In an evolving market, stagnation is death.

Author:Joel John and Siddharth

Compiled by: Shenchao TechFlow

Hello!

A few days ago, I noticed a problem with the way we write. Most of the time, our articles are technical topics written for founders and investors. That’s good. We skip drama, politics, and fraud, and rather become nerds, spending weeks studying topics that can be read in minutes. But we invest and build with founders not in academia, but in the free market. Therefore, it is important to keep up with what is happening around you.

If I told a psychiatrist about my experience in the crypto industry over the past six months, I would sum it up like this:

A 13-year-old kid launched a Meme coin, and thensell-offTake it. Chicago Bulls ‘Scotty Pippen did a storySatoshi NakamotoAfter her dream, she somehow predicted the price of Bitcoin. Speaking of which, Jack Dorsey may be Satoshi Nakamoto. A Frenchman made money by betting on Trump’s election $28 million。By the way, Trump launched a few days before taking office Meme coins。Two weeks ago, Argentina’s president also triedsimilarThings, as a result, evaporated $4 billion in value. Now his opposition is trying to oust him. People in Su Zhu’sexchangeI lost money. By the way, Hawk Tuah Girls also launched a token, and the result was rug。Dave Portnoy also launched a token, also rugged.“” Cz talked about his dog Broccoli, it looks like the token has not been rugged yet, at least not yet.

Meme coins now have the power to oust the president, which can really be said to have far-reaching social effects.

It’s not that no good things happen in our industry.In October, the United Arab Emirates clarified that it would not impose taxes on cryptocurrencies. In the United States, banks can now hold Bitcoin. Someone made $25,000 by deceiving an agent to transfer money. Oh, and also, Marc Andreessen transferred $50,000 to an agent, pushing the market value of a token to $1 billion. There are rumors that the U.S. government is developing strategic cryptocurrency reserves. OpenSea may eventually issue a token to bail out NFT traders who suffered heavy losses in 2022. FalconX acquired Arbelos. Coinbase clarified that the SEC has dropped all lawsuits against it. Last week, Bybit survived one of the largest hacking attacks in human history.

The point is, we are a tough group of people.But most of our collective psychology is entangled in bad news that is price-driven, mixed with fraud and a lot of embarrassing news. You can’t help but wonder, do I really hang out with these clowns? Am I in a circus? Am I the monkey in this game? rdquo; All this is too tiring. Especially considering that the human brain can only process 10 bytes of information per second while thinking.

in 4K Ultra HDHow should I deal with everything in the live broadcast of the fraud craze?

If you don’t consciously set boundaries, working in the crypto industry is like throwing your brain cells into a whirlpool of headlines and spinning at the speed of light until the sun’s heat evaporates all your cherished memories.

A process of gradual madness marked by reckoning and an endless but often meaningless stream of news. It’s like circling around Dante’s hell, jumping from one sin to another.

This is why we, as a current affairs media, tend to distance ourselves from daily drama.

But given the current situation of the market and the feedback we heard when communicating with the founders, I think it’s time to do a vibe check on the current cultural atmosphere. Arguably, in response to the brief period we are experiencing.“ vibecession ”(Climate decline).

“Memesis era

David Perell on Peter Thiel’s investment philosophyarticleIt was one of the important enlightenments in my career.

One of the themes is mimesis.Rene Gerard The defined concept of mimesis revolves around the human tendency to imitate and compete with others.

Think about the career choices you made when you were 17: You would look at what your brightest peers were doing, or an adult who had the lifestyle you wanted to live, and choose their career path. As human beings, we are inherently prone to imitate and compete with our peers because of the extremely high cognitive load required to open up new paths. We like the sense of security in numbers.

this also applies tostartups。

Lock enough smart people in one room and you will see them imitating and competing with each other. Label an accelerator or investment fund (such as Sequoia Capital or YCombinator) as a kind of superior, and we will see a group of smart people rushing to join not only for the financial resources it unlocks, but also for the status it brings.

YC knows this well and claims that its acceptance rate is lower than Harvard. Status is not a commodity with a clearly priced price, but it is definitely implicit in the hearts of the people. That’s why young, motivated and ambitious 20s pack up and head to San Francisco to pay high rents in the hope of moving up the status ladder.

“Mimesis drives us to strive to be the best in the field we do to satisfy our thirst for status

Image from Luke Burgis ‘blog

At the age of 15, I often wondered why so many Indian venture capitalists developed their own worldviews based solely on tweets from A16z partners on Twitter.

After working in venture capital for ten years, I realized they were just imitating big money. If you can copy the best, why innovate? Is this an advantage? Not necessarily. But it makes money. That’s why there are a bunch of follow-up products on the market. Many people imitate and iterate on a concept.

Just like Facebook was not the first social media platform. Instagram is not the first media sharing platform, and Spotify is by no means the first service to allow users to stream.

Repeated iterations benefit consumers.At first, the market will become crowded, but over time, the market will determine who survives. Therefore, you need multiple founders and multiple VCs to solve a problem, and often use similar solutions.

Keith Gill is the Soros of Meme stocks. Murad is the Soros of the Meme coin world. I am trying to become the Soros of the newsletter world.

In liquidity markets, this situation is common. George Soros gained fame for shorting British pounds and defeating the Bank of England. Keith Gill said“Roaring Kitty”——It is famous for igniting the GameStop craze. Both are adept at pulling most market participants into the deals they have entered. Soros persuaded traders to short the pound, offeringBank of EnglandApply pressure. GameStop investors pushed shares higher until Robinhood stepped in to limit shorting.

What Roaring Kitty is doing is nothing more than a modern version of Soros ‘theory of reflexivity, both designers of self-reinforcing cycles.A big deal attracts attention, people follow, prices rise, more people flock in, and assets suddenly hit new highs.

In Soros’s day, there was no Twitter for endless high-talk. In fact, he left the market to gostudying philosophy

People often argueFinancial nihilismIt’s investment by ordinary people Meme The reason for the currency.Think that this generation finds itself at age 30 without a stable career, partner or house, and bet on random code on Twitter in the hope of cracking the financial system that broke them (and put them out of business). But I think this is an untenable argument.

The real reason is mimesis, or imitation.

Yes, the same thing that determines your career choices, which startups YC invests in, and how Keith Gill makes money is why you lose a lot of money on a bunch of jumpShibuInuWallDoesnotExistcoin.

Source: Murad’s tweet

Let me explain what happens when the Internet breaks down barriers to entering financial markets and information barriers.

This is how things usually develop:

You see a 17-year-old on TikTok or Instagram telling you about the road to wealth while sharing the Meme coins he traded the day before. The office’s social media marketing manager showed off a $150,000 NFT on LinkedIn. You watch your bills pile up and feel like you have found another way out. A friend shared a ticker in the WhatsApp group. The exchange launched a new coin with the icon of a dog wearing a hat. You think, this is the opportunity. You invested $100 first and saw it rise to $117. You think, what if you invest $1000? Or $10,000? Before you know it, your credit card will explode and you will be stuck in it.

Note:It should be noted that Murad is mentioned here out of respect for his huge influence on the Meme coin market, not sarcasm. He defined today’s Meme coin category, just as Keith Gill once defined Meme stocks.

Pump It

The emergence of Bitcoin in 2009 completely subverted the way capital operates on the Internet.

You can provide labor through proof of work (PoW, something that ensures network security) and earn Bitcoin as a reward. As asset values will rise further in the future due to demand and deflationary pressures, the future value of current labor will be higher.

People are thus motivated to provide computing power to the network and hold Bitcoin. But with the advent of ICOs, asset issuance has been decoupled from labor certificates, and you can minte tokens without labor.

From March 2017 to 2018, ICO raised approximately US$28 billion.

Venture capital claims this is the future of finance, allowing individuals to coordinate capital and resources to launch new networks. That sounds reasonable until you discover that VCs often invest at low valuations (say,$10 million) and then raise money at much higher valuations (say,$100 million) within a few months.

In the traditional venture capital world, this madness occurred during the Internet bubble 18 years ago, and cryptocurrencies have reproduced this madness.

From 2018 to 2023, the token issuance market gradually matures. We no longer have an ICO boom, but venture capitalists are still keen to invest at low valuations and try to go public at high valuations. This is arbitrage.

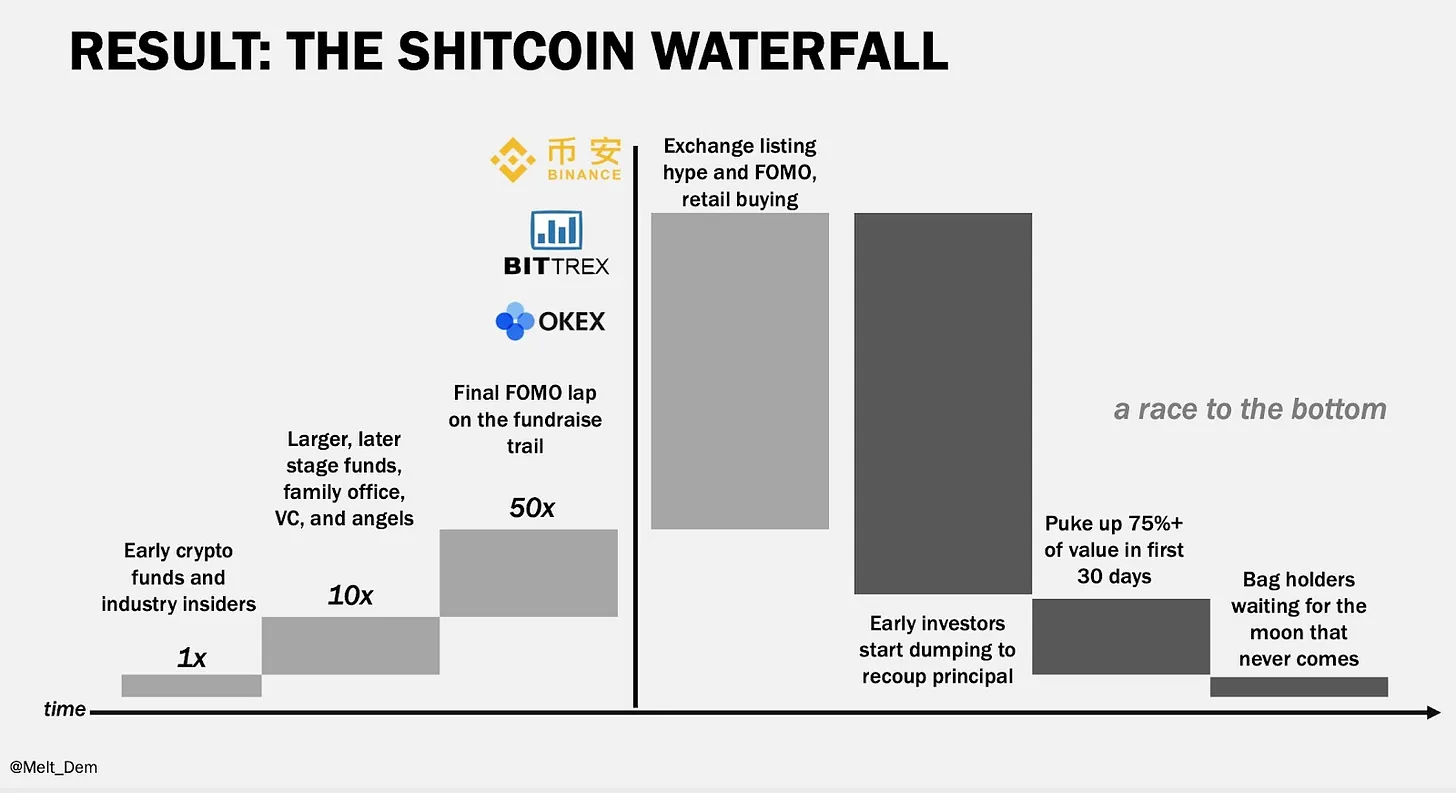

Picture: This video from Meltdem Demirors does a good job explaining how capital allocation in cryptocurrencies starts to fall freely the moment the token goes public

Financing at a low valuation is nothing wrong in itself,However, reselling to retail investors at a high premium without substantial progress is extremely predatory. Chamath also adopted a similar strategy in its SPAC (Special Purpose Acquisition Company) during the 2020 COVID market. Currently, the SPAC he launched has dropped by an average of 42%.

Now, everyone can become their own Chamath or venture capital fund with one click of PumpFun. PumpFun is either the most innovative financial product of the last century or the most predatory platform. The truth may be somewhere in between. Meme coins are to the market what pornography is to the media. Just as pornography does not disappear, Meme assets will exist as long as greed and speculative desires exist. And many Memes will drive meaningful innovation, just as pornography drives technological progress.

Although discussing its ethics is beyond the scope of this newsletter, I would like to share two interesting numbers.

-

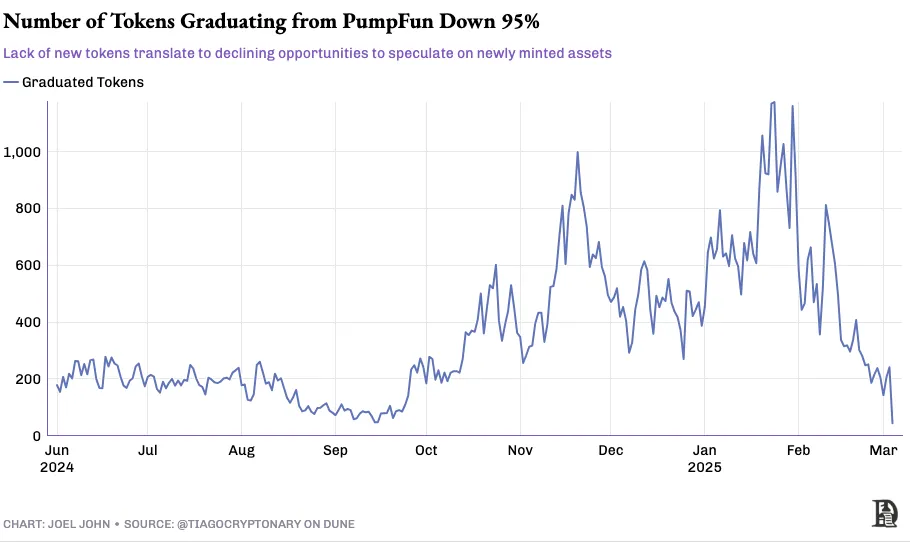

PumpFun cumulative revenue chart. Their total revenue last year was $500 million.

-

Another chart shows the number of new assets issued on Pump over the past few months.

The second chart is strikingly similar to previous hype cycles.

I can overlap it with a chart of ICO or NFT issuance numbers, and they look exactly the same. I am dealing with (or adjusting to) two parallel realities: one is that PumpFun is probably one of the most profitable startups in history; the other is that it provides a stark demonstration of the most primitive way cryptocurrencies work. Dave Portnoy questioned with interest what rug is in a tweet.

When we say that blockchain coordinates capital, we don’t say for whom capital is coordinated.It can be used for cancer research or urban planning, but people on the Internet tend to be indifferent to these. Everyone cares about profits and avoiding losses. We are adults with bills to pay and dreams to pursue. As a result, everyone in the market is betting on the most speculative investments, while capital and attention are lost from what really matters. This is the current situation of the market.

The real impact of PumpFun is that it has transformed cryptocurrency from a niche area into a mass tool. When Internet celebrities, presidents and countries issue tokens and watch prices plummet, we are not creating wealth through cryptocurrency like Bitcoin did in 2009, but destroying it. But just as personal expressions on the Internet cannot be defined by creators, the outcomes of markets cannot be determined by tools. The creators of TCP/IP cannot decide what I will write in this newsletter today.

This fanaticism is the price of releasing the spirit in the bottle.

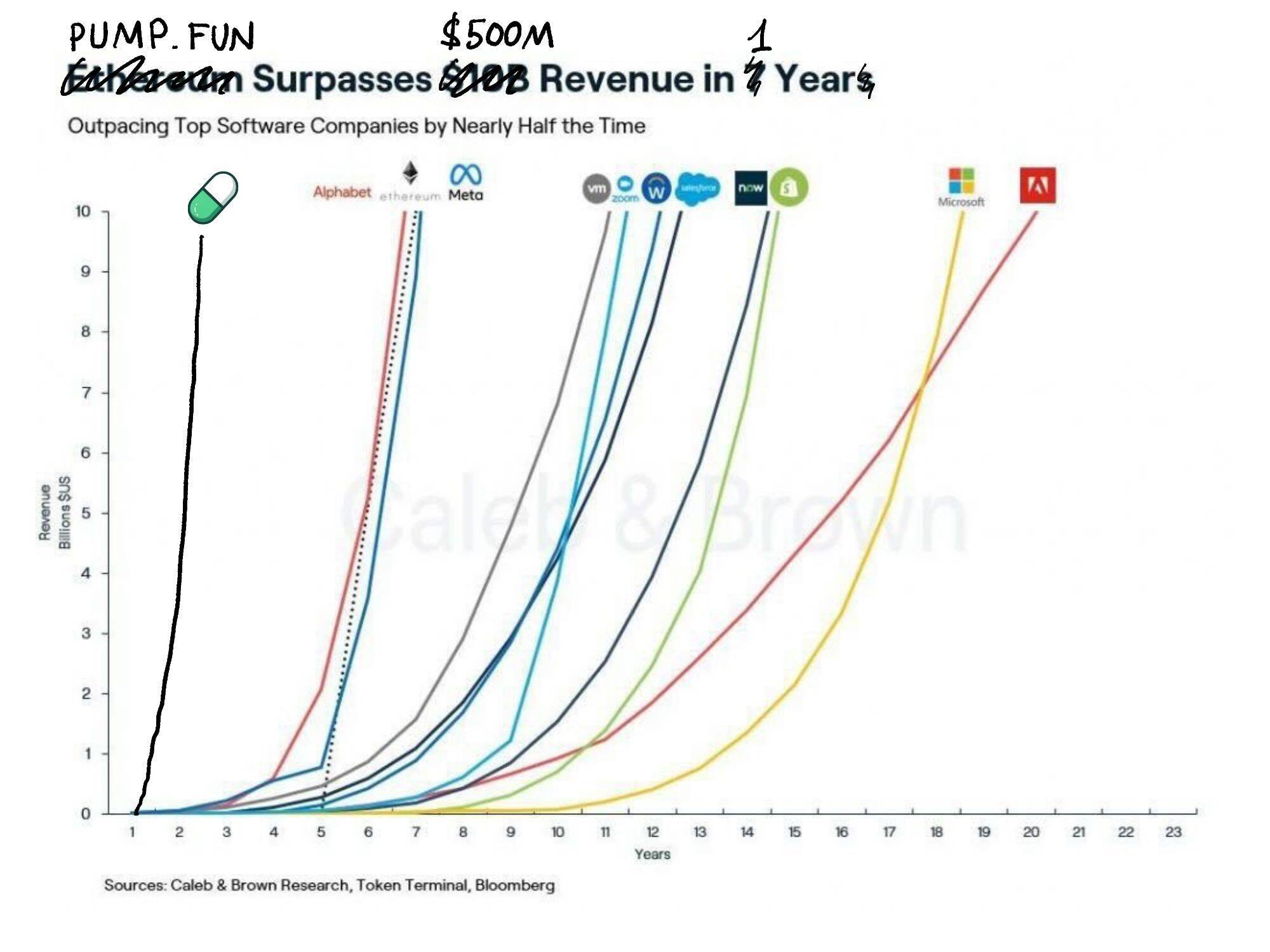

Picture: This chart is a joke inspired by a conversation with ThirdPrime’s CK. I promise you, I have 0.0042 ETH in my cold wallet. I am an Ethereum faction.

If you are not prepared to be offended, there is no real freedom of speech. nofree marketBy providing tools, we cannot avoid most tools that encourage greed and speculation.Especially in an era when regulators are dozing off, the consequences of launching rug pull assets are negligible. Freedom of speech is effective because saying the wrong thing has consequences. How does a free market work without consequences? This is the big question that cryptocurrencies are trying to find answers to. But like most things, the market will eventually find its own solution.

The Meme market has many similarities to blogs and personal expressions on the Internet.

In the early days, blogging was a niche activity. You can open one, but not everyone can read it. I like seeing old WordPress blogs online because they remind me of a time when people wrote to express, not to influence. The same was true for Meme Assets a few years ago. What makes Doge special is precisely because the founders didn’t launch it just to make it Meme. With the development of the Meme asset tool, everyone can launch a Meme coin, just as everyone can open a Facebook page.

In Social networks, attention eventually focuses on a few creators.

In Meme assets, capital will eventually be concentrated in a few key names. The challenge is that people lose money as they mature.

Photo: Wassielawyer’s tweet captures the thoughts in the hearts of many of us

So, where should we go?

Are we finished like Zoomers said? Will there be light at the end of dawn? Do I need to find other industries to develop my career? What should we do!?

I would be lying if I didn’t admit to having thought about these issues many times over the past two quarters. This is not because I have lost confidence in the potential and future of cryptocurrencies, but because of the way attention is allocated. The only antidote I have found is to root my reality in human interactions rather than the noisy rhetoric on Twitter.

Every time I see my information stream filled with the latest scams, I talk to one of the founders in our portfolio for a spiritual massage to restore confidence.。This is perhaps the greatest privilege of working at Decentralised.co We can get a perspective from the founders that transcends the flow of information.

So if I had to zoom out and see what’s exciting and what will define the next decade, I’d lay it out like this:Think of it as a blueprint.

Respect Pump

You just listened to my ten-minute complaint about fraud and lack of substance in cryptocurrencies. If you are still around, fasten your seat belt and prepare for a shot of optimism and the logic behind it.

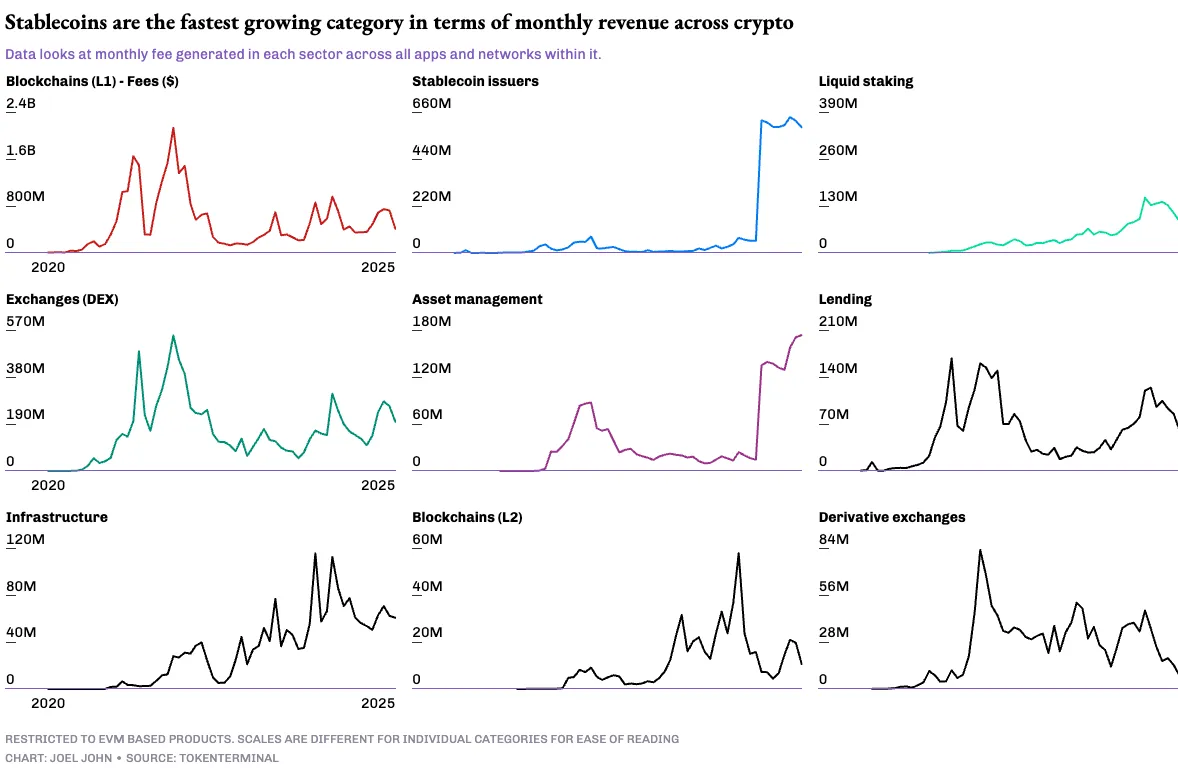

First, let’s take a look at the apps that do make money,Because it will give us a direction to determine whether it is worth the time. TokenTerminal doesn’t track all the apps we want to see, it’s slightly biased towards EVM (Ethereum Virtual Machine), but has the best data in terms of price, revenue and profitability. So, I started my survey by looking at the top ten income categories.

The revenue data you see below is monthly revenue for each of the past ten years.The data is meticulous because we want to play skeptics. We want to see growth because hey, what’s the point of staying in a stagnant industry? We want hockey stick growth.

When considering revenue, you will find that there are three stages of industry growth.

-

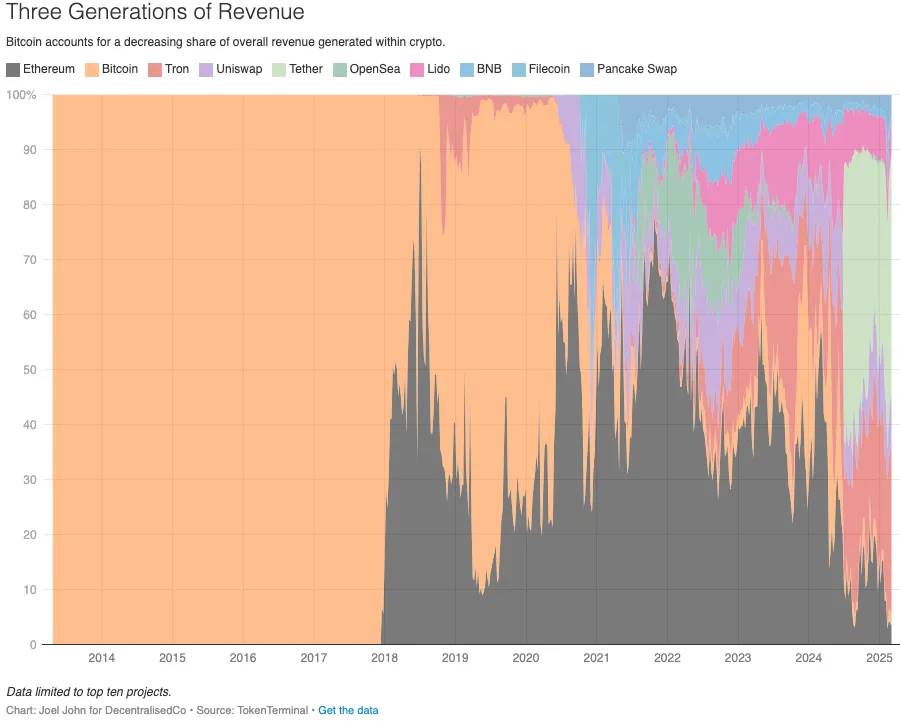

The first stage, I call it the Dark Ages.

Before the rise of Ethereum smart contracts. Before 2018, blockchain transaction fees were the main economic output of the industry. Of course, you can consider miners ‘income and related businesses (such as Coindesk), but this does not apply to marginalized people. Developers did not directly benefit from it.

-

Then between 2018 and 2022, applications and use cases exploded.

Revenue is no longer limited to transaction fees, but extends to on-chain businesses. You can see blockchain Layer-1 fees gradually falling, making way for businesses such as exchanges and lending. I think this is a magical period of enlightenment for cryptocurrencies, where people question the limitations of blockchain, violate the dogma of the savior Satoshi Nakamoto, and create alternative business models.

It was during this era of enlightenment that models such as Play-to-Earn (Axie Infinity) and yield farming took off. Of course, some chapters end in failure, like political alliances in medieval Europe. But it paves the way for people to question possibilities and explore new paths.

-

After 2022, a new category is emerging at an alarming rate.

Guess what I call it? This is the industrial age of cryptocurrencies. Just as humans have discovered the ease of making and transporting machines, crypto practitioners have also discovered the possibility of expanding their income without human intervention.

The alchemy of this era is stablecoin.

Everyone wants income and quick capital flow. FinTech companies still rely on banks, which in turn rely on the government to determine rules for the flow of funds. Stable coins abstract the rules faced by financial technology companies in the history and spawned a new generation of businesses. Tether and Circle made more than $5 billion in one year.

According to The Economist, the value transfer of stablecoins reached US$2.76 trillion last year, accounting for about 2/5 of the value of all transactions on the blockchain, up from only 1/5 in 2020. The same article pointed out that in March 2024, stablecoin transactions accounted for 4% of Turkey’s GDP. This article does not specifically discuss stablecoins, so I won’t say much.

Now that we have established that this industry can make money and reach billions of dollars, it is worth discussing how sticky these incomes are. Cryptocurrency revenue may be seasonal, but in terms of scale, it can change lives. Think of the OpenSea, PumpFun or Play-to-Earn craze. Of course, some people will say that NFTs and Meme assets created huge bubbles and ruined many people’s lives.

Exploring whether markets are zero-sum games is beyond the scope of this article (and I don’t want to put you in a deeper survival crisis). But one way to think about it is that the revenue in these cycles is high enough to allow the company to make money it would not otherwise be able to make in a lifetime.

One mental model that applies to native blockchain applications is that product maturity will vary.

Depending on the market cycle, the speculative premium of the product will increase. Take stablecoins, for example, which have developed to the point where large companies can use them to remit money. That’s why Stripe made a $1 billion acquisition in the space last year.

On-chain analytical tools sold to governments such as Chainalysis and smart contract auditing companies such as Quantstamp have also reached mature revenue scales. These businesses have considerable cash flow and sufficient profit margins, attracting the attention of traditional capital.

Figure: For reference only and not absolute basis. Many of the positioning here are subjective

If you add these questions together, you get a matrix. One end is centralization and decentralization, and the other end is seasonality. Highly seasonal apps like FriendTech may be centralized, but it is difficult to bring value to the ecosystem because they rarely pass on value to edge users. Although most of Uniswap is decentralized, it is difficult to give back value to shareholders. That’s why last year they started adding fee switches on the front end. Since then, Uniswap labs has accumulated nearly $103 million in fees.

Entities ‘business needs to control revenue, profit margins, and capital allocation often conflict with our desire to decentralize and deliver value to users.

A few companies have found a balance between innovation and decentralization, while delivering value to users and having enough room for growth.

My personal favorite is Layer3.

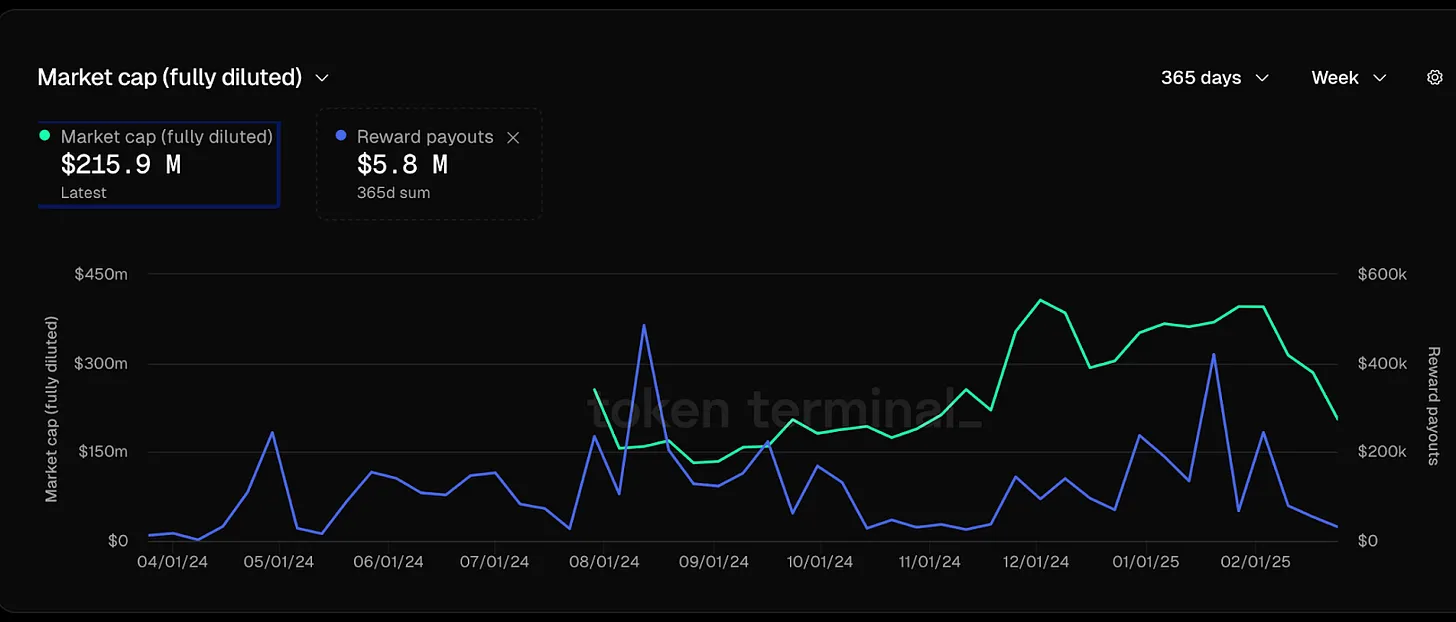

If you first heard of Layer3, think of it as an advertising network that gathers one of the largest user groups in the cryptocurrency space. They help new users discover native crypto products and reward early adopters in dollars or cryptocurrencies. So, if you’re a new app or newsletter like ours, instead of running ads on Google to attract untargeted attention, you’re going to Layer3 to get a carefully selected group of encrypted native users. Unlike Google, Layer3 gives most of the value generated back to users in the form of incentives.

past,I’ve written about how they aggregate users。On average, about 60,000 users trade on their products every day. Last quarter alone, they gave back approximately $1.4 million to users. The cumulative total for the whole year reached US$5.8 million.

In the advertising world,$5.8 million may be insignificant. Kanye West spent more money on Super Bowl ads than that. But the point is, this $5.8 million is interesting because it is an early example of a product giving value back to users. This is an open advertising network where consumers (i.e. early adopters) receive tangible dollar compensation through a global funding channel.

Working Theorys ‘Anu zero-sum and positive-sum products have an exquisite framework. She pointed out that some products reduce the use of others. For example, you either use Google Docs or Notion. Companies rarely switch between the two because every product suite has a lock-in effect and you need to manually migrate the entire team. But some products are positive sum and you can use Perplexity, Claude, and ChatGPT to handle different use cases on the same day. These products won’t erode each other’s market share until user preferences are as clear as Google and Bing.

Predatory products are often zero-sum because they make (average) users worse off.If there is an underlying economic reason, the market is not a zero-sum game. People who bought Tesla stock in 2018 made profits in subsequent gains and did not need others to lose money. You could say that stock movements are related to Tesla’s output. But in the Meme market, games are increasingly like negative sums.

The reason is simple:

Users need others to invest capital to make asset prices rise. This in itself is fair and all capital markets work like this. But users still need this atmosphere to last for a long time. From the beginning, you expected the craze to continue. That works because the greater fool theory will get people to buy assets. But as prices rise, people revalue their net worth based on weak liquidity pools. For example, there is a Congo-related token with an FDV (fully diluted valuation) of US$1 billion, but there is less than US$5 million in the trading pool. People revalue their net worth based on this illusory capital, and when the game inevitably ends, they are often worse off.

Products like Layer3 are positive because they don’t directly extract value from users. If you use their tools and stick with them long enough, you can make thousands of dollars just as an early adopter. As cryptocurrencies cross the user divide, we will see more and more products optimized for positive sum because this is the way to build critical mass of users. The more users there are on Layer3, the better the team will be able to negotiate better deals for users.

Marketers also prefer positive-sum games because they know that Layer3 brings users who are more skilled and experienced and have already used multiple related products.

One way to think about the current revenue status of cryptocurrencies is through what I call the marginal neighbor user perspective. In emerging fields, founders are often better suited to solving niche problems. In the 1970s, Jobs and Wozniak created niche, technical, expensive and targeted products for enthusiasts familiar with computer technology but who needed portable and affordable home computers. In contrast, Jobs in the 1990s was obsessed with bringing technology to the masses that was less technical, more generic, price-sensitive and extremely user-friendly.

If you are building in the crypto space before 2021, it is feasible to build products for active users on the chain because the revenue per customer is high enough. In a market full of curiosity, selling novelties is effective. But as users lost money and lost interest in subsequent years, expanding the market became important. A few chains and applications (mainly on Solana) are doing well and catching the next wave of users on the chain. The risk is that these products could repeat the mistakes of DeFi in 2019, just a little faster, a little cheaper, and a little better experience, but essentially doing the same thing.

According to Mary Meeker’s latest report, there are about 3 billion people on the Internet today. According to the most optimistic estimates, the number of monthly cryptocurrency trading users is between 30 million and 60 million. This is already very generous. But think about it, there are multiple products that have been competing for these users. In essence, this is that industry friction and market growth is not enough to accommodate multiple participants.

As a result, teams compete either on (i) pricing,(ii) incentives, or (iii) functionality until a veritable bottom-to-bottom competition is eliminated because of insufficient profit margins.

What are the alternatives?It is to build things that can go mainstream, because mainstream markets have both moat and profit margins. Our popularity competition in the crypto world about who has the highest TPS (transaction volume per second) and who is more aligned is useful for information flows, but it doesn’t pay bills. Layer3 attracted me because they weren’t chasing existing users, they were expanding the market and capturing some of the value from it.

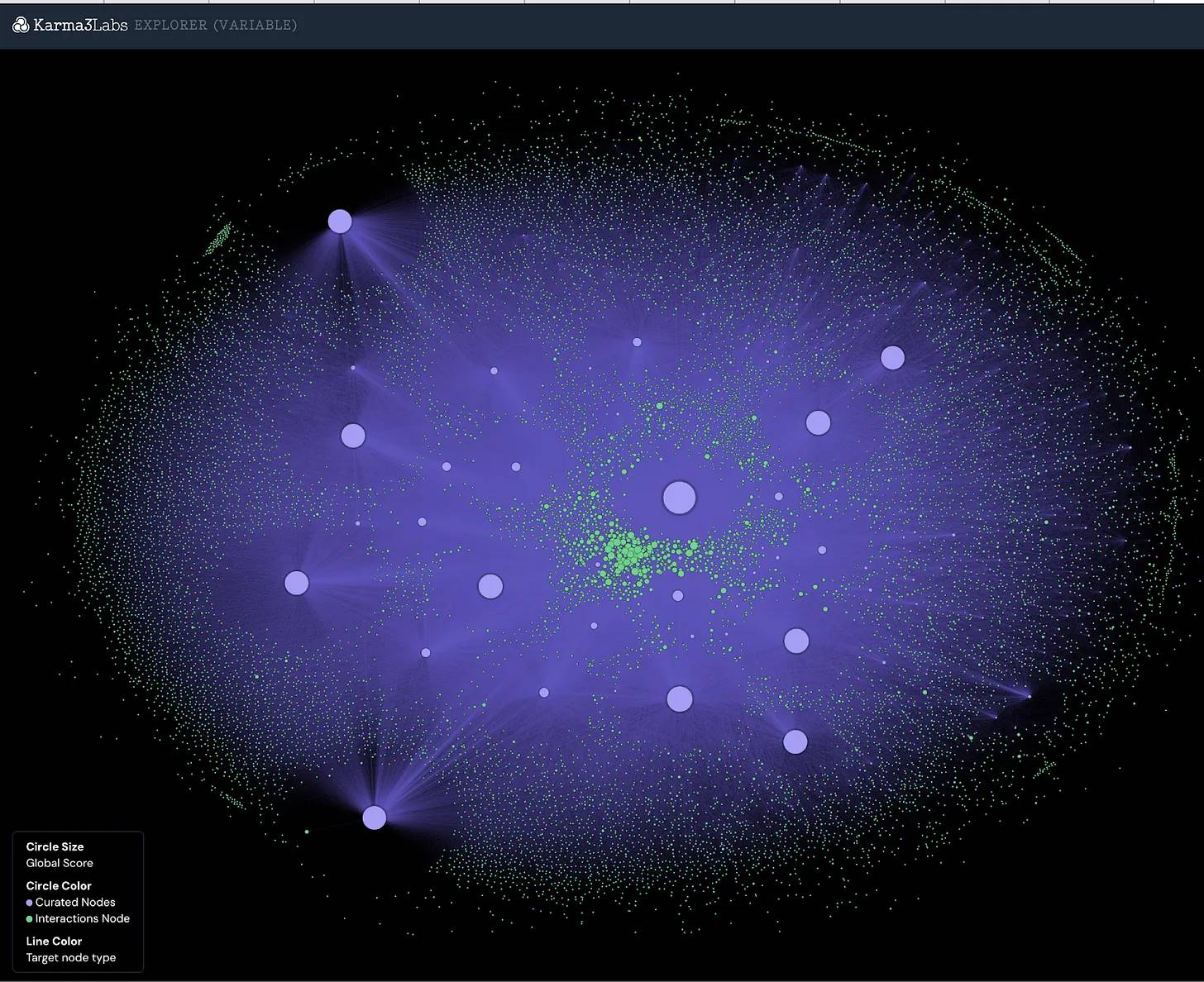

“The theme of market expansion is not limited to Layer3. OpenRank is a product built on Farcaster. Since user activity on Farcaster is often relayed over the open network (blockchain), it is easy to assess which users are valuable and which communities are natural. OpenRank helps identify suitable users and motivate them directly with tokens, NFT or early access rights. This means that any developer can target any user on Social networks.

Figure: Karmalabs maps Farcaster users in their filters

Layer3 and OpenRank are two different methods of advertising in the blockchain era.

One is to craft agreements, users and incentives, and the other is to let the market identify users on the open network and directly target them. While it remains to be seen how Farcaster evolves and which advertising model will last, what is certain is that blockchain is changing the way content value is transferred on the web. Of course, this market is still niche right now, but they have the potential to grow exponentially.

One example I witnessed with my own eyes is stablecoins. In 2019, the total market value of stablecoins was about US$1 billion, and it was hard to imagine that their market value would reach US$204 billion five years later. But today, this is the total market value of stablecoins.

So, the key question is, can the market for cryptocurrency-related users be equally large? Will they grow to hundreds of millions of users in the next five years? What is needed to build such a world?

In the industry segment that interacts directly with hardware networks, we have seen some early clues.

example, Frodobots and Proto Use points or tokens (such as USDC) to encourage users to plot geospatial data. Frodobots delivers physical robots to users, who ride them through towns, and the product uploads data to create the world’s largest urban navigation dataset. Proto encourages users to use their mobile phones to help map dense urban networks. What appeals to me about these models is their ability to capture data from third parties without trust (through device sensors) while using a global capital network to motivate users.

UpRock is using crowds to provide data for website monitoring, which is a variation.

UpRock’s SaaS platform Prism An alternative uptime monitoring system is provided with accuracy comparable to DePIN (Decentralized Physical Infrastructure Network). Their network consists of nearly 2.7 million devices worldwide and forms the backbone of UpRock, the core consumer product that powers Prism. When developers need insights, they can leverage UpRock’s user base, many of whom collect data by running mobile and desktop apps to earn rewards. Can this be achieved on the track of legal tender? Sure.

But try making millions of micropayments every day in more than 190 countries and see what happens. UpRock uses blockchain to accelerate payments and maintains a verifiable, public record of past payments. They connect it all with Core Tokens (UPT). As of writing, the team destroys UPT when it receives external income through Prism.

This is not to say that we are in the midst of a radical wave of innovation that is about to make tokens as defying as Iron Man.

No, we’re not there yet. The best example is agent tokens, which demonstrate the gap between innovation and token performance. Let me start with a set of charts.

After the hype cycle, we can safely ask ourselves: Is there anything of value lurking in this area?

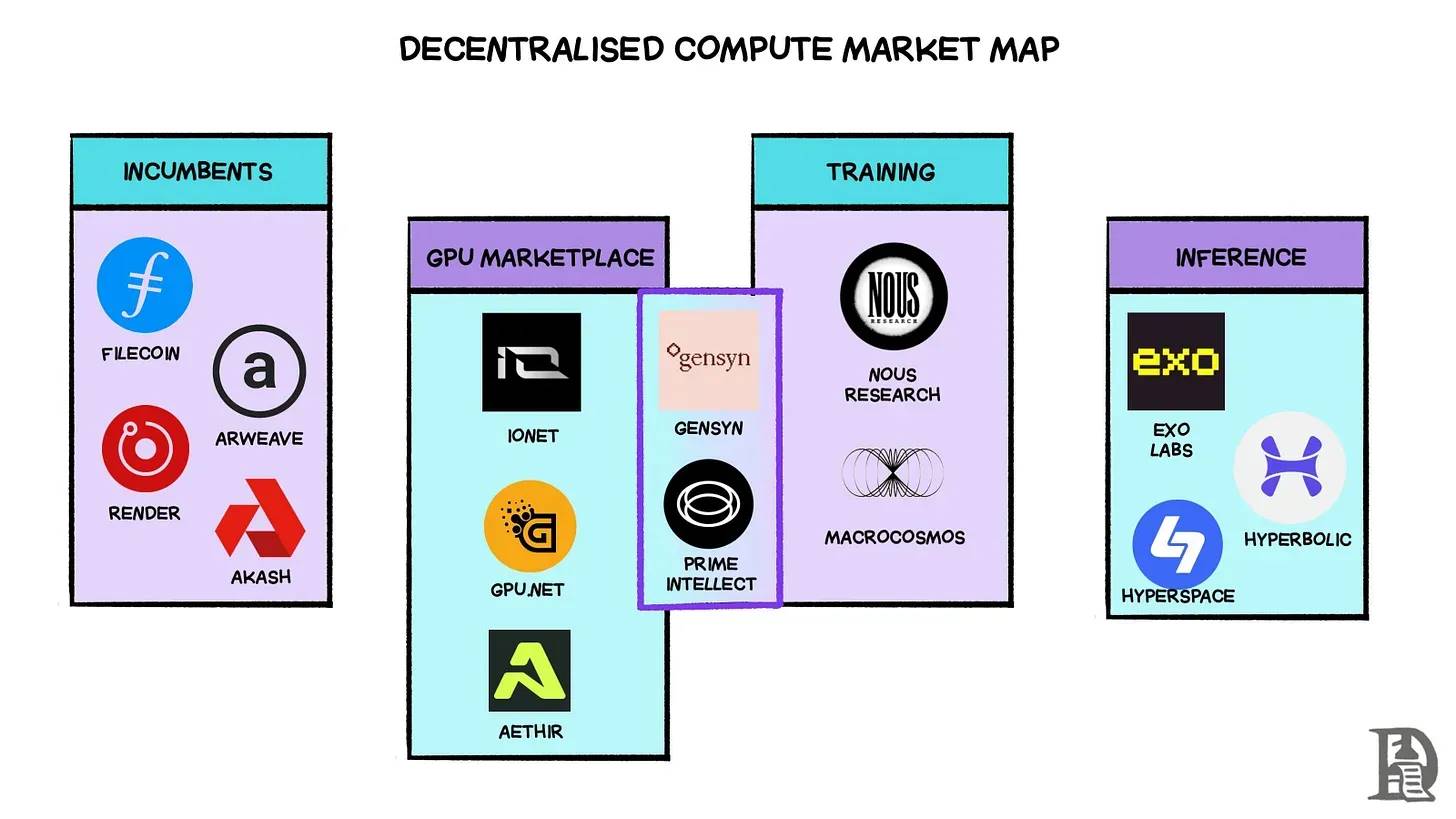

The most striking intersection between cryptocurrency and AI lies not in the agents themselves, but in the decentralized training and computing networks that train and serve AI models on a globally distributed network of computers and GPUs through token incentives.

you canPond’s model factorySee early iterations of this model. They are incentivizing the creation of a machine-learning model that simulates how judges rank open source contributions.

So, you can collect data (like UpRrock) or you can find people to build models (like Pond). But in a world where energy and computing power are scarce, where do you run these models? Shlok in the previous articleHaving explained this, I will share his exact words:

Who are these new AI native markets? io.netIt is one of the early leaders in enterprise-level GPU supply aggregation, with more than 300,000 verified GPUs on its network. They claim 90% cost savings compared to centralized existing businesses and earn more than $25,000 a day ($9 million in annual revenue). Again, AethirAggregated more than 40,000 GPUs (Including more than 4,000 H100s) to serve AI and cloud computing use cases. Previously, we discussed how Prime Intellect creates a large-scale decentralized training framework. In addition to these efforts, they also provided aGPU marketUsers can rent the H100 on demand. Gensyn is another big bet on decentralized training, using a similar training framework and GPU marketing approach.

In other words, cryptocurrency has evolved to the point where we can access data, models, fine-tune models, and assemble the physical infrastructure needed to run AI models. At the same time, ordinary people in the encryption field are still asking when it will increase?” rdquo; I had no idea that they were sitting on a pile of uranium that could take us further. Some developers are aware of this.Gud.Tech and Nomy Teams such as others are working to build trading agents that can accept user input, understand context, and execute transactions.

What does this mean?

Chatbots have been around since at least 2015. Obtaining information from robots is not new in itself. What attracted me to Gud and Nomy was how they abstract the complexity of purchasing assets across chains. Nomy provides a simple chat box. You type in using my eth to buy 50po on base, and the agent will automatically complete the transaction without the user signing multiple times. Similarly, Gud is developing a trading product that almost always provides users with the best price by optimizing liquidity sources. These products blur the line between us consuming information (Twitter, newsletters, etc.) and executing transactions, all built on advances in AI.

Why did I specifically mention these two teams? Because they are the essence of everything we have discussed so far.

-

They are targeting cryptocurrency-related users rather than competing for existing small user groups.

-

They are not zero-sum because their growth depends on continued user engagement.

-

They package critical infrastructure, such as gas-free transactions, into a single product that users can use.

-

They are building on the forefront of cryptocurrency and AI, in a way that is relevant to ordinary Internet users.

I particularly emphasize Gud and Nomy because they were built by teams that worked deeply in the infrastructure space before moving to the application layer. This reveals a simple fact:The application era has arrived.If cash flow, revenue, moat and user retention are really important, then apps will take on this mission. The infrastructure is so mature that arguing about TPS (transaction volume per second) is no longer meaningful. Our reluctance to give up these rules of thumb is just another sign of stagnation.

To evolve, we need to change the way we talk. Perhaps even developing a shared language of optimism.

Cathedral, not trenches

In the mid-1940s, as the threat of World War II waned, the aviation community faced a new challenge to build aircraft that mimicked birds, or rather pigeons (which, by the way, came from“Where is my flying car”, a great book). The challenge is to build an aircraft that can land in the backyard without requiring a long runway. Despite the huge improvement in aircraft efficiency in terms of passenger capacity and fuel efficiency, we still do not have a retail owned flying aircraft.

Does this mean that the aviation industry has failed?No. In 1961, John F. Kennedy said:

We chose to go to the moon. We choose to go to the moon and do other things in this decade not because they are easy, but because they are difficult, because this goal will organize and measure our best energy and skills, because this is a challenge we are willing to accept, a challenge we are unwilling to postpone, a challenge we are determined to win, and other challenges.

Driven by this optimism, decades later, U.S. investment and energy during the Cold War laid the foundation for today’s Silicon Valley. What’s even more interesting is that in 1903, the media publicly argued that we would not have an aircraft in another million years. A million years!? Sounds like they’re counting on evolution to help us. But we are not waiting blindly.

We make it happen.In 1969, we landed on the moon.

But between 1903 and 1969, flight attempts failed multiple times. Cryptocurrency feels a lot like that when we are too focused on improving the engine rather than making it truly serve the transportation of passengers. Kennedy’s political will injected new energy and direction into aviation to mobilize people, resources and policies towards a mission. This is not a one-time event, but a pattern.

In David Perell’s article about Peter Thiel, he highlighted how medieval Europe united to build cathedrals during times of destruction and danger. These buildings are symbols of hope and took hundreds of years to build and consumed a lot of resources. They require coordinating financial, security, talent and labor efforts that go far beyond daily.

Ordinary workers building the cathedral may only hope to see it completed in their lifetime. Today, a similar behavior is taking 4-5 years to expand a consumer application, while most of the industry is obsessed with technical details.

Today, through Meme Coin, we can see that when assets are issued and traded as fast as text messages, humans are trying to solve the problem of how to use currency.We have experienced similar situations before. In the 1400s, we adapted to the impact of interest rates on capital. In the 1700s, we discovered the power and chaos of trading company stocks. The South Sea bubble was so severe that the Bubble Act of 1720 prohibited the creation of joint-stock companies without royal charter.

Bubbles are a feature, even a necessity.Economists view them negatively, but bubbles are how capital markets identify and evolve into new structures. Most bubbles begin with a surge in energy, attention and obsession with emerging areas. This excitement pushes capital into anything that can be invested, driving up prices. Recently, I saw this obsession in agency projects. Without the combination of financial incentives (token prices) and hype, we wouldn’t have so many developers exploring this area.

We call them bubbles because they burst. But falling prices are not the only result. Bubbles drive radical innovation. Amazon didn’t become useless in 2004, but laid the foundation for today’s AWS, which drives the modern web. Could investors in 1998 predict Jeff Bezos’s success? Probably not. This is the second aspect of bubble-they create enough experimental variants to ultimately produce a winner.

But how do we experiment enough to witness winners?

That’s why we need to focus on building cathedrals rather than dancing in the trenches. My argument is that Meme assets are not bad per se. They are an excellent testing ground for financial innovation. But they are not the long-term, revenue-generating, PMF (product-market fit) games we should play.They are test tubes, not laboratories. To build our cathedral, we need a new language.

We have already seen the prototype of this new language in projects such as Kaito and Hype. I don’t hold their tokens, but they have become category leaders in their own way. Their token prices have also found a stable foundation, unlike many VC backed star projects that found nothing after 36 months of symposiums. As people realize that the core meta-game of cryptocurrency has evolved, more people will gather around this new language.

Picture: To end stagnation, one must face the monster within one face”

In 2023, I am writing“Has cryptocurrency failed?”When I thoughtWe will move towards a market where founders and VCs recognize the importance of revenue and PMF. That was my post-traumatic stress disorder after the FTX incident, hoping that the industry would become rational participants. In 2025, I fully realize that this is no longer a reality, and hope is no longer a strategy.

People will start asking: Why am I here? rdquo;, and then switch the game they play.

The divergence between income-generating and non-income-generating instruments will be a huge watershed for cryptocurrencies. Eventually, we will no longer talk about working in the crypto space, just as no one today says I work on the Internet or on mobile apps. They are talking about what the product does. This is the language we should use more frequently.

When I started writing this article, I tried to find out what was really bothering me. Is it fraud? Is it Meme Asset? Not exactly. I think the real pain comes from recognizing the gap between effort and impact in the crypto field, especially compared to AI. Of course, we have stablecoins, but there are many other innovations that people hardly know about or talk about. This makes me feel stagnant.

In an evolving market, stagnation is death.

If you stop, you die. But if you end stagnation, you survive. This is the irony behind ending stagnation. In order to protect life, you must be willing to end the core within. This is the price of evolution and the price of maintaining relevance. Cryptocurrency is at that crossroads. It must choose to end certain parts of itself and give those parts that can evolve and dominate the opportunity to grow beyond the primary stage.

Respect the cathedral,

Joel John

This article is largely influenced byInspiration from the end of bubbles and stagnation.If you haven’t read it yet, I absolutely urge you to read it.

Welcome to join the official social community of Shenchao TechFlow

Telegram subscription group: www.gushiio.com/TechFlowDaily

Official Twitter account: www.gushiio.com/TechFlowPost

Twitter英文账号:https://www.gushiio.com/DeFlow_Intern