Author: David Grid, Partner at FinalityCap

Compiled by: zhouzhou, BlockBeats

Editor’s note: This article discusses the impact of Solana’s SIMD-0228 proposal on the profitability of verifiers, and builds a model to estimate the number and profitability of Solana verifiers under different scenarios, including changes in factors such as inflation, fees and MEV. The model also analyzes the profitability of the validators, proposing that Solana may lose a large number of validators if revenue declines.

The following is the original content (the original content has been compiled for ease of reading and understanding):

Solana SIMD-0228 sparked a lot of discussion, but I haven’t seen much data on its impact, so I made a model.

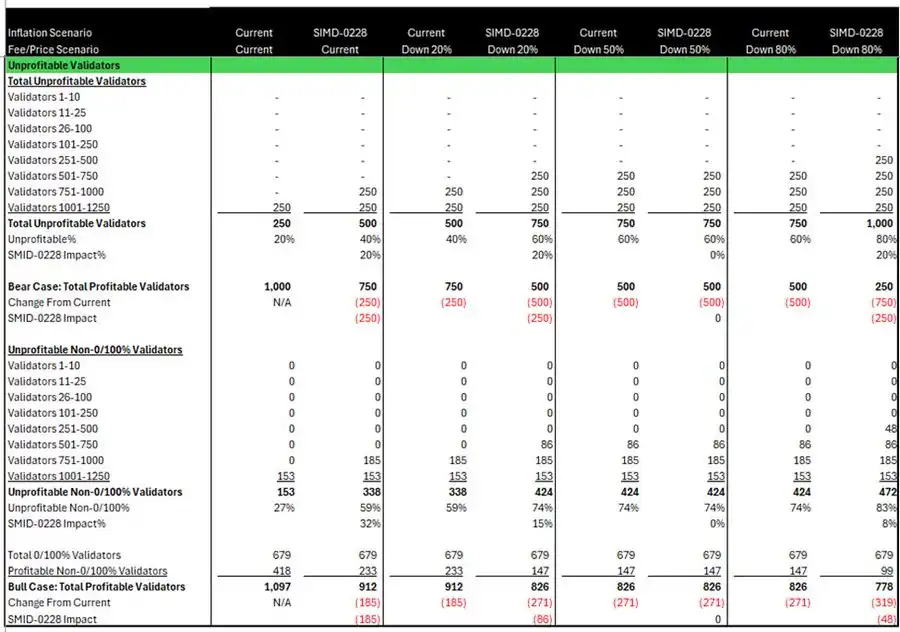

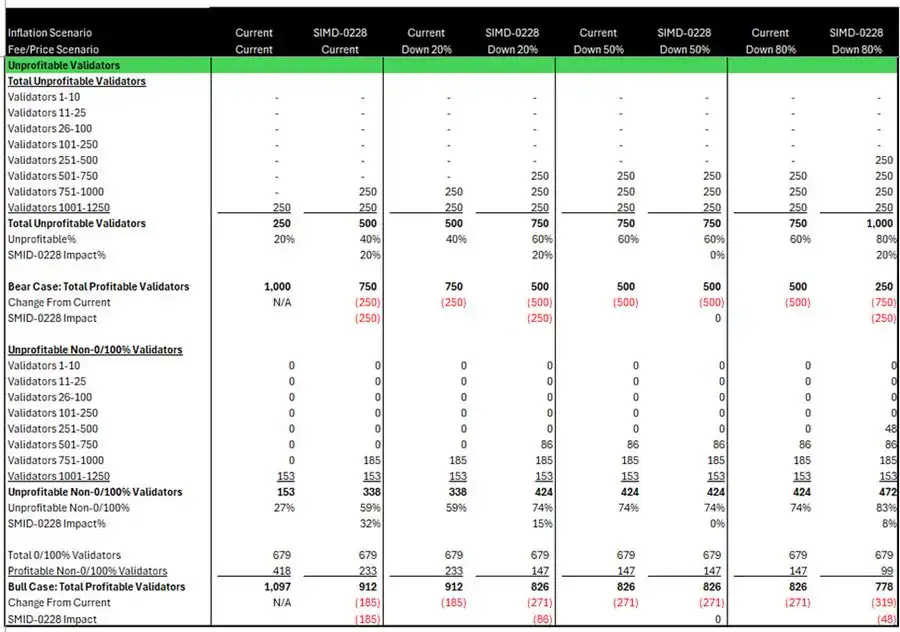

After the implementation of SIMD-0228, Solana may lose approximately 50 to 250 additional validators under different revenue adjustments.

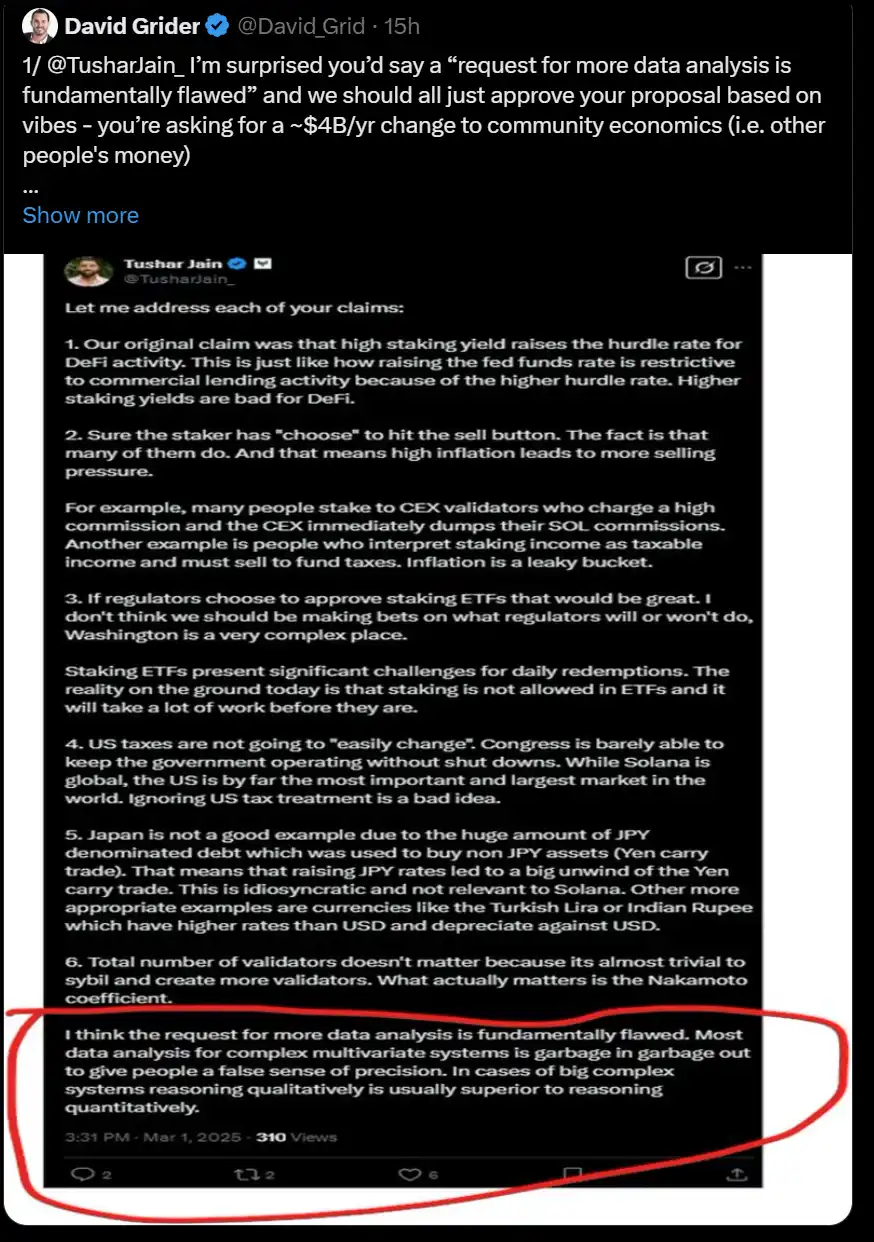

But first, why would I build this model? Because I think the proposal is in the right direction, but I’m worried that supporters will push it and think the data is irrelevant.

This is a link to the model. There is no only correct answer here. I believe that many aspects can be improved and assumptions can be further refined. But this is a starting point, and feedback from the community is welcome.

What are the goals of this model?

It aims to estimate the number of validators who can remain profitable in different Solana fee/price decline scenarios under the current and proposed SIMD-0228 inflation rates.

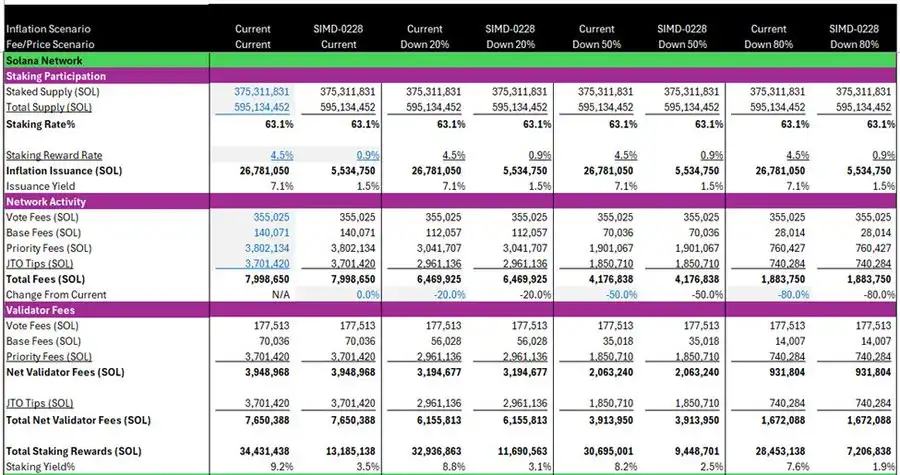

The model starts with the current pledge and FDV supply, and uses the current pledge reward rate and the reward rate provided by the SIMD-0228 calculator. Anyone can copy the model and adjust the pledge rate for stress testing.

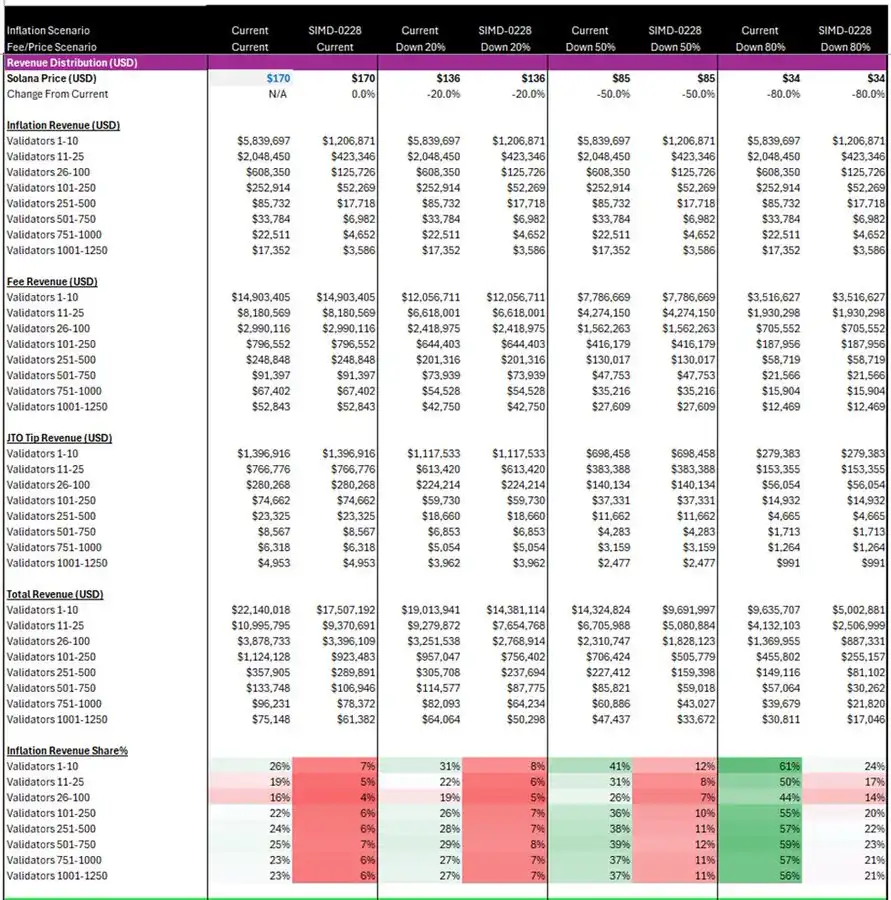

Next, it analyzes assumptions about network costs. I used the actual 2024 fees provided by Blockworks as a starting point and lowered them by 20%, 50%, and 80% respectively (voting fees remained the same). The model then calculates the burned portion to arrive at the final verifier fee.

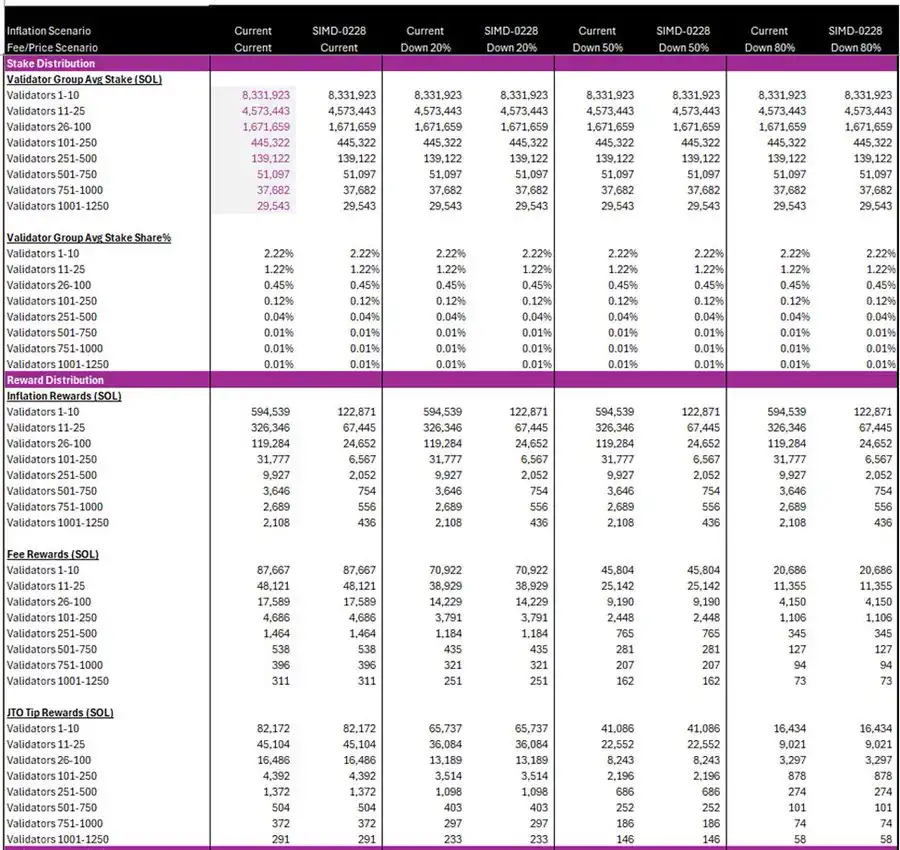

Pledge distribution data is from Solana Beach, and the model uses the average pledge volume for each validator ranking interval and assumes that the distribution remains constant in all scenarios. But I think under SIMD-0228, pledges may become more concentrated.

The model then uses the average pledge share to estimate the SOL fees and inflation rewards that typical verifiers can receive in this range.

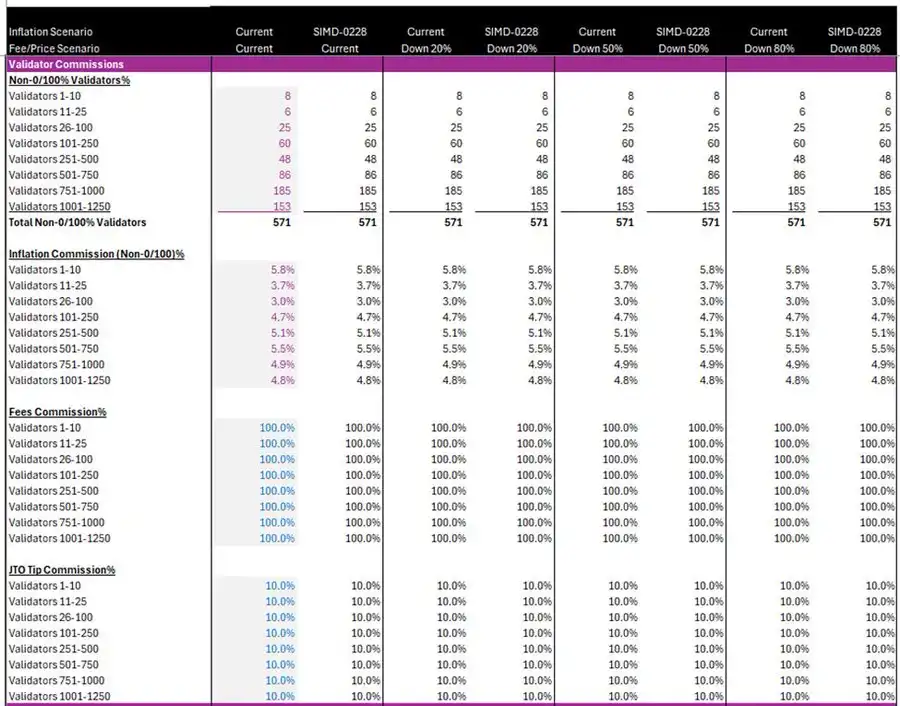

The model then analyzed the actual non-0% and non-100% commission validators present in each interval (the 100% commission may be private validators) to estimate the optimism of the impact of SIMD-0228. It assumes that the validator receives commissions from the principal come from the following three sources:

1. Inflation rewards: The model uses the actual average commission for each validator group provided by Solana Beach (excluding validators with 0% or 100% commissions).

2. Transaction costs (voting fees, base fees, priority fees): The model assumes that 100% is owned by the verifier.

3. Jito MEV Tip: The model assumes that the verifier gets a 10% MEV return.

Are these data completely accurate? No. But they are based on discussions with verifiers. I very much welcome further feedback from the community.

One more thing to note: SIMD-0228 lowering inflation may indirectly affect fee allocation. After inflation falls, clients may further compress verifier fees and MEV revenue share to make up for the decline in revenue. As a result, I think the verifier’s profitability may have more downside risks than the model suggests.

The commission ratio directly affects the SOL revenue that the validator operator receives from various sources (inflation incentives, transaction fees, MEVs).

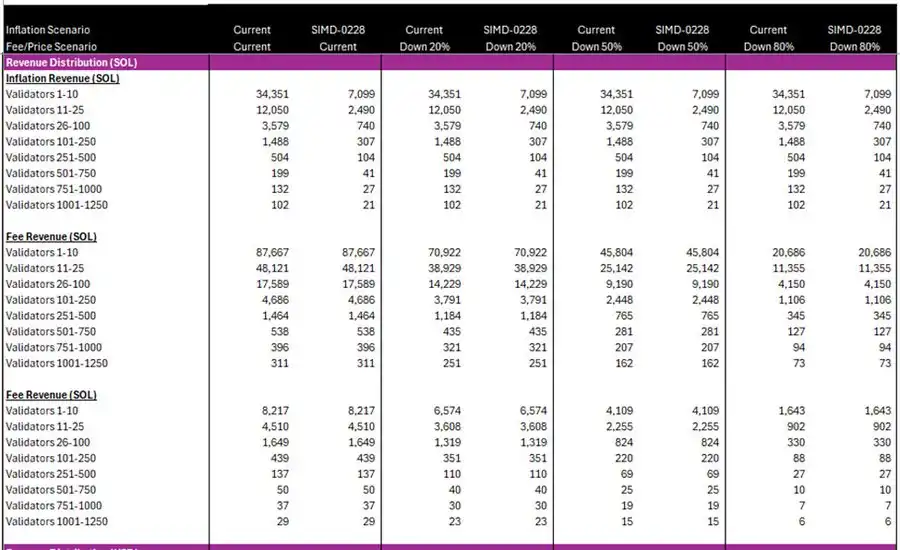

The model then uses different SOL price (USD) assumptions and uses the same magnitude of change as in previous expense scenarios to calculate the dollar value of the verifier’s income from various sources. Please pay attention to the data at the bottom. Compare the current inflation curve with SIMD-0228, and the changes in the proportion of inflation rewards in total income under different scenarios. You can see how the importance of inflation has increased.

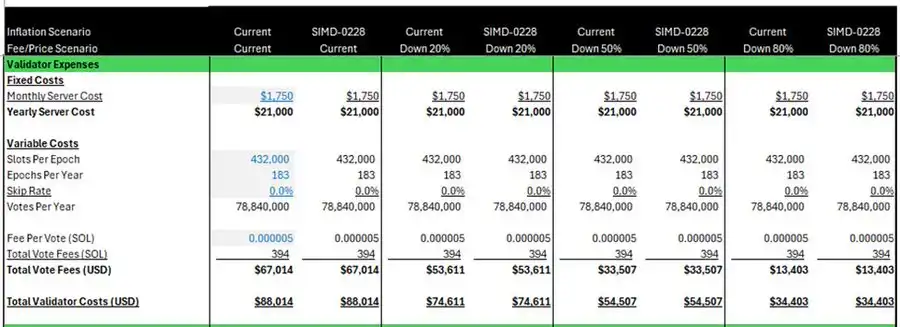

The model then estimated the annual cost of running a Solana validator at approximately $85,000.

The fixed cost comes from exchanges with validators, who say running two servers plus bandwidth costs between $1500 and $2000 per month. The model also estimates variable voting costs based on different SOL prices and current transaction costs.

Currently, the community is discussing adjusting voting fees to help small validators reduce costs. You can adjust different levels of voting fees in the model to see the impact.

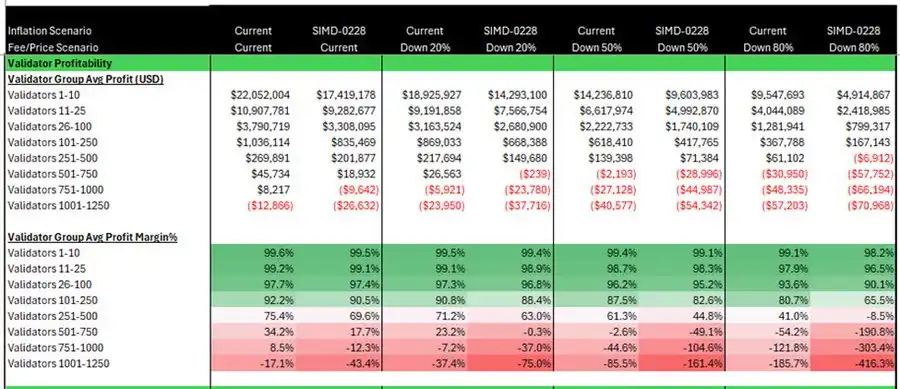

The model then yields average verifier profitability by tier. What does the data tell us?

·The smallest 250 validators are still not profitable but remain online, which may be related to the Solana Foundation’s commissioning plan.

·At current price and fee levels, validators at the 751-1000 level may become no longer profitable under SIMD-0228.

·If revenue drops by 20%, under SIMD-0228, the Solana network could lose an additional 250 validators (validators at levels 501-750) that would otherwise be profitable.

·The same 501-750 level validators may remain profitable/online under the current model until their revenue drops to-50%.

·With an 80% drop in revenue, only Solana’s top 250 validators tiers are likely to remain profitable under SIMD-0228, while if inflation remains constant, the top 500 validators are likely to remain profitable.

Through verifier level profitability, the model analyzes the optimistic and pessimistic situation of the number of verifiers that the network may use.

·The pessimistic scenario assumes that all unprofitable validators leave the network.

·The optimistic scenario assumes that only non-0% and 100% commission verifiers leave the network.

How many validators should Solana have?

I don’t know the answer. This issue is left to the community to decide. I hope this model will help you think about the impact of SIMD-0228 through data rather than intuition.

What are my thoughts on SIMD-0228?

Now I may be neutral. I opposed it before mainly because I felt that no one had done enough analysis to understand its impact. What can I support it?

Reduce voting fees before implementing SIMD-0228

Add an adjustment factor to target not only the pledge rate, but also the number of verifiers

“Original link”