Original title: Bittensor = AI Bitcoin?

Author: S4mmyEth, Decentralized AI Research

Compiled by: zhouzhou, BlockBeats

Editor’s note:This article discusses Bittensor, a decentralized AI platform that hopes to break the monopoly of centralized AI companies through blockchain technology and promote an open, collaborative AI ecosystem. Bittensor uses a subnet model that allows for the emergence of different AI solutions and encourages innovation through TAO tokens. Although the AI market has matured, Bittensor faces competitive risks and may be influenced by other open source AI frameworks. He continues to study subnetworks in depth, analyze their applications and development potential, and focuses on how Bittensor can promote the future of decentralized AI.

The following is the original content (the original content has been compiled for ease of reading and understanding):

As Bittensor’s first halving in November 2025 approaches, speculation is growing that it may be similar to Bitcoin’s historical price cycle-only this time, artificial intelligence is at the core.

introduction

The rise of artificial intelligence has been dominated by centralized entities such as OpenAI, Google and Meta. Although these companies have driven incredible technological advances, they also maintain tight control over the development of AI, data access and monetization.

At this time, Bittensor (TAO) came into being-a decentralized AI market that aims to disrupt traditional business models by creating a peer-to-peer economic model in which contributors (whether providing computing resources, AI models or data) are directly rewarded.

Bittensor provides a transparent and motivational approach to AI innovation with similar characteristics to Bitcoin network incentives.

The goal is to democratize AI and ensure that no single entity has too much control over machine intelligence.

This analysis will explore how Bittensor works, its unique subnet structure, token incentive mechanisms, and why it may be one of the most attractive cases for decentralized AI development.

directory

What is Bittensor?

How Bittensor works

Comparison with Bitcoin

subnet ecosystem

Network incentives and dynamic TAO

Key differences from centralized AI companies

conclusion

What is Bittensor?

Bittensor is a decentralized blockchain-based network designed to facilitate the collaborative development, sharing and improvement of AI models.

Why should I pay attention?

Unlike traditional centralized AI systems such as OpenAI, Bittensor creates an open point-to-point ecosystem. Participants will be rewarded for their contributions, such as computing resources, data, or AI models.

Bittensor’s mission is to make AI more democratize, make it more accessible, and reduce the number of situations where it is controlled by a few large companies.

Comparison with Bitcoin

AI will not disappear, it is a macro trend that will be integrated into various industries. There are opportunities hidden here. If Bittensor becomes a key decentralized network for open source AI and institutional investors are familiar with Bitcoin’s halving mechanism, TAO could become a very attractive investment asset.

Bittensor uses a similar halving mechanism to Bitcoin;TAO’s first halving is expected to occur in November this year.

Bitcoin’s first halving occurred on November 28, 2012, and its market value has since soared 13,125 times:

Do I think TAO will rise to 13,000 times from here?

Absolutely not. That would be crazy. Its market value has now reached US$2.9 billion (price: US$342), and our current market conditions are clearly more mature than in 2012. Therefore, it can be said that in the current state of the network, many speculative factors have been reflected in prices.

However, the collaborative open source nature of the Bittensor Network means that development is very fast and shows parabolic growth.

Any development, motivation, or innovation from a subnet can be replicated on other subnets, raising the level of the entire ecosystem.

You can think that one of these Alpha tokens (subnet tokens) may have greater potential for multifold growth, but there is also a risk of choosing the wrong token. So let’s get a deeper understanding of how it works.

How does Bittensor work?

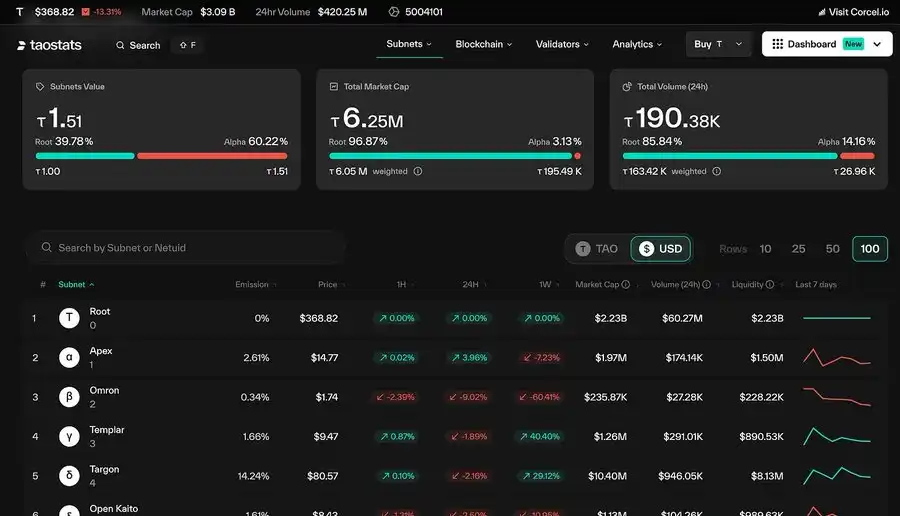

Bittensor operates as a machine intelligence market powered by TAO. The Tao Stats website created by Mogmachine provides a good dashboard to view the 70 existing subnets:

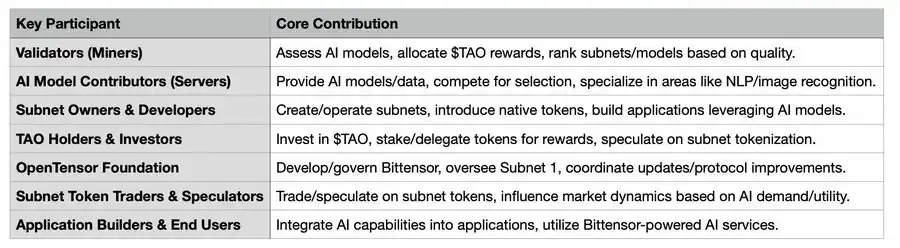

Indexing the TAO ecosystem is not easy, so user interfaces (UIs) like this summarize data in a meaningful way for analysis. Key participants in the TAO ecosystem can be divided into the following categories:

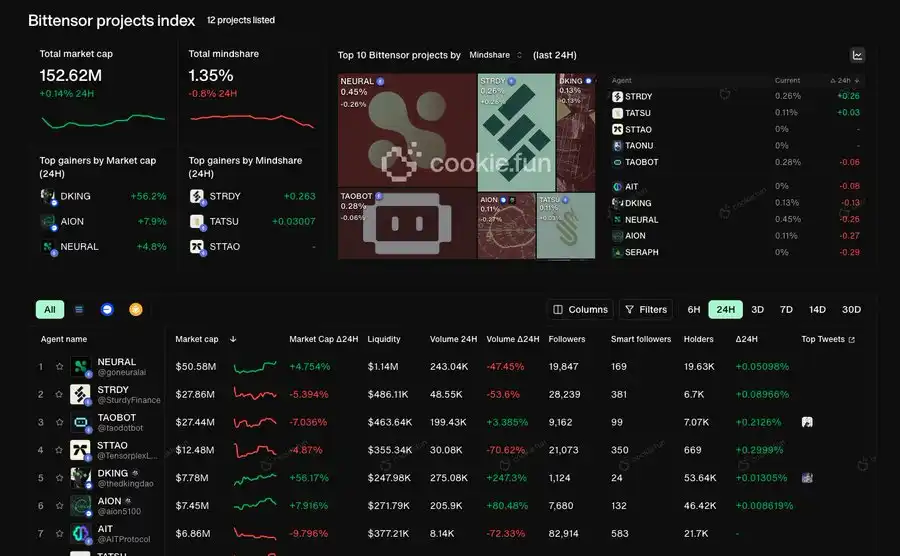

Ultimately, the accumulation of value comes from application developers and end users who create products that leverage the Bittensor subnet AI model. Cookiedotfun recently launched a dashboard that highlights some of the agents that leverage Bittensor:

There are currently only 12 listed, but this number is expected to grow as more apps leverage Bittensor:

However, the dashboard only covers agents that utilize Bittensor, and as they enter the market, more content will be gradually added in the future. Many protocols also use Bittensor for AI integration.

subnet ecosystem

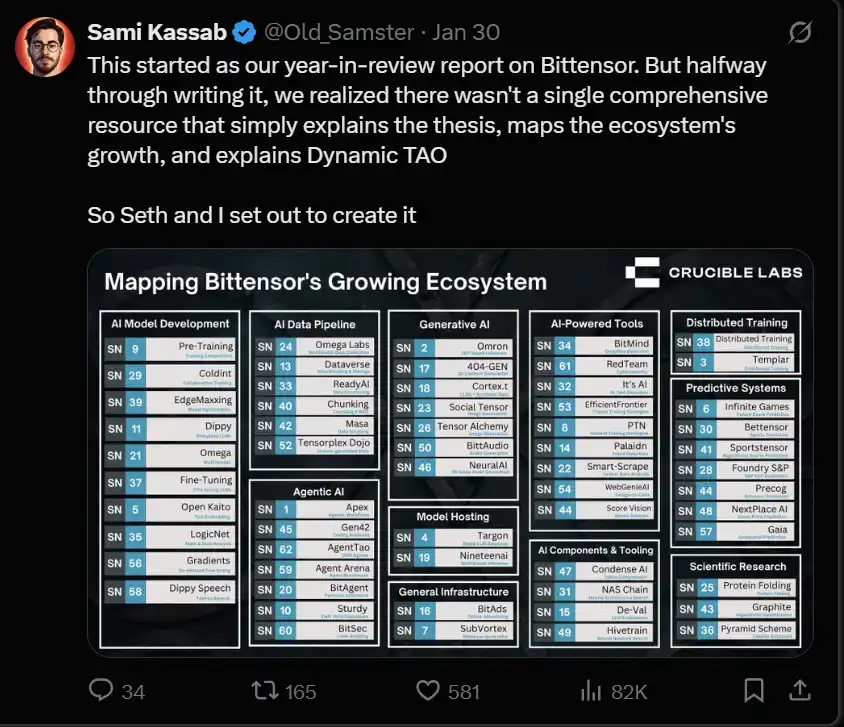

Subnet 1 (rootnet) is dedicated to text prompts and is owned by the opentensor Foundation; it currently holds most of the pledged TAOs, with a total market value of US$2.09 billion. In October 2023, the network expanded with more subnets, and now has a total of 69 subnets owned by third parties outside the foundation. This is a wonderful division of these subnets by old samster at Crucible Labs:

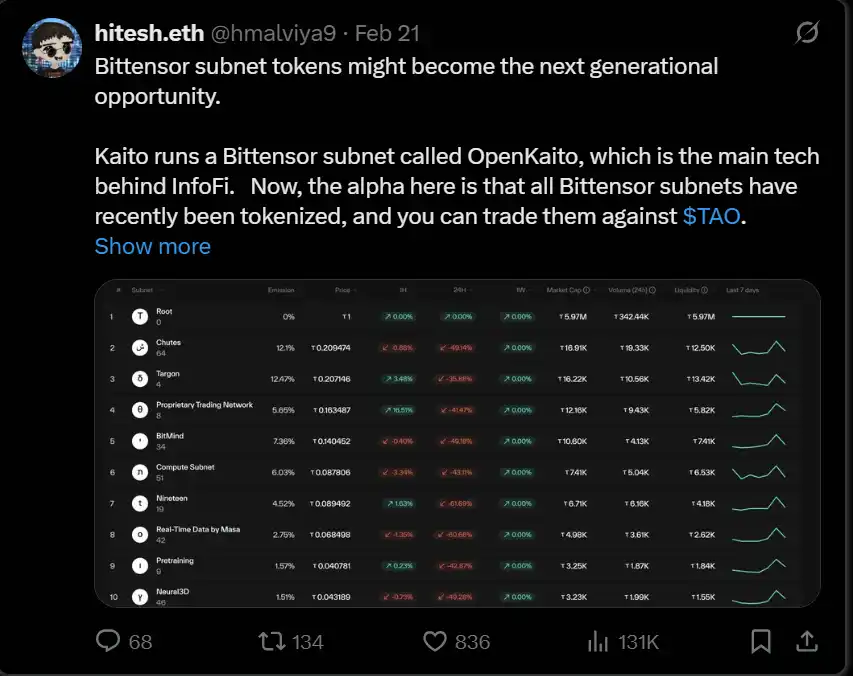

Each subnet focuses on specific AI-related tasks and serves as an independent market where participants collaborate and compete. If you are building an application, one of the subnets may enhance the solution you provide with AI. Some people compare TAO’s subnets to “accelerated versions of virtual machines” and believe that bidding on specific subnets may bring opportunities for high activity in the future. hmalviya9 points to subnet 5 (OpenKaito) as an opportunity, especially in the recent craze of KAITO airdrops:

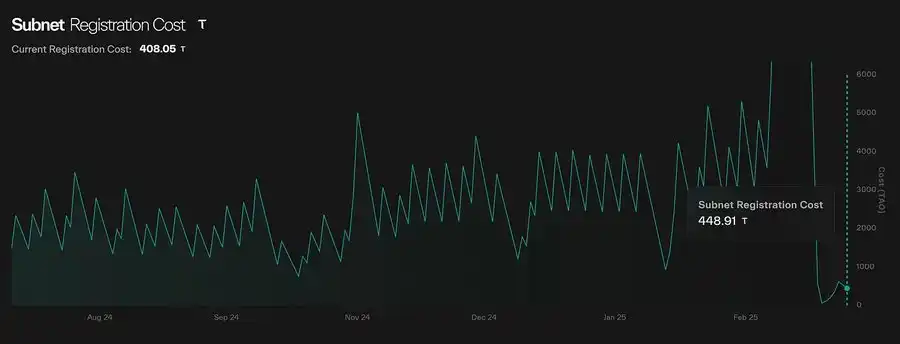

But before you go all out to buy subnet tokens, make sure you understand each subnet’s emission mechanism and core value proposition. Currently, the total market value of all 70 subnets is US$72.5 million, registering a subnet currently requires 408 TAOs (approximately US$151,000) and is now non-refundable:

It’s a bit like locking Virtualsio’s tokens in an LP to provide services to a single agent. But in this case, each subnet has a unique value proposition that can be leveraged by real-world applications to increase efficiency.

Therefore, subnets must have a strong value proposition to remain viable. If you rush to buy a specific subnet token, it may cause that subnet to gradually disappear and the price will fall accordingly.

example subnet

Some of the subnets you may be familiar with come from the following holistic applications:

·Open Kaito ai (subnet 5): used to provide AI algorithm support for KAITO

·Sports Tensor (Subnet 41): Used to support agents such as askBillyBets

Synth (Subnet 50): Used for predictive analysis of the pricing of cryptoassets and integrated into Modenetwork’s DeFAI solution

network activation

Incentives for TAO tokens are allocated based on the “Yuma Consensus” model. This model allocates rewards based on the activity of the subnet, further driving each subnet to create real value for the applications it builds.

Dynamic TAO (coming online on February 13, 2025) is a new level to fine-tune the economics of rewards, making emissions more flexible and tied to overall network activity, rather than relying solely on the previous “Bitcoin halving” mechanism.

Subnetworks must create real demand for their Alpha tokens (subnet tokens) to earn more TAOs, creating a competitive environment where practicality drives success.

If you want to understand this more comprehensively, you can read 0xPrismatic’s article.

Key distinguishing factors from centralized AI companies

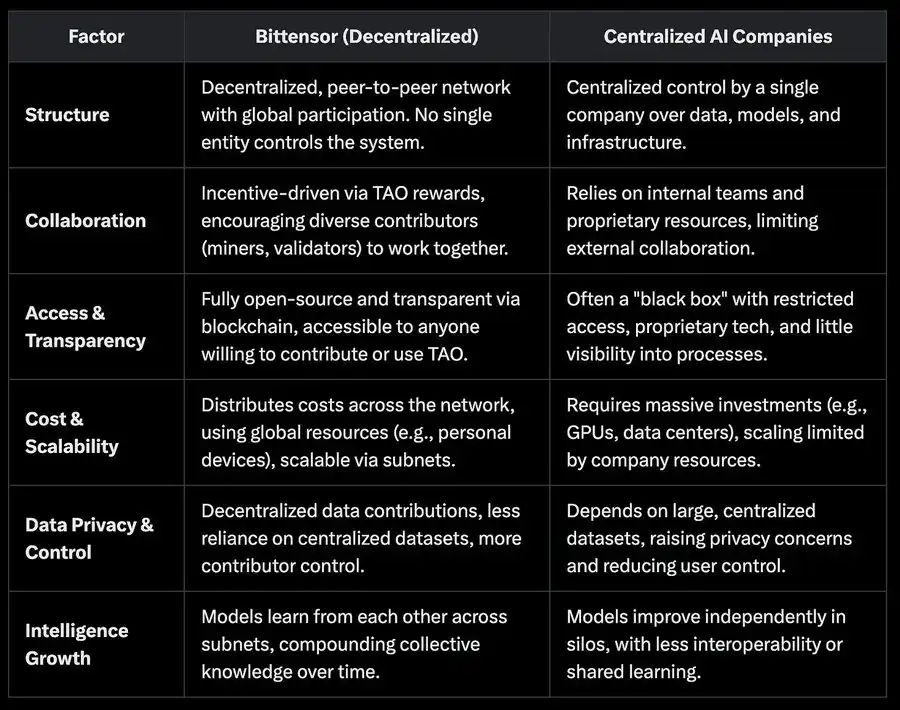

Why do we need to develop a decentralized alternative to challenge companies like OpenAI?

Ultimately, centralized models rely on opaque black boxes, internal teams, and developing solutions in isolated environments. Decentralized models provide greater transparency and allow more contributors to participate in a collaborative manner. Here is a more comprehensive comparison:

conclusion

Bittensor represents a paradigm shift in AI development-from centralized control to a more open, peer-driven ecosystem. The network’s subnet model allows for the emergence of specialized AI solutions, while TAO’s incentive structure ensures that only the most useful and innovative subnets can thrive.

With the introduction of dynamic TAO, the protocol now has an adaptive economic model that rewards real-world practicality and participation. However, investors and developers must carefully evaluate subnets before entering, because only the strongest projects can maintain long-term value.

As Bittensor’s first halving in November 2025 approaches, there is growing speculation that this may be similar to Bitcoin’s historical price cycle-except that this time AI has become the center. However, it is important to keep in mind that the market has matured, we have just experienced a preliminary AI boom, and there is a risk that other open source AI contributors may create equally valuable frameworks or networks, which may reduce the accumulation of value for TAO tokens.

Whether Bittensor ultimately becomes a pillar of decentralized AI or simply serves as a groundbreaking experiment, it has sparked important discussions about AI governance, accessibility and the future of innovation.

“Original link”