Zhang Hui, former vice president of Zheshang Securities, took the post of general manager of Guodu Securities, taking the lead in “parachuted” to occupy important management positions, or to accelerate the integration of the two companies ‘business and improve governance.

50 million shares of Guodu Securities are put on the judicial auction shelves, and the “Zheshang + Guodu” merger is a temporary examination of corporate governance and business integration.

Photo source: Visual China

Blue Whale News, February 20 (Reporter Hu Jie)Recently, the shares of many securities firms have been auctioned off by the judiciary, and now another example is Guodu Securities (870488.NQ).

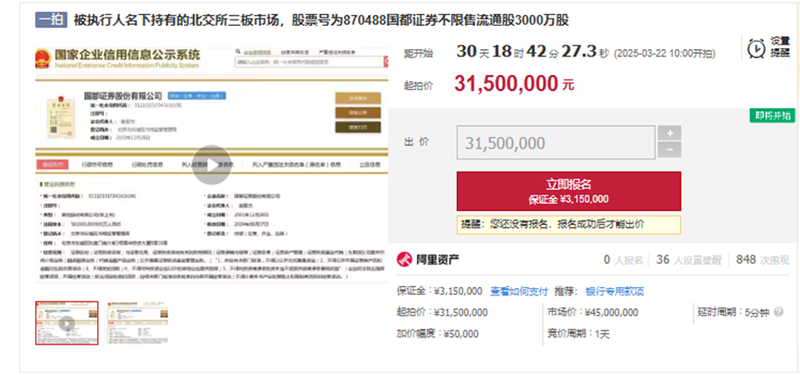

Recently, Alibaba Assets Judicial Auction Network showed that 30 million shares of Guodu Securities will be auctioned on March 22, with a starting price of 31.5 million yuan, a 30% discount to the market price of 45 million yuan. Blue Whale News reporter noticed that in addition to the shares to be auctioned, another 19.291 million shares of Guodu Securities held by Xinhua Agricultural Industrial and Commercial Company in Haidian District of Beijing City were auctioned in August last year. Later, due to objections from outsiders to the execution target, the auction is still on hold.

At present, the transfer of 34.25% of the shares of Guodu Securities transferred by Zheshang Securities (601876.SH) was completed at the end of last year, becoming the largest shareholder. If Zheshang Securities wants to further increase its shareholding ratio in Guodu Securities, it does not rule out taking two equity shares.

Since Zheshang Securities entered Guodu Securities, in February this year, Zhang Hui, former vice president of Zheshang Securities, took up the post of general manager of Guodu Securities. After he started in a business department, he became chief risk officer. Now he is the first to occupy important management positions, or to accelerate the integration of the two companies ‘businesses and optimize the governance of Guodu Securities.

Some industry analysts pointed out that there are many differences between the two institutions in terms of organizational structure and business line integration. For example, in investment banking, asset management, and brokerage, there may be problems such as business overlap, personnel redundancy or unclear division of responsibilities. Personnel deployment is still facing difficulties.

30 million shares of Guodu Securities will be released at a 30% discount”

Alibaba Assets Judicial Auction Network shows that 30 million shares of Guodu Securities held by a company in Shanghai (hereinafter referred to as the party subject to execution) will be officially auctioned starting from 10:00 on March 22, with a starting price of 31.5 million yuan, relative to 45 million yuan. There is a 30% discount on the market price of 10,000 yuan. However, due to real-time changes in stocks and other reasons, the actual starting price will be adjusted accordingly before the starting date (one day before the auction starts). The adjusted price will be the actual starting price of this auction.

Photo source: Ali Assets Judicial Auction Network

The execution ruling disclosed in this auction shows that in the execution of the equity transfer dispute between a certain company in Shanghai and the person subject to execution, the People’s Court of Minhang District, Shanghai City, ordered the person subject to execution to perform the obligations determined in the effective legal document and bear double the debt interest during the period of delay in performance, but the person subject to execution has not yet been able to perform. In accordance with relevant regulations, it was ruled to auction and sell 30 million shares of Guodu Securities held by the person subject to execution.

The reporter noticed that in addition to the shares that are about to be auctioned, another 19.291 million shares of Guodu Securities held by Xinhua Agricultural Industrial and Commercial Company in Haidian District of Beijing City were auctioned on the Jingdong Asset Trading Platform in August last year. The auction execution ruling shows that this part of the equity was auctioned because the person subject to execution, Xinhua Agricultural Industrial and Commercial Company of Haidian District, Beijing City, failed to fulfill the obligations determined in the effective legal document in accordance with the execution notice, and the court ruled to auction its equity in the above-mentioned Guodu Securities.

It is worth mentioning that the auction is still on hold due to objections from outsiders to the execution target.

Photo source: Jingdong Asset Trading Platform

“In judicial auctions, the reason why outsiders raise objections and suspend the auction may be that there is a legal or factual basis before the auction that the auction target is related to the outsiders. If auctioned, the rights and interests of the outsiders may be damaged. rdquo; Xia Hui, a partner of Gongcheng Yingtai Law Firm, pointed out in an interview with reporters.

It is understood that the transfer of 34.25% of the shares of Guodu Securities transferred by Zheshang Securities was completed at the end of last year, becoming the largest shareholder of Guodu Securities.

It is worth exploring if the above-mentioned auction suspension is lifted, can Zheshang Securities take the opportunity to collect the above two auctioned shares of Guodu Securities?

Regarding this possibility, lawyer Xia Hui said that when the auction suspension is lifted and the auction process is re-entered, the bidders can participate in the auction if they are qualified to bid. rdquo;

Therefore, if Zheshang Securities wants to further increase its shareholding ratio in Guodu Securities, it does not rule out taking the two equity shares. However, the auction announcement reminds that if a bidder still participates in the bidding after holding 30% of the shares of the listed company, it should apply specifically to the court and handle it in accordance with the relevant provisions of the Securities Law.

At present, competition in the securities industry is fierce and the head effect is significant. While small and medium-sized securities firms have limited profit margins, there are increasing cases in which their shareholders transfer their equity. Due to practical factors such as low return on investment and difficult operations, the equity of some small and medium-sized securities firms often fails to sell. In addition, the equity is relatively scattered. If a small proportion of equity is auctioned, it will be more difficult to sell. Even if the recipient wins, it will be difficult to have enough say. Overall, a small proportion of equity is not popular. If existing shareholders are optimistic about the target, they may be able to digest this share of equity.

After Zheshang Securities entered the company, Guodu Securities accelerated personnel adjustments

It is noteworthy that since Zheshang Securities entered Guodu Securities, Guodu Securities has experienced frequent personnel changes recently.

Recently, Guodu Securities announced that the board of directors decided to appoint Zhang Hui as the general manager of the company based on the nomination of the board of directors ‘remuneration and nomination committee. Since the day Zhang Hui assumed the position of general manager of the company, Li Rui, deputy general manager of the company, no longer performed the position of general manager on his behalf.

Public resume information shows that from August 2007 to January 2025, Zhang Hui was rooted in Zheshang Securities for nearly 18 years. He has served as general manager of fixed income headquarters, general manager of bond investment banking headquarters, director of bond investment banking headquarters, secretary of the board of directors, vice president, chief risk officer and other positions until recently joining Guodu Securities. It is reported that while serving as secretary of the board of directors of Zheshang Securities, Zhang Hui also led the preliminary negotiation and coordination of the acquisition project of Guodu Securities.

A closer look at this personnel layout shows some important signals. Judging from Zhang Hui’s resume, he came from a business department and accumulated in the brokerage and investment banking business lines. He has since served as chief risk officer.

In recent years, Guodu Securities has repeatedly stepped on compliance risk control and corporate governance. For example, in April last year, Guodu Securities was ordered by the Beijing Securities Regulatory Bureau to make corrections due to problems such as imperfect internal control systems for honest practices, ineffective job checks and balances and internal supervision, and insufficient accountability of responsible persons after the event. In October of the same year, Yang Jiangquan, former general manager of Guodu Securities, was investigated by the China Securities Regulatory Commission on suspicion of illegal stock holding by employees.

In January this year, due to the imperfect system construction and internal management mechanism for managing employees ‘investment behavior, the internal monitoring and inspection mechanism for employees’ investment behavior was not in place, and the Beijing Securities Regulatory Bureau also issued a warning letter to Guodu Securities.

It can be seen that Zhang Hui, who once served as chief risk officer, took the lead in landing at Guodu Securities as general manager. There is also the hope of Zheshang Securities that he can break through Guodu Securities’s historical shortcomings, eliminate hidden risks, reorganize the governance environment, and improve compliance management.

According to industry sources, in addition to Zhang Hui’s move to Guodu Securities, Zheshang Securities also dispatched core financial and investment bank personnel to Guodu Securities simultaneously. This adjustment of management and business team is also considered by the industry to pave the way for the in-depth integration of subsequent businesses.

However, some industry analysts pointed out that the two institutions have many differences in organizational structure and business line integration. For example, there may be business overlap, personnel redundancy or division of responsibilities in common businesses such as investment banking, asset management, and brokerage., making it more difficult to adjust personnel deployment in the later period. In addition, friction may also arise between the two parties in the connection and integration of corporate development models, management processes, and management styles. The integration process will inevitably need to balance the interests of all parties. (Blue Whale News Hu Jiehujie@lanjinger.com)

![Cailian Auto Morning Post [February 22]](https://gushiio.com/wp-content/themes/boke2/thumb.php?src=https://gushiio.com/wp-content/themes/boke2/assets/img/default.png&w=243&h=156)