From “tokenized green bonds” to “Hong Kong dollar stablecoin regulatory sandbox”, from “RWA ecology” to “decentralized AI”, Hong Kong is using policy innovation as an engine to shift the narrative of Web3 from technical experiments to deep integration with the real world.

Nearly 10,000 participants flocked to the Hong Kong Convention and Exhibition Center, which was the first time that Consensus, the world’s top Web3 industry summit, had landed in Asia. Hong Kong was chosen not only because it is a testing ground for financial innovation, but also a hub for the flow of value between the East and the West. From “tokenized green bonds” to “Hong Kong dollar stablecoin regulatory sandbox”, from “RWA ecology” to “decentralized AI”, Hong Kong is using policy innovation as an engine to shift the narrative of Web3 from technical experiments to deep integration with the real world.

Since 2022, OKG Research has continued to track the development of Hong Kong’s Web3, focusing on ecological and technological innovation practices. It has produced more than 30 in-depth articles on hot topics such as VASP, stablecoins, and RWA tokenization, and has collaborated with Hong Kong’s mainstream media Sing Tao Group and Dagong Wenhui Media Group have established column cooperation to continue to export industry insights.Taking the Consensus Conference as an opportunity, we once again focused on the core topics of Hong Kong’s Web3 and launched “HK Web3 Frontline“Special topic, analyzing the past, present and future of Hong Kong’s Web3 from a differentiated perspective.

1. Supervision comes first: Exploring the boundaries of Web3 compliance in an orderly manner

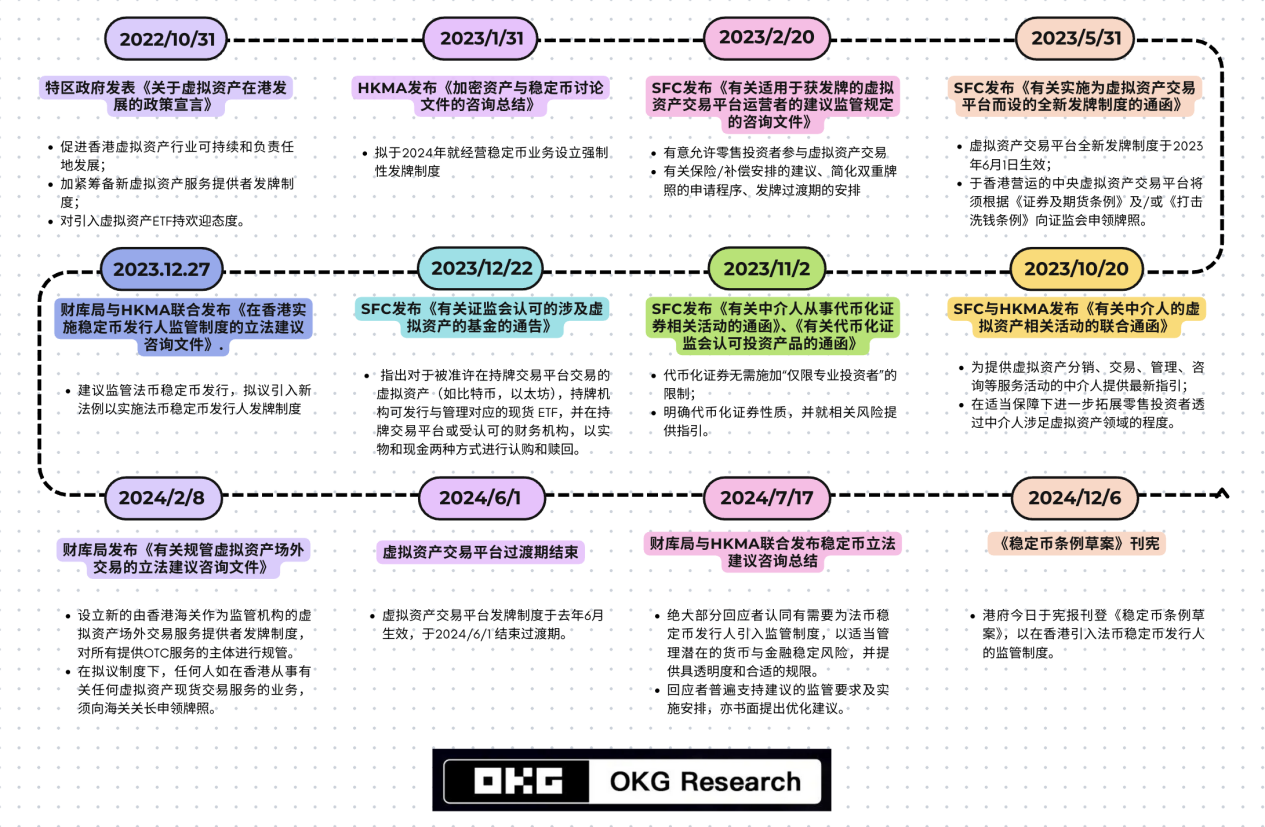

If Hong Kong’s Web3 ecosystem is likened to a building, a reliable and applicable regulatory framework is the foundation. Since the policy declaration was issued at the end of 2022, Hong Kong has continuously reviewed and improved its regulatory system to promote the autonomous evolution of the virtual asset ecosystem within the boundaries of security and compliance. By developing a comprehensive regulatory framework covering virtual asset exchanges, stablecoin issuers, custodian providers and over-the-counter trading activities, Hong Kong has paved the way for value interoperability and long-term innovation in financial markets.

These measures not only enhance the credibility of Hong Kong’s virtual asset market, but also continue to attract capital and corporate inflows. As of the end of 2024, Hong Kong Cyberport alone has gathered nearly 300 Web3 companies, with a cumulative financing scale exceeding HK$400 million.

But the global Web3 landscape has undergone tremendous changes in the past two years. With Trump returning to the White House, the situation of crypto supervision in the United States has obviously improved. The high-pressure penalty supervision model that has lasted for many years is disappearing, and regions such as Singapore and Dubai have also continued to release crypto-friendly signals. When “rising from the east and descending from the west” is no longer mentioned, and when global Web3 competition becomes increasingly fierce, how should Hong Kong seize this wave of innovation? OKG Research once proposed that Hong Kong’s development of Web3 and virtual assets is not only pragmatic, but also pragmatic: the Hong Kong government is concerned about technological innovation and application innovation that can have a substantial impact on the economy and society. Leung Feng-yee, CEO of the Hong Kong Securities and Futures Commission, also expressed similar views in her speech at the Consensus Conference,”The second trend shaping the future financial landscape is the integration of Web3 innovation into the real economy.”

But at the same time, although the crypto asset market accounts for less than 1% of the global financial system, its rapid expansion speed and increasing correlation with mainstream financial assets have made its risks impossible to ignore. In the past, Hong Kong and the United States seemed to have different paths at many points in time, but in fact they reached the same goal:All are maintaining innovative activities while guarding against potential financial risks brought by this new class of assets.

2. Hong Kong dollar stablecoins: Hong Kong’s “financial” ambitions

Stable coins are a hot topic at this Consensus conference and a key area that Hong Kong has continued to pay attention to and invest in the past two years. Standard Chartered Hong Kong, ASG Group and Hong Kong Telecom were recently reported to form a joint venture company, hoping to apply to the Hong Kong Monetary Authority for a license under the new regulatory system to issue stable currencies pegged to the Hong Kong dollar. Circle, the issuer of USDC, has previously announced cooperation with Hong Kong’s three major banknote banks to launch HKDCoin anchored 1:1 to the Hong Kong dollar.

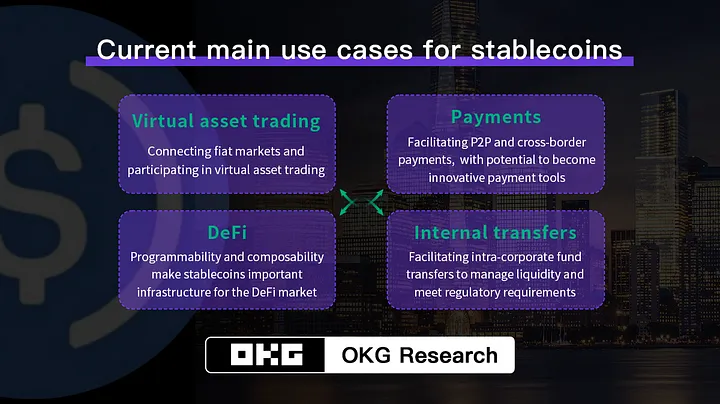

Although it is uncertain how much pie the Hong Kong dollar stablecoins will ultimately get in today’s environment where the US dollar stablecoins occupy absolute market share, for Hong Kong,Developing Hong Kong dollar stablecoins is an inevitable choice to seize the initiative in Web3 development and seize future financial opportunities。The connection channel with fiat currency is the most worthwhile and most valuable scenario in the current encryption ecosystem, and stablecoins are the indispensable infrastructure for building channels; at the same time, the next stage of Hong Kong’s Web3 development focuses on breaking the gap between the virtual world and the real world, while stablecoins are the core link connecting traditional finance and the crypto world, and may become a widely accepted payment tool.

But how exactly should Hong Kong dollar stablecoins be issued? What should Hong Kong do? Which institutions will become the first batch of “crab eaters”?《Seven Questions about Hong Kong dollar stablecoins: Issuance Logic, Regulatory Rules and Potential Impact“gives the answer and believes that at present, stablecoins backed by non-US dollar assets cannot compete with US dollar stablecoins in the short term. However, through mechanism innovation (such as interest-bearing stablecoins) and application innovation (such as RWA), Hong Kong dollar stablecoins are expected to avoid Direct competition with US dollar stablecoins, thereby attracting more institutions and users to participate.

Of course, we also need to distinguish between Hong Kong dollar stablecoins and Cyberport dollars. Although there may be potential competition between the digital Hong Kong dollar and the Hong Kong dollar stablecoin in the short term, it is expected to achieve resource sharing and complementary advantages in the future: the utilization, expansion and friendliness of the Hong Kong dollar stablecoin the virtual asset market will be far better than that of the digital Hong Kong dollar, while the digital Hong Kong dollar will be in a leading position in terms of value support and reliability.

3. RWA tokenization: The fission from concept to the 100 billion market

RWA is undoubtedly the hottest concept in this year’s Consensus.“RWA tokenization is not a trend, but a necessity.The assertion made by John Cahill, head of digital assets at Morgan Stanley, at the Institutional Investment Summit revealed the general strategic shift among traditional financial giants today.

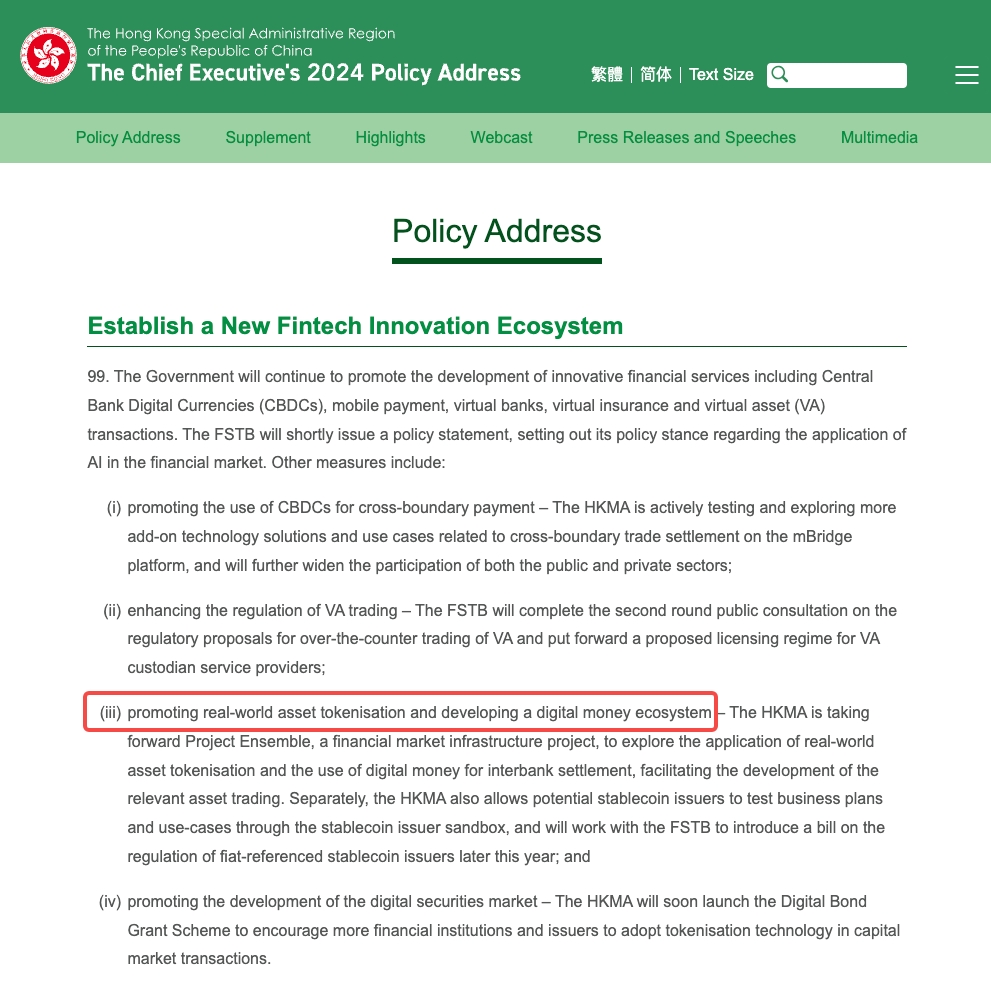

OKG Research proposed in 2023 that RWA is an important area worthy of long-term attention and investment in Hong Kong. How to tokenize huge traditional assets is the biggest development opportunity for Hong Kong’s virtual asset industry. Today, Hong Kong is already actively embracing the wave of RWA tokenization. The 2024 policy address proposed to promote RWA tokenization and the construction of a digital currency ecosystem, while the Hong Kong Monetary Authority launched the “Digital Bond Funding Scheme” to encourage the capital market to adopt tokenization technology. When attending the Consensus conference, Secretary for Financial Services and the Treasury of the Hong Kong SAR Government, Hui Ching-woo, also said that Hong Kong is considering promoting gold tokenization.

However, the initiative in the tokenization narrative at this stage does not lie in Web3, but depends more on Web2 institutions to see whether they have enough motivation to change the status quo and link and tokenize the assets in their hands. This is not easy for traditional organizations: Any new technology that attempts to migrate traditional assets/businesses into new areas is often difficult to succeed quickly because the incremental value it creates may not be large enough, but the costs are often high. The same is true for RWA. However, as Wall Street accelerates the layout of the tokenization market in the United States, Hong Kong urgently needs more institutions with resources and assets to actively participate in tokenization innovation in order to gain more initiative in change and avoid competition with the United States. Be quickly pulled out. How to stimulate market vitality is still an important proposition.

In addition, OKG Research publishedHow long does RWA tokenization have for Hong Kong?“It also suggested thatIn the short term, Hong Kong should focus on the most suitable standardized financial assets for tokenization, give full play to Hong Kong’s geographical and institutional advantages as an international financial, trade and shipping center, focus on tokenization applications in trade and cross-border related scenarios, and quickly Increase the scale of Hong Kong’s RWA tokenization market.

4. ETFs and OTC: The “confrontation between dark and dark” in the capital channel

Another key measure for the development of Hong Kong’s Web3 in 2024 is the launch of virtual asset spot ETFs. From the explicit acceptance of relevant applications at the end of 2023 to the official listing of six virtual asset spot ETFs officially approved by the Hong Kong Securities and Futures Commission on the Hong Kong Stock Exchange at the end of April, it took only more than a hundred days, which is enough to reflect the “speed” and “efficiency” of Hong Kong regulatory authorities. The launch of virtual asset spot ETFs has opened up another funding channel for investors to deploy encrypted assets. As of the end of 2024, the total asset management scale of Hong Kong’s Bitcoin Spot ETF has exceeded HK$3 billion, accounting for 0.66% of the total volume of the Hong Kong ETF market.

Compared with the United States, the main advantages of Hong Kong’s virtual asset spot ETF are its support for physical redemption and the first launch of the Ethereum spot ETF, but these have not brought about sustained growth. Although the share of ETFs purchased in physical form accounts for more than 50% of the initial issuance size, due to macro expectations, Bitcoin holding groups are reluctant to easily release their liquidity, while the Ethereum spot ETF does not support pledges and affects investors ‘enthusiasm. Although the current yield on Ethereum pledge is only about 3%, both from a narrative perspective and an economic perspective, the additional benefits brought by the pledge are likely to be an important factor in attracting investors, especially traditional financial investors. It is also the main feature that distinguishes Bitcoin and Ethereum.

In addition to the ETF channel,Hong Kong has also gradually formed a three-layer capital network of “licensed exchange-compliant OTC-bank”How can Hong Kong’s crypto market improve liquidity?“stated that the focus of liquidity at this stage is off-site. Although trading platforms are still the most important infrastructure in the crypto market, observing recent trends reveals that crypto liquidity is gradually converging into the OTC (over-the-counter) market. At present, the annual transaction volume handled by the Hong Kong OTC market reaches nearly 10 billion US dollars. At the same time, thanks to the encryption exchange shop, a physical product with regional characteristics, it not only attracts young investors from all over the world, but also attracts participants in the middle and high age groups. Attractive. In recent years, Hong Kong’s OTC market has also attracted the attention of many users and institutions in the fields of international trade and cross-border payments, becoming another important channel for Hong Kong to pool global funds.

The Hong Kong government is considering bringing OTC into the scope of supervision. Although it may have an impact on trading activity in the short term, it can help Hong Kong attract more compliance funds in the long run, and also help Hong Kong add another channel for the free flow of funds in addition to licensed VATPs. Perhaps in the near future, a safe and compliant OTC market will not only help the Hong Kong market improve liquidity, but will also become an important channel for the crypto market and the Web3 ecosystem to connect the real liquidity market.