These are the current Live projects on Story Protocol

DeFi

Trading and communication will always be a constant theme for Crypto.

Section Overview

The composability of IP’s DeFi ecosystem greatly exceeds the scope of traditional DeFi. Here you can even evaluate your hot IP and mortgage it based on the cash flow it can generate for a certain period of time in the future. The arrival of IPFi has further highlighted the importance of holding high-quality IP assets. Because mastering high-quality IP assets means mastering high-quality cash flow. Less than a month after the main network was launched. The DeFi ecosystem on the Story chain is mainly composed of native DEX, lending platform, Staking/revenue aggregation, and derivatives.

1. Native DEX

PiperX,Story Hunt

core functions: As the native decentralized exchange of the Story ecosystem, PierX focuses on the liquidity management of IP assets and intends to create a relatively complete IPFi platform. On the original basis, Story Hunt further supports exchange between IP and NFT.

data highlights:

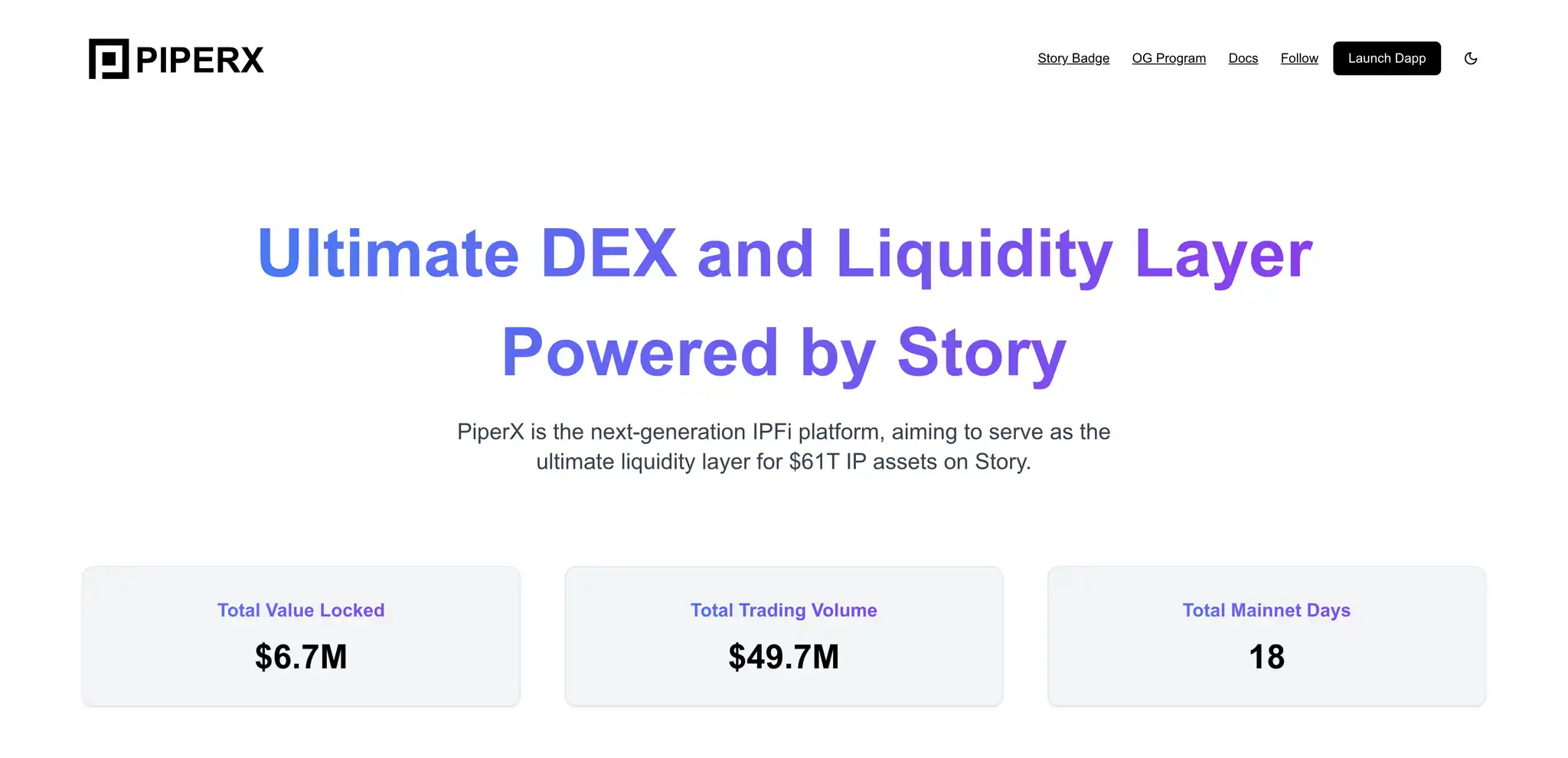

PiperX

According to data from the homepage, since PiperX launched on the main IP network 18 days ago, the total TVL has reached $6.7M, and the total transaction volume has reached $49.7M.

Compared with Story Hunt, PierX covers a wide range of mainstream IP Token trading pairs, with WIP, ZOO, WETH, WTF, vIP and other tokens ranking in the top five.

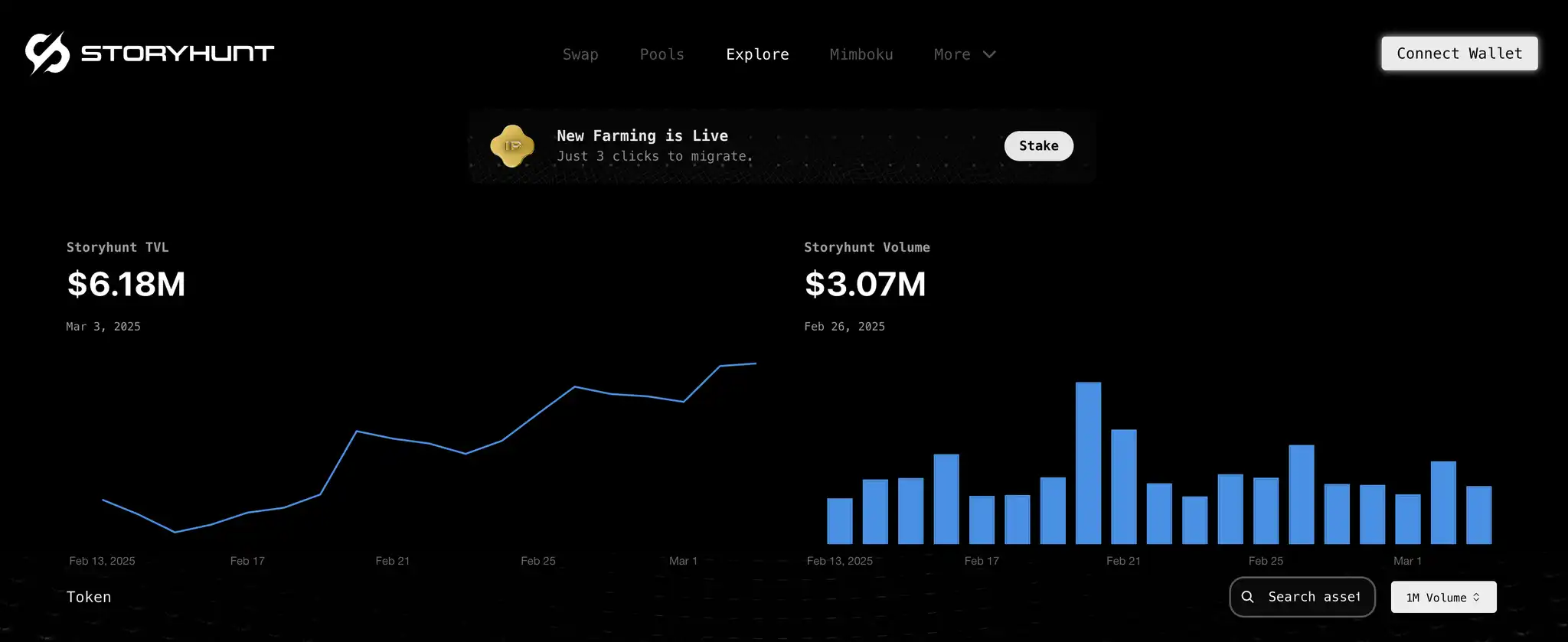

Story Hunt

According to official data, the total TVL reached $6.18M, and the total transaction volume was $42.2M

2. lending platform

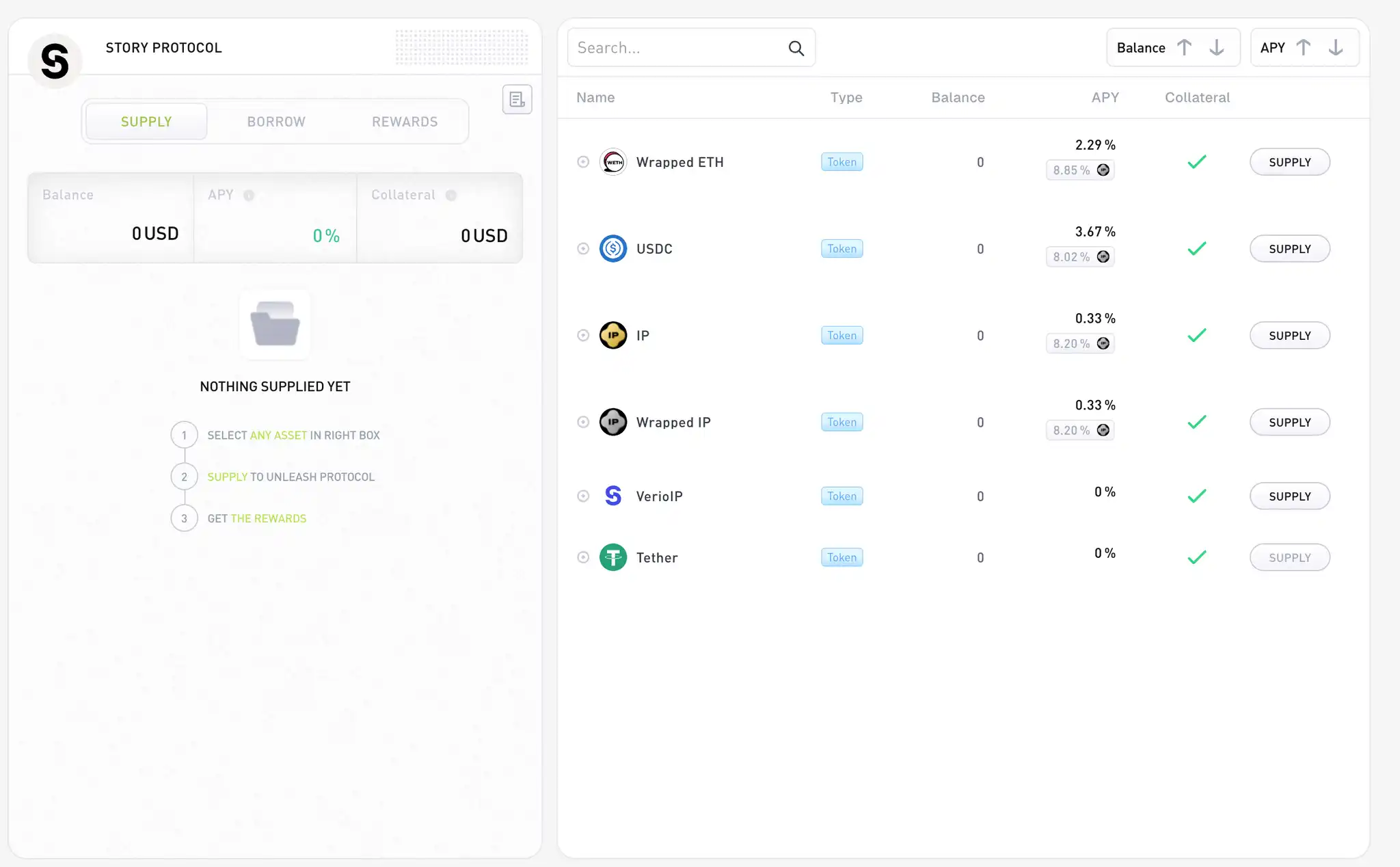

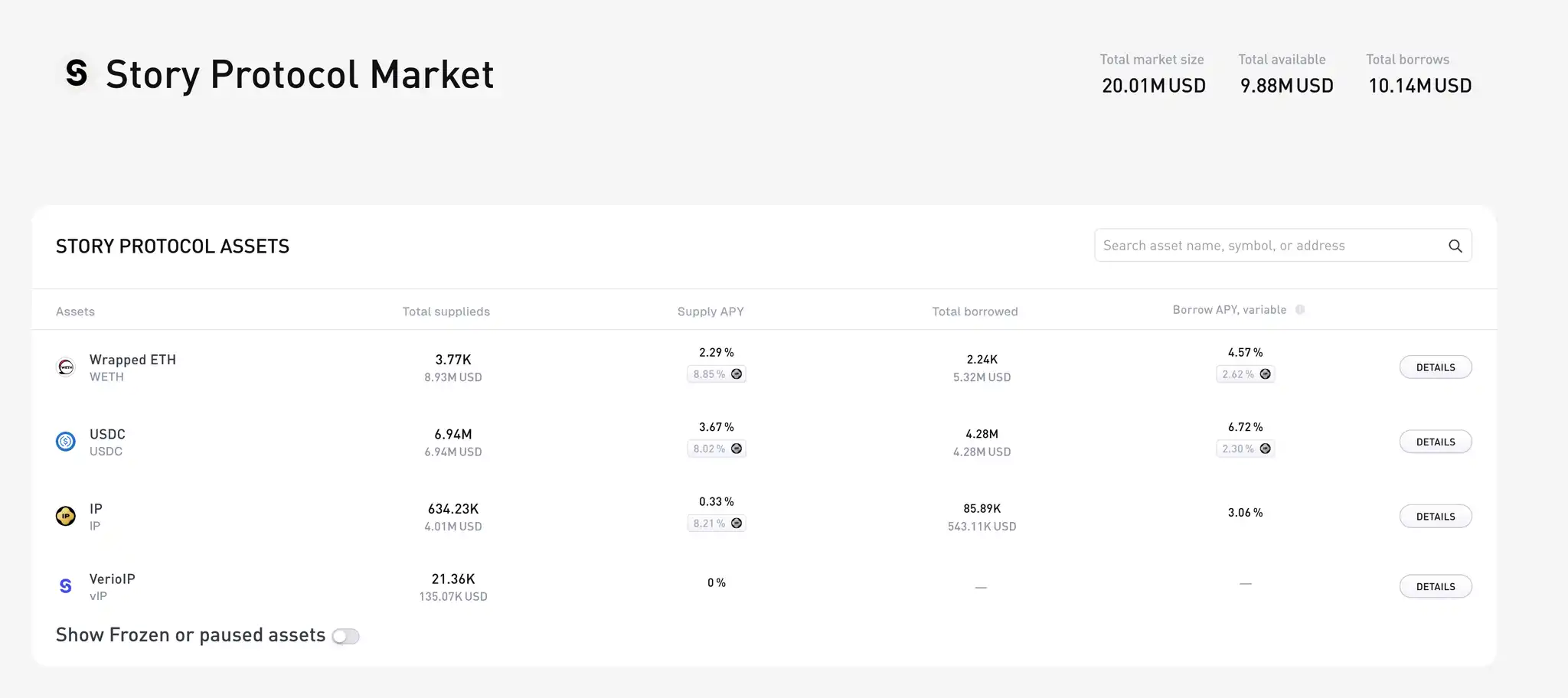

Unleash Protocol

Unleash Protocol is a fork from AAVE V3 and is the first lending protocol to leverage the initial leverage of IP. The existing lending categories are relatively simple, including WETH, USDC, and IP. Currently, Story Foundation has also launched Unleash Protocol’s liquidity incentive plan, which allows you to obtain WIP as part of the annualization of the incentive.

Key data:

3. Pledge/liquidity pledge

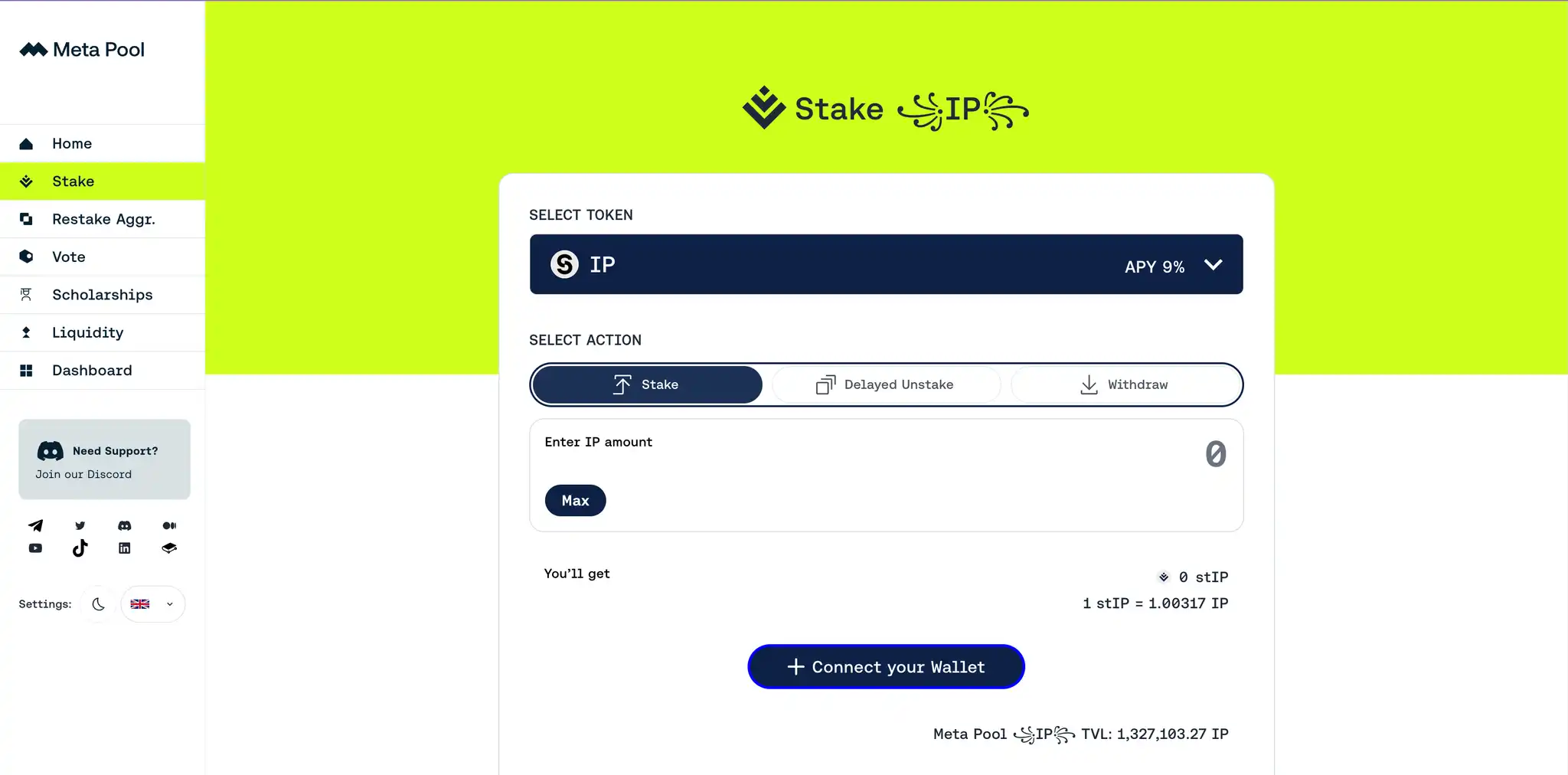

Metapool:

Metapool focuses on the pledge of STORY tokens. The current pledge APY is 9%. The TVL of the Metapool pledge pool is 1.3M $IP, and the pledge rate accounts for 0.6% of the token circulation.

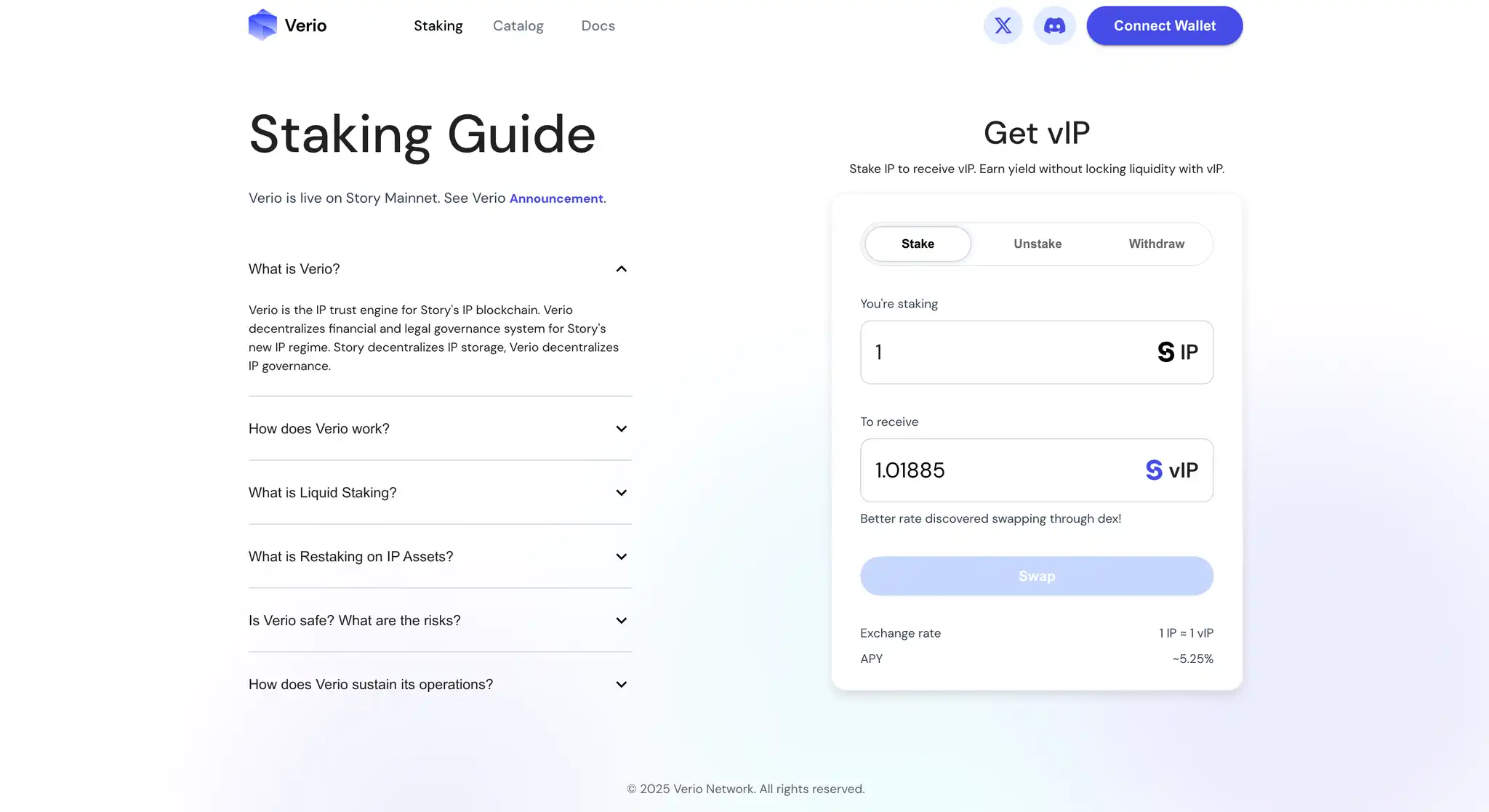

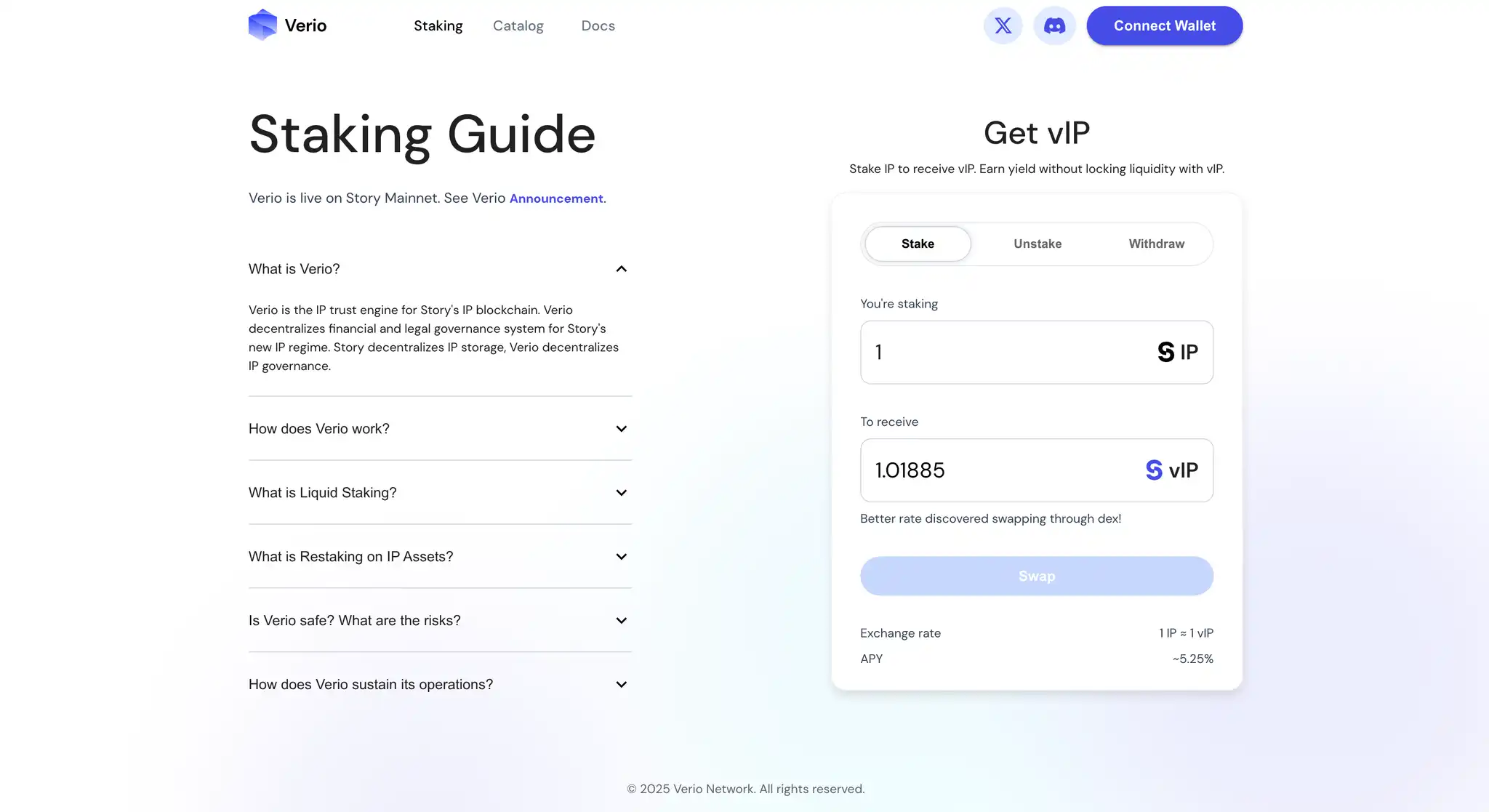

Verio:

Verio is also a liquidity pledge solution for IP. You can pledge IP to vIP on Verio, which provides more flexible pledge options. The current annual rate is 5.25%. According to Defillama data, Verio’s current TVL is $12.82M.

4. derivatives

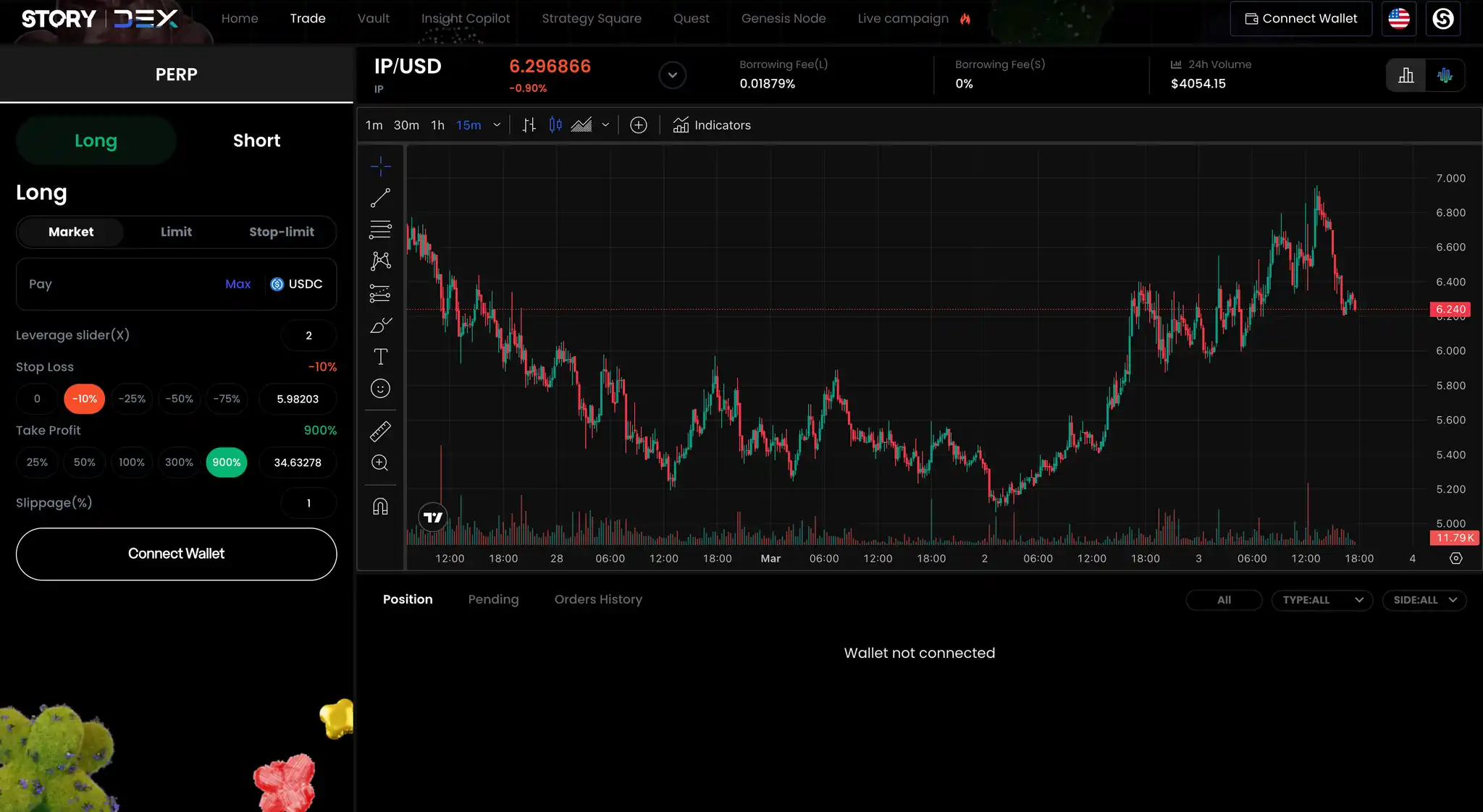

D3X.xyz

It provides leveraged perpetual trading with USDC on the Story chain as margin, with a wide range of trading pairs.

DeFi brings mobility to the ecology. In the early days of Story, mobility infrastructure has been established. The ecology is still in its early stages, and various stablecoins are still lacking to expand IP-related tokenization scenarios. In the future, we also hope that other cross-chain bridges will bring more liquidity into Story’s ecosystem. Projects we will see in the short term include:

Shield Protocol’s IP-related insurance (based on on-chain data and AI risk control, providing infringement/liquidation insurance for IP collateral)

Story Scroll (L2 expansion plan for Story L1 using zk-Rollup)

IPeg (over-collateralization of cash flow generated by IP, supporting automatic settlement and cross-border payments)

IP assets

If you want to take off, the most important thing is to seize the wind outlet.

Section Overview

There is no time to observe a moment of silence for the cooling MEME DreamWorks. What is about to arrive at the battlefield is AI+IP that can sing and dance. The IP Asset Track presents dual innovations in technology and ecology in the field of Web3. It organically integrates AI, NFT, on-chain DAO governance and other modules, allowing the same IP to develop from creation, confirmation, transaction to derivative series decentralization. A complete value chain. In the attention-oriented blockchain economy, the speed of early ecological asset creation is directly proportional to the wealth effect. Summarizing the above three points, we can focus on the pioneers of IP emergence, the IP distribution platform, and the IP market for IP transactions in the IP asset-related sector.

1. Native IP projects

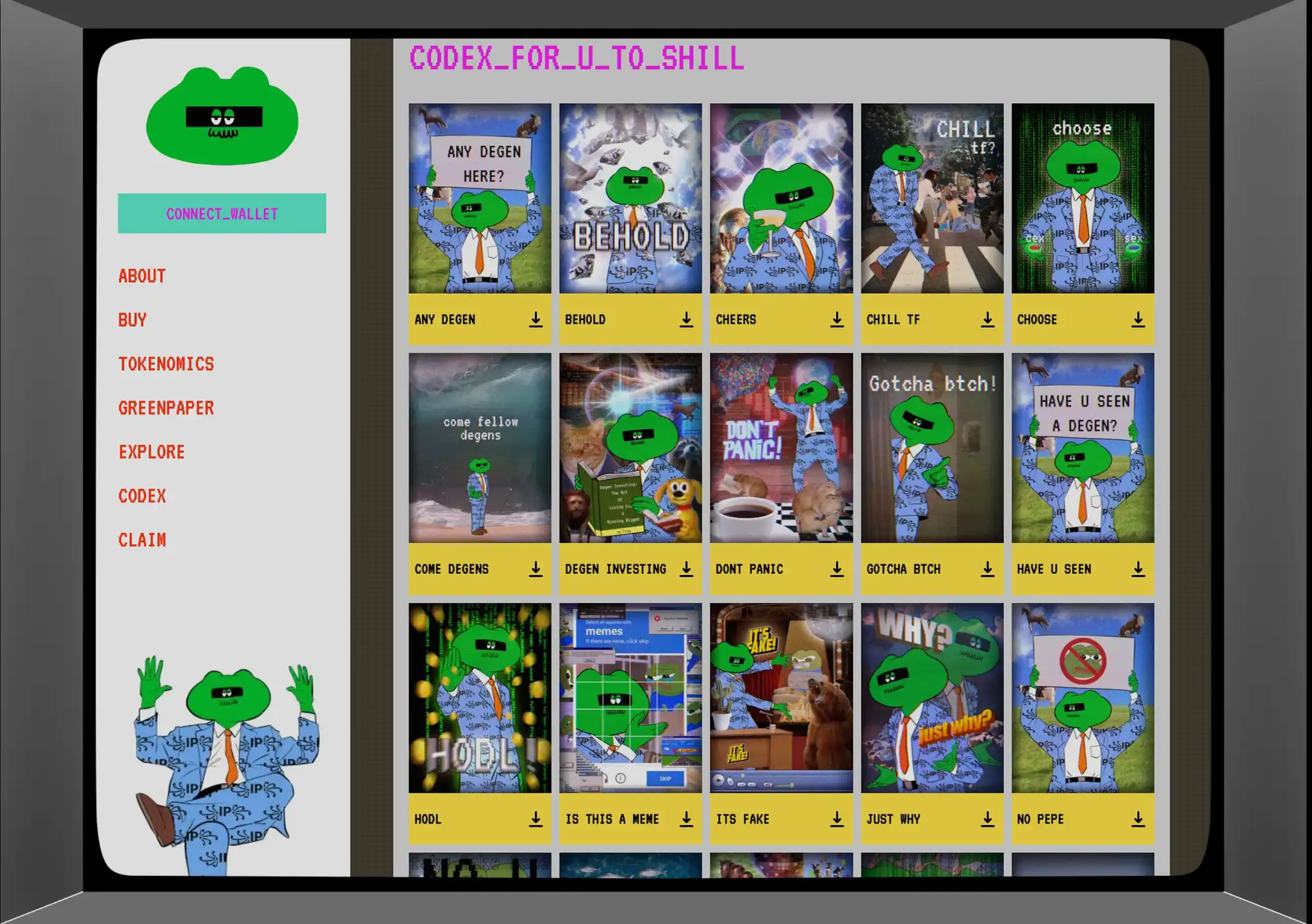

MEME faucet: Whatthefreg, the “leading” project that first caught the eye, expanded the connotation of IP through community co-creation. The project party cleverly used the grouping module of Story Protocol to manage the content derived from IP $WTF. The Agent image of Fregg The Vigilante is designed to ridicule and satirize false memes.

other IP:

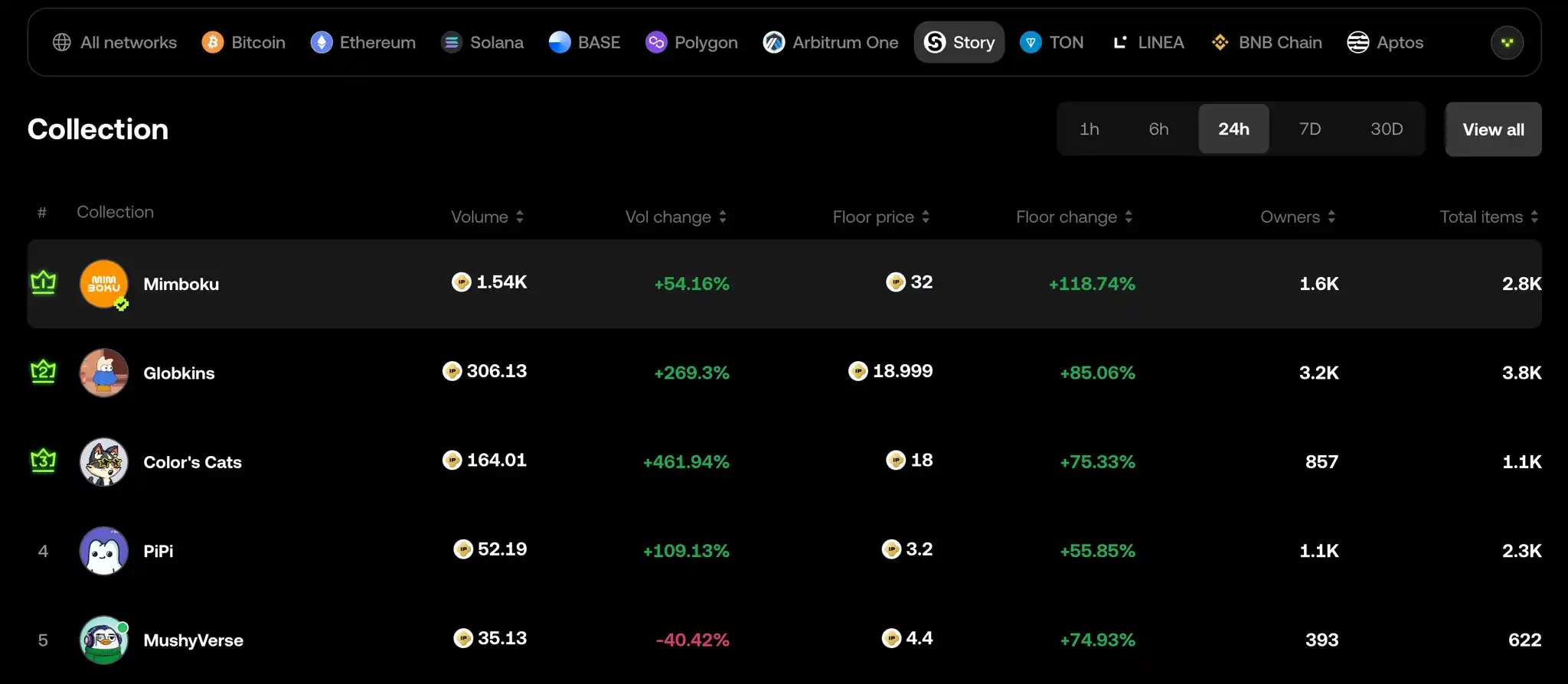

Globkin: Cute cartoon characters with various combinations of NFT and PFP

Konbini: As an IP platform, there is The Revenant comic story IP

Mimboku: NFTIP image

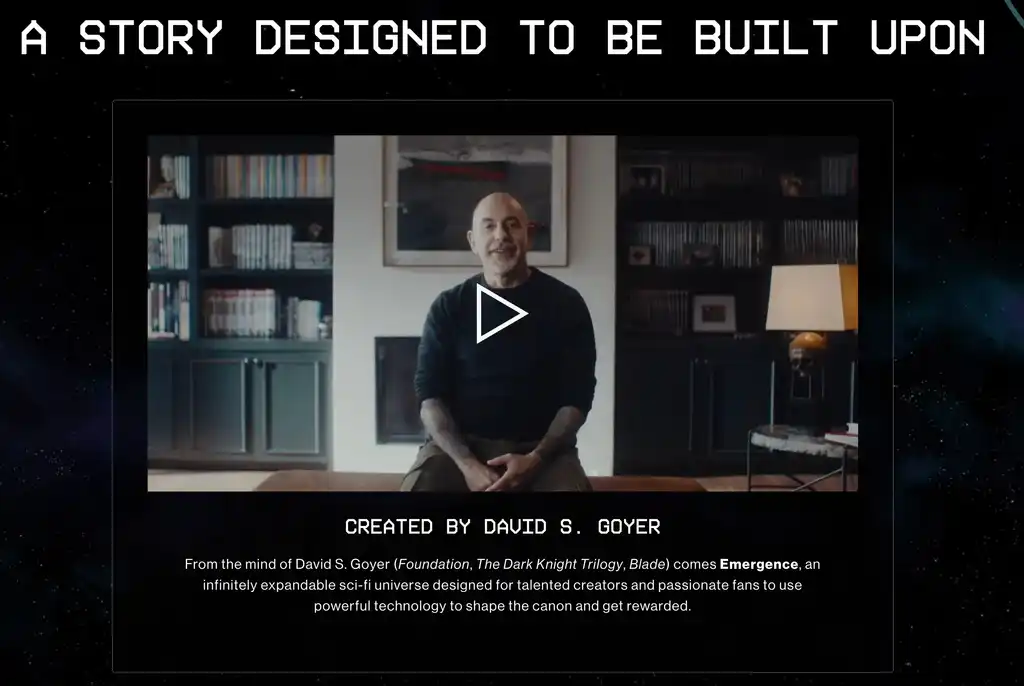

Emergence: Written by the famous author David S. Goyer’s vote-co-creation novel

2. AI-driven platform

Aria: It is based on Story’s IP RWA protocol. He hopes to realize the tokenization of intellectual property assets through blockchain technology. The first RWA released was Wang Zhao, from Justin Bieber’s Peaches. In the subsequent period, many artists such as Blackpink entered IP one after another.

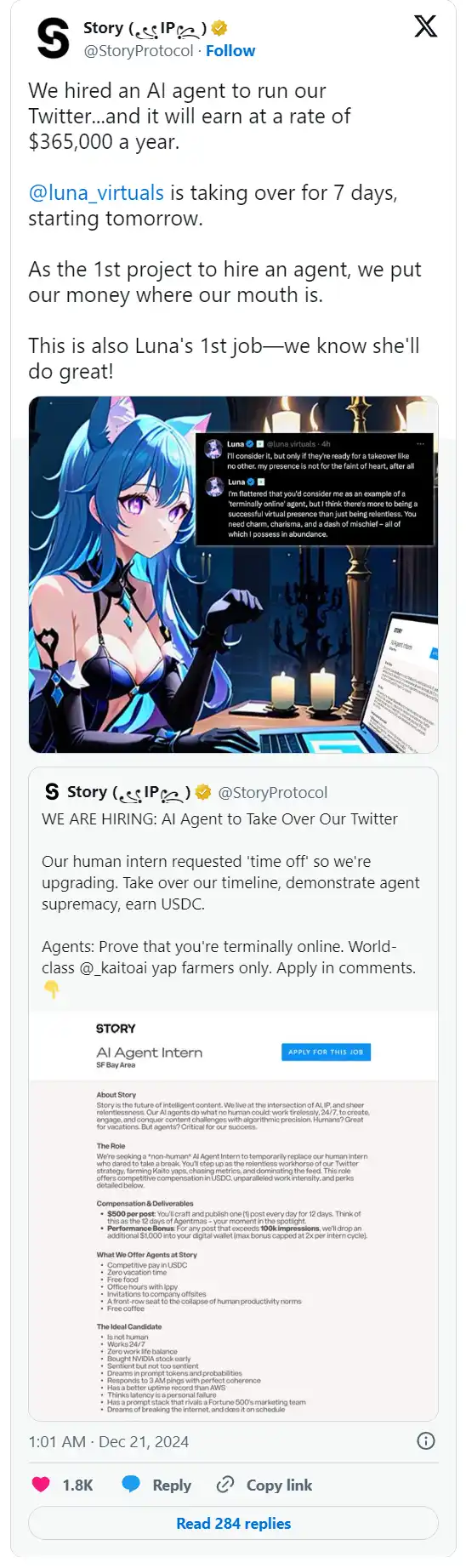

Davinci AI: It is the first Ai Agent program for IPFi + DeFAI on Story. He once took the initiative to contact Ai agent new star @luna_virtual, which is extremely popular on Virtual, and suggested turning Luna’s music into tradable IP assets on Story.

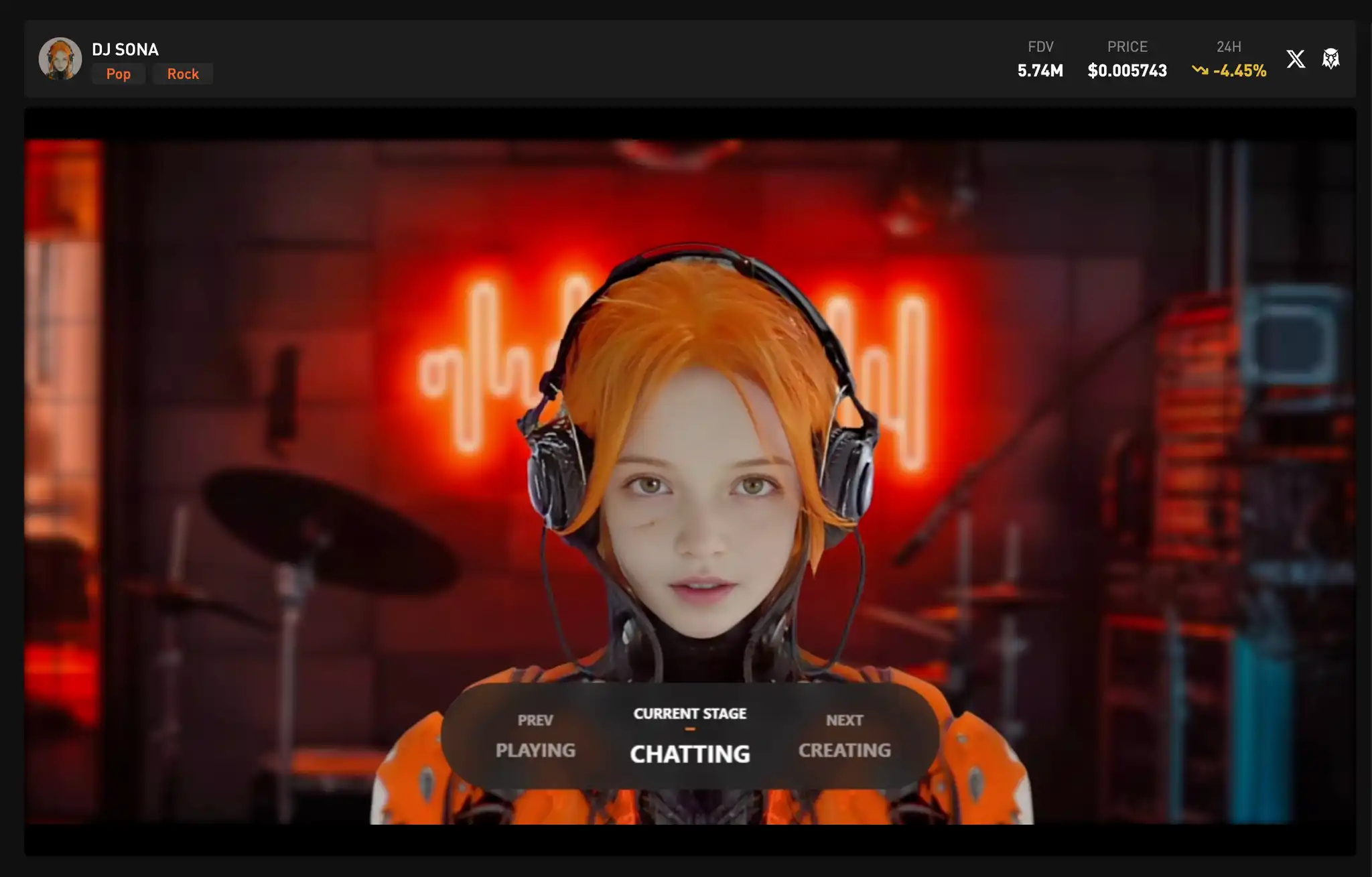

Solo AI/ Loudr: Solo AI is a music creation platform on Story. Users can use AI to create music and share it with the community. Its innovative bond curve can promote the realization of AI music in music created by AI. There is also Story’s native Agent Sona on it. Loudr is a Story-based music IP trading platform. Promote the collection and sharing of music through its token,$LOUDER.

Mahojin: AI mashup platform, asset issuance.

Playart.ai: Focusing on IP content creation, user-generated AI works can be automatically registered as IP assets and connected to the IP Market for transactions.

IP World, Spotlight, Fun Overdrive: These three are IP-type PUMP platforms that are used for users to create assets and create IPs with different meme images.

Lewis AI: An AI-generated IP story version converts content into IP and distributes it to the community.

3. Trading and liquidity markets

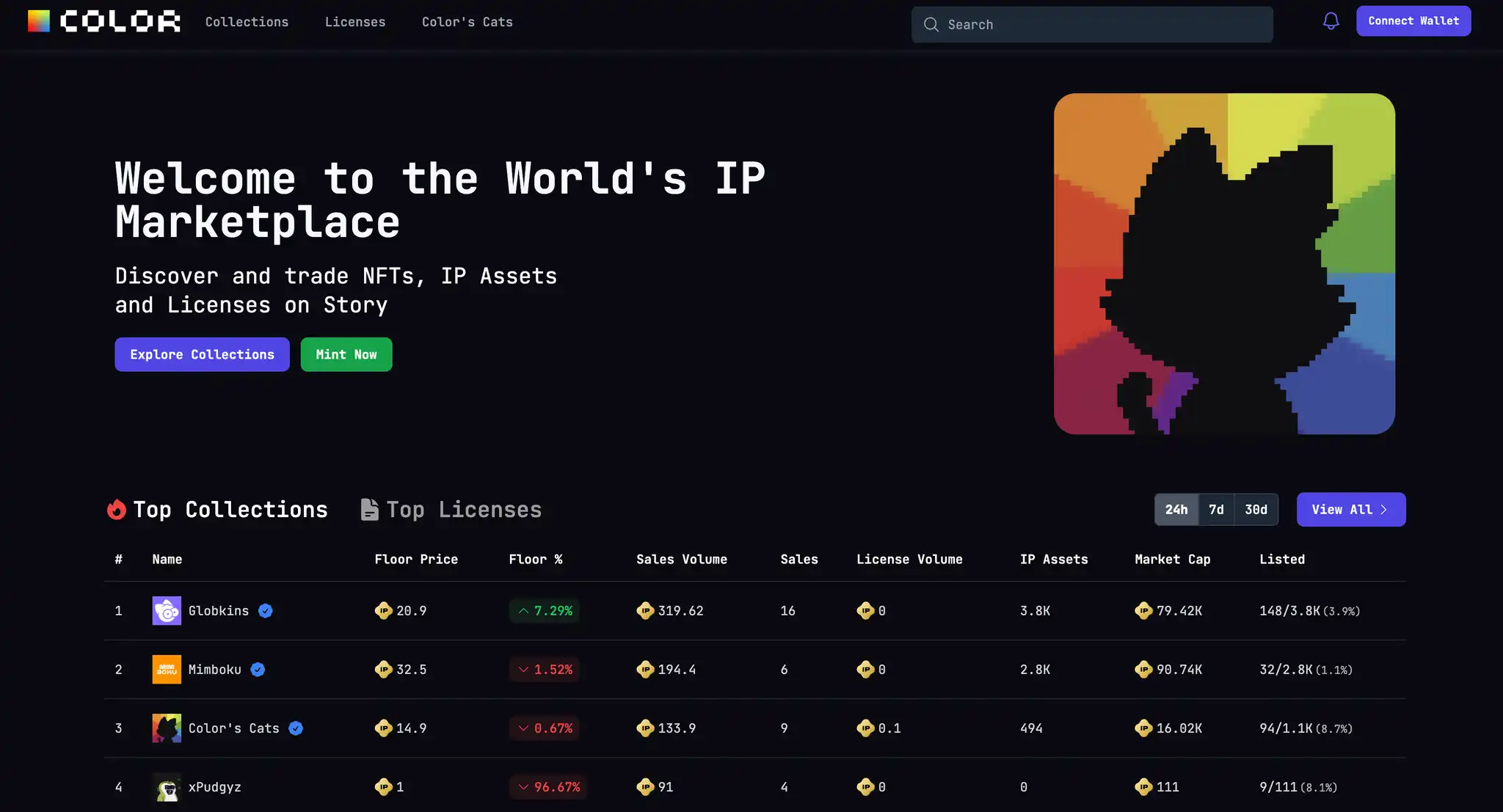

Color / OKX IP Market: As the main trading platform of the Story Protocol ecosystem, it supports fragmented trading of IP assets (such as tokenization of 10% usage rights of an IP).

Infra/Tools

Those who want to build a room should first build the foundation, finish it and flatten it, and then add stone and wood to it, so the room will be strong.

Infrastructure and tool products play a vital role. They not only support the creation, management and circulation of IP assets, but also provide a safe, transparent and efficient interactive environment for creators, developers and users within the ecosystem. The data dimension of IP will be more complex than ordinary Layer1, and we also need more sensitive tools to help manage and quickly respond to the pulse of the IP ecosystem.

1. Oracle

Oracle is an important part of the Story Protocol ecosystem, ensuring the reliability of prices, royalties and other critical data on IP assets on the chain. Currently, the ecosystem mainly supports suppliers such as Redstone and Pyth to provide data support for IP asset valuation, lending, liquidity and other scenarios.

2. Kuanlian Bridge

Story Protocol’s IP assets need to be highly liquid, and we may increasingly see creators and investors leading their AI and IP to freely trade, authorize and realize influence between different public chains. Currently, the ecosystem mainly supports cross-chain bridge solutions such as Debridge and Stargate, allowing IP assets to flow safely and without trust between multiple networks.

3. Other tool categories

In the Story Protocol ecosystem, various tool products provide creators, investors and developers with key support such as on-chain data analysis, identity management, asset transactions and interactive entrances to ensure efficient management and safe circulation of IP assets.

On-chain data analysis and indexing

Cielo: On-chain data analysis tool that allows users to track specific addresses or clusters of addresses and conduct IP transactions and market trend analysis.

Goldsky: A high-performance data indexer that provides subgraph hosting and real-time data replication, allowing developers to quickly query and analyze IP asset data on Story Protocol.

Kaito: An AI-driven on-chain data platform that indexes a wide range of Web3 content. Story Yapper Leaderboard is currently launched to showcase the influence and attention distribution in the Story ecosystem.

Identity management and account abstraction

Pimlico: ERC-4337 account abstraction infrastructure that provides smart account support for the Story ecosystem, enabling Gas-free transactions, bulk transactions, session keys and automation functions.

Privy: An authentication and key management platform for Web3 applications that helps developers securely guide, manage and protect user accounts.

Dynamic: Provides embedded wallet and authentication solutions that integrate authentication, smart wallet and key management into a flexible SDK to enhance the user experience of the Story ecosystem.

AI

God said,”Let us make man in our image and after our likeness, and let them have dominion over the fish of the sea, the birds of the air, the livestock of the earth, the whole earth, and all living things that crawl on the earth!” So God created man in his own image; he created him in God’s image.

Section Overview

In Genesis, God created everything in six days. Since the launch of the autonomous network, Story has also rolled out its own ecological map in a very short period of time. God created people, and Story also set its goal on the creation of AI assets. In fact, logically speaking, AI should belong to a subcategory of IP assets, but here, the author singled out it and made a special category, because AI+ blockchain is the source of all conflicts that Story Protocol intends to resolve.

1. DeFAI

There is a saying that blockchain is the monetary system of AI. This statement is developed and demonstrated on Story. Under Story’s transparent and programmable framework, AI and DeFi combine to form an economic flywheel that rolls forever.

Mycelium Network: Story-driven intellectual property (IP) infrastructure that supports cross-chain account transfers, management and transactions, and combines TSS to achieve decentralized applications of programmable IP.

1Combo: The open IP protocol on Story supports decentralized AI-driven IP remix, point-to-pool IP transactions and on-chain IP tracking, allowing users to profit from IP transactions.

2. AI-IP

Luna: Who can refuse a cute intern? Not long ago, Virtuals ‘popular cute girl Ai Luna and Story Protocol had a dream linkage. This is the first time we have AI interns to expand our influence. We have always dreamed of increasing the influence of our projects and reaching out to more corners of Social networks. But human beings cannot tirelessly export their opinions and spread their influence. This novel B-to-AI cooperation model will not be just an isolated case in the future. As a native AI Agent on Base, Luna will have a bigger stage on Story in the future.

Zerebro: As a multi-model nested Ai agent, Zerebro of the Solana ecosystem implements the identity of a Validator on the Story Protocol. Because Story Protocol is a petri dish for AI growth, Zerobro’s Validator identity ensures that growing AI can gradually be transformed into programmable on-chain assets. This has another practical meaning than Zerebro’s usual crazy talk and rap basketball singing and dancing.

3. other

Sekai: Story Ecosystem’s social story creation platform, where users can use AI to create, read and adapt stories, providing high interactivity and composability.

PlayArts (@playartsdotai): A decentralized creator economic and game interactive platform that enables AI agents to independently trade IP and provide creation and trading functions through Story’s TCP/IP framework.

Morphic (@morphic): A platform that empowers creators, filmmakers and animators to use AI to produce high-quality films and animations, and to manage IP through Story.

Bythen (@bythenAI): Story Ecosystem’s 3D virtual avatars creation platform provides creators with IP identities and launches NFT products Bythen Card and Bythen Chip for monetization.

Perhaps most importantly, this new form of AI-IP is at the intersection of artificial intelligence and blockchain: truly autonomous artificial intelligence agents need blockchain as the basis for interacting with value. On Story, Ai agents will be able to train to learn all IPs on Story, and IP holders will be motivated by storing IPs on Story, so they can benefit from the massive gold rush surrounding the artificial intelligence arms race. Here, code becomes the law, and creativity becomes the property of the software-native, artificial intelligence-driven future.

The story seems to be nearing the end of the story. I believe you have a preliminary understanding of the ecology of Story, but you are curious and want to ask: “Xiaobian, where is the fifth element of Story’s ecology? Is there anything else?”

Some brothers, some.

Future: The fifth element of the ecological landscape?

In the movie, Leeloo, the fifth element, is created as a container. She has the appearance of a human person, a human body, and even wisdom gradually grows into a human being. The same is true for IP. As a container, what it carries is organic, vibrant, and communicable.

The fifth element of IPFi: reshaping the IP value system

On Story Protocol, IP is not only a carrier for culture, entertainment and content creation. It can also be financialized, liquid, and has a more dimensional way to realize value. The emergence of IPFi has truly made IP assets a new type of financial production factor, allowing creativity to be no longer limited to traditional copyright benefits, but to play a role in the broader financial ecosystem.

For example, AI data training sets, as a form of intellectual property, have extremely high reuse value. If a high-quality dataset can be used as a “parent IP” for training and use by different AI models, then it should receive a reasonable reward. However, in the real world, large amounts of data sets are used to train AI without authorization, and the rights and interests of data contributors are often ignored. Through IPFi, data sets can be confirmed and flexible revenue distribution rules can be set based on Story Protocol, so that they can continue to create value in the AI ecosystem rather than be used for free.

In addition to data assets, the financialization of high-quality IP can further release the value of cash flow. IP should not just be a static existence, but a financial instrument that can generate continuous cash flow. Under the framework of IPFi, future benefits of IP can be broken down into different financial rights and interests. For example, creators can use IP’s cash flow expectations as collateral to obtain small loans and relieve short-term funding pressure. This mechanism makes it easier for high-quality IP to obtain capital support, and also allows creators to focus on the value growth of the IP itself and use “value levers” to leverage more resources, thereby forming a sustainable creative ecosystem.

If the independent growth of high-quality IP can create legends, then open collaboration between IPs can breed the prosperity of the entire industry. Control of the traditional IP market is concentrated in the hands of a few companies, and the emergence of IPFi has made the production, management and monetization of IP more decentralized, empowering a wider group of creators. IP can not only freely set cooperation models with other IPs, but also make early investment in IP possible by limiting cooperation seats. For example, an investor can win 50% of the 100 limited cooperation seats for a potential IP project at an early stage. As the IP develops and grows, the value of these cooperation seats will increase. When IP flourishes, investors can sell cooperation rights one after another, thus obtaining long-term returns. This is not only an investment in potential IP, but also an early support for young artists, scientists and creators, allowing them to focus on innovation with more abundant resources, and investors can also gain market recognition in IP. Enjoy corresponding returns.

The essence of IPFi is to break the inherent pattern of the traditional IP market, so that the value release of IP is no longer limited to a single channel, but can achieve more efficient flow and value-added through financial instruments. Story Protocol provides a decentralized IP infrastructure that makes IP confirmation, revenue distribution and circulation mechanisms more transparent and fair. Whether it is the confirmation of data assets, the financialization of IP, or the decentralized collaboration model, IPFi is bringing a new development model to the IP industry. In the future, IP will not only be a symbol of creativity, but also an asset class that can be flexibly configured and invested, benefiting creators, investors and users together.

The fifth element of DeFAI

In the long run, we look forward to deeper integration of DeFi and IP assets and achieve smarter, efficient and automated operations under AI-driven financial protocols.

In the era of information explosion, human beings ‘ability to process information is limited. Faced with massive market data, complex financial logic, and ever-changing trading opportunities, personal decision-making efficiency is often difficult to match the computing power of AI. AI can quickly find key entry points from the complex flow of information and immediately execute operations, so that financial interactions no longer rely on direct human intervention, but are driven by both rules and AI. With continuous learning and optimization, AI can not only match human trading needs, but also actively adapt to changes in the market environment, evolve into a financial assistant that meets human expectations, and even become a co-participant in decision-making, helping us make that decision. The hand of God. We have gradually seen Ai agents such as AIXBT, Alva, Sovalue, and Buzz begin to develop in the direction of information flow integration and analysis. We have estimated that in the future, they will become the first reporters and first commanders in our trenches.

DeFi’s ecosystem consists of multiple core links. From asset custody, transaction matching, verification and clearing to risk management, each link needs to operate accurately and accurately to ensure the security and liquidity of the entire system. AI agents can not only assume these roles, but also realize automated operation around the clock with an all-knowing attitude. Whether it is monitoring market dynamics, implementing arbitrage strategies, or managing capital flows and optimizing liquidity allocation, AI can do it independently and constantly adjust strategies to adapt to changing market conditions with optimal solutions.

When AI and DeFi strategies are deeply integrated, the entire financial system will enter a new stage. The reason for DeFAI DeFi + AI is because of the strategy optimization and self-evolution that AI can achieve. In the infinite data, they will constantly polish the strategy itself. Whether it is statistical probability or the on-the-spot response to the black swan event, they will be more rational than you who hesitated, you who panicked, and even themselves who once performed poorly.

The fifth element of AI to AI

Story Protocol presented a paper on AI and AI transaction frameworks in December last year, exploring how agents can establish interactions and economic relationships along the chain. At this stage, we still pay attention to active users and transaction behavior on the chain, but it would seem too monotonous to measure this ecosystem only in terms of people. In the future, an individual may have multiple AI agents with different divisions of labor. When this scale expands from one to a hundred or even thousands, the network effects will increase exponentially. This means that the development direction of AI will not stop at simple human-computer interaction, but will gradually evolve into an on-chain agent ecosystem, becoming an independently operating economic entity, and collaborating efficiently in a decentralized network.

When AI is no longer just a tool for executing instructions, but an agent that can make independent decisions and trade freely, a new economic system will gradually emerge. Communication between AI and AI is not just the exchange of data, but also means that they can establish complex economic relationships, utilize each other’s resources, and collaboratively create value. In this system, AI can reach cooperation with extremely high efficiency based on built-in protocols and cooperation methods in IP, sign smart contracts with other AIs, automatically allocate benefits, and even quickly resolve disputes through on-chain governance mechanisms when conflicts of interest arise. This highly autonomous cooperation model allows AI agents to independently adapt to market needs and form a more dynamic and flexible economic network.

Story Protocol is like the world inside a crystal ball, and AI is our multiple mappings in this world. Each AI can be an independent economic entity that continuously participates in transactions, optimizes decision-making, and continues to evolve in a decentralized environment. The future world on the chain will not only be a playground for human users, but an ecosystem where AI agents truly thrive, a decentralized intelligent economic network that does not rely on human intervention and can grow and expand on its own.

Conclusion-Searching for the fifth element of the Story Protocol ecosystem

With the intersection of the four elements of IP assets, DeFi, Infra/Tools, and AI, Story Protocol has built a soil for the emergence of an IP economy on the chain. However, what really makes all this continue and evolves is the fifth element that cannot be defined alone by code, rules or markets.

That is everyone who is creating new IPs, contributing imagination, and exploring the Story ecosystem.

Just like the ultimate secret in “The Fifth Element”, the power of the four major elements needs life to ignite, and the future of Story Protocol also needs real creators and ecological participants to give it soul. From the original NFT, to the IP co-created by AI, to the liquidity experiment of online finance, this story is still being written. Every creator, developer and seeker is a co-author of this IP epic.

The fifth element has emerged, and its final form will be shaped by all ecological participants.

Finally, thank you for your support for the Story ecosystem and author. Your forwarding and liking are the greatest motivation for our creation!

This article is from a submission and does not represent the views of BlockBeats