Mode’s core goal is to develop open source tools for the Superchain ecosystem that support the application of native revenue, smart vaults, and on-chain AI agents.

Author:Memento Research

Compiled by: Shenchao TechFlow

Mode is an Ethereum Layer 2 (L2) solution built on OP Stack and an important part of Optimism Superchain. It aims to increase Ethereum’s scalability, especially in the decentralized finance (DeFi) space.

Mode’s core goal is to develop open source tools for the Superchain ecosystem that support the application of native revenue, smart vaults, and on-chain AI agents.

Since its official launch in January 2024, Mode has developed rapidly, attracting more than US$700 million in cross-chain funding in just a few months.

Currently, Mode is working to build a future driven by an autonomous economy on the chain through its DeFAI stack.

report summary

This report will explore the following:

-

The evolution of DeFi to DeFAI and its future potential;

-

Mode’s DeFAI stack and its strategic positioning as the leading DeFAI chain;

-

Overview of Mode’s current ecosystem and its competitive position in the industry;

-

Mode’s future development plans include promoting the expansion of DeFi through on-chain agents and AI-driven financial tools;

From DeFi to DeFAI: The evolution of technology and applications

Limitations of DeFi

Decentralized Finance (DeFi) has made tremendous progress in the past few years, with the total locked value (TVL) currently exceeding US$120 billion. However, DeFi still faces some key issues that hinder its wider adoption:

-

Investment complexity:Users face difficulties in finding the best income opportunities, and the lack of a clear investment strategy may lead to inefficient allocation of funds.

-

Financial risk:Impermanent losses (i.e., losses that liquidity providers can suffer due to price fluctuations) and smart contract vulnerabilities have deterred many users, especially in decentralized exchanges (DEX).

-

cross-chainDispersion of liquidity:Liquidity is dispersed across multiple blockchains, and cross-chain transactions are inefficient and cumbersome to operate.

-

Insufficient user experience:DeFi’s interface and operations are still complex, creating a high threshold for new users and hindering the entry of mainstream users.

Solving these issues is crucial to promoting the next stage of DeFi’s development, while also allowing more users to enjoy more efficient and secure financial services.

The Rise of DeFAI

With the gradual integration of artificial intelligence technology into the field of encryption, DeFi is undergoing a profound transformation. Early projects such as Bittensor, Akash and Render have demonstrated the potential of AI, but it is some AI-themed tokens (such as GOAT) that really hit the market.

GOAT is a memecoin backed by AI chat robot Truth Terminal, and its market value quickly exceeded US$1 billion in a few days. This phenomenon has driven widespread interest in AI in the market and promoted the transition from speculative tokens to practical AI applications.

The combination of DeFi and AI, known as DeFAI, is accelerating the formation of a new realm of encryption. Projects like Orbit, Griffain, and Mode are using AI technology to optimize DeFi’s decision-making process, helping users improve the efficiency of digging revenue, trading strategies, and portfolio management.

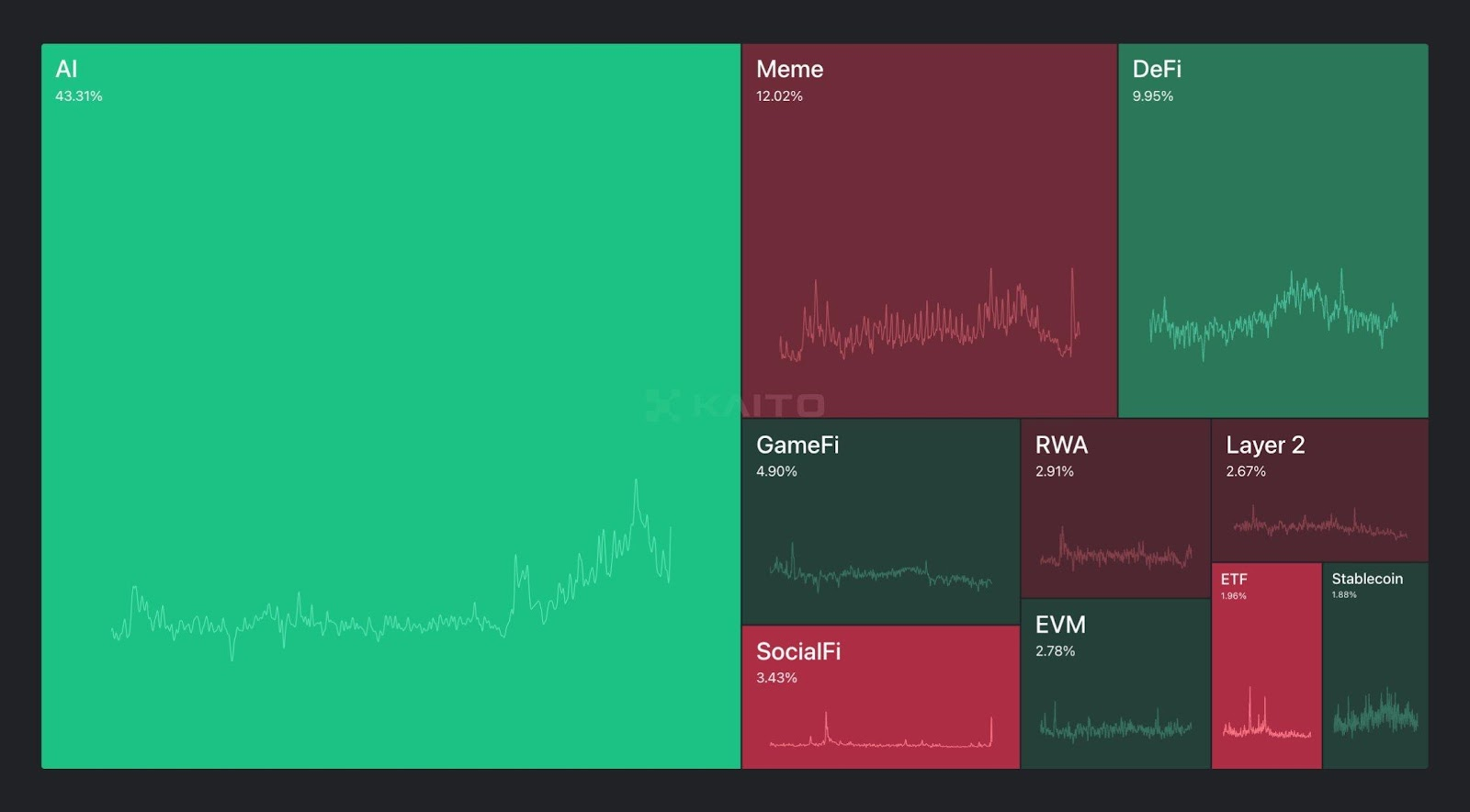

At present, the total market value of DeFAI market has reached US$2.11 billion, accounting for 53.26% of market attention, surpassing traditional memecoin.

Market attention for existing narratives

Source: Kaito

DeFAI products and development potential

Classification of existing DeFAI ecosystems

The DeFAI ecosystem can be divided into the following four main areas, a framework first proposed by @poopmandefi:

-

abstract AI With the user experience layer:Front-end GPT technology can already complete tasks such as buying and selling tokens, income agriculture, and portfolio management through natural language instructions. This abstraction lowers the threshold for DeFi and makes it easier for more types of users to get started.

-

market analysisAnd trend predictions:AI agents such as AIXBT can integrate data from social media such as Twitter to predict market trends for users. Although these tools are not yet fully automated, future AI agents may directly execute trading strategies.

-

AI Infrastructure and platforms:Platforms like Virtuals and ai16z provide strong technical support for AI agents. In the future, a dedicated DeFAI app store may emerge to provide customized AI tools for tasks such as revenue optimization and risk management.

-

Revenue optimization and investment automation:Integrating AI technology into DeFi can help users automate investment strategies, maximize benefits and optimize risk management. This automation-centered approach will also significantly improve DeFi’s capital efficiency.

Development potential of DeFAI

The rise of DeFAI has brought new possibilities to DeFi and solved many long-standing problems, such as complex operating processes and inefficient capital allocation.

Although DeFAI’s current market value is only US$2.1 billion, which is still far from DeFi’s market value of US$128 billion, the growth potential in this area cannot be ignored.

As technology matures and users gradually accept it, DeFAI is expected to become an important pillar of the crypto economy, seamlessly combining the advantages of artificial intelligence and decentralized finance.

Mode: The leader in the full-stack DeFAI chain

Introduction to Mode

Mode is a Layer 2 solution based on the Ethereum Virtual Machine (EVM) and built using OP Stack technology. As part of OP Superchain, Mode benefits from this interoperable blockchain ecosystem. Through optimistic rollup, Mode is able to process transactions offline and then settle them in batches to the Ethereum main chain. This design not only ensures the speed and cost-effectiveness of transactions, but also maintains the security of Ethereum.

Since its launch on the main network in February 2024, Mode has achieved remarkable results:

-

Completed more than 59 million transactions;

-

Deployed 73 DeFi protocols;

-

Has more than 400,000 users;

-

The total value (TVL) of lockups reached US$400 million, ranking third among Superchain’s Layer 2 solutions.

On this basis, Mode is committed to building a full-stack DeFAI infrastructure to meet the needs of this emerging field. As a DeFi-focused Layer 2 chain, Mode’s goal is to expand DeFi to billions of users through on-chain agents and AI-driven financial applications.

To support this vision, Mode has funded five projects and helped nine teams through the AIFI accelerator. In addition, Mode launched the Bittensor-based Synth subnet and an AI agent application store, and successfully held DeFAI hackathons.

As of January 2025, Mode has deployed more than 7300 AI agents and processed 12,800 AI transactions. As the demand for DeFAI continues to grow, Mode is leading the development of this field, gradually achieving a fully autonomous on-chain economy.

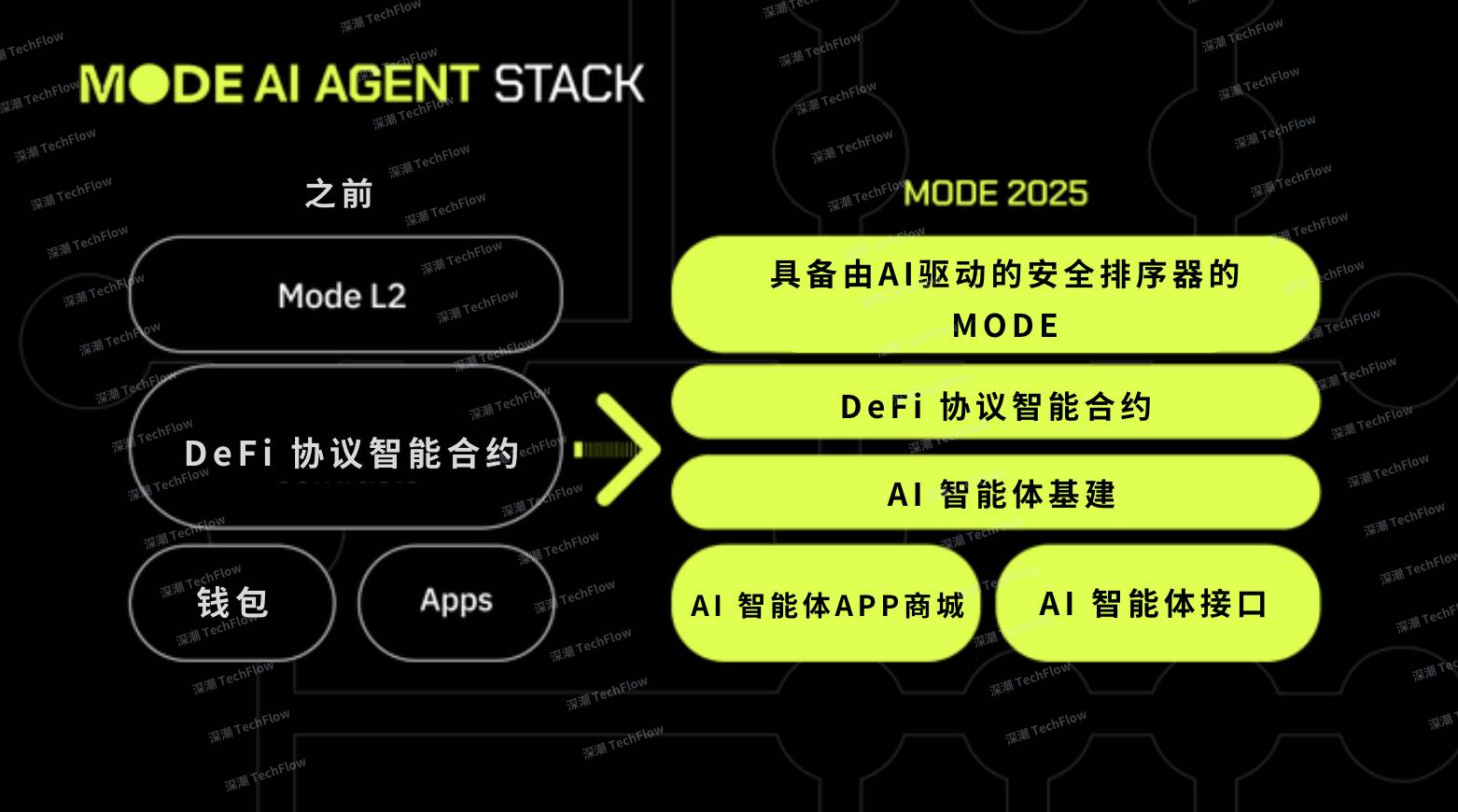

What is Mode’s DeFAI stack?

Mode’s DeFAI Stack

Source:Mode(Compiled by Shenchao TechFlow)

-

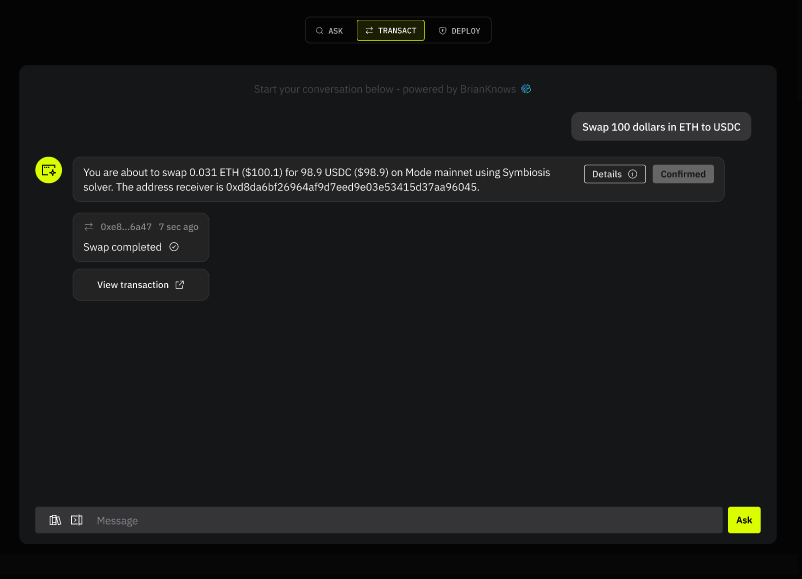

Interaction Layer

Mode’s interactive layer brings two innovative solutions: AI Terminal and AI Agent App Store. These tools redefine the way users interact with DeFi, allowing users to automate on-chain transactions, smart contract deployment, and asset management through AI without relying on multiple dApp front-ends.

AI Terminal: DeFi’s smart assistant (expected to open beta to $MODE pledgers in January 2025)

AI Terminal, your DeFi smart assistant

Source:Mode

AI Terminal is a DeFi interface driven by GPT technology that helps users easily complete the following tasks:

-

Manage cross-chain investment portfolios;

-

Deploy smart contracts and distribute tokens;

-

Launch NFT projects and interact with assets on the chain;

-

Use AI to assist in executing pledge and revenue agricultural strategies.

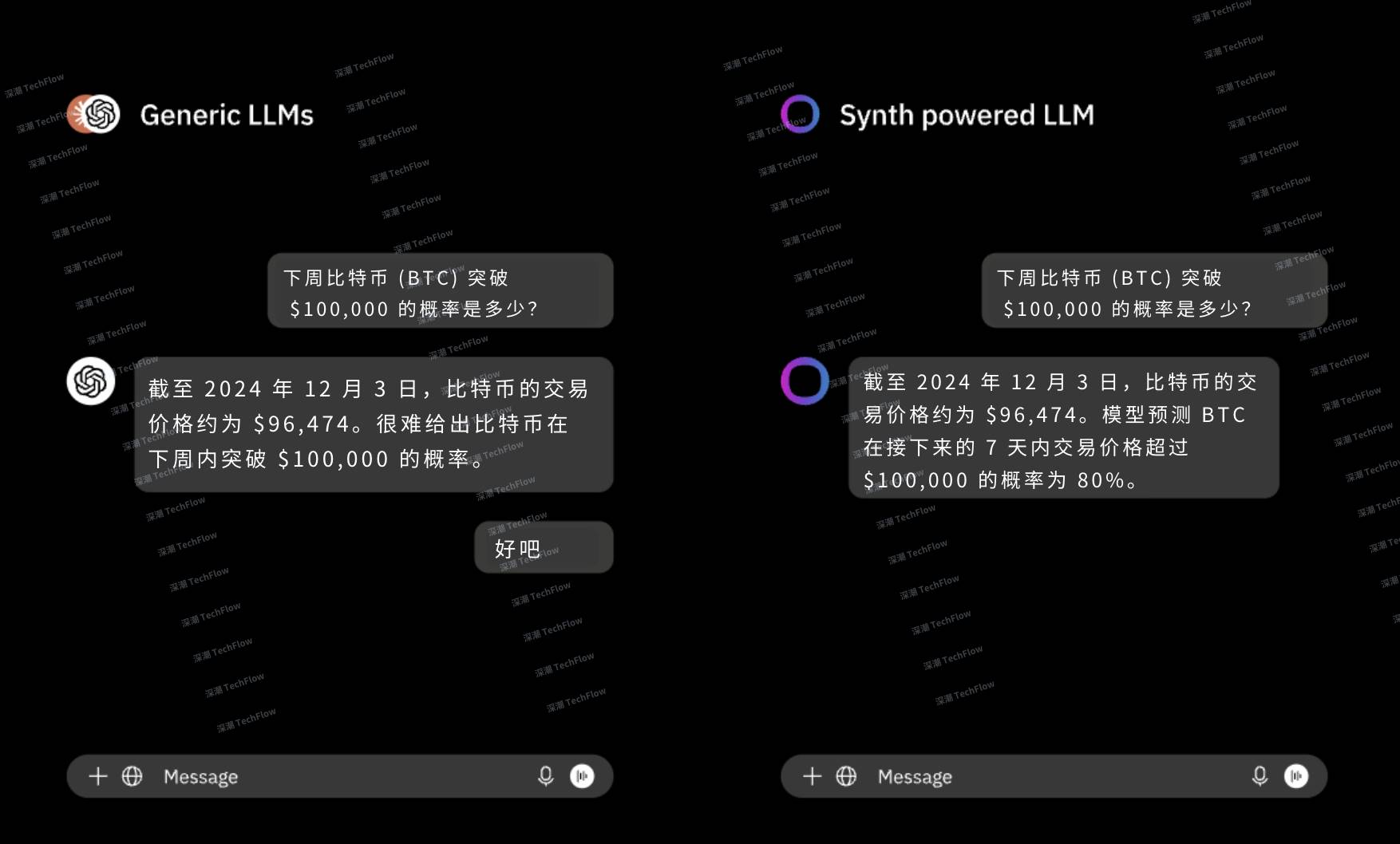

The highlight of AI Terminal is its deep integration with Synth. Synth is a synthetic data layer that provides users with high-precision market probability analysis. This feature is not currently available in other large language models (LLMs) or AI agents.

As DeFi’s smart assistant, AI Terminal allows users to easily use DeFi applications. It initially supported the Mode ecosystem and plans to expand to multi-chain operations in the future.

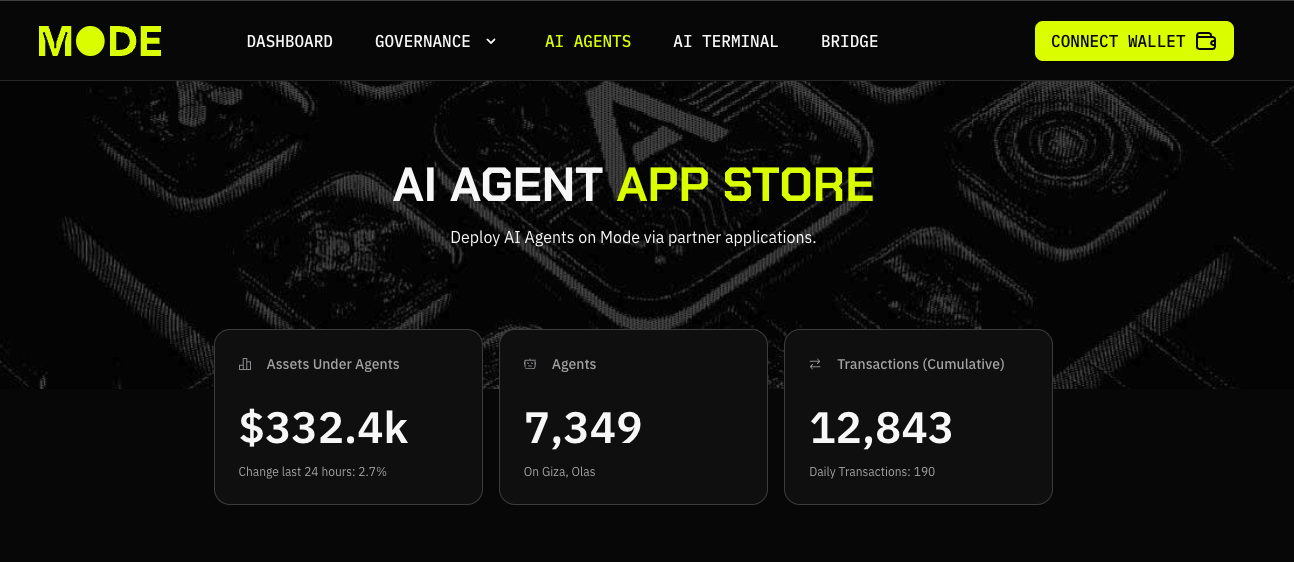

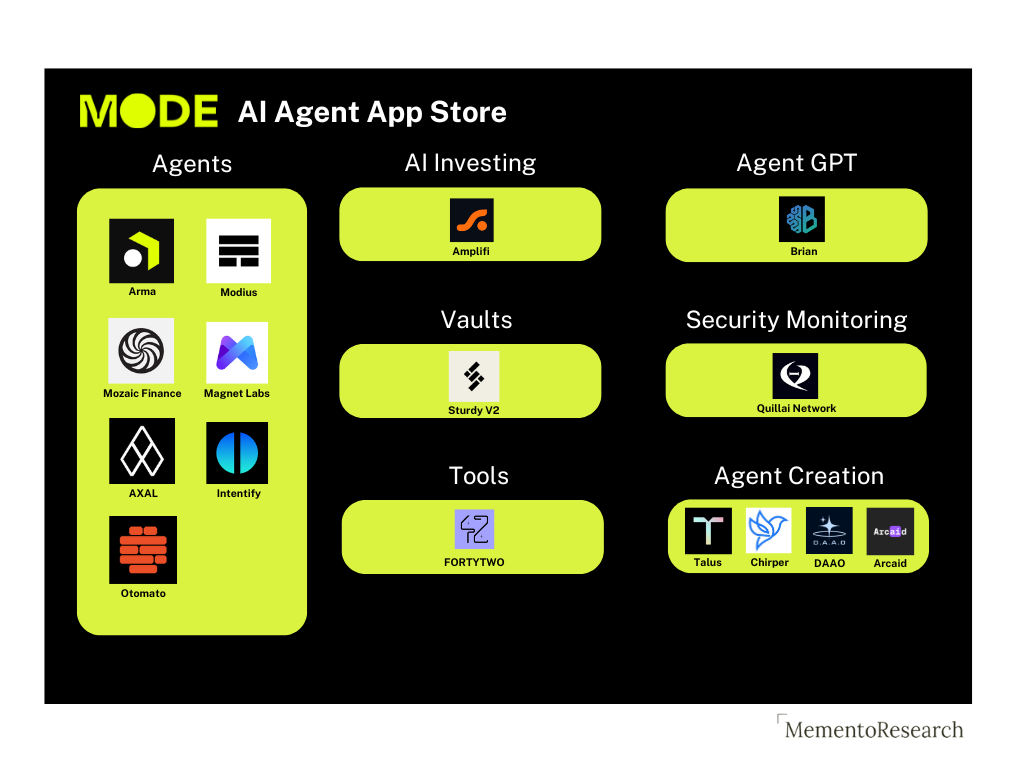

AI Agent App Store: An integrated platform for on-chain AI strategies

Mode’s AI Agent App Store

Source:Mode

The AI Agent App Store is an integrated platform that provides users with DeFi policy AI agents. Since its launch in November 2024, the platform has achieved:

-

Deploy 7349+ AI agents (running on Giza and Olas);

-

Manage assets exceeding $332K.

As a coordination platform, the AI Agent App Store provides a variety of pre-built AI agents to help users complete specific DeFi tasks.

In the future, the platform will launch more frameworks and launch tools. The new agents planned for release this year will focus on automated governance, cross-chain policies, and autonomous protocol deployment on Mode.

-

Data Layer

Data and computing are the core cornerstones of AI agent development, and both are indispensable.

The level of intelligence of an AI agent depends on the quality of its training data. However, many existing financial AI agents lack high-quality synthetic price data and are difficult to provide accurate predictions or conduct probability analysis.

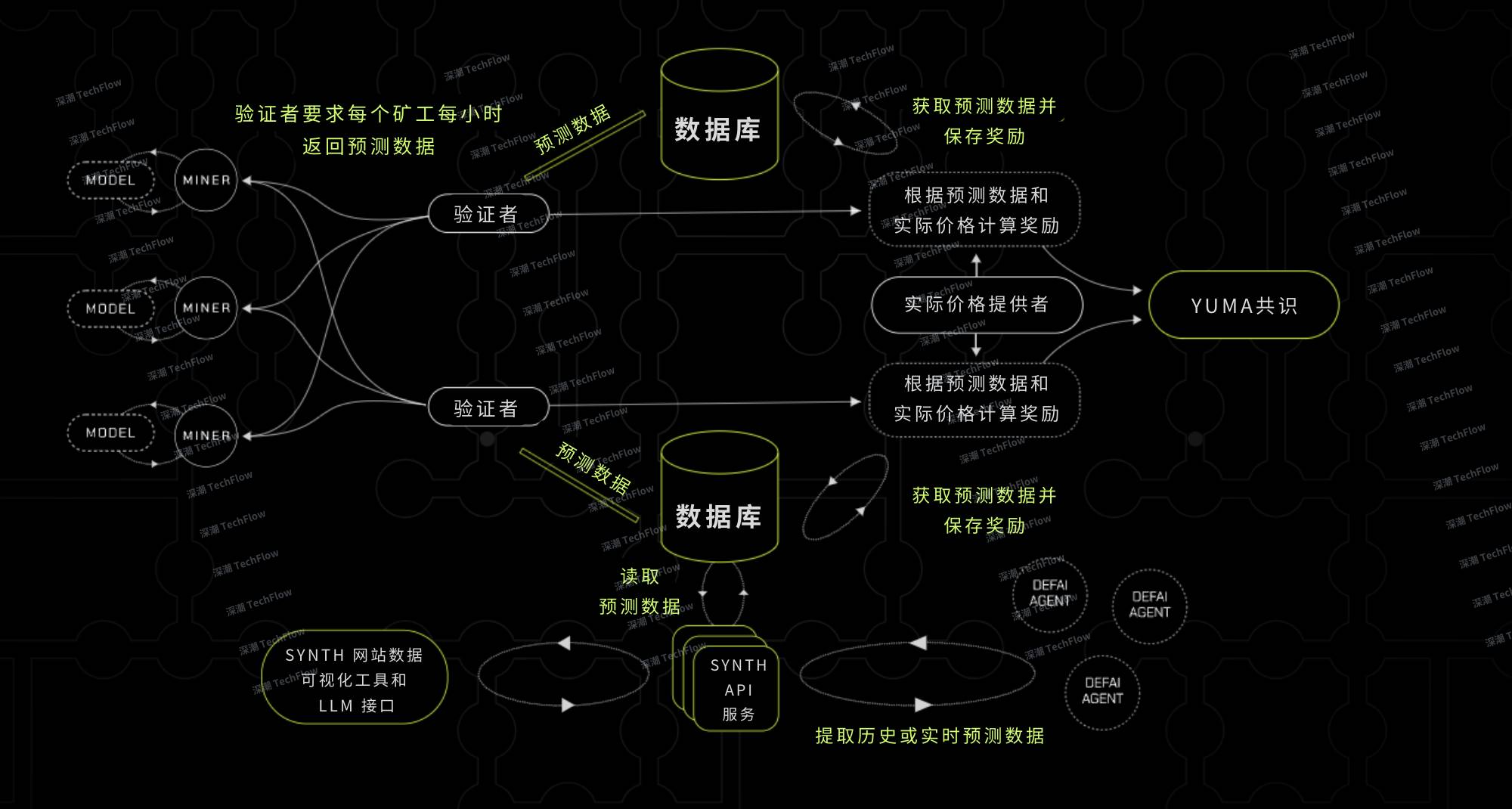

To this end, Mode created a Synth subnet on Bittensor to provide high-quality synthetic price data to support the operation of AI agents and LLM. This innovation unlocks multiple new DeFi use cases, including:

-

Optimize the liquidity range of automated market makers (AMM);

-

Option pricing based on probability model;

-

AI-driven trading strategies based on multipath simulation.

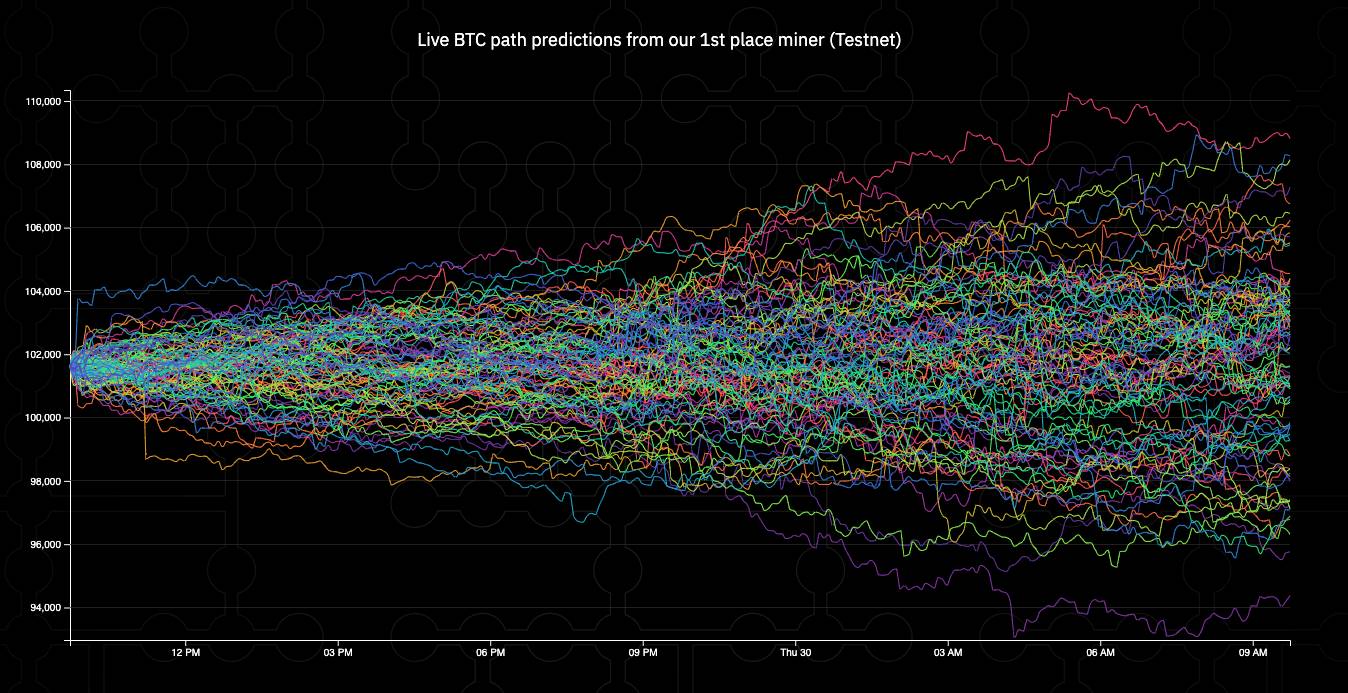

The art of prediction? Yes, that’s what makes Synth unique.

Source:Mode

Mode focuses on generating a complete probability distribution of price changes, rather than just predictions of a single outcome. This capability opens up new possibilities for DeFi’s risk management and revenue optimization.

Synth’s workflow

Source:Mode(Compiled by Shenchao TechFlow)

working principle

Mode’s Synth subnet generates accurate probability predictions by simulating multiple price paths. Unlike traditional models that only predict a single price, Synth is able to capture real market dynamics, including extreme fluctuations and price changes.

The system uses the Continuous Ranked Probability Score (CRPS) to evaluate the accuracy of the forecast, mainly from the following two aspects:

-

Sharpness: How accurately the model predicts the price range;

-

Calibration: The degree to which forecast results match actual market changes. This mechanism allows AI agents to make smarter and more flexible decisions.

With the recent launch of the Synth Subnetwork Main Network (SN50) on Bittensor, Mode’s DeFAI agents are now able to obtain probability prediction capabilities in real time.

Prediction capabilities of the Synth subnet

Source:Mode(Compiled by Shenchao TechFlow)

-

Infrastructure Layer

Mode’s infrastructure layer further upgrades the security and interoperability of the ecosystem.

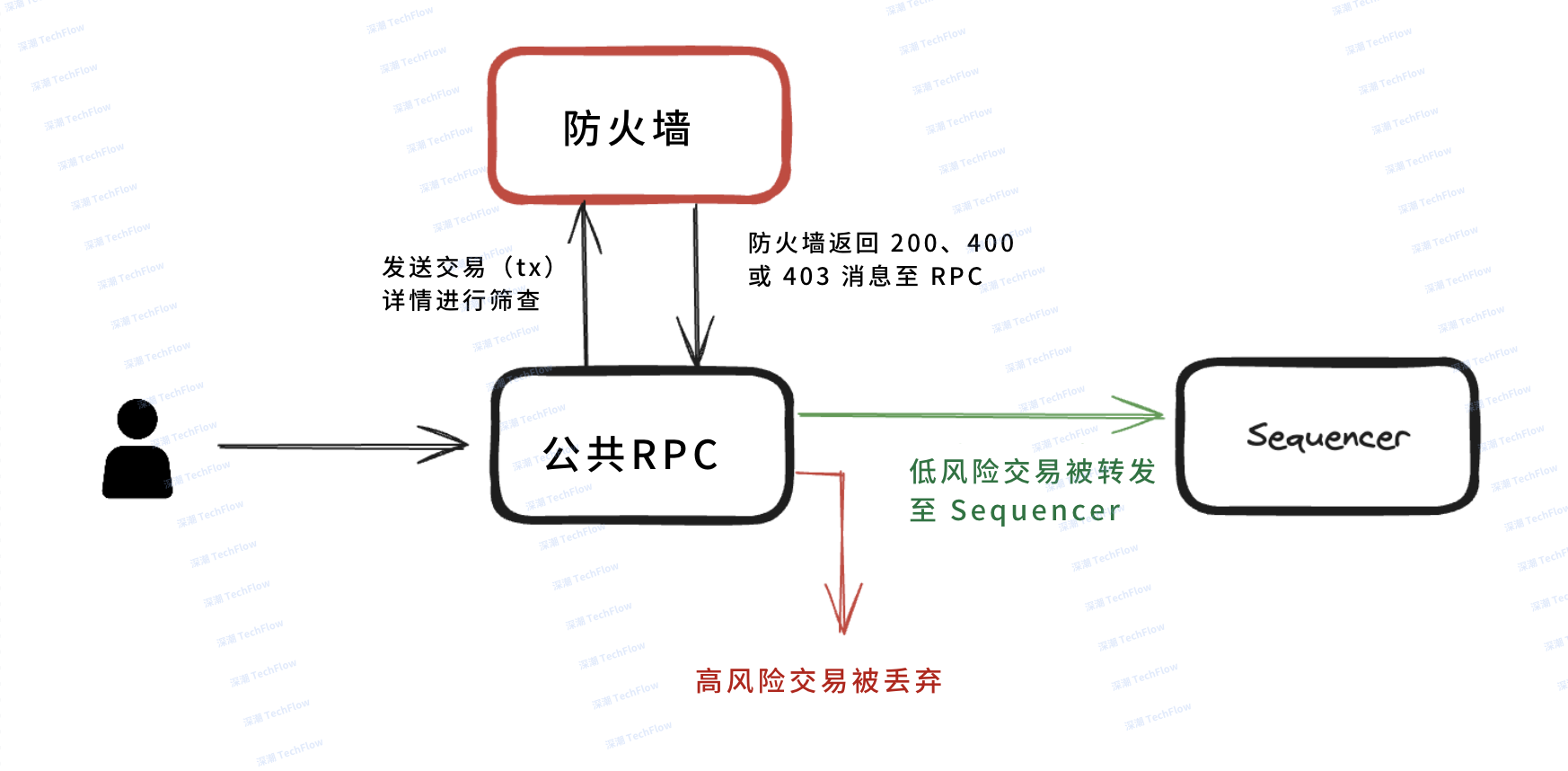

AI Secured Sequencer

Mode is developing an AI security sequencer that combines Forta Firewall technology to provide greater security for Layer 2 transaction processing. This feature is currently in the testnet phase and is designed to intercept potentially malicious transactions before they are executed.

Integration of transaction flow with Forta Firewall

Source:Forta(Compiled by Shenchao TechFlow)

Working principle:

-

Forta’s AI firewall analyzes transactions in real time and identifies potential risks;

-

Suspicious transactions will be flagged, intercepted or delayed for further review;

-

Malicious activity is blocked at the source, effectively preventing vulnerability exploitation.

Main advantages:

-

High detection accuracy: Forta can detect 99% of vulnerabilities, with a false alarm rate of less than 0.001%, and a response time of only 50 milliseconds;

-

Enhance the security of developers and users: Developers ‘applications have built-in security protections to protect user assets from malicious transactions.

Interoperability of Superchain:

As a core member of Superchain, Mode can access multiple DeFi protocols. Through Mode’s application and interface, users can realize cross-chain bridging of assets and implement cross-chain strategies. This design not only simplifies cross-chain deployment, but also ensures ecosystem interoperability standards.

Mode’s ecosystem and application scenarios

Ecosystem overview: Mode

Mode ecosystem as of May 2024

Source:Mode

Mode’s DeFi ecosystem is rapidly expanding, with more than 250 dApps currently being developed on its network. Thanks to Superchain’s interoperability and growing mobility, Mode occupies an important position in the DeFAI field.

AI-driven functions such as probability prediction implemented through the Synth subnet bring significant advantages to the DeFi protocol and promote a smooth transition from traditional DeFi to DeFAI.

Although still in its early stages, Mode has attracted more than $332K in assets. This number has grown significantly since the launch of the AI Agent App Store, which provides users with a variety of agents and tools to meet different DeFi needs.

Mode’s AI Agent App Store

Source: Memento Research

Ecosystem expansion plan

Mode is accelerating the expansion of its DeFAI ecosystem through a series of initiatives, including accelerator programs and hackathone activities, while working with frameworks such as a16z, GOAT and Olas to jointly promote technological innovation.

-

Mode AIFi/DeFAI accelerator program

To promote DeFAI’s technological innovation, Mode launched the DeFAI accelerator program in October 2024, providing a total of $100,000 in bonuses to outstanding teams.

This two-month intensive program recruits a batch of teams every quarter to promote the growth of the DeFAI ecosystem through multiple incentives.

Participating teams can not only obtain up to $10M in early fund support through Mode’s angel investment and venture capital network, but also enjoy Optimism audit subsidies without having to hand over shares in Token.

The first nine teams focused on key areas of DeFAI, including:

-

AI agent infrastructure: Talus Network, Infy;

-

DeFi agent training platform: Almanak;

-

AI asset management: Amplifi;

-

Security agent: QuillAI;

-

AI-driven front-end: FortyTwo;

-

Verified AI computing: Inference Labs, Aizel Network;

-

Code-less model training (mobile): Cerbo AI.

-

Mode AI Agent hackathon

The Mode AI Agent hackathon (first round) will be held from December 17 to 23, 2024, providing developers with the opportunity to develop AI agents based on the Mode platform and the following three frameworks:

-

GOAT: An open source framework that provides on-chain tool support for AI agents;

-

Eliza: A multi-agent simulation framework for deploying autonomous AI agents;

-

Olas: A platform that integrates tools and skills markets focused on creating efficient AI agents.

This hackathon revolves around five major themes: DeFi, BTCFi, social, games and Wildcard. The event attracted 698 registrants in just 6 days, and five award-winning projects were finally selected:

-

Midas: A chat-driven AI agent that handles complex DeFi operations such as trading, casting/destroying LP positions and liquidity management;

-

MoDAS: A multi-agent AI system used for DeFi automation to enable task collaboration between agents;

-

Memex: An AI-driven Meme coin deployment tool that automatically generates tokens using real-time trends;

-

Mode Mind: An AI agent that provides in-depth Token analysis for Mode and shares insights through X (Twitter);

-

Research Idea Generator: An AI tool that integrates NFT casting, voice-controlled note management capabilities, streamlining workflow through Eliza.

As more hackathon activities are launched, Mode will continue to promote technological innovation in the DeFAI field.

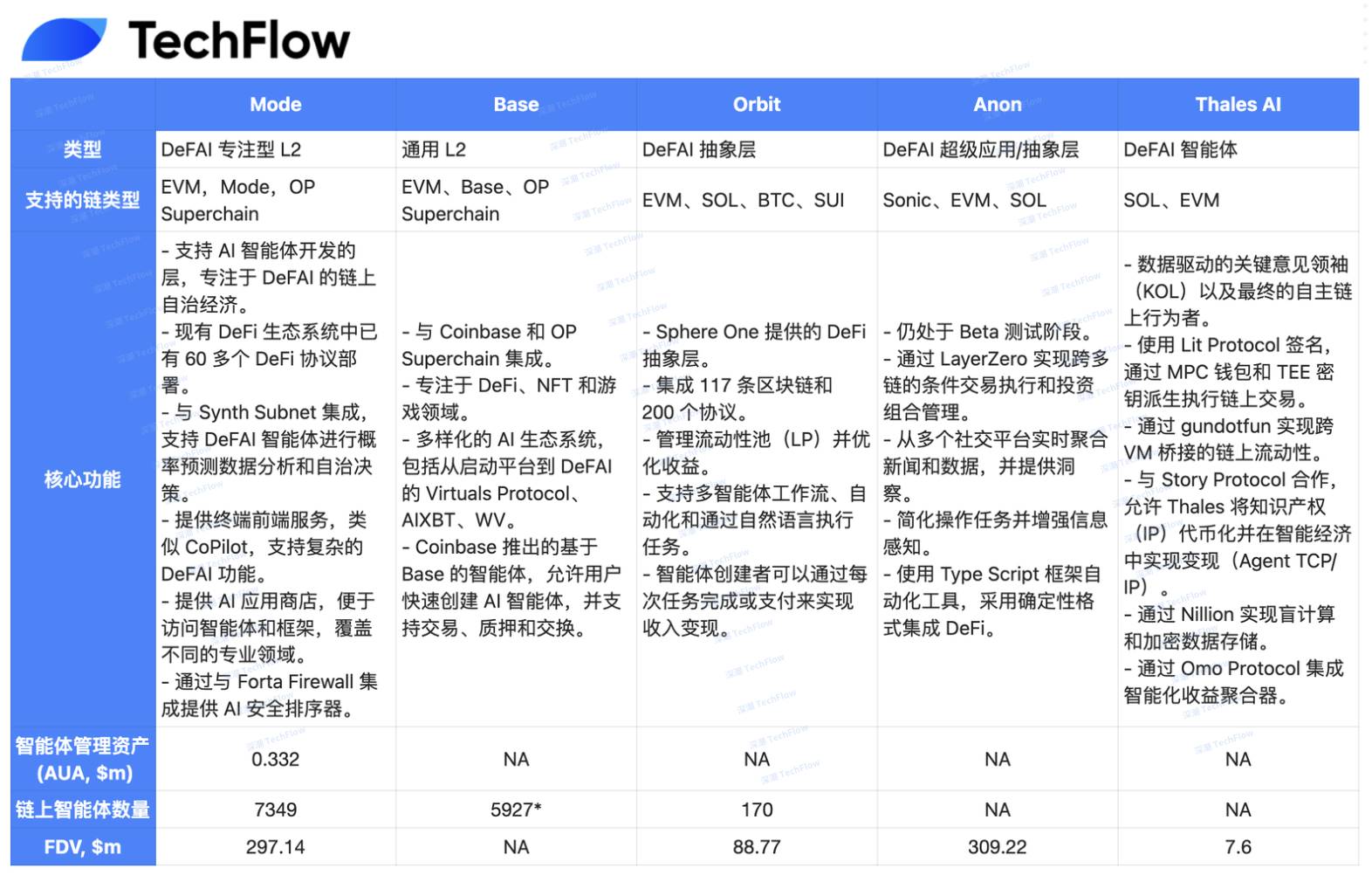

competitor analysis

L2 and DeFAI competitor analysis

Source: Memento Research (compiled by Shenzhen TechFlow)

Compared with other Layer 2 solutions such as Base, Mode stands out with its DeFAI-focused infrastructure, providing unique capabilities at the protocol level, such as the AI Agent App Store, front-end abstract terminals, and core infrastructure.

This focus has enabled Mode to successfully deploy more than 7,300 AI agents in its App Store, surpassing Base’s more than 5,900.

Although Base’s ecosystem covers a wide range of areas from launch platforms to DeFAI, at the L2 level, Mode’s deep focus on DeFAI is more advantageous. In addition, Mode is committed to building an autonomous on-chain economy, and its vision is gradually realized through the Synth subnet. The Synth subnet utilizes high-quality synthetic data to enable models to make autonomous predictions and decisions.

Currently, Mode’s agent managed assets (AUA) are approximately US$332,000, but its growth potential is huge as community expansion and ecological integration advance.

Compared with other protocols focused on DeFAI, such as Orbit, Anon, and Thales, Mode is unique in that it is a complete DeFAI L2 chain that provides core infrastructure support for AI agents to interact seamlessly in the ecosystem.

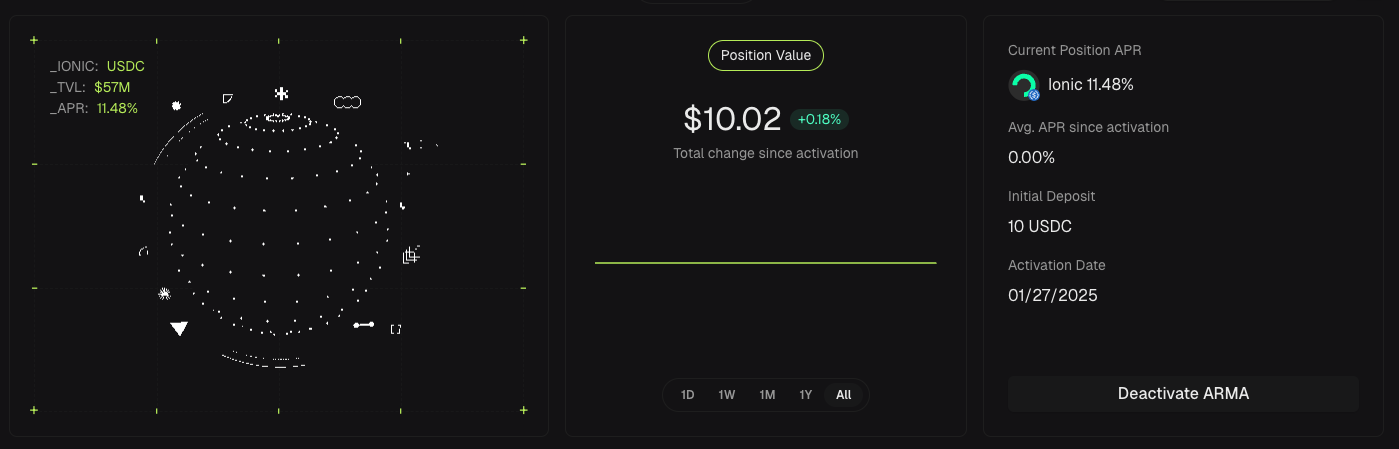

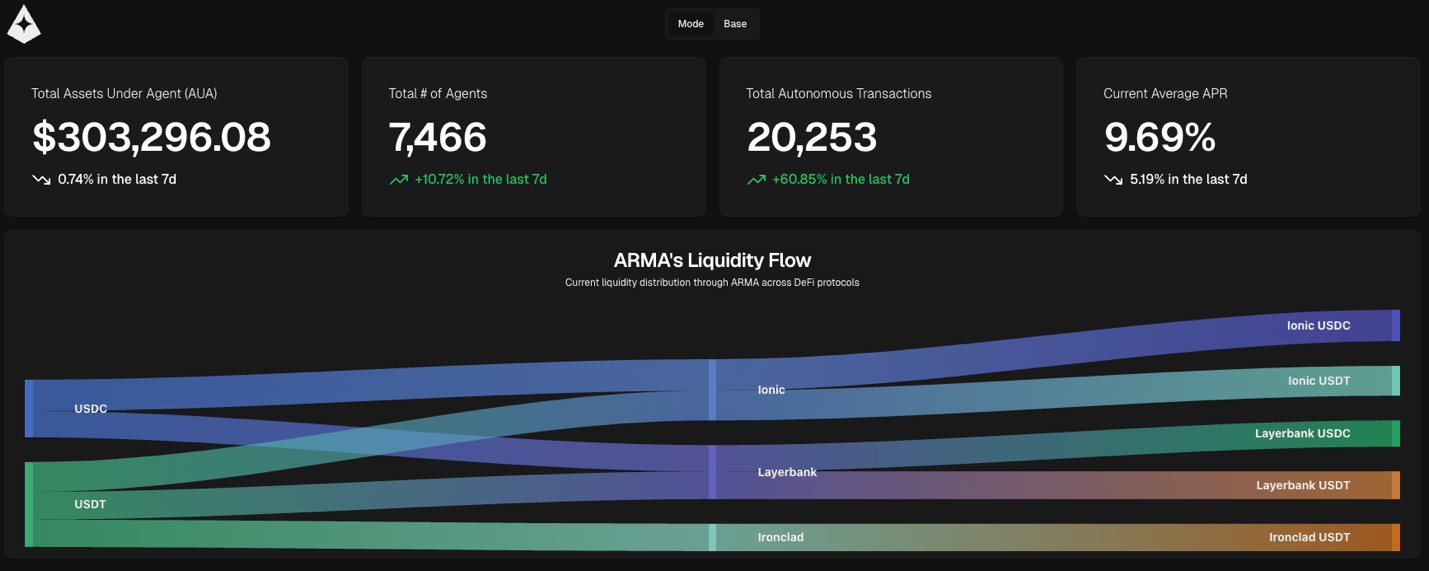

Case study: AI intelligence in the App Store

Giza’s ARM

ARMA Dashboard

Source:Arma

ARMA is an autonomous revenue optimization agent designed to maximize the deposit income of stablecoins (USDT, USDC). It continuously evaluates borrowing rates through Mode’s lending agreements (Ionic, LayerBank, and Ironclad) and dynamically allocates funds to the pool with the highest yields. ARMA ensures that users always control their funds by reducing transaction costs and increasing revenue. Main functions:

-

Self-managed smart accounts: Account abstraction technology ensures users have complete control over their funds.

-

Automatic rebalancing: Dynamically adjust assets to the most profitable loan pool.

-

Automatic compound interest: Automatically reinvest earnings to maximize long-term earnings. ARMA has managed more than US$300,000 in assets, deployed more than 7,400 agents, completed more than 20,000 autonomous transactions, and achieved an annualized rate of return (APR) of 9.69%.

ARMA Overview

Source:Giza

Amplifi

Amplifi is a member of Mode’s AI accelerator program, focusing on providing AI-driven revenue strategies for BTC and stablecoins. With a one-click vault, Amplifi eliminates Gas fees, redemption and cross-chain operations, making DeFi operations simpler and more efficient. Amplifi leverages full-chain liquidity to achieve optimal returns while ensuring full custody of assets. Its AI engine dynamically adjusts the allocation of funds between liquidity pools to prevent revenue decline.

Amplifi’s BTC policy example

Source:Amplifi

Main functions:

-

Dynamic asset management: Automatically optimize assets into the pool with the highest APY, suitable for BTC and stablecoin strategies.

-

Seamless cross-chain function: Utilize Polyhedra’s zkBridge technology to optimize cross-chain strategies and eliminate manual cross-chain operations and Gas fees.

-

Account abstraction: Supports gas-free transaction and provides Web2-style social login to enhance user experience.

-

Stabilize APY management: AI-driven mechanism ensures stable revenue and prevents revenue decline. Amplifi is currently in closed testing and plans to enter public testing in the first quarter of 2025. In the future, Superchain (BOB and Base), Cardano, Bitlayer and SVM/Move will be further integrated, and a full v1 version is planned to be released in the fourth quarter of 2025.

Modius by Autonolas

BabyDegen Overview

Source:Olas(Compiled by Shenchao TechFlow)

BabyDegen is an automated portfolio management tool developed by Autonolas that uses AI models and real-time market data to complete transactions independently on the Mode platform. By integrating external data sources such as CoinGecko, BabyDegen is able to analyze price trends and select the best trading strategy based on market dynamics, making decisions on buying, selling or holding operations in real time.

Main functions:

-

Personalized portfolio management: dynamically adjust trading strategies based on market changes.

-

Protocol and asset support: Supports USDC and ETH and runs on Balancer and Sturdy platforms.

-

Full autonomy and user control: Operate independently while ensuring full user control over the tool.

An Alpha version of BabyDegen is available to developers on GitHub, and a consumer-oriented version is expected to be available soon.

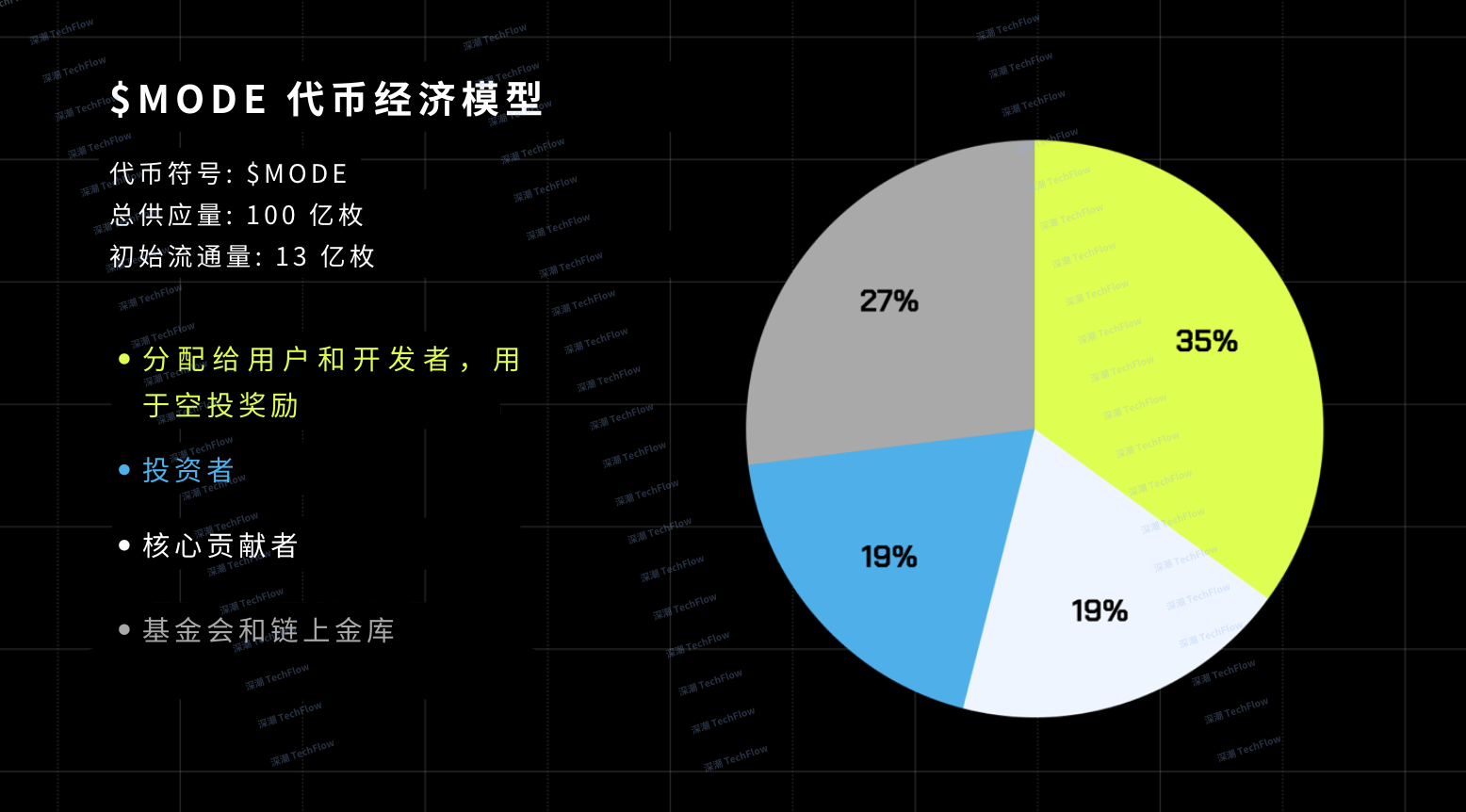

$MODE: Season decomposition and token economy

token distribution

Decomposition of token economy

Source:Mode(Compiled by Shenchao TechFlow)

$MODE was officially launched in May 2024 with an initial supply of 1.3 billion tokens, 35% of which will be allocated to users and developers to drive rapid growth in the ecosystem. The distribution so far is as follows:

-

Season 1: Allocate 5.5% of total supply.

-

Season 2: Allocate 5% of total supply.

-

Season 3: Marking the end of the points season, the focus shifts to the veMODE model.

-

Remaining allocation: 24.5% of total supply. Token allocation to core contributors (19%) and investors (19%) follows the following rules:

-

There is a 12-month lock-up period starting from the TGE (token generation event);

-

Unlock in a linear manner within 24 months.

27% of the tokens are allocated to foundations and on-chain treasury to support ecosystem plans and provide incentives for application users.

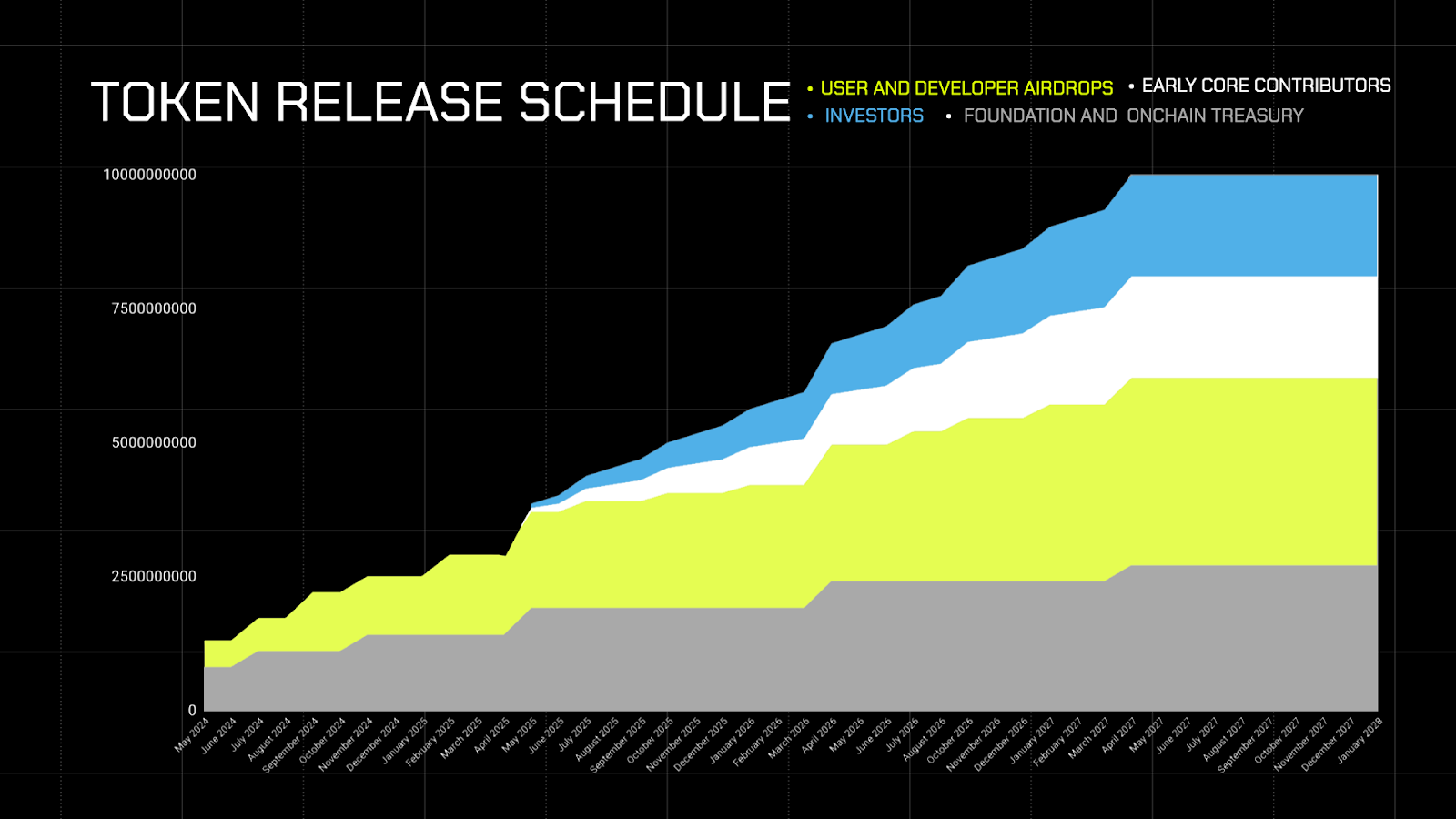

Unlock plan

Source:Mode

MODE: Season 1 3

Mode is currently in Season 4, and the previous three seasons have clear goals and tasks:

-

Season 1 (ending in May 2024): 5.5% of total supply was dropped to early participants.

-

Season 2 (May 10, 2024): 5% of $MODE and 1,000,000 $OP tokens were distributed through incentive activities.

-

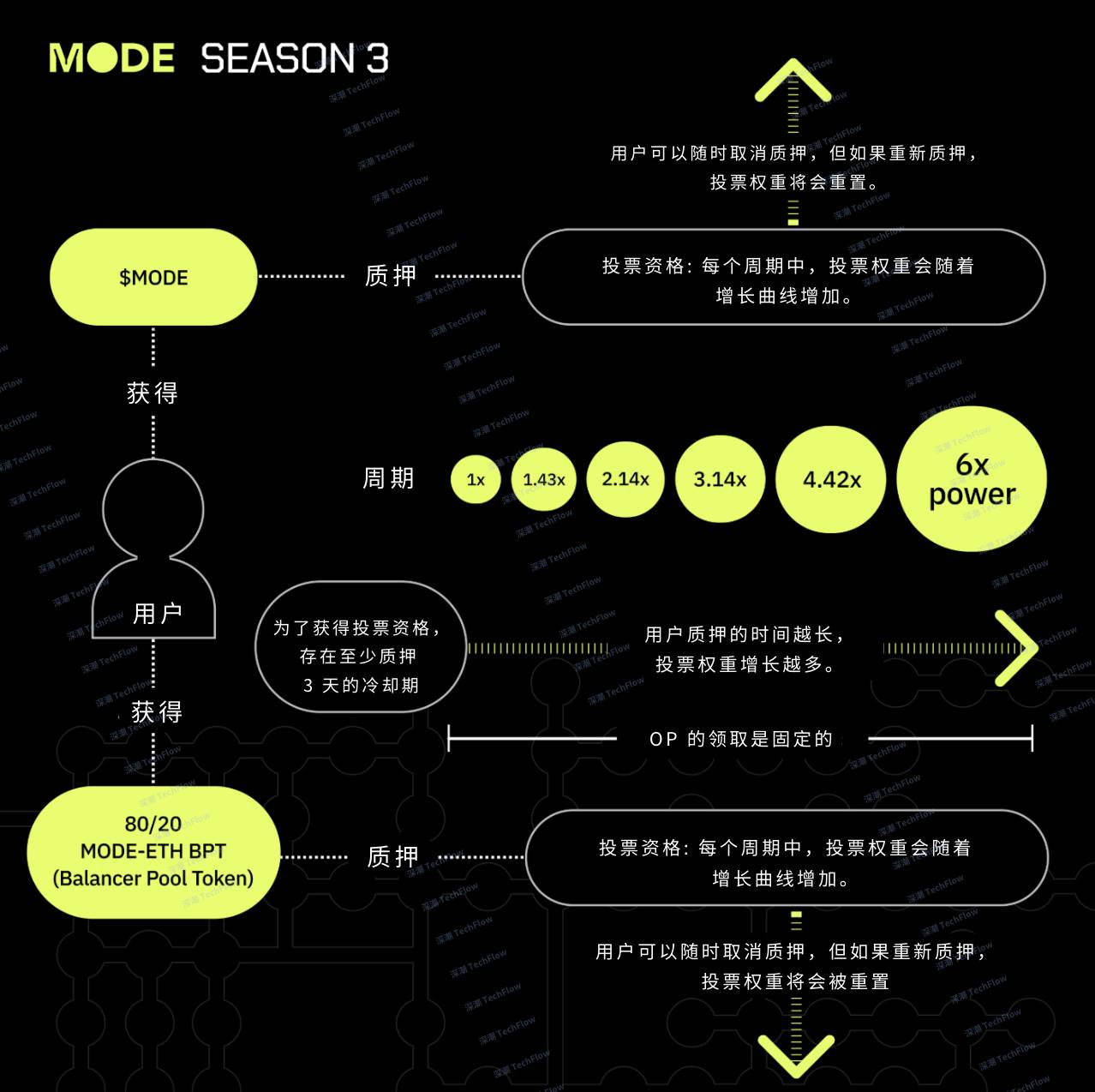

Season 3 (October 2024 and January 2025): Introducing veMODE and veBPT tokens, drawing on Curve Finance’s voting custody system, and promoting decentralized governance and incentive distribution.

Season 3 veToken Model

Source:Mode(Compiled by Shenchao TechFlow)

Season 3: Introduction of the veToken model

In Season 3, two tokens, veMODE and veBPT, were launched. Users gain governance rights and incentive distribution rights by pledging tokens.

-

veMODE: Obtained by pledging $MODE tokens, voting rights will increase as the pledge time extends.

-

veBPT: Obtained by pledging 80/20 MODE/ETH LP tokens on Balancer. The voting rights dynamic rules are similar to veMODE. Excitation is distributed in a 10:1 ratio of veMODE and veBPT. Holders of both token types can receive OP rewards based on the amount of pledge and voting participation. When the pledge is released, a 3-6-day cooling-off period will be triggered, and the voting rights and rewards accumulated during this period will be cleared. Voting takes place every two weeks for six cycles, and users can vote for agreements to compete for community incentive shares. The more votes the agreement receives, the greater its reward share. Incentives initially supported by OP grants will gradually transition to an airdrop program supported by $MODE. In the future, Mode will introduce a smart treasury similar to Olympus to support protocol operations and provide long-term incentive funds to veToken holders.

Mode: Season 4 (currently in progress)

Season 4 officially kicks off on January 20, 2025, launching the Bribe Marketplace and Proxy Staking/Voting governance mechanisms to further enhance the interaction between agreements and voters through bribery.

In Season 3, bribes were provided only in the form of isolated airdrops, while Season 4 integrated with the Hidden Hand platform to create a centralized market. Agreements can deposit bribes in the market and set specific payment conditions, and voters can easily track and receive rewards. This mechanism makes it easier for voters to support their preferred agreements.

$OP remains the main source of incentives, focusing on practical scenarios on the chain, such as revenue and liquidity incentives. At the same time, the bribery mechanism further enhances community participation by rewarding voters who participate in governance.

In addition, Season 4 also introduced pledge and voting functions for AI agent applications, using Crossmint’s GOAT framework to create new opportunities for AI-driven governance models. This breakthrough was due to Mode’s recent AI agent hackathon event.

Function of $MODE

As the core token of the ecosystem,$MODE has multiple purposes. Its main function is to join the veMODE club through pledge. After pledge, token holders can unlock the following rights:

-

Obtained whitelist eligibility for the AI agent project at the Mode launch board conference.

-

Participate in financing activities for AI agent projects through $MODE.

-

The AI agent project’s liquidity pool will run on the Velodrome platform and be exclusively paired with $MODE.

-

Participate in governance decisions on grant application and incentive allocation.

-

Promote collaboration between users and protocols by obtaining incentives (initially $OP, which will later shift to on-chain treasury support) through governance voting and participation in the bribery market.

-

Experience DeFAI tools such as Mode AI Terminal in advance.

-

Obtain airdrop qualification for the AI agent project. These functions effectively control the pace of token issuance and reduce inflationary pressures. At the same time, the introduction of veToken governance enhances the value of long-term holders through the token lockdown mechanism and lays a solid foundation for the prosperity of the DeFAI ecosystem.

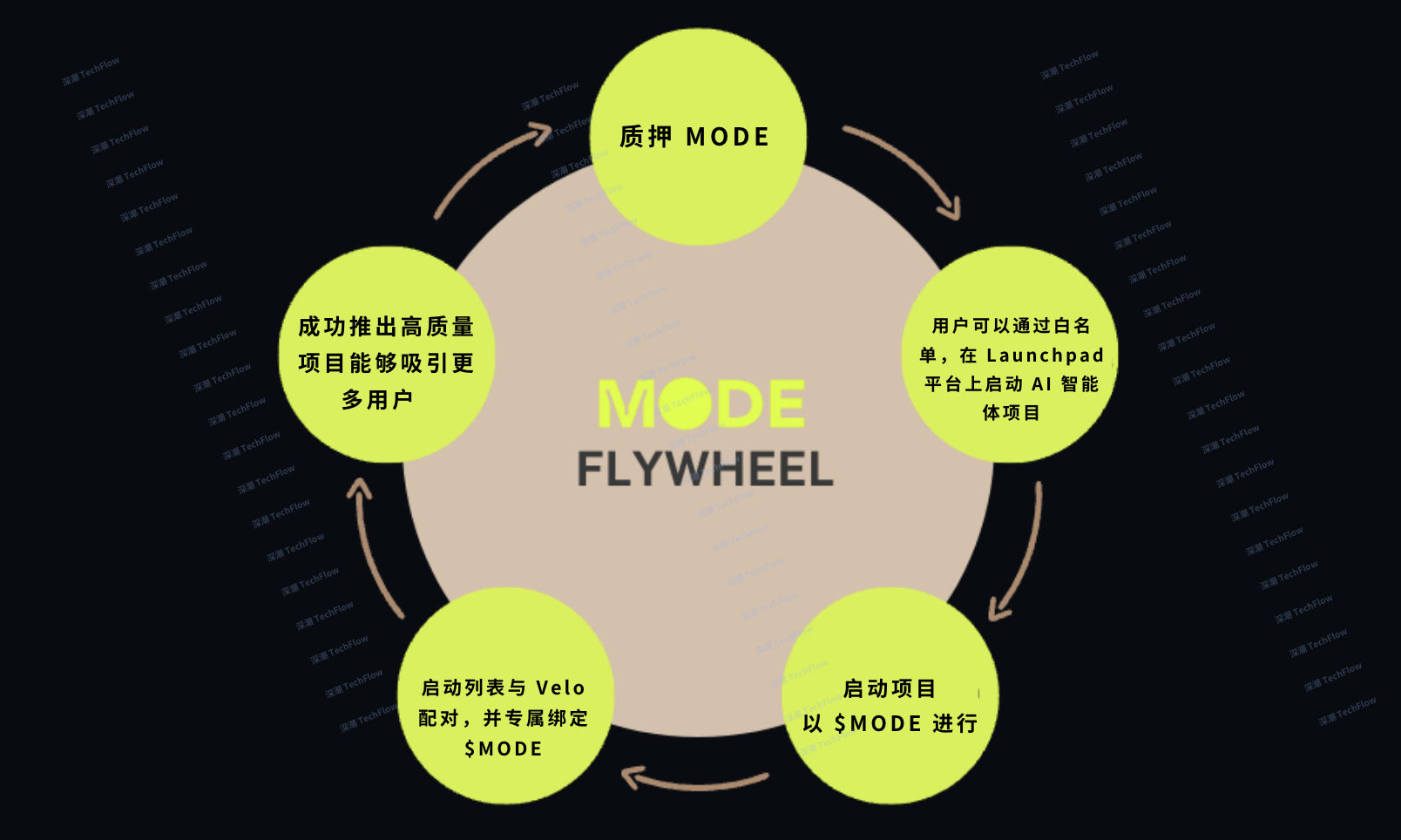

The ecological growth cycle of $MODE

With the launch of Season 4, the improvement of full-stack DeFAI infrastructure, and the release of more and more AI agent projects, Mode is forming a strong ecological growth cycle:

Original picture from Memento Research, compiled by Shenchao TechFlow

-

Users purchase and pledge $MODE to obtain veMODE.

-

After pledge, users can give priority to participating in project release activities on AI agent launch platforms (such as Chirper, DAAO and Arcaid).

-

On the launch platform, financing for AI agent projects is carried out in $MODE.

-

The new AI agent project will create a liquidity pool on the Velodrome platform and exclusively pair it with $MODE.

-

The release of high-quality AI agent projects has further increased the demand for $MODE, thereby attracting more users to participate in the pledge. This ecological cycle accelerates the expansion of the Mode ecosystem. In order to maintain this growth momentum, attracting high-quality AI agent projects developed based on Mode infrastructure is key, which will drive widespread adoption and prosperity of the DeFAI ecosystem.

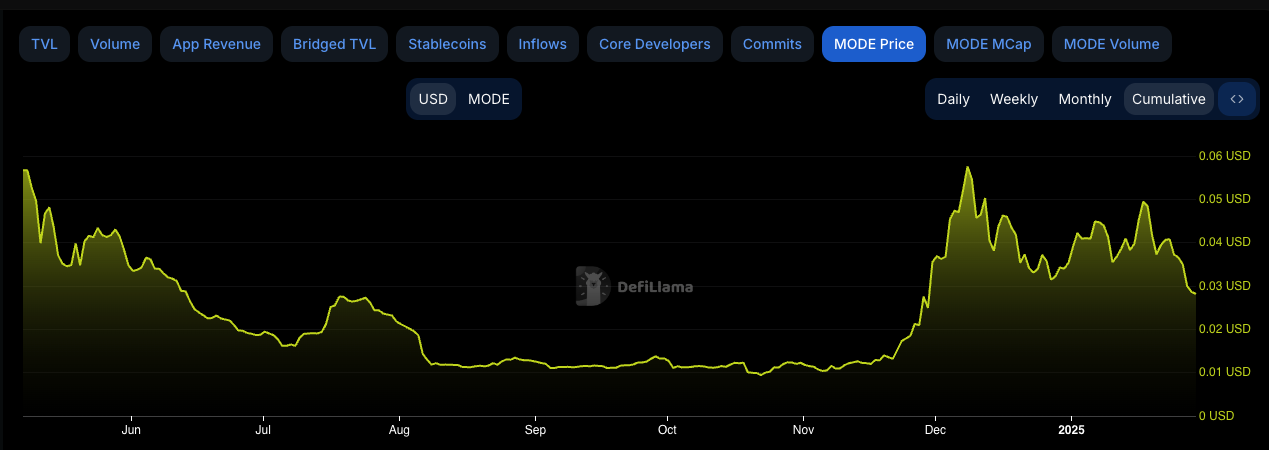

Impact of the veToken model

As of January 2025, approximately 432 million $MODE tokens have been pledged, accounting for 17.28% of the circulation supply. Since the launch of veMODE in October 2024, the vote-escrow model has become an effective token locking mechanism, reducing market supply and thus having a positive impact on the price of $MODE.

Price changes for $MODE

Data source: DefiLlama

Although veMODE has only been launched for three months, the pledge is still significantly attractive, especially driven by the upcoming autonomous chain economic project. As more high-quality projects are released on Mode, this ecological cycle will gain greater momentum.

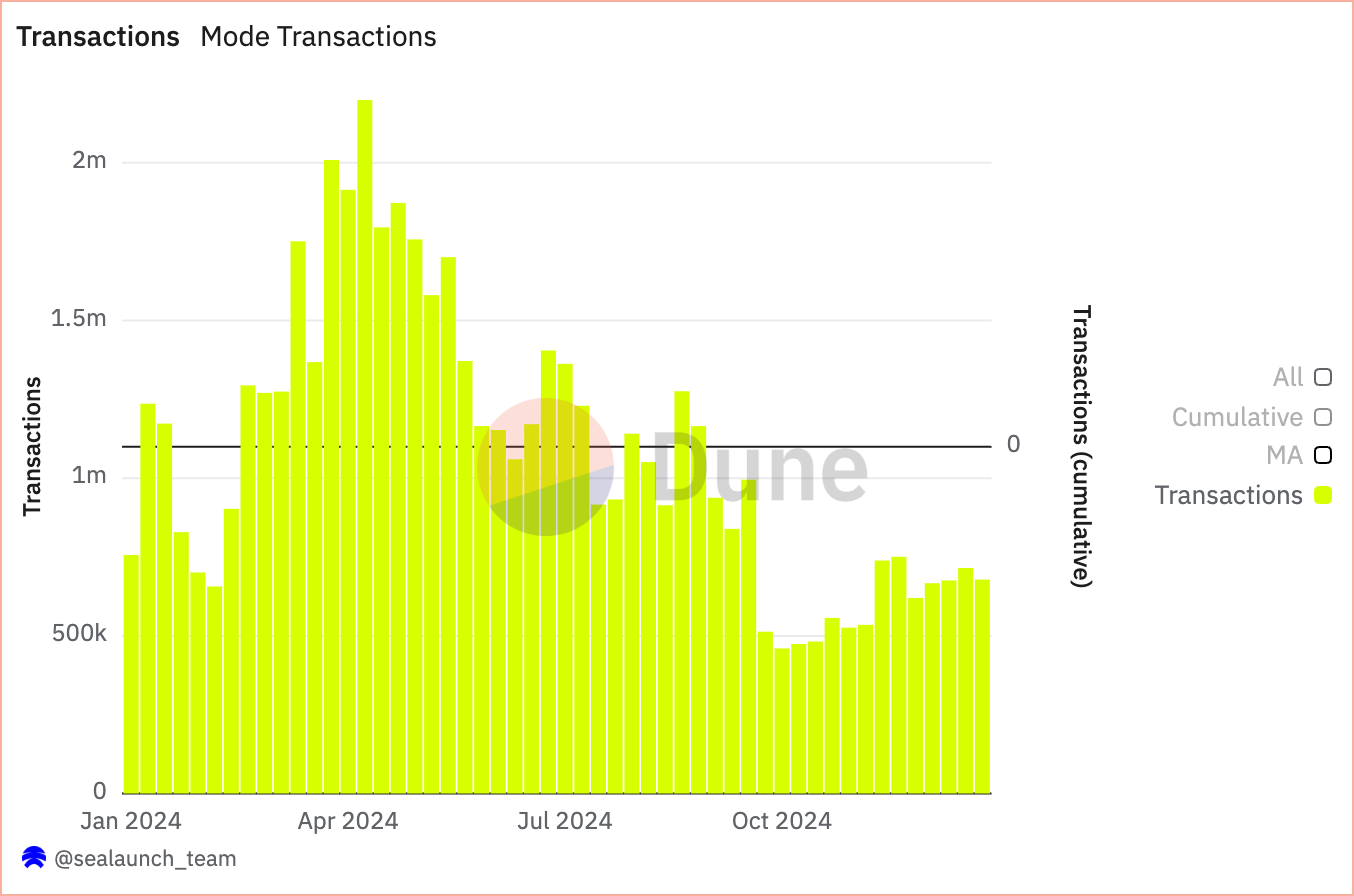

In addition, Mode’s total locked position value (TVL) has grown steadily, and on-chain trading activity has also shown a positive trend. Since the introduction of the veToken governance mechanism, daily trading volume has continued to increase.

Mode Daily trading volume growth trend

Data source:sealaunch_team (Dune)

The future development direction of MODE

In 2024, Mode focused on building a DeFi ecosystem for revenue assets, integrating more than 70 DeFi protocols and bridging more than $700 million in assets into the Mode network in just a few months.

Looking forward to 2025, Mode will further consolidate its position as a full-stack DeFAI chain, strengthening its DeFi ecosystem with a series of key releases. The main development directions include:

-

AI Terminal provides DeFi users with more convenient access methods and automated features.

-

The data layer of the Synth subnet improves prediction capabilities and on-chain decision-making efficiency.

-

The infrastructure layer enhances AI-driven security and interoperability with Superchain.

-

The recent launch of the Synth subnet is a major milestone for Mode, providing an efficient source of synthetic price data. This feature enables agents and large language models (LLMs) to improve prediction accuracy and support probabilistic reasoning, unlocking new probabilistic DeFi models and promoting the realization of economies on autonomous chains.

-

At the same time, Mode has further expanded the ecosystem and simplified the release process of Level 3 DeFAI agents through cooperation with AI-focused launch platforms such as Chirper AI.

-

In order to accelerate DeFAI innovation, Mode launched new programs such as the AI Agent Founders School in 2025, aiming to simplify the development and deployment process of AI agents on the Mode network.

Final thinking

The rise of DeFAI is fundamentally changing the landscape of DeFi, injecting more innovative power into decentralized finance, and tapping the synergy potential of AI and DeFi. With the rapid development of this field, we are gradually moving towards an autonomous and intelligent financial system.

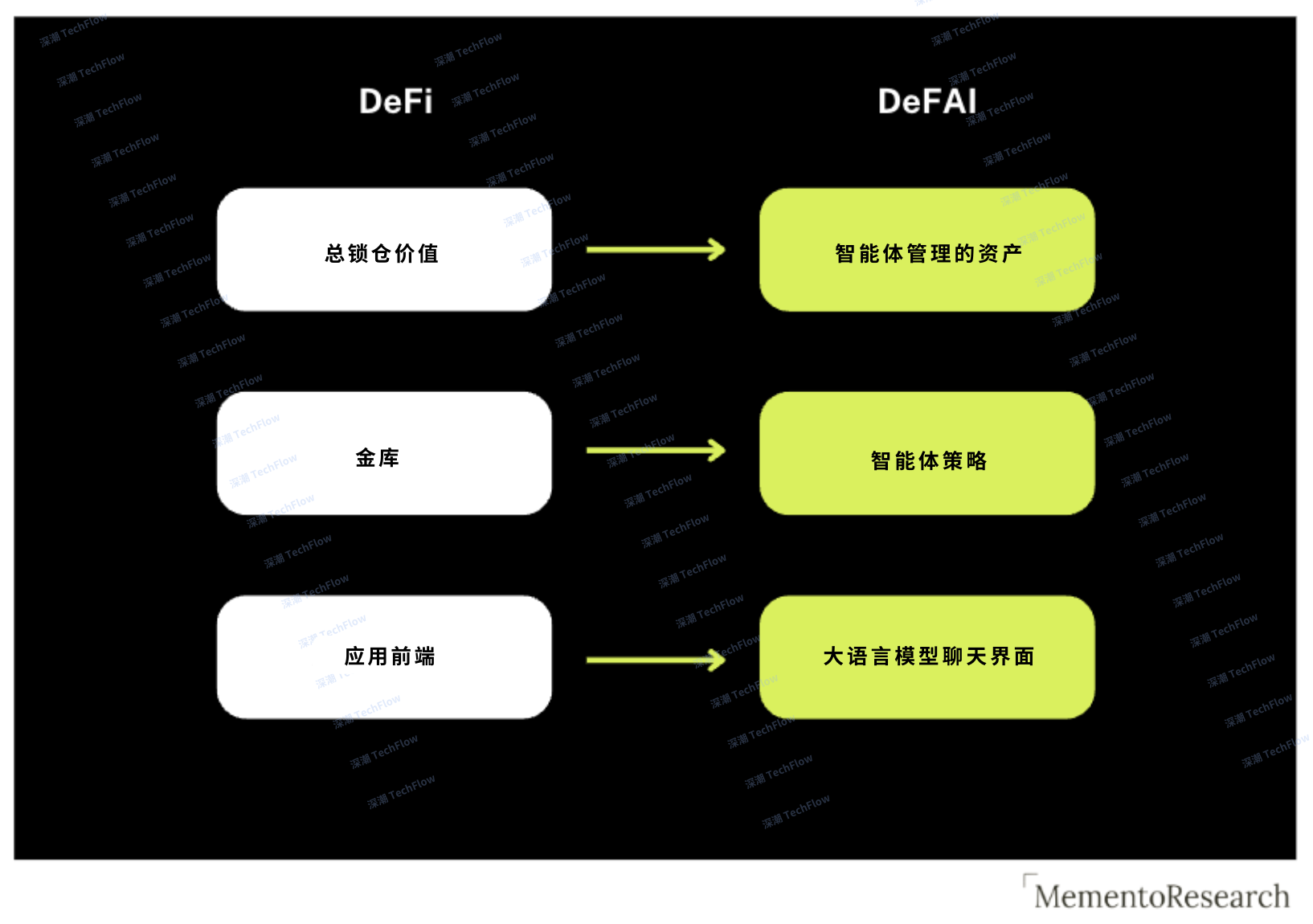

In the future, we can foresee:

-

Total locked value (TVL) will gradually transform into agent asset management (AUA), with assets dynamically managed by agents.

-

Vaults will be upgraded to Agent Strategies to realize intelligent optimization of revenue.

-

The traditional DeFi front end will be replaced by a Big Language Model (LLM)-driven chat interface, providing users with a more intuitive and automated interactive experience.

Transition to DeFAI

Data source: Memento Research (compiled by Shenchao TechFlow)

AI-driven interaction models have begun to take shape. Users accustomed to the Google era are gradually turning to smart conversation tools such as ChatGPT to get answers.

2025 is regarded as the first year of practical-driven AI agents. These autonomous agents can perform transactions, provide liquidity, lend and lend on behalf of users. With its complete full-stack infrastructure, rich ecological construction plans, and continuous investment in simplifying the development of AI agents, Mode has a unique advantage in this wave of autonomous chain agent economy.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern