the launch of the “Viva la Libertad” project in a high-profile manner and showed off the success of the token $LIBRA, it claimed that the project was led by a private company and had nothing to do with Argentine President Milei. However, the statement was quickly slapped in the face.

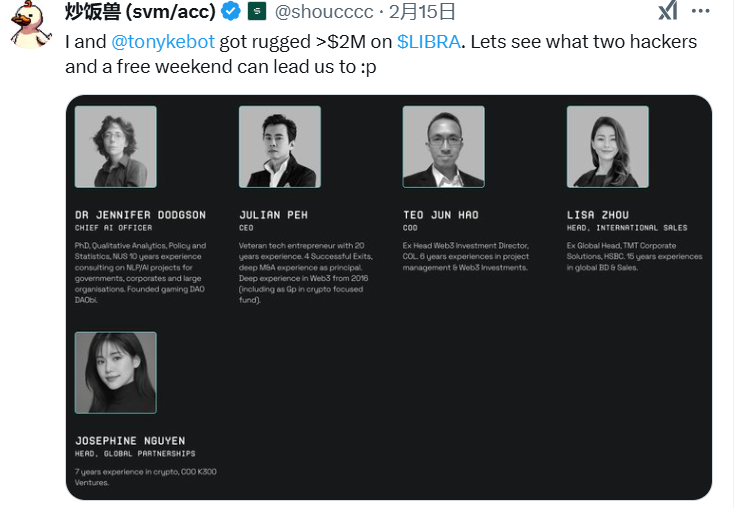

Chaofan Shou, co-founder of Fuzzland, began to criticize KIP Protocol, calling out “RNM, refund money!” He cried that he and Solayer engineer @tonykebot had lost more than $2 million on the LIBRA project, and revealed the list of core members of the team behind LIBRA, KIP Protocol, claiming that “let’s see what two hackers and a free weekend can bring us,” hinting that action would be taken. (It is reported that Shou enjoys a high reputation in the field of network security. His team has successfully recovered more than US$33 million in stolen funds, and the vulnerability bounty in the Web2 security field exceeds US$1.9 million.)

In the next few days, Shou and Julian, co-founder of KIP Protocol, had an online “tussle” on Twitter. Julian said,”If the project really rugs, come to me. You lost money is your problem, not that it means the project has rugs.” In response, Shou made harsh remarks that he would pursue the relevant responsible persons,”From Vietnam to Singapore to the United States, no one can escape.” Immediately, Shou revealed Julian’s personal identity information and bluntly said,”Whether you refund the money or not, running is running.” He warned,”A US$200 million case may face up to 50 years in prison in the United States. I advise you to return to Singapore early.” Although the behavior of running away is really hateful, Xiao Bian believes that it is true and inappropriate to reveal the identity of others before knowing the results.

Uncover the true face of the project party

After such a disturbance in the market, many Solana ecological projects have expressed that they “have no relationship with me” and have distanced themselves from LIBRA. Ben Chow, co-founder of Meteora, said he has never purchased, received or managed any LIBRA tokens;Jupiter co-founder Siong also said he has not collaborated with projects such as $LIBRA and $ENRON.

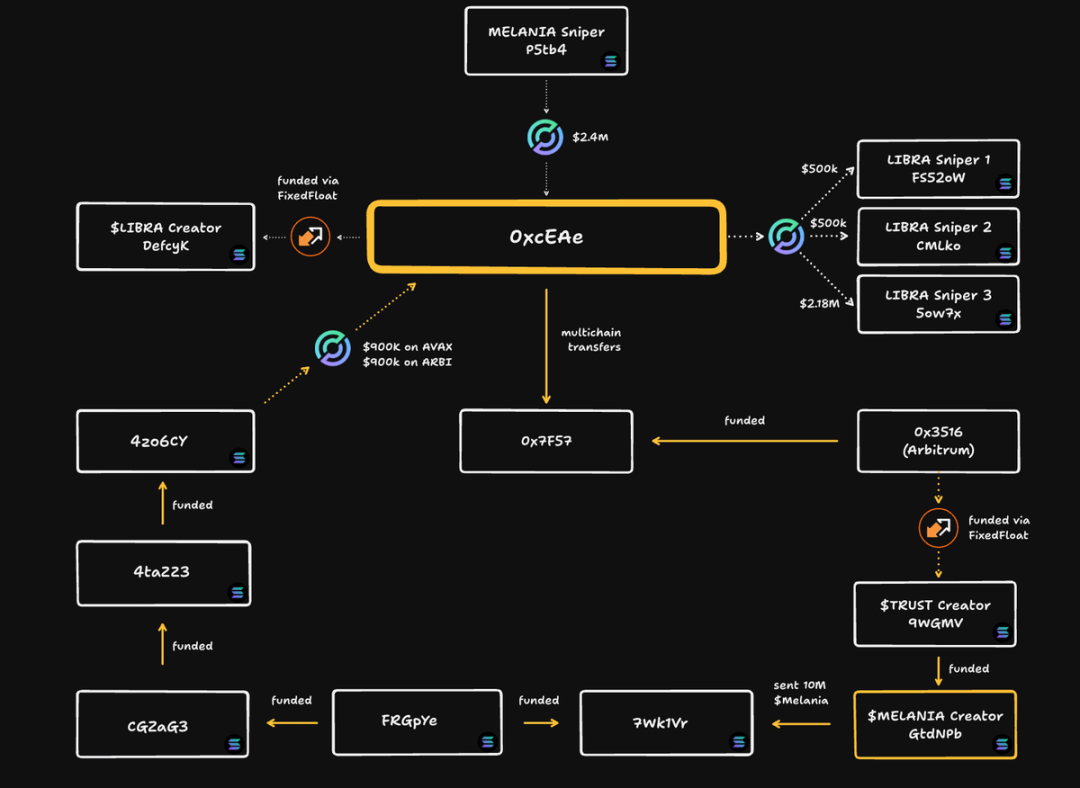

A survey by blockchain analysis company Bubblemaps shows a close connection between LIBRA and the previously controversial MELANIA token project. The early sniper wallets of the two projects overlapped highly, and both used similar “pump and dump” techniques.

- Use Cross-Chain Protocol (CCTP) to transfer funds between different public chains

- Conduct rushing transactions through multiple associated wallets"

- Draw approximately $87 million from the liquidity pool

In an interview with YouTube blogger Coffeezilla, Hayden Davis admitted that the team made sniper transactions when both LIBRA and MELANIA projects were launched, but emphasized that the original intention of the operation was to protect project liquidity rather than profit from it. Core members of the LIBRA project include:

- Hayden Davis (founder of Kelsier Ventures)

- Julian Peh (founder of KIP Protocol)

- Mauricio Novelli (Argentina Science and Technology Forum)

- Manuel Godoy (Argentina Science and Technology Forum)

Hayden said that LIBRA’s coin issuance was not “cutting leeks”, but a failure of the plan led to a market collapse. He currently has US$100 million in funding and is seeking a solution. He revealed that sniper operations have become a common phenomenon in the meme coin field, and most projects are used by insiders or high-frequency traders during the coin issuance stage.

In addition, Hayden also pointed out that large-scale memecoin projects including TRUMP, MELANIA, and LIBRA are essentially “insider games” and it is difficult for ordinary investors to participate fairly. He also defended Argentine President Javier Milei’s role in LIBRA, saying that Milei had limited knowledge of cryptocurrencies and that his support for LIBRA was more an experimental attempt.

Event reflection

The chain reaction triggered by the incident continues to ferment:

- Market level:Bitcoin’s market share climbed to a four-year high of 60%. QCP Capital analysis pointed out that the “running away” scandal of the LIBRA project may suppress the market for altcoins and Meme coins for a long time;

- Judicial level:At present, the Argentine government has established an inter-departmental investigation team to jointly investigate cases with financial regulatory and anti-money laundering agencies. Former central bank governor and others have filed lawsuits accusing Milei of playing a key role in the project and suspected fraud;

- Industry reflection:Zhu Su, co-founder of Three Arrow Capital, believes that the Libra team’s main mistake was to withdraw from the Meteora liquidity pool and conduct short-term arbitrage operations, otherwise it would behave similar to TRUMP tokens.

This cryptocurrency drama that combines political endorsement, hacker confrontation and capital manipulation exposes three major practical dilemmas in the Web3 world:

- Government endorsement does not mean project credibility

- Insider trading and market manipulation remain common in the cryptocurrency market

- Community autonomy, especially the participation of technical experts, may be more effective than traditional supervision