Exchanges need to integrate on-chain functions and DeFi elements while ensuring platform stability and compliance.

Author:Tiger Research Reports

Compiled by: Shenchao TechFlow

summary

- Memecoins has transformed from purely speculative assets to dominant trading forces, not only attracting a lot of liquidity, but also reshaping the capital flow pattern in the crypto market.

- Platforms represented by Pump.fun have driven the rise of decentralized exchanges (DEX), attracting liquid and active traders, thereby weakening the early price discovery capabilities of centralized exchanges (CEX).

- Exchanges like MEXC that quickly adapted to trading in Memecoins performed strongly, while slower-responsive platforms such as Binance faced dual challenges of liquidity and market influence.

1. Exchange’s new battlefield

Memecoins is redefining the cryptocurrency market. From their initial speculative trend, they have now become important trading instruments on major exchanges, driving huge trading volumes.

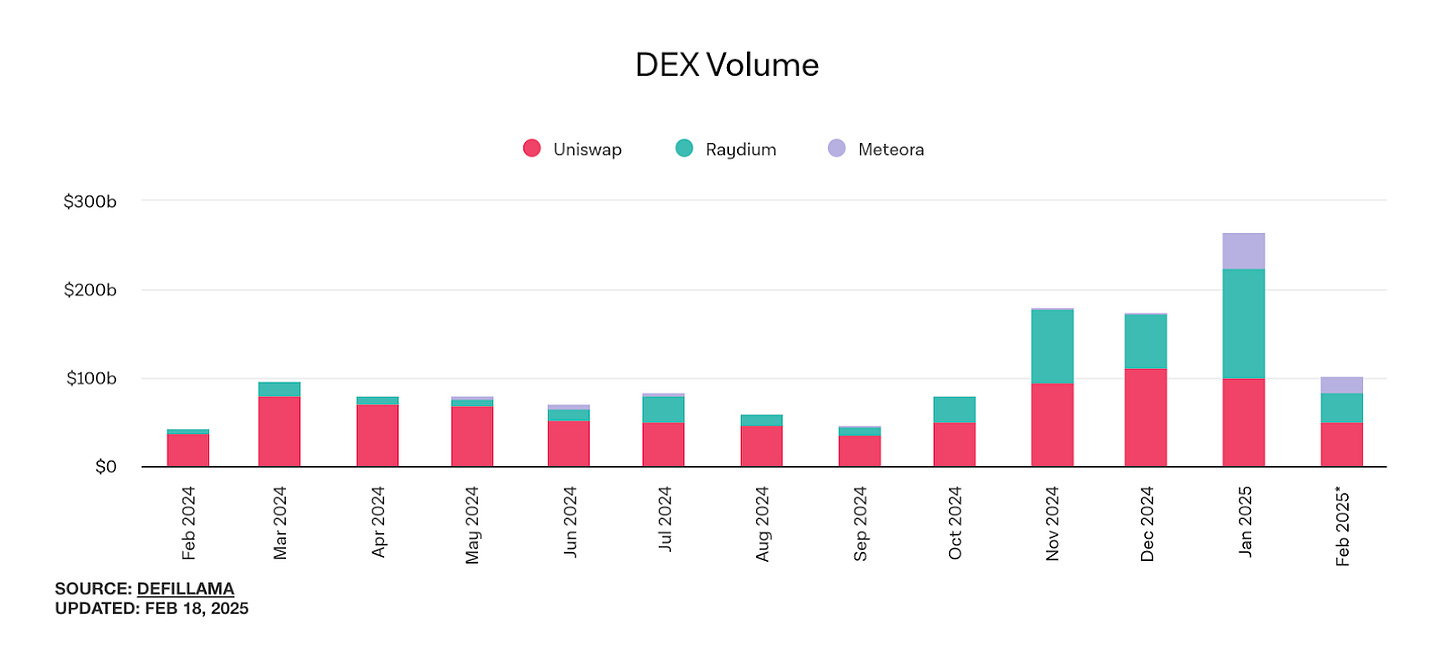

In order to adapt to this trend, exchanges have adjusted their strategies. Gate.io and MEXC gained market share by quickly launching Memecoins, while Binance launched Binance Alpha, focusing on early Memecoins launches and providing a smooth transition. In the DEX market, Solana-based Raydium has successfully surpassed Ethereum-based Uniswap to become the market leader. This change proves the powerful driving effect of Memecoins on the market.

As Memecoins continue to grow in importance on exchanges, their broader impact is also worthy of attention. Will Memecoins trading lead to a lasting market change, or is it just a short-lived cyclical phenomenon? In addition, how will changes in regulatory policies affect the sustainability of Memecoins as a mainstream asset? These issues will determine the future direction of retail trading and exchanges.

2. DEX breaks the status quo: Raydium surpasses Uniswap

Source: The Block, DefiLlama

The craze for Memecoins has driven the rapid rise of Raydium. As of January 2025, Raydium has accounted for 27% of the DEX market, becoming the platform of choice for retail investors. Raydium’s success is inseparable from the technical advantages of Solana Chain, which provides lower fees and faster trading speeds than exchanges on the Ethereum Chain. These characteristics make Raydium the core platform for Memecoins trading.

At the same time, Uniswap’s market share fell from 34.5% in December 2024 to 22% in January 2025, losing its dominant position in the DEX market. High Ethereum Gas fees have become a major obstacle for Memecoins traders, which has also led many cost-sensitive retail investors to turn to other platforms. If Ethereum-based DEXs cannot innovate in a timely manner, they will face greater liquidity transfer pressure.

Although the Memecoins deal has clearly driven Raydium’s growth, the sustainability of this trend needs to be observed further. Some analysts believe that the buying boom in Memecoins may fade as speculative demand declines. However, Raydium has become a familiar platform for users with Memecoins trading. If it can seize this trend, Raydium is expected to further consolidate its market position by strengthening liquidity pools, optimizing user experience, and building an efficient trading system. These efforts will help Raydium maintain a long-term advantage in the competition between DEX and CEX.

3. CEX’s response: Can they keep up with the rise of DEX?

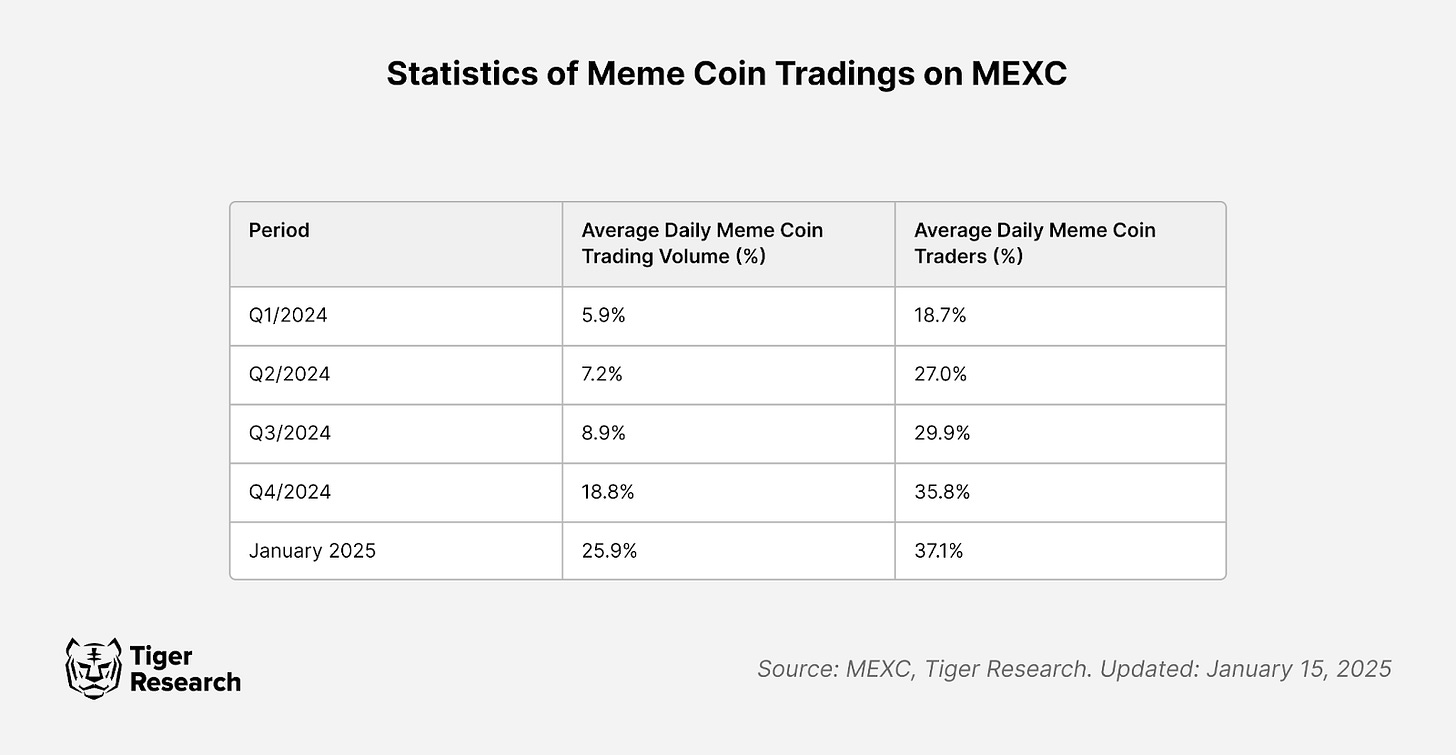

By focusing on Memecoins ‘listing strategies, Gate.io and MEXC have successfully attracted a large number of retail investors interested in speculative assets. Among them, MEXC has become a leader in this trend with its rapid Memecoins launch policy. For example, they opened trading on Memecoins Official Trump ($TRUMP) the day it went public, which directly led to record transaction volume and rapid growth in the number of users.

These strategies have had significant results. MEXC’s daily Memecoins trading volume soared from 5.9% in the first quarter of 2024 to 25.9% in January 2025. At the same time, the proportion of Memecoins traders also increased from 18.7% to 37.1%.

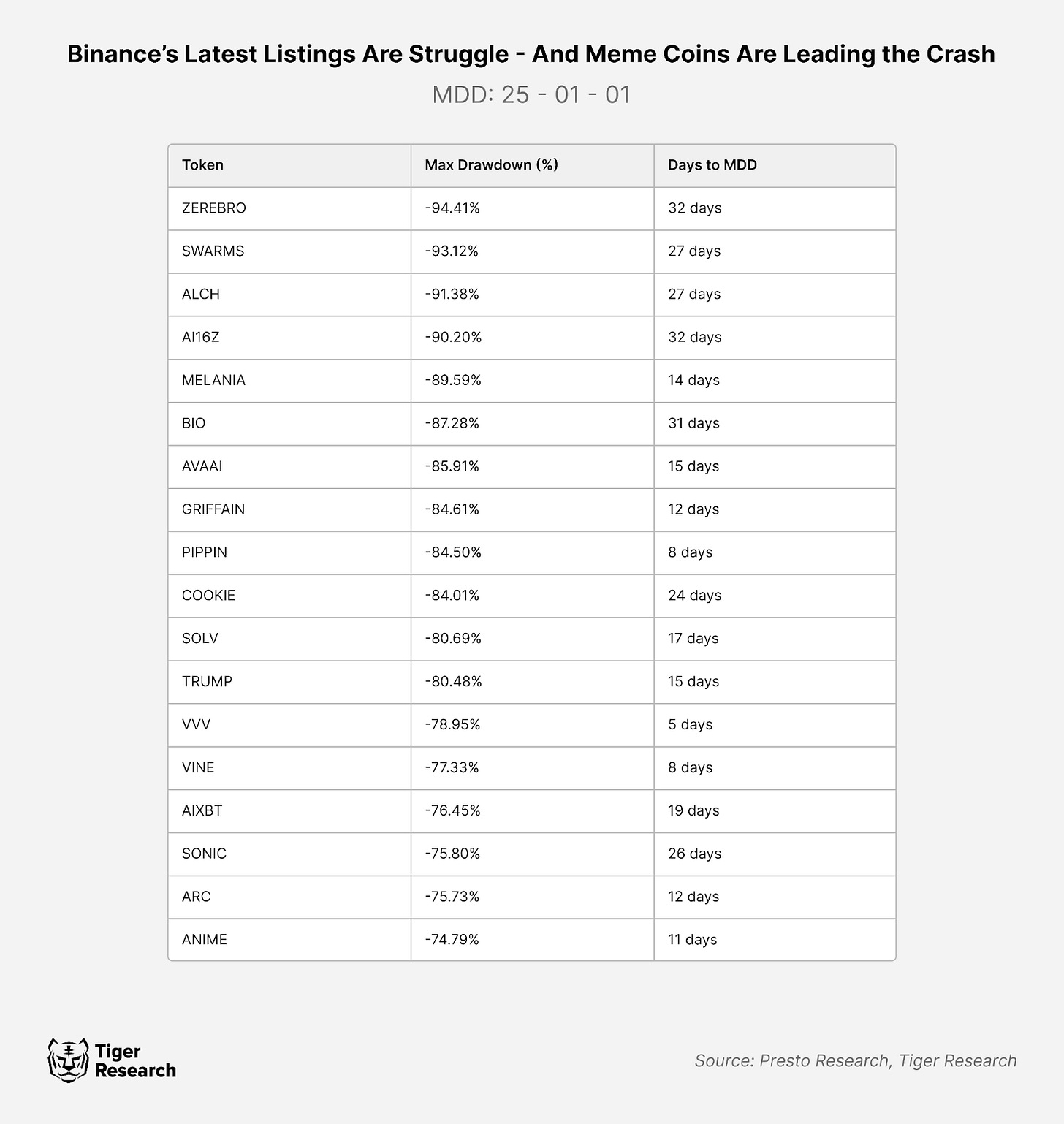

As the world’s largest cryptocurrency exchange, Binance is also actively expanding its Memecoins listing to attract retail liquidity. Recently, Binance has focused more on speculative assets in an attempt to seize market opportunities in the attention economy. However, due to its nature as a centralized exchange (CEX), Binance is inevitably limited by an internal review process. These processes lead to Memecoins being usually launched only when market popularity has dropped or is moving towards new trends.

Although Binance provided sufficient liquidity to protect investors, this liquidity instead became an outlet for early holders to sell Memecoins. Since the sell-off has little impact on market prices, the prices of many newly listed Memecoins generally fell by more than 75% in the short term, causing a large number of investors to suffer losses. This situation not only damaged Binance’s long-term reputation, but also raised questions about its listing review process.

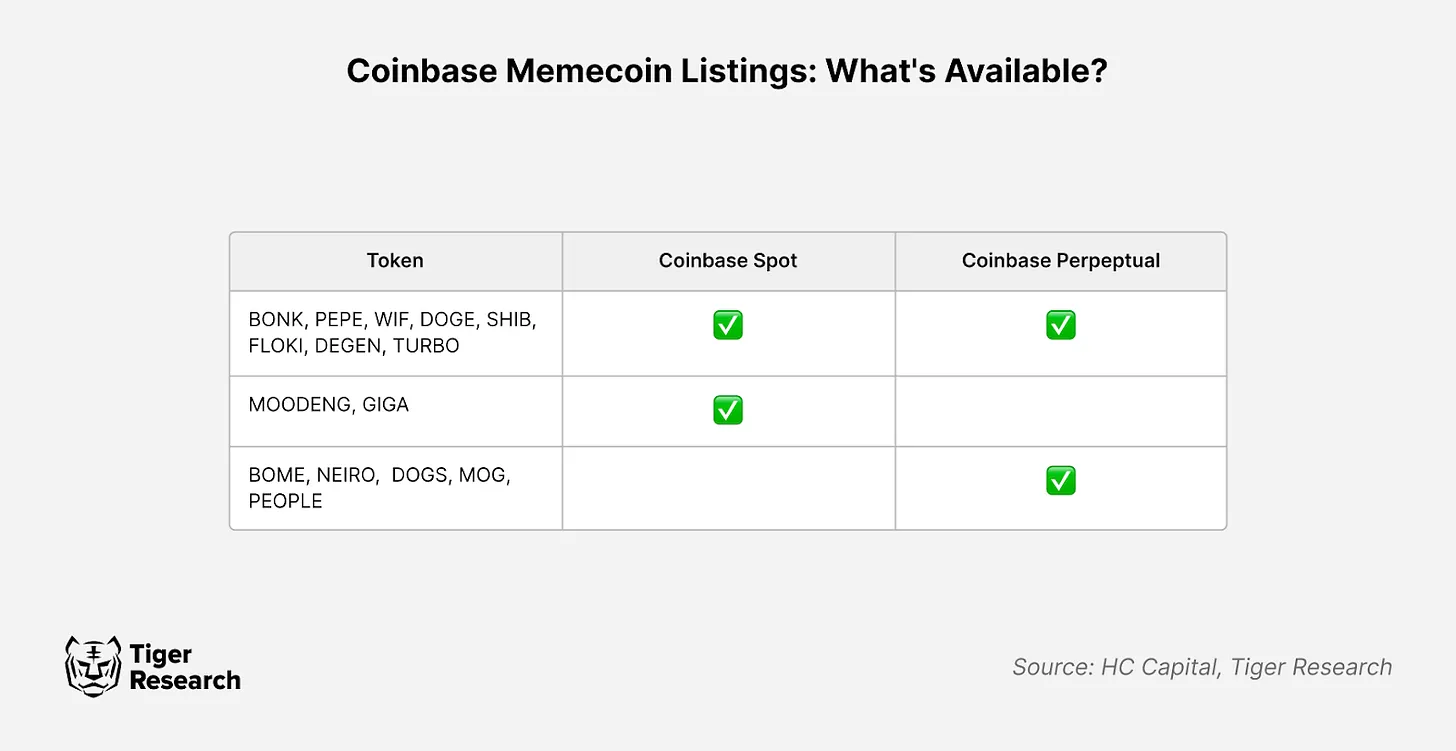

Compared to Binance, major centralized exchanges such as Coinbase, Kraken and Upbit have adopted a more conservative strategy, focusing on verified cryptocurrencies rather than Memecoins. Although this strategy cannot seize short-term high-yield market opportunities, it helps the stability of the platform and reduces regulatory risks.

In recent years, the trend of funds flowing from CEX to DEX has become increasingly obvious, indicating that CEX no longer occupies an absolute market dominant position. Faced with this change, CEX needs to re-examine its strategic layout. They can choose from the following methods:

- Screen early assets and provide transparent information (such as Binance Alpha);

- Manage risk through selective listing of Memecoins;

- Introduce a hybrid trading model that combines on-chain order books and DeFi elements.

CEX’s current core challenge is how to find a balance between attracting short-term trading activity and maintaining long-term platform stability, while maintaining the trust of institutional investors and effectively attracting more retail investors.

4. Strategy summary and future prospects

Memecoins has gradually evolved from a purely speculative tool to an important trading variety in the cryptocurrency market. As Memecoins trading volume on decentralized exchanges (DEX) has grown significantly, this trend has brought new opportunities and challenges to the crypto industry.

In the recent bull market, Memecoins on DEX have performed significantly better than assets listed on a centralized exchange (CEX), prompting more and more investors to turn to DEX. Platforms like Pump.fun optimize the issuance and trading process of Memecoins, allowing new tokens to rapidly explode even if they are not listed on CEX.

In order to adapt to this change, market makers, liquidity providers and project teams have adjusted their strategies. They no longer just focus on the launch of CEX, but begin to pay attention to the DEX environment. They have improved the accessibility and flexibility of transactions by establishing liquidity pools on multiple platforms.

However, the Memecoins market still faces many risks. Unethical behaviors such as running money, small group manipulation and malicious trading seriously harm the interests of investors. Due to the lack of effective market supervision, these problems are common. For example, the Libra ($LIBRA) scandal in Argentina exposed these potential risks, sparked widespread market doubts about Memecoins and led to a significant decline in Solana DEX trading volume.

Despite this, Memecoins still demonstrated its potential in the crypto space. They have gradually become representative assets of certain entities and groups. For example, Elon Musk’s relationship with Dogecoin, Trump’s association with Official Trump Token, and the cases of some startups and state-issued Memecoins all suggest that cryptocurrencies are capturing real economic and social value. This trend is similar to the securitization process in traditional financial markets and may gradually evolve into a new cultural phenomenon.

Faced with this change, CEX must quickly adjust its strategy. Investors no longer wait for CEX to go public before starting trading potential assets. To attract more users and remain competitive,Exchanges need to integrate on-chain functions and DeFi elements,At the same time, ensure the stability and compliance of the platform.This flexible and innovative strategy will be the key to pushing the crypto market into the next stage of growth.

disclaimer

This report is prepared based on information that is considered reliable. However, we make no express or implied warranties as to the accuracy, completeness or suitability of the information. We are not responsible for any losses incurred as a result of the use of this report and its contents. The conclusions and recommendations of this report are based on the information available at the time of preparation of the report and may change at any time without notice. All projects, estimates, forecasts, goals and opinions mentioned in this report are subject to change and may be inconsistent with the opinions of other individuals or institutions.

This report is for reference only and should not be regarded as legal, commercial, investment or tax advice. Any mention of securities or digital assets is for illustrative purposes only and does not constitute investment advice or an invitation to provide investment advisory services. This report is not directed at any investor or potential investor.

Terms of Use

Tiger Research allows reasonable use of its reports.& ldquo; The principle of fair use means that the content of the report can be used for public interest-related purposes without damaging the commercial value of the material. If the use falls within the scope of reasonable use, the report may be used without prior permission. However, when quoting Tiger Research’s reports, the following requirements must be followed: 1) clearly identify Tiger Research as the source;2) attach the Tiger Research logo (black or white). If material needs to be re-edited or released, it will need to be negotiated separately with Tiger Research. Unauthorized use of reports may lead to legal prosecution.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern