Original title: Crypto is Macro Again

Author: Marco Manoppo, investor at Primitive Ventures

Compiled by: Ashley, BlockBeats

Editor’s note: The author analyzed that the crypto market will be affected by macroeconomic and policy changes, especially Trump’s tax increase policy and inflationary pressure. As the Trump administration strengthens regulatory support for cryptocurrencies, including the CFTC’s focus on fraud prevention and the FDIC’s adjustment of banking policies, it may promote the stability of the crypto market. In the coming months, stablecoin bills and macroeconomic factors may dominate the market.

The following is the original content (the original content has been compiled for ease of reading and understanding):

Currently, the cryptocurrency market is no longer an isolated asset class. They are once again deeply intertwined with macroeconomic forces and regulatory changes. In the next 3-6 months, regulation and macroeconomics will dominate the cryptocurrency market, rather than microeconomics within the industry or industry development.

Since the launch of the $TRUMP token, cryptocurrencies have been steadily declining. The token was released on January 17, 2025, just days before Trump’s second inauguration. The token sparked speculative sentiment but failed to continue to push the market higher.

At the same time, macroeconomic forces are also at play.

On February 1, 2025, President Trump imposed a 25% tariff on all imports from Mexico and Canada, a 10% tariff on Canadian energy exports, and an additional 10% tariff on imports from China. The impact of this move on risky assets was immediate.

Since the introduction of these tariffs, the overall cryptocurrency market value has fallen by approximately 13%, from US$3.8 trillion to US$3.3 trillion. Bitcoin itself rebounded to US$96K after hitting a three-week low of US$91K, while Ethereum and other major cryptocurrencies fell even more sharply, reaching as high as 25%.

Why does the crypto market react to tariffs?

Trade war fear and risk aversion

The threat of a global trade war has sent investors fleeing risky assets. TradFi investors view bitcoin as a risky asset and are turning to safer assets such as gold, bonds and the U.S. dollar. Typical risk-averse transactions are happening, and cryptocurrencies are included in this category.

Inflation and interest rates are again in focus

Tariffs increase the cost of imported goods and may lead to higher inflation. If inflation remains high, the Fed may delay or cancel expected interest rate cuts, reducing liquidity in financial markets. Because Bitcoin does not generate yields, higher interest rates make it less attractive compared to U.S. Treasury bonds and even cash deposits.

This dynamic contrasts sharply with the low-interest rate, liquidity-driven environment of 2020-2021, when cryptocurrencies flourished. As a result, macro trends have once again become the main driver affecting the performance of cryptocurrencies.

The role of regulation and traditional finance

While tariffs and inflation dominate the short-term outlook, regulatory changes are equally crucial. Regulators around the world are stepping up their scrutiny of the crypto market, and the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have recently taken some industry-friendly measures, signaling a more constructive U.S. regulatory attitude.

·Matt Britzman of Hargreaves Lansdown pointed out that fears of a trade war triggered by tariffs usually fade quickly, but during this period investors hedge against gold, Treasuries and the U.S. dollar.

·Similarly, Joel Kruger of LMAX Group pointed out that markets are not afraid of extreme tariff measures, but are adapting to Trump’s negotiating tactics.

This means that while volatility is high in the short term, long-term investors may continue to accumulate bitcoin and other cryptocurrencies as prices fall.

What might happen in the next 3-6 months?

Cryptocurrencies have once again become part of the macro economy. Cryptocurrencies are no longer independent of the fluctuations of traditional markets. Economic policies, central bank decisions, and geopolitical events all directly affect the performance of digital assets.

As inflation, interest rates and trade policies dominate the dynamics of financial markets, digital assets are no longer divorced from the broader economic environment. Institutional funds now view major cryptocurrencies as part of the traditional finance (TradFi) landscape, which means regulatory changes and global economic trends will shape the trajectory of cryptocurrencies.

Over the next 3-6 months, markets are expected to continue to face volatility as they digest tariff updates, Fed policy decisions, and upcoming regulatory measures.

The question is not whether cryptocurrency will decouple from the macro economy, but how it responds to this new reality.

What really matters right now is the macro events and what Trump has to say about regulation.

Markets are reacting violently to trade policies, interest rate expectations and regulatory decisions, factors that could shape the trajectory of the entire industry in the coming months.

Review of key regulations and macro developments driving the cryptocurrency industry

Cryptocurrency has become a national priority for the United States

The order protects fair bank access for self-custodial and crypto companies and explicitly prohibits the launch of the U.S. Central Bank of China’s digital currency (CBDC). It also revoked the digital asset policy of the Biden administration, marking a shift in U.S. regulatory attitude towards supporting cryptocurrencies. The working group is led by David Sacks (cryptocurrency czar).

Impact on cryptocurrencies:

·Refuse to launch CBDC and support private dollar-backed stablecoins, which could benefit stablecoin issuers while limiting government-controlled alternatives.

·Industry expectations for strategic bitcoin reserves have not yet been realized, but assessments of digital asset reserves suggest government accumulation may occur in the future.

Regulatory team supporting cryptocurrencies

Trump has almost completed the formation of his cryptocurrency regulatory team, nominating Jonathan Gould (Office of the Comptroller of the Currency), Jonathan McKernan (Consumer Financial Protection Bureau CFPB) and Brian Quintenz of a16z (Commodity Futures Trading Commission CFTC).

These candidates all have experience in cryptocurrency or financial supervision, demonstrating their support for marketization.

Although the Senate confirmation process may take time, the Trump administration is developing a potentially more open regulatory framework for digital assets.

Impact on cryptocurrencies:

· Gould may promote banking licenses that support cryptocurrencies, while Quintenz’s CFTC may support blockchain innovation.

·This marks a shift in the regulatory attitude of the United States, especially in the regulation of stablecoins and cryptobanking, and clearer and more favorable regulatory policies may emerge in the future.

19 U.S. states and endowments consider Bitcoin investments

An increasing number of 19 U.S. states are considering legislation to invest public funds in Bitcoin. Some proposals allocate up to 10% of state funds to large-market-value cryptocurrencies.

Wisconsin and Michigan have included Bitcoin in public employee retirement portfolios, and 23 other states are actively debating similar proposals.

At the same time, endowments in the United States are also increasing their exposure to cryptocurrencies, as digital asset prices soar to new highs.

Impact on cryptocurrencies:

·State-level Bitcoin investments may increase legitimacy, demand and price stability, promote institutional adoption and accelerate regulatory clarity. If passed, these laws will further advance the integration of cryptocurrencies with public finances, but legislative approval remains a key obstacle.

Tokenization pilot program

Acting CFTC Chairman Caroline Pham is advancing a tokenization pilot program that will use stablecoins as collateral.

She is organizing a CEO summit with leaders of Coinbase, Ripple, Circle and other major crypto companies to discuss the plan.

Impact on cryptocurrencies:

·If this pilot program is implemented, it will help legalize stablecoins in traditional finance, enhance liquidity in derivatives markets, and promote the widespread use of tokenized assets.

·By integrating blockchain-based collateral into regulated markets, the plan could set a precedent for the CFTC to develop future policies to support cryptocurrencies under its evolving leadership.

CFTC now focuses on preventing fraud

Acting CFTC Chairman Caroline Pham also announced a major reorganization of the agency’s law enforcement arm, shifting the focus from “supervision through law enforcement” to “preventing fraud.”

The reorganization reduces the number of task forces and consolidates law enforcement into two groups: the Complex Fraud Task Force and the Retail Fraud and General Law Enforcement Task Force.

Impact on cryptocurrencies:

·By focusing more clearly on preventing fraud rather than widespread crackdowns, legitimate cryptocurrency companies may face fewer regulatory obstacles, thereby promoting more institutional participation and improving market stability.

“Re-banking” of cryptocurrency

Travis Hill, acting chairman of the FDIC, announced a major shift in the agency’s cryptocurrency regulation, promising to re-evaluate past guidance that discouraged banks from working with crypto companies.

As part of the reform, the FDIC released internal documents showing that regulators had pressured banks to cut ties with cryptocurrencies.

Impact on cryptocurrencies:

·If the FDIC implements its reforms to support cryptocurrencies, banks may be more confident in working with digital asset companies to improve the industry’s access to financial services.

·This shift could increase liquidity, encourage institutional adoption and lay the foundation for more balanced regulatory policies.

·However, Senate hearings and ongoing political debate will determine the extent and speed of change.

SEC’s new cryptocurrency task force

SEC Commissioner Hester Peirce outlined 10 priorities for the agency’s newly formed cryptocurrency task force, which aims to provide regulatory clarity to the crypto industry.

The focus includes defining the difference between securities and commodities, clarifying the rules for crypto lending and pledge, and creating a more feasible registration process.

Impact on cryptocurrencies:

·Clearer classification rules and registration paths may encourage more institutions to adopt and comply with the law, while the agency’s focus on fraud prevention is aimed at building market confidence.

·However, due to continued litigation and policy review, the true clarity of regulation may take some time to emerge.

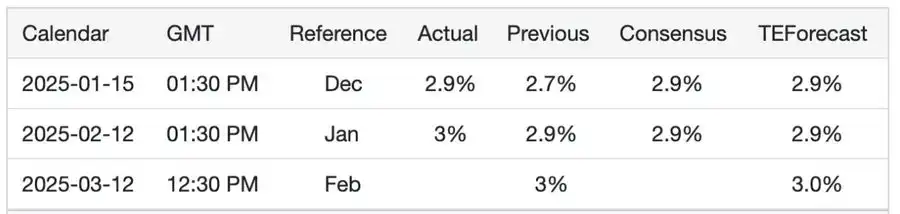

U.S. stablecoin rules are taking shape

The United States is moving in the direction of stablecoin regulation, with two competing bills: the House STABLE bill and the Senate GENIUS bill that propose different frameworks but agree on strict compliance measures.

Both bills support private, dollar-backed stablecoins and ban central bank digital currencies (CBDC).

The main differences include:

·Regulatory oversight (GENIUS allows states to regulate issuers until the market value reaches US$10 billion;STABLE allows the option to opt out of federal supervision if state rules meet standards)

Reserve requirements (STABLE allows the use of treasury bonds, bank deposits and central bank reserves, while GENIUS also includes money market funds and reverse repos)

·Consumer protection (GENIUS focuses on transparency and enforcement, while STABLE requires one-to-one reserves and prohibits algorithmic stablecoins)

Impact on cryptocurrencies:

·Tighter regulations could challenge Tether’s dominance, as both bills require monthly audits, asset sequestration and strict reporting, potentially forcing exchanges to remove non-compliant stablecoins, similar to the impact of the EU MiCA.

·These laws will pave the way for the legalization of stablecoins and attract institutional adoption, while creating obstacles for issuers that are not transparent enough. If adopted, they will establish clear guidelines for stablecoin issuers to ensure market stability and compliance.

Final thoughts

So far, it is clear that the cryptocurrency market is deeply embedded in the macro market. Currently, macroeconomic conditions and policies will drive price fluctuations in the coming quarters rather than innovation within the industry.

Although I mentioned before that Trump’s actions in support of cryptocurrencies, such as executive orders, the pardon for Ross Ulbricht, and the launch of memecoin, have stimulated market optimism, many believe that most of these factors are driven by short-term optimization and speculation-and what we need more are long-term fundamental catalysts to properly attract new capital inflows from traditional finance (TradFi).

No matter what Trump says, the U.S. government’s policies will affect the sentiment of traditional financial participants towards cryptocurrencies, thereby affecting broader market liquidity.

“Original link”