Behind the popularity of Memecoins, is it an inevitable phenomenon driven by market demand, or is it a speculative craze caused by the lack of supervision?

Original title: “Memecoins- The inevitable path to mainstream adoption or the symptom of a broken system?”

Author: Jen Albert

Compilation: Vernacular blockchain

As the host of Blockchain Banter, I recently led a discussion on memecoins-a topic that has generated strong controversy across the industry. Whether you love them or hate them, you cannot deny their influence. Some believe they are destroying the crypto industry, while others see them as a natural evolution of the development of decentralized markets.

To delve into this debate, I invited Justin Havens (head of ecological growth at Polygon DeFi) and Dr. Mark Richardson (head of the Bancor Carbon DeFi project) to discuss it.& We had in-depth discussions around the following core topics:

- The origin and role of Memecoins

- regulatory challenges

- Investor vs. Gambler mentality

- Influencers vs. Key Opinion Leaders (KOL)

- Possibilities and Limitations of DYOR (Self-Research)

This conversation reveals the multiple impacts of memecoins in the crypto market. You are welcome to discuss it together!

1. Memecoin dispute

Memecoins has caused huge divisions in the field of encryption. Some see them as an interesting and community-driven way to engage in the market, while others see them as undermining the legitimacy of the industry. On the one hand, well-known figures like Benjamin Cowen even bluntly said: “Memecoins are destroying the encryption industry.”

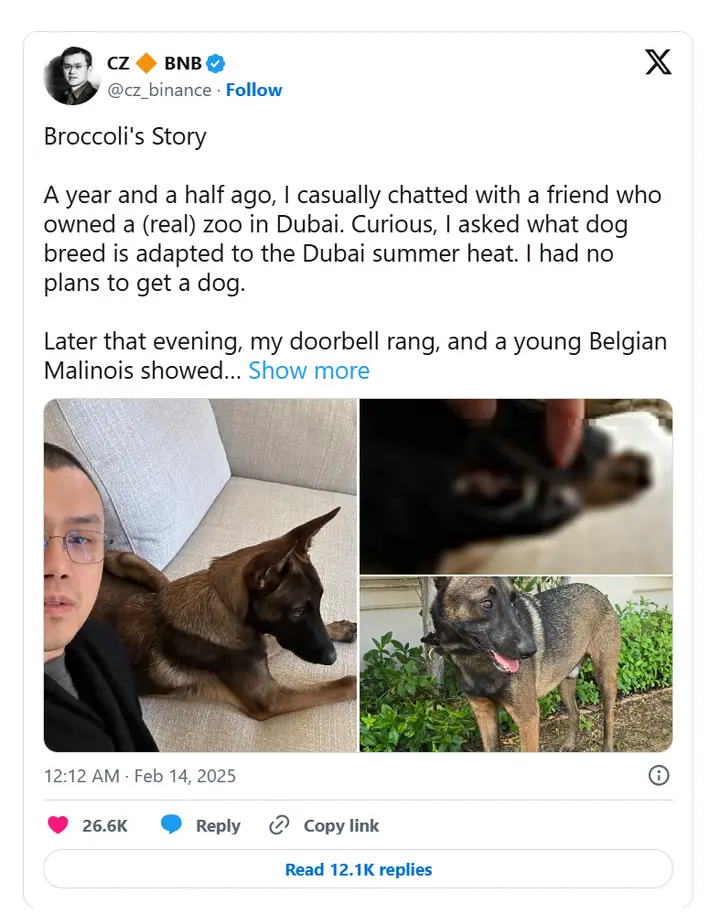

On the other hand, we have also seen some industry celebrities holding the opposite attitude, such as BN (Binance) co-founder and former CEO Zhao Changpeng (CZ), who published photos of his pet dog Broccoli and attached a full-page story background., seems to encourage (or not) the birth of more memecoin.

“I just sent a photo and name of my dog. I don’t publish memecoin myself, and whether to create it depends entirely on the community (or not to create it). However, I may interact with some of the more popular memecoins on BNB Chain (BSC). The BNB Foundation may provide rewards for top memecoins on BNB Chain, such as LP support or other incentives. Details are still under discussion, so stay tuned.”

Justin believes that memecoins are not an accidental product, but the inevitable result of regulatory crackdowns on structured Token issuance. Due to concerns about legal risks, the project party had to choose the following methods:

- Completely avoid any discussion of the usefulness of Tokens

- Choose to raise financing and exclude retail investors

- Issue Tokens with no clear purpose

So, what happens when the only feasible way to issue publicly offered tokens is tokens with no practical use? The answer is-the rise of memecoins.

Mark further pointed out: “Market incentives determine the final outcome.” Regulators have created an environment where practical Tokens fall into legal gray areas, while Tokens that clearly claim to be “useless” face little compliance risks. The result was that memecoins quickly took over.

2. Investor or gambler? The subtle boundaries of the crypto market

One of the biggest misunderstandings in the crypto world is the belief that there is a clear line between investment and gambling. But does this boundary really exist?

Investors study fundamentals, assess risks, and make decisions from a long-term perspective.

Gamblers chase hot spots, trade impulsively, and accept extreme risks.

Justin pointed out that many retail traders are forced into a “gambling mentality” because they cannot participate in traditional early-stage investments. Unless you are a qualified investor, your only option is speculative trading-which includes memecoins.

Mark believes that this line is more blurred than most people think. After all, there are many obvious scams among the best-performing crypto assets in history. As he said:

“People will advise you not to vote for this, saying it’s a scam. And others will say,’I know it is.』」

3. Has KOL contributed to the craze of Memecoin?

The topic naturally turned to KOL (Key Opinion Leaders) and paid Internet celebrities-important drivers in the memecoin ecosystem. So, is the root cause of the problem memecoins themselves, or are the people who market them for profit?

- In fact, there is an essential difference between real KOL and paid Internet celebrities:

- A real KOL is a respected industry builder and expert.

- Paid Internet celebrities are often promoting Tokens that they are paid to promote, creating the illusion of “natural market attention.”

This also explains the other side of memecoin hype-does market demand create them, or does artificial fuel?

4. Has the word KOL been abused in the crypto circle?

Mark believes that the word “KOL” is often misused in the encryption field. Many so-called “opinion leaders” are essentially just advertisers selling Token shares behind the scenes. If a project requires money to get people to talk about it, it’s worth thinking: Why does it need to do this?

What is the core? Question the incentive mechanism. If someone sells a Token desperately, ask yourself first-what can they gain from it?

5. DYOR: Is it really feasible?

The phrase “DYOR” is repeatedly emphasized in the crypto circle, but reality is often much more complex than the slogan. As viewer Mike pointed out, DYOR is easier said than done.

Most people lack neither the tools nor the expertise to correctly analyze:

- Allocation of Tokens

- Potential risks of smart contracts

- Key elements such as liquidity structure

Although true on-chain analysis requires a certain amount of investment, there are some tools that can help, such as Bubble Maps, which can visually track Token distribution and identify potential scams. But ultimately, if you don’t understand what you’re buying at all, it’s more like you’re gambling than investing.

6. Can Memecoins also evolve? Take Sei as an example

There was a reverse view in the discussion: Some memecoins, although initially just a joke, later developed into real projects.

Seiyan (memecoin on the Sei chain) is a typical example-it started out as just a memecoin, but later launched its own aggregator that transformed the community’s momentum into a more practical product.

The line between Memecoins and utility tokens is not always clear. Sometimes, memecoins can grow into real projects and contribute far more to the ecosystem than a “fun Token.”

7. Conclusion: Memecoins will not disappear

Memecoins remains one of the most controversial topics in the crypto industry, and the discussion is far from over.

But one thing is beyond doubt-memecoins have become part of the market and will not disappear anytime soon. Their demand is market-driven, and memecoins are likely to continue to dominate until regulations are clear and cannot support structured Token issuance.

So, what is the root cause of the problem?

Memecoins themselves?

Is it the speculative mentality of KOL and the market?

Or is the regulatory system imperfect?

As Justin concluded:

“If you fix the incentives, you can fix the market.”