(Photo source: Photo taken by Zhijia Lin, editor of GuShiio.comAGI)

io.Real-time Interactive Technology Inc.、Agora, Inc.& nbsp;(NASDAQ: API) announced its fourth quarter and full-year financial results for fiscal 2024.

Financial report shows that in the fourth quarter of 2024,Agora, Inc. achieved total revenue of US$34.5 million, a decrease of 4.4% from US$36 million in the fourth quarter of 2023;Adjusted revenue after deducting low-margin business was US$34.45 million, a year-on-year increase of 3.6%;Under the. General Accounting Standards (GAAP),Agora, Inc. Net profit for the fourth quarter was US$160,000 (approximately RMB 1.1597 million), which was the second time that a year-on-year turnaround was achieved in more than four years. The last time was the first fiscal quarter of 2020 before listing.

Fiscal year 2024,Agora, Inc.’s total revenue was US$133.3 million, down 5.9% from the same period last year, including US$6.6 million from certain discontinued products, compared with US$10.7 million in 2023; the net loss narrowed, with the company’s net loss of US$42.7 million in 2024, compared with a loss of US$87.2 million in 2023.

At the earnings conference on the morning of February 25, Beijing time,Zhao Bin, founder and CEO of SoundNet and Agora, Inc., said that we are pleased to announce that thanks to the revenue growth brought by new application scenarios and effective cost control, the company will achieve profitability under the U.S. General Accounting Standards (GAAP) in the fourth quarter of 2024. rdquo;

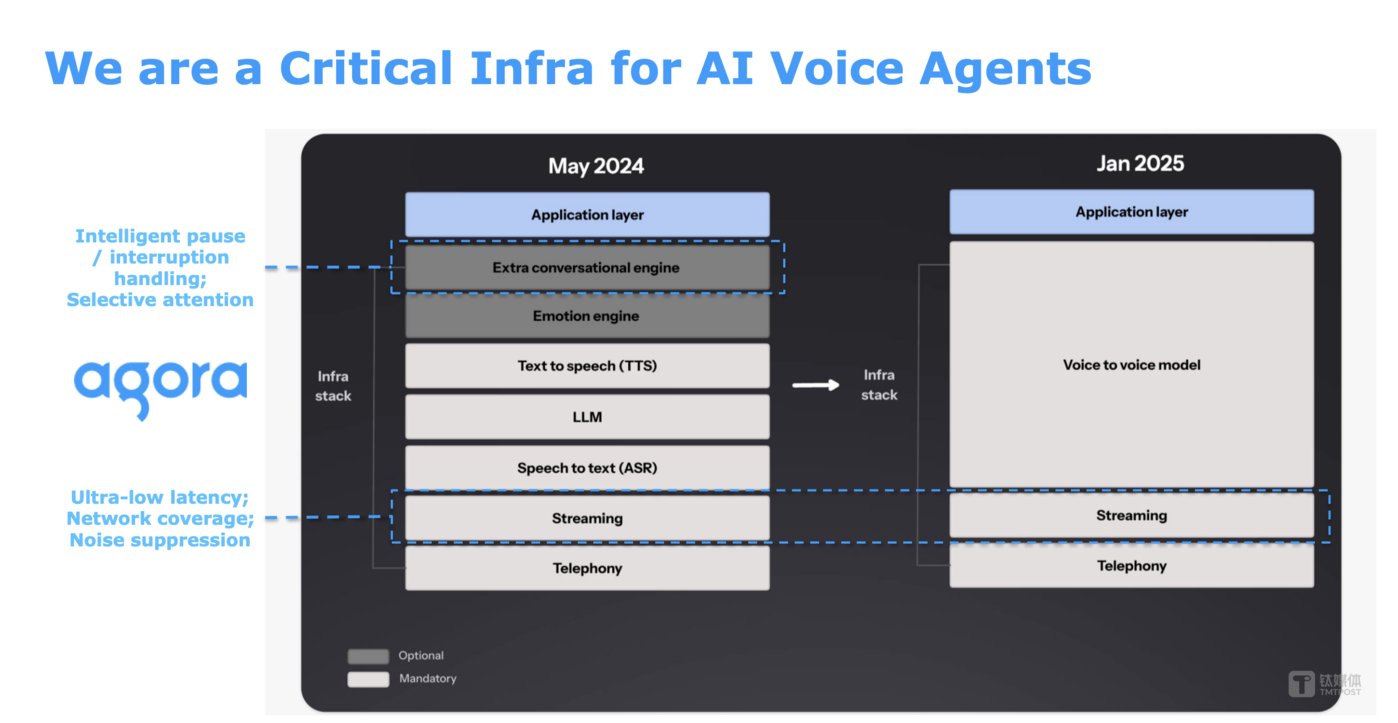

Zhao Bin pointed out that generative AI has brought us transformative opportunities, especially in realizing real-time voice interaction between people and artificial intelligence models. Many large language models do not yet provide voice interaction capabilities, and models that provide voice interaction capabilities do not have an optimized experience. To bridge this gap, the company has launched a Beta version of its conversational AI engine, a solution designed to provide natural conversation dynamics, including intelligent pause and interrupt processing, advanced voice processing, and ultra-low latency.

“The generative AI revolution is advancing at an incredible speed. In the past few months, we have seen groundbreaking developments from AI inference models to Google multimodal, as well as outstanding open source innovations such as DeepSeek. This transformation brings extraordinary opportunities to our business.& rdquo; Zhao Bin said at the earnings conference that we firmly believe that this breakthrough innovation will accelerate the penetration of conversational artificial intelligence applications in various industries and become the core driver of the company’s future growth. rdquo;

Specifically, Agora, Inc.’s business mainly includes two parts: domestic sound networks and overseas Agora.

Among them, in the fourth quarter,AgoraRevenue was US$17.4 million, an increase of 13.7% from US$15.3 million in the fourth quarter of 2023; SoundNet revenue was 122.2 million yuan (US$17.1 million), a decrease of 17.6% from 148.3 million yuan (US$20.7 million) in the fourth quarter of 2023, including revenue of 19 million yuan (US$2.7 million) from certain terminal sales products.

In terms of customer size, as of December 31, 2024, the number of active customers on SoundNet reached 1979, a year-on-year increase of 8%, and the number of registered applications globally exceeded 931,000, a year-on-year increase of 25%. In addition, in the fourth quarter of 2024, net cash provided by the Group’s operating activities was US$4.5 million, compared with US$3.7 million in the fourth quarter of 2023. Free cash flow for the quarter was $4.3 million, compared with $3.4 million for the same period.

Throughout 2024, the company will increase its efforts to reduce costs and increase efficiency. Sound.com’s revenue in 2024 will be 489.6 million yuan (approximately US$68.8 million), a decrease of 13.7% from 2023, including 47.4 million yuan from products sold at certain terminals.(approximately US$6.6 million), compared with 75.3 million yuan (approximately US$10.7 million) in 2023.

It is worth noting thatAgora, Inc. is increasing its investment in research and development. Financial reports show thatResearch and development expenses in 2024 are US$80.3 million, an increase of 3.4% from 2023; while sales and marketing expenses are US$27.2 million, a decrease of 19.8% from US$34 million in 2023. The main reasons include factors such as restructuring, optimization, equity incentives and severance.

Currently, SoundNet and Agora are both committed to building the critical infrastructure of artificial intelligence voice agents.The TEN (Transformative Extensions Network) service provided by the company has been found in AI companies and products such as DeepSeek, AliTongyi Qwen, Step Star, MiniMax, Amazon Bedrock, Baidu, and iFlytek.

On February 25, Zhao Bin said at the earnings call that AI will bring more activities to the world and explore the potential of the global market. After the release of TEN, the company has received considerable interest from customers and is actively exploring opportunities to establish with it. So in general, on the demand side, especially with the launch of many open source models, around artificial intelligence, it sees growing interest from developers and customers.

“Our conversational AI engine products are ideal for opportunities to build application-based voice AI Agents, or voice artificial intelligence. We see some huge potential in several use cases, such as companionship in apps and IoT devices, such as companionship robots and children’s smart toys. rdquo; Zhao Bin said.

Zhao Bin further explained that conversational AI enablers can be divided into two categories: basically serving agent efficiency and saving time. Accompanying is basically for entertainment and may spend more of people’s time on better emotional support or other social needs.

“We see that companionship apps are very active, especially on IoT devices, and educational use cases are also a trend. As a result, the company has seen a real growth trend that will allow our financial performance to continue to grow over the next two years. rdquo; Zhao Bin said.

Looking forward to 2025, SoundNet said it will continue to focus on improving operational efficiency and promoting sustainable and profitable business growth. For the first quarter of 2025, Agora, Inc.’s revenue guidance is US$31 million to US$33 million, a year-on-year growth rate of 4.4-11.1%, which is faster than the Q4 revenue growth in 2024.

Zhao Bin emphasized that Agora, Inc. will continue to promote the improvement of the quality capabilities of language models.Over the next 2 years, including multimodal or voice conversations, AI experiences will begin to grow into more practical use cases,Multimodal understanding will also help AI interaction capabilities improve and become more effective.

Affected by the AI boom, Agora, Inc.’s share price continues to recover. As of the close on February 24, it has risen 28.15% year-to-date, and has risen 103.64% in the past 12 months.